$100,000 Bitcoin? Trump's Speech And The Future Of BTC Price

Table of Contents

Trump's Statements and their Market Impact

While precise quotes regarding Bitcoin from Donald Trump's recent speeches need to be specified (and inserted here, ideally with links to verifiable sources), the general sentiment expressed (if positive) can significantly influence the crypto market. Any statement perceived as favorable towards Bitcoin, even indirect, can trigger a buying frenzy amongst investors. This is because Trump's pronouncements often carry considerable weight, influencing not just the stock market but also the sentiment around emerging assets like Bitcoin.

The immediate market reaction following such a speech is usually dramatic. We'd expect to see a rapid increase in Bitcoin's price, possibly accompanied by increased volatility. (Insert a chart or graph here visualizing price movement after a hypothetical Trump statement. This could show a spike in price followed by consolidation or further price action).

- Positive sentiment towards Bitcoin following Trump's comments: A positive statement could lead to a surge in investor confidence and a subsequent price increase.

- Increase in trading volume after the speech: Increased market interest often translates to higher trading volume, indicating greater investor activity.

- Short-term price fluctuations and volatility: The initial surge is often followed by a period of price correction and volatility as the market digests the information and adjusts accordingly. Keywords: Trump cryptocurrency, Trump Bitcoin comments, Bitcoin market reaction, crypto market volatility, Bitcoin price chart.

Factors Influencing Bitcoin's Price Beyond Trump's Speech

While Trump's words can create short-term ripples, several broader factors significantly impact Bitcoin's long-term price trajectory.

Macroeconomic Factors

Global economic conditions play a crucial role in Bitcoin's valuation. High inflation, for example, can push investors towards Bitcoin as a hedge against currency devaluation. Conversely, fears of a recession can lead to a risk-off sentiment, impacting Bitcoin's price negatively. The correlation between traditional markets and the cryptocurrency market isn't always direct, but a strong downturn in equities can spill over into crypto.

- Inflation's impact on Bitcoin adoption: High inflation drives demand for inflation-resistant assets, boosting Bitcoin's appeal.

- Global economic uncertainty driving Bitcoin investment: Uncertainty encourages investors to seek safe havens, including Bitcoin.

- The role of government regulations on Bitcoin price: Clear and favorable regulations can boost investor confidence, while harsh restrictions can dampen enthusiasm.

Technological Advancements and Adoption

The underlying technology and its adoption rates are critical to Bitcoin's future price. Improvements in scalability, such as the Lightning Network, reduce transaction fees and processing times, increasing its practicality for everyday use. Simultaneously, increased adoption by institutional investors and businesses strengthens Bitcoin's position as a legitimate asset class.

- The Lightning Network and its impact on transaction fees: Reduced fees make Bitcoin more efficient and attractive for everyday transactions.

- Growing institutional investment in Bitcoin: Large-scale investment signals confidence and potential for price appreciation.

- Increased use of Bitcoin for payments and remittances: Wider adoption boosts network effects and increases demand. Keywords: Bitcoin adoption, Bitcoin scalability, institutional Bitcoin investment, macroeconomic factors Bitcoin, Bitcoin regulation, Bitcoin technology.

Predicting the Future of Bitcoin's Price

Predicting Bitcoin's price with certainty is impossible. Numerous models exist, including technical analysis (chart patterns, indicators) and fundamental analysis (examining the underlying technology, adoption rate, and market sentiment). However, these methods have limitations; unforeseen events can drastically alter price predictions. Expert opinions vary widely, with some predicting a bullish future for Bitcoin, others a bearish one, and many maintaining a neutral stance.

- Technical analysis of Bitcoin price charts: Identifying trends and patterns to anticipate future price movements.

- Fundamental analysis of the Bitcoin ecosystem: Evaluating factors such as adoption rate, network security, and regulatory landscape.

- Expert opinions on the long-term price outlook: Consulting with financial analysts and crypto experts for diverse perspectives. Keywords: Bitcoin price prediction 2024, Bitcoin price forecast, Bitcoin future price, bullish Bitcoin, bearish Bitcoin.

Conclusion

While Trump's statements can temporarily influence Bitcoin's price, the long-term trajectory depends on a complex interplay of factors. Macroeconomic trends, technological advancements, regulatory landscapes, and overall market sentiment all contribute to Bitcoin's value. A $100,000 Bitcoin remains a speculative possibility, dependent on continued adoption, technological improvements, and favorable regulatory environments. The inherent volatility of the cryptocurrency market necessitates a careful and informed approach to investment.

Call to Action: While a $100,000 Bitcoin remains speculative, understanding the interplay of political statements, macroeconomic conditions, and technological advancements is crucial for navigating the volatile cryptocurrency market. Stay informed about the latest news and developments to make informed decisions regarding your Bitcoin investments. Continue learning about $100,000 Bitcoin possibilities and its potential impact on your portfolio. Keywords: $100,000 Bitcoin prediction, Bitcoin investment, Bitcoin future, crypto investment strategy.

Featured Posts

-

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025 -

Missing Dwp Letter 6 828 Costly Mistake

May 08, 2025

Missing Dwp Letter 6 828 Costly Mistake

May 08, 2025 -

Nba Playoffs Trivia Triple Doubles Edition Test Your Knowledge

May 08, 2025

Nba Playoffs Trivia Triple Doubles Edition Test Your Knowledge

May 08, 2025 -

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025 -

Psl 10 Tickets Available Today Get Yours Now

May 08, 2025

Psl 10 Tickets Available Today Get Yours Now

May 08, 2025

Latest Posts

-

Sergio Hernandez Dirigira Al Flamengo Un Nuevo Capitulo Para El Equipo

May 08, 2025

Sergio Hernandez Dirigira Al Flamengo Un Nuevo Capitulo Para El Equipo

May 08, 2025 -

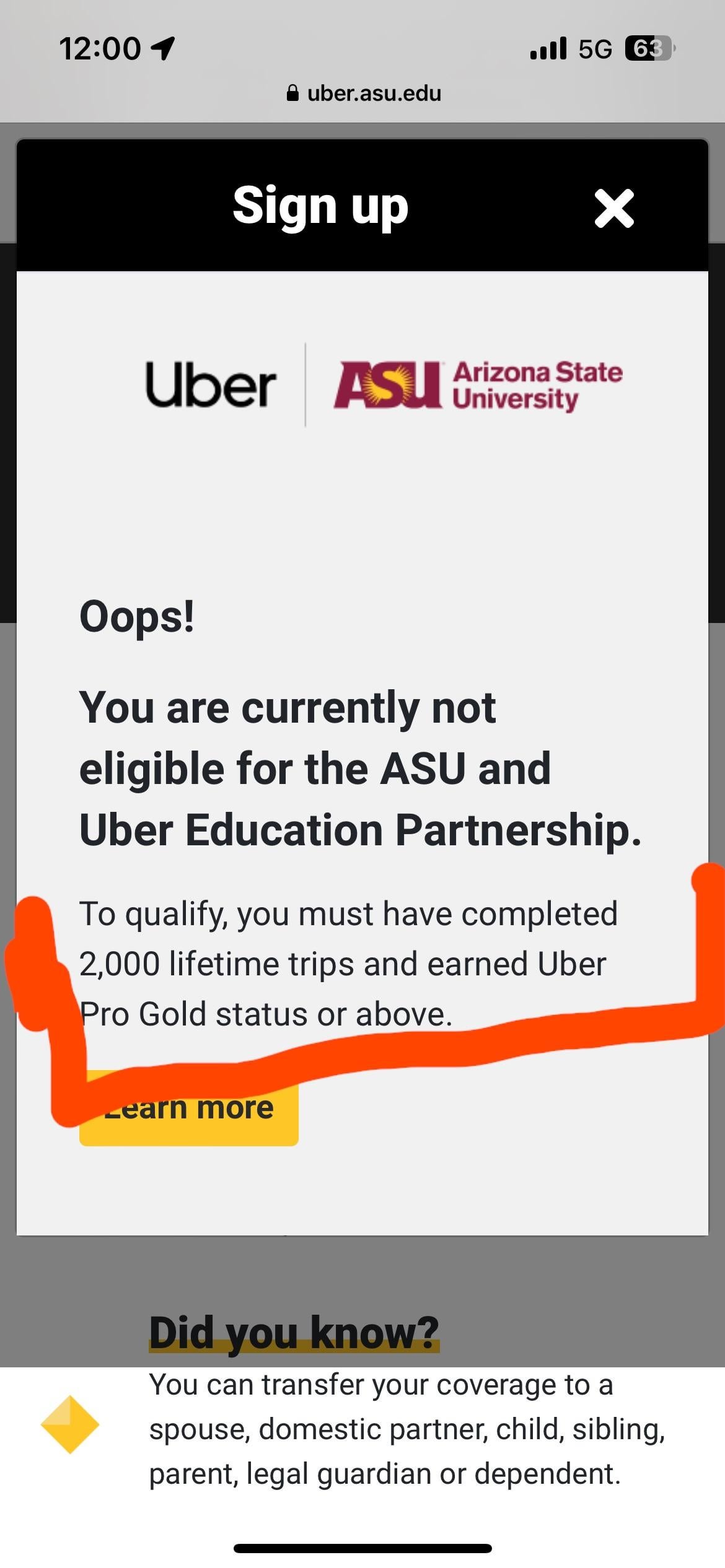

Understanding Ubers New Driver Subscription Plans

May 08, 2025

Understanding Ubers New Driver Subscription Plans

May 08, 2025 -

Taca Guanabara El Golazo De Arrascaeta Que Decidio El Partido Para El Flamengo

May 08, 2025

Taca Guanabara El Golazo De Arrascaeta Que Decidio El Partido Para El Flamengo

May 08, 2025 -

Uber One Arrives In Kenya Get Free Delivery And More

May 08, 2025

Uber One Arrives In Kenya Get Free Delivery And More

May 08, 2025 -

Flamengo Confirma A Sergio Hernandez Como Su Nuevo Entrenador

May 08, 2025

Flamengo Confirma A Sergio Hernandez Como Su Nuevo Entrenador

May 08, 2025