110% Potential: The BlackRock ETF Billionaires Are Investing In For 2025

Table of Contents

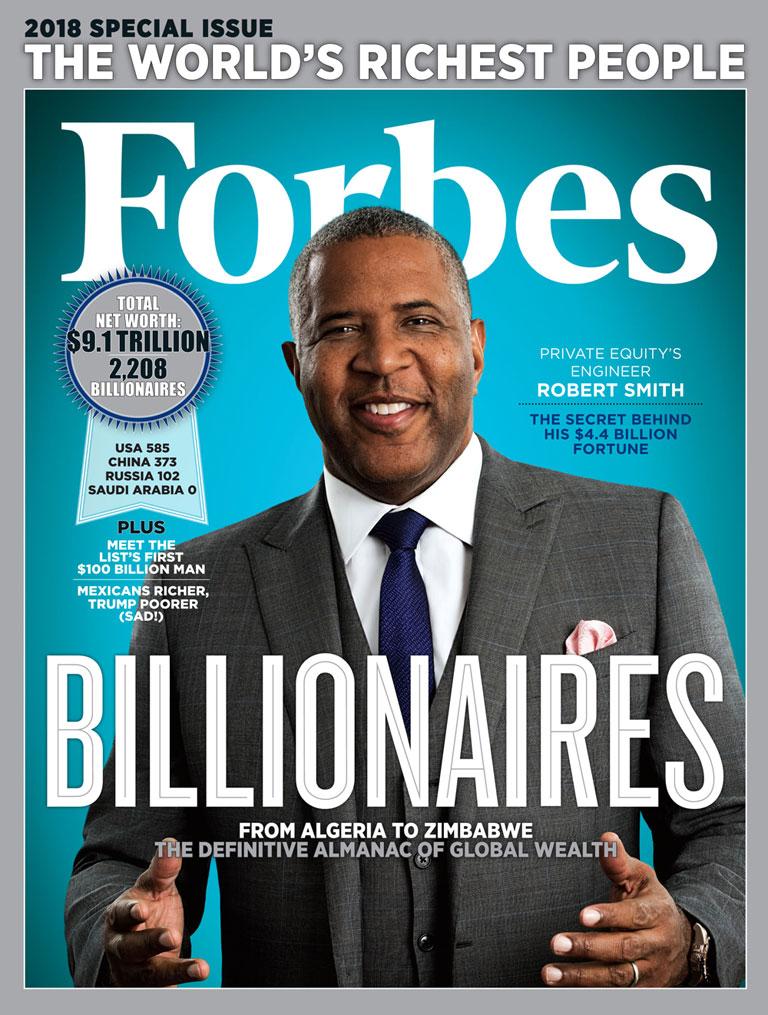

Whispers in the financial world suggest a potential 110% return on investment by 2025. This isn't some fly-by-night scheme; we're talking about specific BlackRock ETFs, the giants of the exchange-traded fund market, favored by billionaires themselves. BlackRock ETFs, known for their stability and diverse holdings, are positioning themselves for significant growth in the coming years. This article explores the specific BlackRock ETFs attracting billionaire investors for 2025 and delves into the reasons behind their projected success, helping you understand the potential for remarkable returns.

H2: Top BlackRock ETFs Favored by Billionaires for 2025:

H3: Analyzing the iShares CORE U.S. Aggregate Bond ETF (AGG):

The iShares CORE U.S. Aggregate Bond ETF (AGG) is a cornerstone of many diversified portfolios, including those of high-net-worth individuals. Why? Because even in potentially volatile markets, AGG offers relative stability.

- Steady Income Potential: AGG provides a consistent stream of income through its holdings of investment-grade U.S. government and corporate bonds. This is particularly appealing in times of economic uncertainty.

- Low-Risk Profile: Its focus on investment-grade bonds makes it a relatively low-risk investment compared to equity-based ETFs.

- Diversification: AGG's broad diversification across numerous bonds reduces the impact of any single bond defaulting.

- Historical Performance: While past performance isn't indicative of future results, AGG has historically demonstrated resilience, providing a relatively stable return even during market downturns. (Note: Include specific data points here, if available, on historical performance and expense ratio).

Keywords: bond ETF, fixed income, low risk, diversification, AGG, iShares CORE U.S. Aggregate Bond ETF

H3: Exploring the iShares S&P 500 ETF (IVV):

The iShares S&P 500 ETF (IVV) is a classic choice, tracking the performance of the S&P 500 index, representing 500 of the largest publicly traded companies in the U.S.

- Market Exposure: IVV provides broad exposure to the U.S. market, benefiting from the overall growth of these major corporations.

- Historical Performance: The S&P 500 has historically shown robust long-term growth, making IVV an attractive investment for long-term growth. (Note: Include specific data points here, if available, on historical correlation with market growth and long-term returns).

- Market Capitalization Weighting: IVV's weighting based on market capitalization ensures exposure to the most significant companies in the U.S. economy.

- Simplicity: Its straightforward approach makes it easy to understand and manage.

Keywords: index fund, S&P 500, market capitalization, growth potential, IVV, iShares S&P 500 ETF

H3: Delving into Sector-Specific BlackRock ETFs:

Billionaires often employ a strategy of targeted growth through sector-specific ETFs. For 2025, BlackRock offers several compelling options.

- Technology ETFs: The ongoing technological revolution makes technology ETFs highly attractive. (Note: Mention a specific BlackRock technology ETF and its potential here). High growth potential is predicted in areas like artificial intelligence and cloud computing.

- Renewable Energy ETFs: The global shift towards sustainability makes renewable energy ETFs another promising area. (Note: Mention a specific BlackRock renewable energy ETF and its potential here). This sector is poised for significant expansion as governments worldwide push for cleaner energy sources.

Keywords: sector-specific ETF, technology ETF, renewable energy ETF, high-growth potential

H3: The Role of ESG Investing in Billionaire BlackRock ETF Choices:

Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions. Many billionaires prioritize sustainable and responsible investing.

- ESG ETFs: BlackRock offers a range of ETFs focused on ESG criteria, aligning investments with ethical and environmental goals. (Note: Mention a specific BlackRock ESG ETF here).

- Long-Term Value: ESG investing is often linked to long-term value creation and reduced risk.

- Socially Conscious Investing: It appeals to investors who wish to align their portfolios with their values.

Keywords: ESG investing, sustainable investing, responsible investing, BlackRock ESG ETFs

H2: Why These BlackRock ETFs Offer 110% Potential:

H3: Market Predictions and Growth Projections:

The "110% potential" claim is based on several factors, including projected economic growth, technological advancements, and shifts in consumer behavior. (Note: Include specific data points and sources here, backing up this claim. Clearly state that this is a potential projection and not a guarantee, and that investments involve risk).

Keywords: market forecast, economic outlook, growth projections, return on investment

H3: BlackRock's Expertise and Track Record:

BlackRock's vast experience in asset management and ETF creation provides a level of confidence. Their expertise in portfolio construction and risk management is unparalleled.

Keywords: BlackRock expertise, ETF management, asset management, market leader

H3: Diversification and Risk Management:

Diversifying investments across various BlackRock ETFs minimizes the impact of potential losses in any single asset class. This approach offers a higher probability of achieving substantial gains while managing risk.

Keywords: portfolio diversification, risk management, asset allocation

3. Conclusion:

The BlackRock ETFs highlighted – AGG, IVV, and sector-specific choices – demonstrate strong potential for significant growth in 2025. The combination of market predictions, BlackRock's expertise, and a diversified investment strategy contributes to the potential for impressive returns. The 110% potential is a projection based on current market analysis and should be viewed as such; all investments carry risk.

Call to Action: Unlock the 110% potential of BlackRock ETFs! Explore these top BlackRock ETFs favored by billionaires and consider incorporating them into your 2025 investment strategy. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions. Invest wisely and responsibly. [Link to relevant resources, if applicable].

Featured Posts

-

Everything You Need To Know Before Andor Season 2 Airs

May 08, 2025

Everything You Need To Know Before Andor Season 2 Airs

May 08, 2025 -

Cowherds Persistent Attacks On Jayson Tatum An Analysis

May 08, 2025

Cowherds Persistent Attacks On Jayson Tatum An Analysis

May 08, 2025 -

Dwp Warning 12 Benefits At Risk Urgent Bank Account Check Needed

May 08, 2025

Dwp Warning 12 Benefits At Risk Urgent Bank Account Check Needed

May 08, 2025 -

Directive To Expedite Crime Control Measures A Comprehensive Guide

May 08, 2025

Directive To Expedite Crime Control Measures A Comprehensive Guide

May 08, 2025 -

Disfruta De La Autentica Cocina Mexicana En Cantina Canalla Malaga

May 08, 2025

Disfruta De La Autentica Cocina Mexicana En Cantina Canalla Malaga

May 08, 2025

Jayson Tatums Ankle A Look At The Injury And Potential Recovery Time For The Celtics Star

Jayson Tatums Ankle A Look At The Injury And Potential Recovery Time For The Celtics Star

Jayson Tatum Ankle Injury Updates On Celtics Forwards Condition

Jayson Tatum Ankle Injury Updates On Celtics Forwards Condition

Tatums Respect For Curry Post All Star Game Comments

Tatums Respect For Curry Post All Star Game Comments