13 Analyst Ratings: Principal Financial Group (PFG) Stock Assessment

Table of Contents

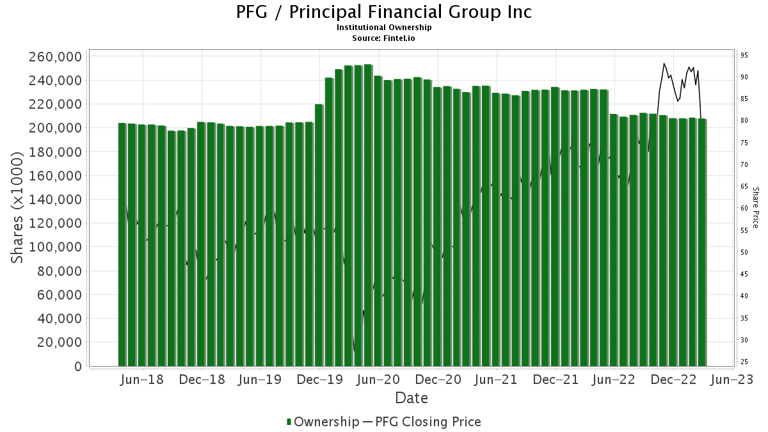

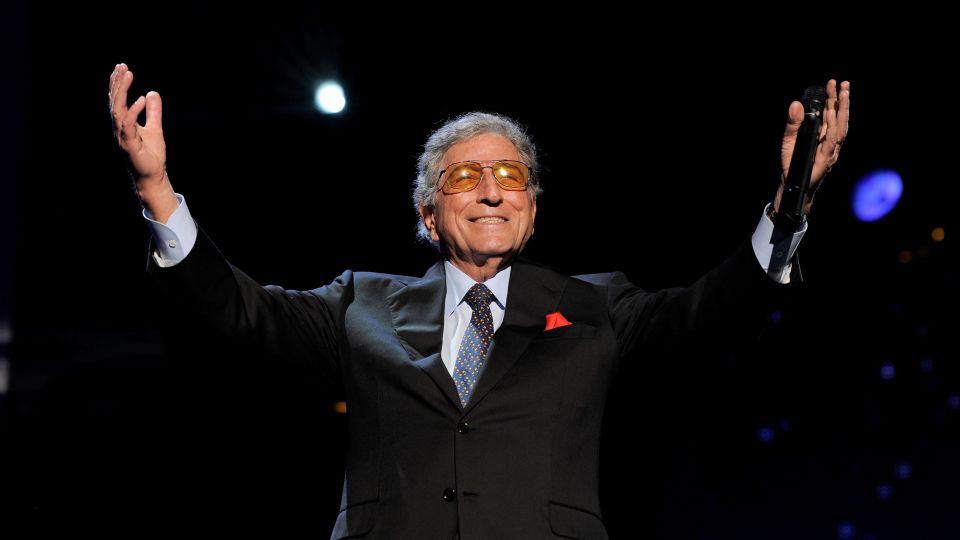

Understanding Analyst Ratings: A Key to PFG Stock Performance

Analyst ratings are opinions from financial professionals who dedicate their careers to analyzing companies and their stock performance. These ratings are a vital tool in the investment decision-making process, offering valuable insights into a company's future prospects. Understanding their significance is crucial for any investor considering PFG stock.

-

Different Types of Ratings: Analyst ratings typically fall into categories such as "Buy," "Sell," "Hold," "Overweight," "Underweight," or "Neutral." A "Buy" rating suggests the analyst believes the stock is undervalued and likely to appreciate, while a "Sell" rating indicates the opposite. "Hold" suggests the stock is fairly valued and the analyst doesn't see a compelling reason to buy or sell.

-

Key Metrics Used: Analysts employ various metrics to evaluate PFG stock, including:

- Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share, indicating how much investors are willing to pay for each dollar of earnings. A high P/E ratio can suggest high growth expectations, while a low P/E might indicate undervaluation or lower growth potential.

- Dividend Yield: This represents the annual dividend payment relative to the stock price, providing insights into the potential for income generation from the investment.

- Growth Prospects: Analysts consider factors such as revenue growth, market share, and competitive landscape to assess the company's future growth potential.

- Financial Strength: Metrics such as debt-to-equity ratios and cash flow help assess the company's long-term financial health and stability.

Summary of 13 Analyst Ratings for Principal Financial Group (PFG): A Detailed Breakdown

Below is a table summarizing 13 recent analyst ratings for Principal Financial Group (PFG). Remember that these ratings represent opinions and are subject to change.

| Rating Agency | Date | Rating | Target Price (USD) |

|---|---|---|---|

| Analyst Firm A | Oct 26, 2023 | Buy | 80 |

| Analyst Firm B | Oct 20, 2023 | Hold | 75 |

| Analyst Firm C | Oct 15, 2023 | Buy | 82 |

| Analyst Firm D | Oct 10, 2023 | Hold | 78 |

| Analyst Firm E | Oct 5, 2023 | Overweight | 85 |

| Analyst Firm F | Sept 29, 2023 | Buy | 79 |

| Analyst Firm G | Sept 22, 2023 | Hold | 76 |

| Analyst Firm H | Sept 15, 2023 | Buy | 83 |

| Analyst Firm I | Sept 8, 2023 | Outperform | 81 |

| Analyst Firm J | Sept 1, 2023 | Hold | 77 |

| Analyst Firm K | Aug 25, 2023 | Buy | 84 |

| Analyst Firm L | Aug 18, 2023 | Neutral | N/A |

| Analyst Firm M | Aug 11, 2023 | Overweight | 86 |

(Note: This table is an example and should be replaced with actual data from reputable sources.)

As you can see, there's a mix of "Buy," "Hold," and "Overweight" ratings. The presence of several "Buy" ratings suggests a generally positive sentiment, although the variations in target prices indicate some divergence in expectations regarding future stock price movements.

Factors Influencing Analyst Ratings of PFG Stock

Several factors influence analyst ratings for PFG stock. A comprehensive assessment requires considering these interacting elements:

-

Macroeconomic Factors: Interest rate changes, inflation levels, and overall economic growth significantly impact PFG's performance. Rising interest rates, for instance, can positively affect the profitability of its investment management segment, while inflation might pressure expenses.

-

Financial Performance: PFG's financial health, reflected in its revenue, earnings, and debt levels, directly impacts analyst sentiment. Strong financial results generally lead to positive ratings, while weaker performance might trigger downgrades.

-

Competitive Landscape: The competitive dynamics within the financial services sector also play a significant role. Analyst ratings consider PFG's competitive positioning, market share, and ability to adapt to evolving industry trends.

-

Recent News and Events: Significant news events—such as acquisitions, regulatory changes, or unexpected market fluctuations—can influence analyst perceptions and trigger rating adjustments.

Interpreting the Consensus: What do the Analyst Ratings Suggest for PFG Investors?

To interpret the overall sentiment, we could calculate a weighted average rating (incorporating target prices where available). This average, however, should be considered alongside the individual ratings and their underlying justifications. The prevalence of "Buy" and "Overweight" ratings in our example suggests a generally positive outlook for PFG stock.

-

Potential Risks and Opportunities: While the overall sentiment may be positive, investors should be aware of potential risks, including macroeconomic uncertainties, increased competition, and regulatory changes. Opportunities may exist due to PFG's strong market position and diversification across various financial services.

-

Investor Profiles: The suitability of PFG stock depends on individual investor profiles. Long-term investors might find PFG attractive due to its potential for steady growth and dividends, while short-term investors might prefer stocks with higher volatility and quicker potential returns.

Making Informed Decisions about Principal Financial Group (PFG) Stock

The 13 analyst ratings analyzed here provide valuable insights but are just one piece of the puzzle. They represent expert opinions but should not be the sole basis for investment decisions. Remember that analyst ratings are subject to change based on new information and shifting market conditions. It's crucial to conduct thorough research, considering fundamental analysis, technical analysis, and your own risk tolerance before making any investment in PFG stock or any other security.

Stay informed about the latest analyst ratings for Principal Financial Group (PFG) stock to make well-informed investment decisions. Remember that a diversified investment strategy, incorporating various asset classes, is crucial for mitigating risk and achieving your long-term financial goals.

Featured Posts

-

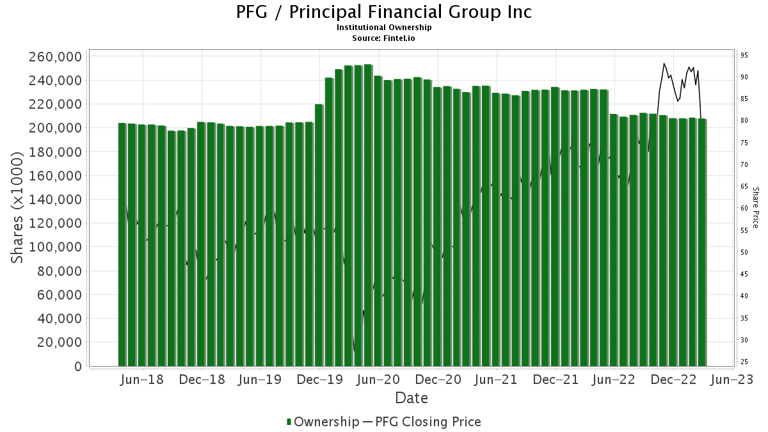

Investing In Uber A Practical Guide For Potential Investors

May 17, 2025

Investing In Uber A Practical Guide For Potential Investors

May 17, 2025 -

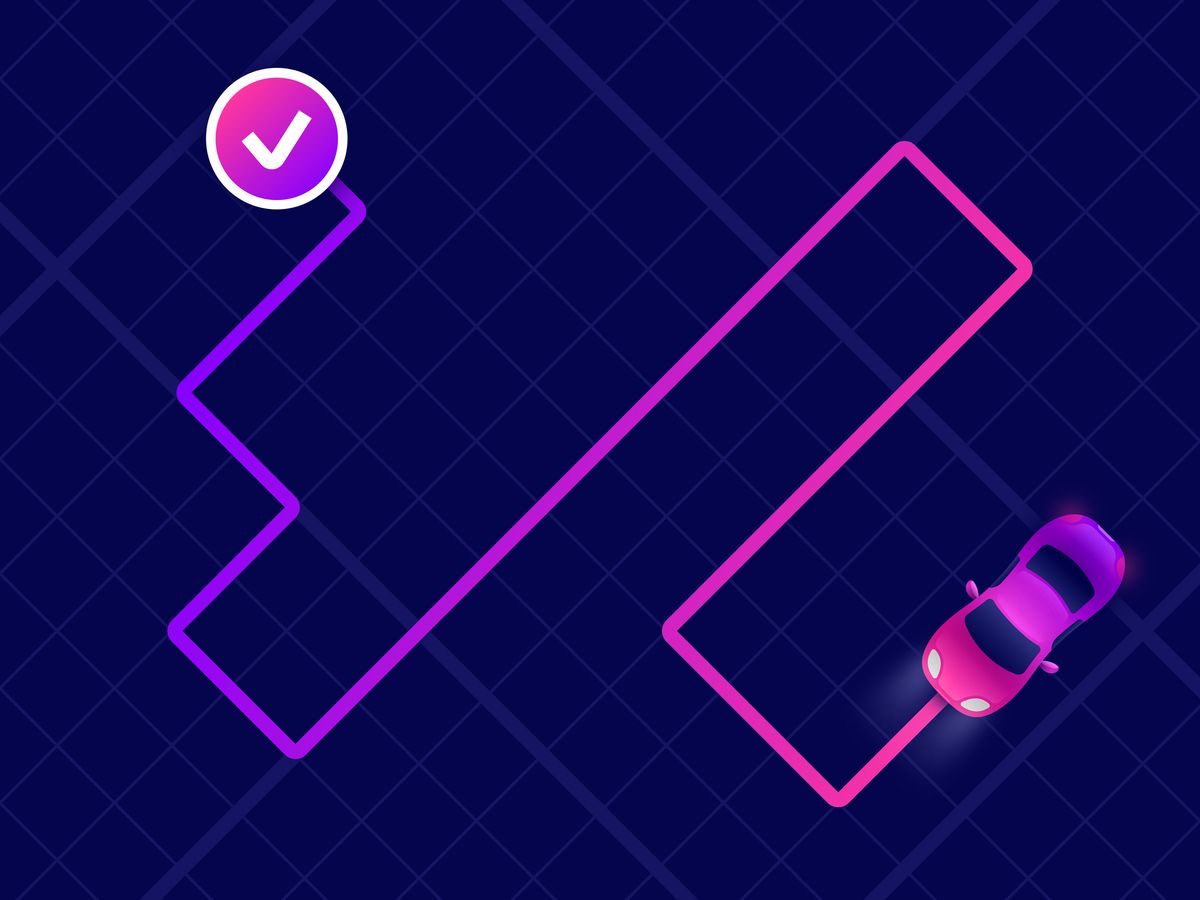

Tony Bennett From Crooner To Cultural Icon

May 17, 2025

Tony Bennett From Crooner To Cultural Icon

May 17, 2025 -

Student Loan Payment Problems Protecting Your Credit Rating

May 17, 2025

Student Loan Payment Problems Protecting Your Credit Rating

May 17, 2025 -

Project Name S Demise Kalanick Reflects On A Costly Decision

May 17, 2025

Project Name S Demise Kalanick Reflects On A Costly Decision

May 17, 2025 -

Shkembimi I Te Burgosurve Midis Rusise Dhe Ukraines Roli Kyc I Emirateve Te Bashkuara Arabe

May 17, 2025

Shkembimi I Te Burgosurve Midis Rusise Dhe Ukraines Roli Kyc I Emirateve Te Bashkuara Arabe

May 17, 2025

Latest Posts

-

Unlock Bet365 Bonus Code Nypbet Knicks Vs Pistons Series Betting Guide

May 17, 2025

Unlock Bet365 Bonus Code Nypbet Knicks Vs Pistons Series Betting Guide

May 17, 2025 -

Nba Playoffs Knicks Vs Pistons Betting Preview With Bet365 Bonus Code Nypbet

May 17, 2025

Nba Playoffs Knicks Vs Pistons Betting Preview With Bet365 Bonus Code Nypbet

May 17, 2025 -

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Odds And Picks

May 17, 2025

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Odds And Picks

May 17, 2025 -

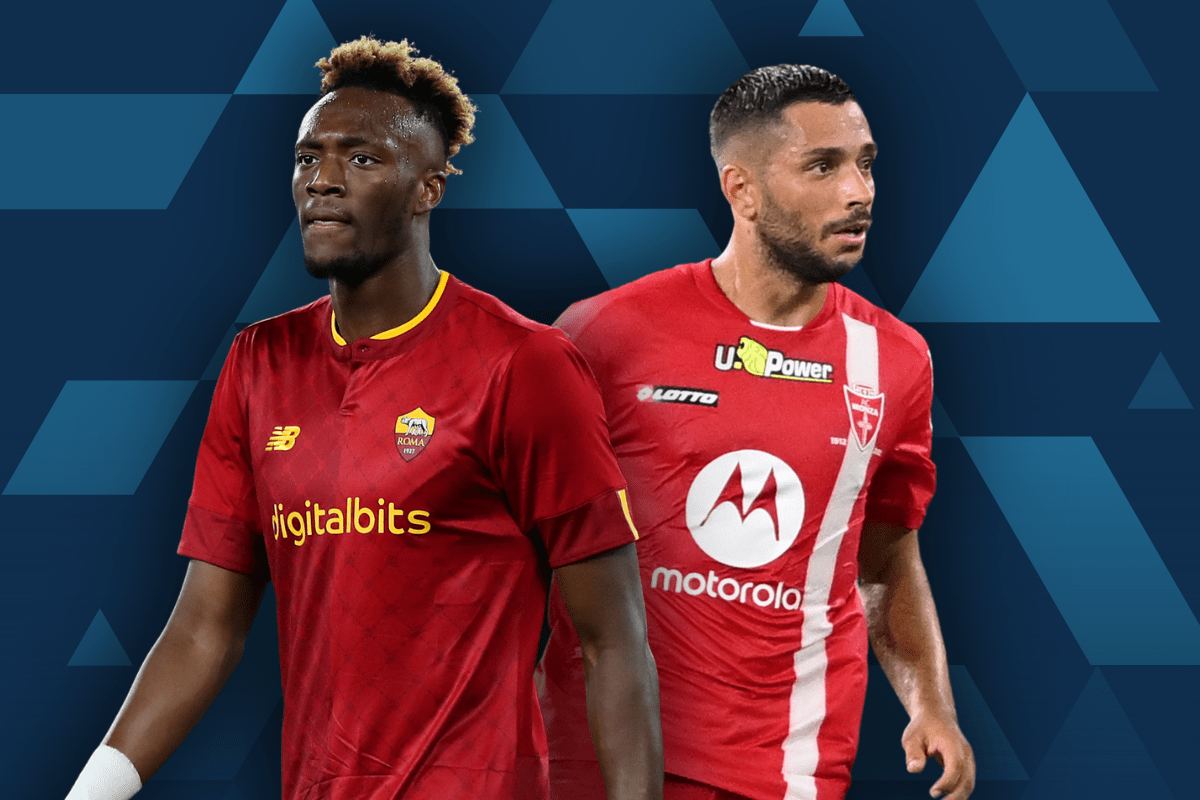

Roma Vs Monza Partido En Directo

May 17, 2025

Roma Vs Monza Partido En Directo

May 17, 2025 -

Crystal Palace Vs Nottingham Forest Resultado En Directo Y Resumen

May 17, 2025

Crystal Palace Vs Nottingham Forest Resultado En Directo Y Resumen

May 17, 2025