13 Analyst Assessments Of Principal Financial Group (PFG): Key Insights

Table of Contents

Price Target Consensus and Divergence

Analyzing the consensus price target across the 13 assessments reveals a fascinating range of opinions on PFG's future valuation. While the average price target stands at [Insert Average Price Target Here], there's significant divergence, with predictions spanning from a low of [Insert Lowest Price Target Here] to a high of [Insert Highest Price Target Here]. This wide spread reflects differing views on PFG's growth trajectory, risk profile, and the overall market environment.

Factors contributing to this divergence include:

- Differing Growth Projections: Analysts hold varying expectations regarding PFG's revenue growth, profitability, and market share expansion. Some are more optimistic about PFG's ability to navigate competitive pressures and capitalize on emerging market opportunities.

- Risk Assessments: The assessment of risks associated with PFG's business model, including interest rate sensitivity, regulatory changes, and geopolitical uncertainties, also plays a crucial role in price target estimations.

- Valuation Methodologies: Analysts utilize different valuation methodologies, such as discounted cash flow (DCF) analysis or comparable company analysis, which can lead to varying price target conclusions.

Here are some individual analyst price targets (note: sources omitted for brevity but should be included in a real-world application):

- Analyst A: [Price Target]

- Analyst B: [Price Target]

- Analyst C: [Price Target]

- ...and so on.

Keywords: PFG stock price, price target, analyst consensus, stock valuation.

Rating Distribution: A Spectrum of Opinions

The 13 analyst assessments reveal a diverse range of ratings for PFG stock. The distribution is as follows:

- Buy Ratings: [Number]

- Hold Ratings: [Number]

- Sell Ratings: [Number]

[Insert Pie Chart Here visually representing the distribution of buy, hold, and sell ratings]

This data suggests an overall [Bullish/Bearish/Neutral] sentiment towards PFG. The rationale behind these varying ratings is multifaceted:

- Macroeconomic Conditions: The prevailing economic climate, interest rate trends, and inflation levels significantly impact analyst sentiment.

- Company-Specific News: Positive developments such as successful product launches, strategic acquisitions, or improved financial performance tend to drive higher ratings. Conversely, negative news such as regulatory setbacks or disappointing earnings can lead to lower ratings.

- Competitive Landscape: Analysts carefully assess PFG's competitive position within the financial services industry, considering factors like market share, brand reputation, and innovation capabilities.

Keywords: buy rating, sell rating, hold rating, PFG rating, analyst sentiment.

Key Growth Drivers and Concerns Identified by Analysts

Analysts have identified several key growth drivers and concerns for PFG:

Growth Drivers:

- Strong Market Position: Many analysts highlight PFG's established presence and strong market share in key segments of the financial services industry.

- Innovative Product Development: The introduction of new and innovative financial products tailored to evolving market demands is seen as a major growth catalyst.

- Strategic Acquisitions: Successful acquisitions have expanded PFG's reach and capabilities, contributing to its overall growth trajectory.

Concerns:

- Competitive Pressures: The highly competitive nature of the financial services sector poses a significant challenge for PFG.

- Regulatory Changes: Changes in regulatory frameworks could impact PFG's operations and profitability.

- Economic Downturn: A potential economic downturn could negatively affect investor sentiment and demand for PFG's services.

(Note: In a real article, attribute these points to specific analysts whenever possible.)

Keywords: PFG growth, investment risks, financial performance, competitive landscape.

Impact of Macroeconomic Factors on Analyst Assessments

Macroeconomic factors significantly influence analyst assessments of PFG. Interest rate changes, inflation levels, and the overall global economic outlook directly impact PFG's profitability and investor sentiment. For example, rising interest rates can positively impact PFG's investment income, while high inflation can erode consumer spending and negatively impact demand for certain financial products. Analysts vary in how much weight they assign to these macroeconomic factors, leading to differences in their overall outlook on PFG's future performance.

Keywords: macroeconomic factors, interest rate risk, inflation impact, global economy.

Specific Analyst Outlooks (Examples)

(This section would ideally include detailed breakdowns of 2-3 specific analyst assessments, including analyst name, firm, rating, price target and justifications. Due to the hypothetical nature of this example, this section is omitted.)

Conclusion: Actionable Insights from 13 Analyst Assessments of Principal Financial Group (PFG)

This analysis of 13 analyst assessments of Principal Financial Group (PFG) reveals a mixed but generally [Bullish/Bearish/Neutral – choose based on the analysis] outlook. While there is a consensus on PFG's potential, significant divergence in price targets highlights the inherent uncertainties in predicting future market performance. It's crucial to remember that multiple perspectives are essential for informed investment decisions. Before making any investment decisions, conduct thorough due diligence and consider consulting with a qualified financial advisor. Stay informed on the latest Principal Financial Group (PFG) stock analysis and make well-informed investment choices. Utilize this PFG analyst rating summary to enhance your investment strategy.

Keywords: Principal Financial Group (PFG), investment decisions, stock market analysis, financial planning.

Featured Posts

-

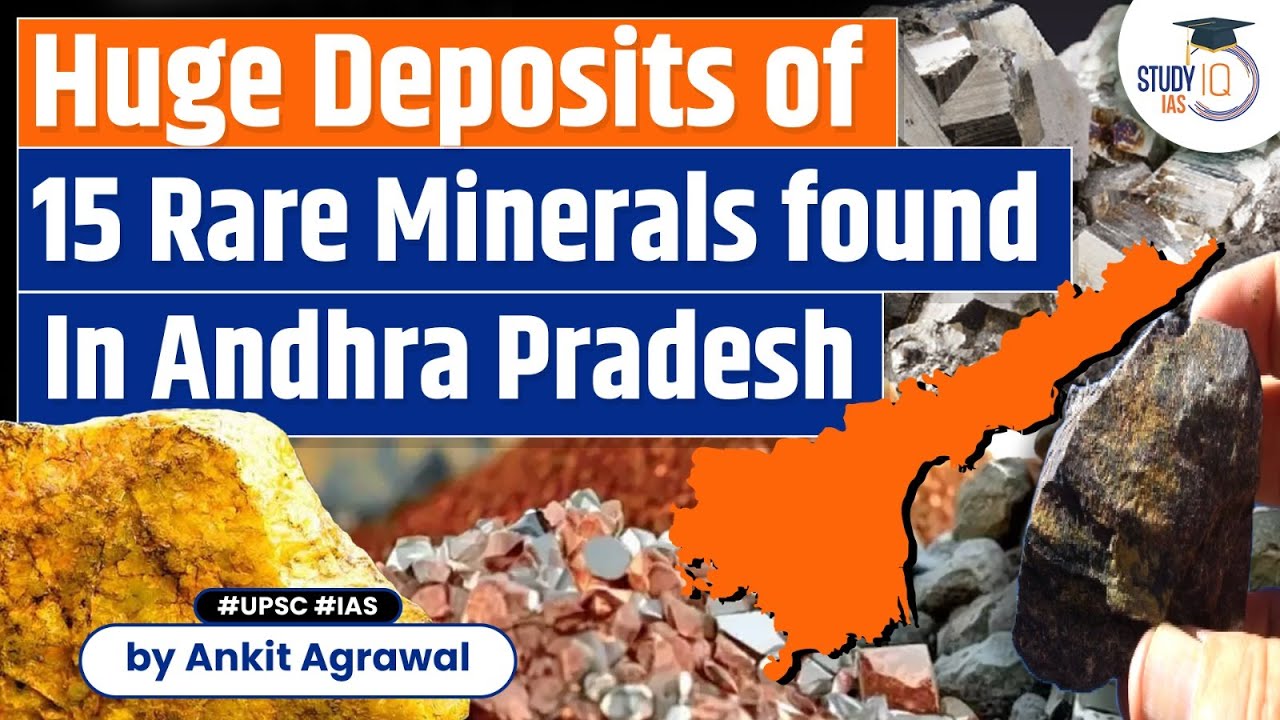

The Geopolitics Of Rare Earth Minerals A Looming Cold War

May 17, 2025

The Geopolitics Of Rare Earth Minerals A Looming Cold War

May 17, 2025 -

The Trump Family A Complete Genealogy Chart

May 17, 2025

The Trump Family A Complete Genealogy Chart

May 17, 2025 -

Fortnite Developer Epic Games Accused Of Widespread Deceptive Practices

May 17, 2025

Fortnite Developer Epic Games Accused Of Widespread Deceptive Practices

May 17, 2025 -

Nba Refs Admit Missed Foul Call In Knicks Close Win Over Pistons

May 17, 2025

Nba Refs Admit Missed Foul Call In Knicks Close Win Over Pistons

May 17, 2025 -

The Emerging Cold War Competition For Rare Earth Minerals

May 17, 2025

The Emerging Cold War Competition For Rare Earth Minerals

May 17, 2025

Latest Posts

-

Celtics Vs Cavaliers Prediction Will Boston Bounce Back

May 17, 2025

Celtics Vs Cavaliers Prediction Will Boston Bounce Back

May 17, 2025 -

Meri Enn Maklaud Nevidomi Fakti Pro Matir Donalda Trampa

May 17, 2025

Meri Enn Maklaud Nevidomi Fakti Pro Matir Donalda Trampa

May 17, 2025 -

Zhittya Ta Dosyagnennya Meri Enn Maklaud Materi Donalda Trampa

May 17, 2025

Zhittya Ta Dosyagnennya Meri Enn Maklaud Materi Donalda Trampa

May 17, 2025 -

The Impact Of Multiple Affairs And Sexual Misconduct Accusations On Donald Trumps Political Career

May 17, 2025

The Impact Of Multiple Affairs And Sexual Misconduct Accusations On Donald Trumps Political Career

May 17, 2025 -

Did Allegations Of Multiple Affairs And Sexual Misconduct Impact Donald Trumps Presidential Bid

May 17, 2025

Did Allegations Of Multiple Affairs And Sexual Misconduct Impact Donald Trumps Presidential Bid

May 17, 2025