10%+ Stock Gains On BSE: Sensex's Impressive Rise Explained

Table of Contents

<meta name="description" content="Uncover the reasons behind the Sensex's recent surge, exceeding 10% gains on the BSE. Learn about the key factors driving this impressive market rally and what it means for investors.">

The Bombay Stock Exchange (BSE) has witnessed a remarkable surge, with the Sensex achieving impressive 10%+ stock gains. This significant market rally, observed over [Specify timeframe, e.g., the last quarter], has left investors wondering about the driving forces behind this positive trend. This article delves into the key economic indicators, global factors, and sector-specific performances that contributed to these impressive 10%+ stock gains on BSE.

<h2>Economic Indicators Fueling the Sensex Rally</h2>

Several robust economic indicators have fueled investor confidence and contributed significantly to the Sensex's impressive climb.

<h3>Positive GDP Growth and its Impact</h3>

India's recent GDP growth figures have painted a positive picture of the economy's recovery.

- The [Specify Quarter] GDP growth registered a [Specific Percentage]% increase, exceeding expectations and signaling a strong rebound from previous quarters.

- This positive revision from initial estimates further boosted investor sentiment.

- Analysts have attributed this growth to [mention key contributing factors, e.g., increased consumer spending, robust industrial production].

These positive GDP growth figures, coupled with the overall economic recovery, are key drivers behind the improved investor sentiment and subsequent 10%+ stock gains on BSE. Keywords: GDP growth, economic recovery, investor sentiment.

<h3>Inflation Cooling and RBI's Monetary Policy</h3>

The cooling inflation rates have played a crucial role in supporting the Sensex rally.

- The inflation rate has steadily decreased from [Previous Percentage]% to [Current Percentage]%, providing relief to investors concerned about inflationary pressures.

- The Reserve Bank of India's (RBI) monetary policy decisions, including [mention specific policy changes, e.g., interest rate cuts or pauses], have further contributed to a more positive market outlook.

- Analysts predict that [mention future predictions regarding inflation and RBI policy], further supporting sustained market growth.

Keywords: inflation rate, monetary policy, RBI, interest rates.

<h3>Strong Corporate Earnings</h3>

Robust corporate earnings across various sectors have significantly boosted market sentiment.

- Several key sectors, including [mention specific sectors, e.g., IT, Pharmaceuticals, Financials], have reported exceptionally strong earnings, exceeding analyst expectations.

- Companies like [mention specific examples of high-performing companies] have showcased impressive profit growth, contributing to the overall market optimism.

- The overall earnings growth has reinforced investor confidence, driving further investment and pushing the Sensex towards 10%+ stock gains on BSE.

Keywords: corporate earnings, profit growth, sector performance.

<h2>Global Factors Influencing the BSE</h2>

Besides domestic factors, global trends have also played a crucial role in the Sensex's impressive rise.

<h3>Positive Global Market Trends</h3>

Positive trends in global markets have had a ripple effect on the BSE.

- Major global indices like the Dow Jones and Nasdaq have shown positive growth, indicating a generally positive global economic outlook.

- Positive global economic news, including [mention specific news, e.g., easing trade tensions, improved global manufacturing data], has further boosted investor confidence.

- This positive global sentiment has attracted significant foreign investment into the Indian market, contributing to the 10%+ stock gains on BSE.

Keywords: global markets, foreign investment, international trade.

<h3>Foreign Institutional Investor (FII) Activity</h3>

Foreign Institutional Investor (FII) activity has been a key driver of the Sensex's recent gains.

- FIIs have poured significant capital into the Indian stock market, injecting substantial liquidity into the system.

- [Mention specific FII investment figures if available]. This surge in investment can be attributed to [mention reasons, e.g., India's strong economic fundamentals, positive growth outlook].

- Increased FII activity has not only boosted the Sensex but has also improved market liquidity, creating a more favorable investment environment.

Keywords: FII, foreign institutional investment, market liquidity.

<h2>Sector-Specific Performances Contributing to 10%+ Stock Gains on BSE</h2>

Certain sectors have significantly outperformed others, contributing disproportionately to the overall 10%+ stock gains on BSE.

<h3>Top Performing Sectors</h3>

The IT, Pharmaceuticals, and Financials sectors have been among the top performers.

- The IT sector has benefitted from [mention specific reasons, e.g., increased global demand for technology services, strong order books]. Specific companies like [mention examples] have shown remarkable growth.

- The Pharmaceuticals sector has seen strong growth due to [mention reasons, e.g., increased demand for healthcare products, successful new product launches]. Companies like [mention examples] have significantly contributed to this sector's performance.

- The Financials sector's performance has been driven by [mention reasons, e.g., improving credit growth, increased lending activity]. Banks such as [mention examples] have displayed strong earnings.

Keywords: sectoral growth, stock performance, IT sector, Pharmaceuticals sector, Financials sector.

<h2>Conclusion</h2>

The impressive 10%+ stock gains on BSE, reflected in the Sensex's rise, are a result of a confluence of factors. Positive economic indicators like strong GDP growth and cooling inflation, coupled with supportive RBI monetary policy, have created a favorable investment climate. Furthermore, robust corporate earnings, positive global market trends, and significant FII investments have all played crucial roles. The strong performance of specific sectors like IT, Pharmaceuticals, and Financials further amplified these gains.

Stay updated on future market movements and learn more about achieving 10%+ stock gains on BSE by exploring our other resources. Don't rely solely on this article for investment decisions; always consult with a qualified financial advisor before making any investment choices.

Featured Posts

-

Portland Timbers Defeat Against San Jose Earthquakes Match Analysis

May 15, 2025

Portland Timbers Defeat Against San Jose Earthquakes Match Analysis

May 15, 2025 -

La Fire Aftermath Price Gouging Concerns Raised By Selling Sunset Cast Member

May 15, 2025

La Fire Aftermath Price Gouging Concerns Raised By Selling Sunset Cast Member

May 15, 2025 -

Roma Vs Monza En Vivo Y Online

May 15, 2025

Roma Vs Monza En Vivo Y Online

May 15, 2025 -

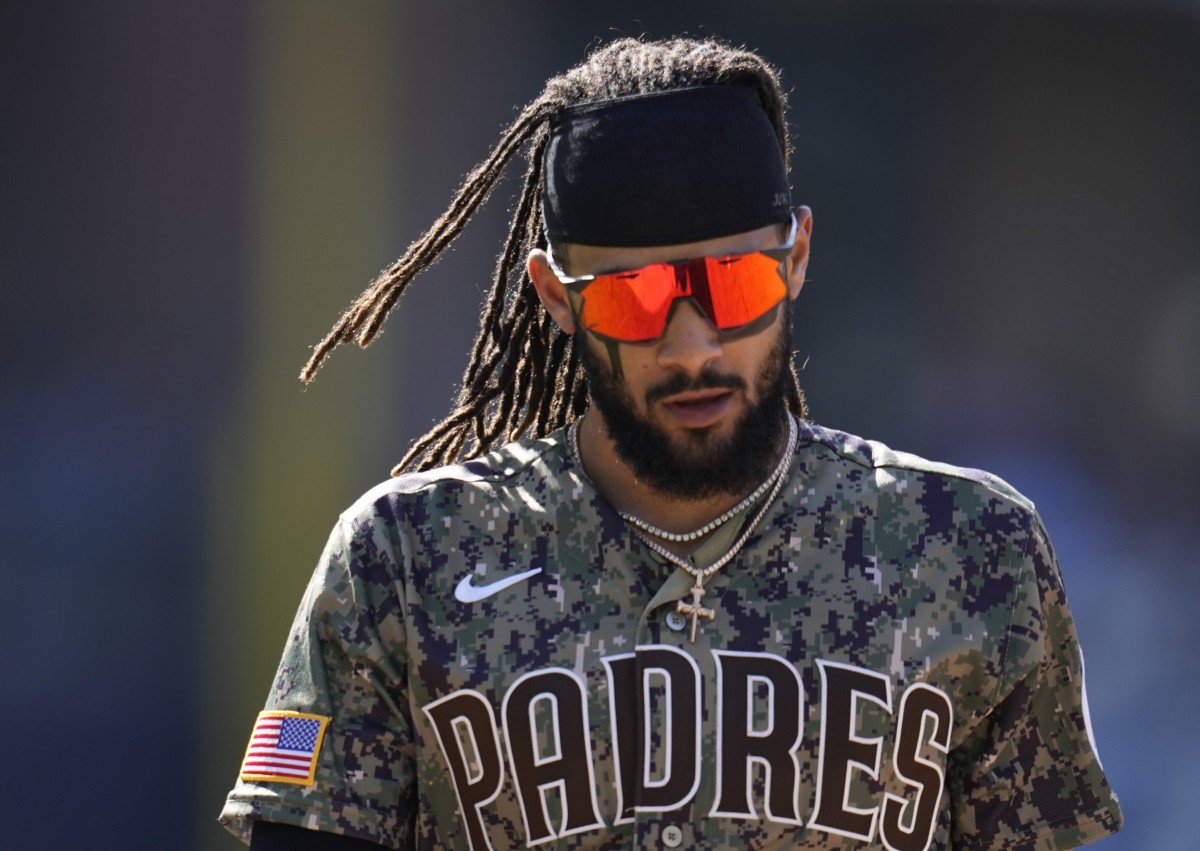

Padres Stage Comeback Victory Against Cubs

May 15, 2025

Padres Stage Comeback Victory Against Cubs

May 15, 2025 -

Maple Leafs Vs Blue Jackets Prediction Picks And Odds For Tonights Nhl Game

May 15, 2025

Maple Leafs Vs Blue Jackets Prediction Picks And Odds For Tonights Nhl Game

May 15, 2025