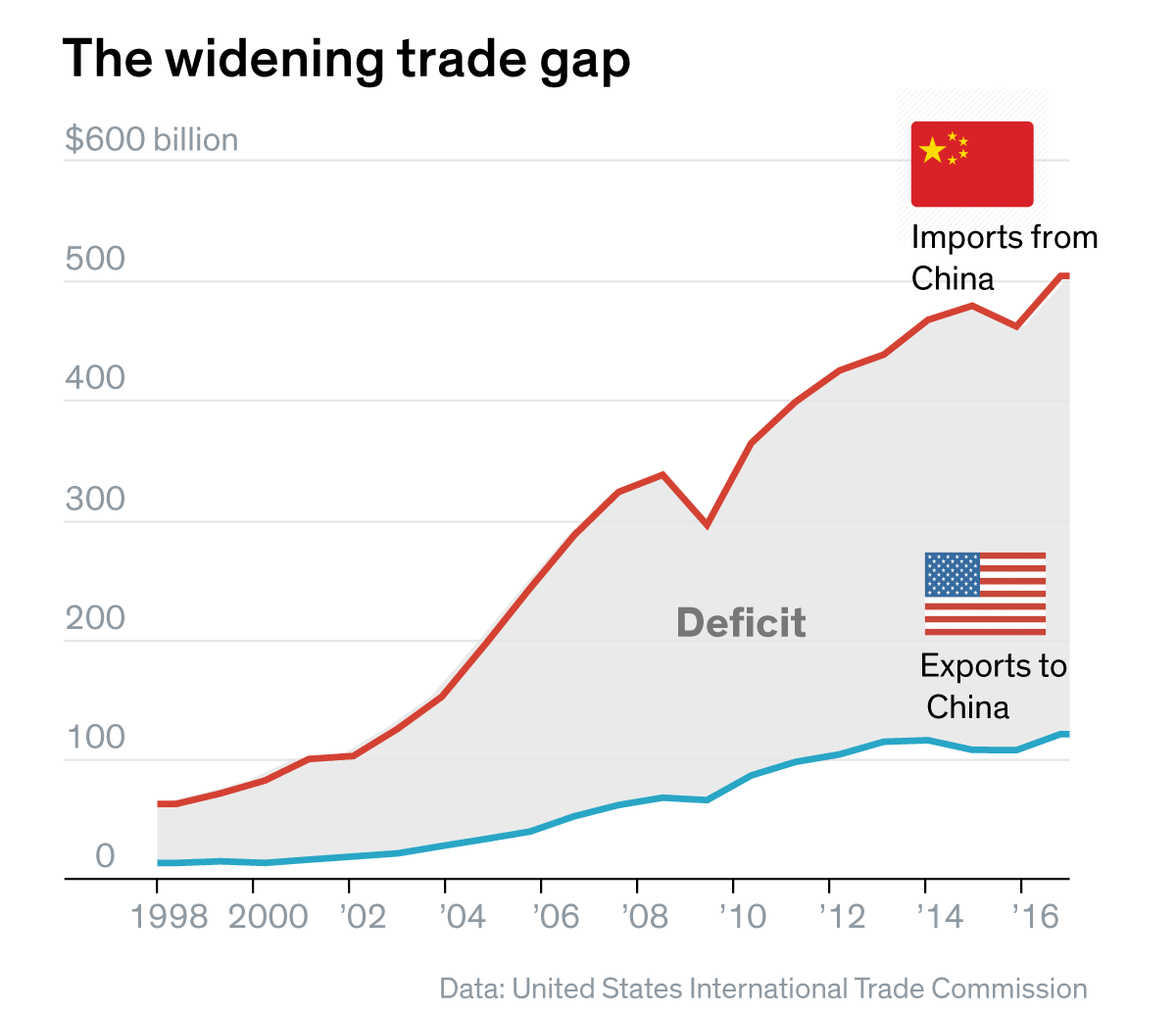

$14.6 Billion Deficit: How Tariffs Impact Ontario's Finances

Table of Contents

The Direct Impact of Tariffs on Ontario Businesses

Tariffs, essentially taxes on imported and exported goods, create a ripple effect throughout Ontario's economic landscape, significantly impacting businesses across diverse sectors.

Increased Input Costs

-

Higher prices for imported raw materials and components: Many Ontario businesses rely on imported raw materials and components for their production processes. Tariffs increase the cost of these inputs, directly squeezing profit margins. This is particularly true in manufacturing, where increased import costs translate to higher production costs, making Ontario-made goods less competitive both domestically and internationally. The automotive industry, for instance, heavily relies on imported parts, and tariffs have significantly impacted their production costs.

-

Case studies of businesses struggling due to tariff increases: Numerous case studies illustrate the detrimental effects. Small and medium-sized enterprises (SMEs) are often the most vulnerable, lacking the resources to absorb increased import costs. For example, a furniture manufacturer may find the cost of imported wood significantly increased, impacting their ability to price competitively. This leads to reduced sales and potential job losses.

-

Keyword optimization: Import costs, manufacturing costs, supply chain disruption, raw materials prices, SME impact, Ontario manufacturing.

Reduced Export Competitiveness

-

Retaliatory tariffs imposed by other countries: When one country imposes tariffs, other countries often retaliate with their own tariffs on that country’s exports. This creates a vicious cycle, harming Ontario's export-oriented sectors. Retaliatory tariffs decrease the demand for Ontario goods in international markets, leading to reduced export revenue and impacting economic growth.

-

Impact on specific export-oriented sectors: The agricultural sector, for instance, heavily relies on exports. Tariffs on Ontario agricultural products can severely damage the industry, leading to farm closures and job losses. The technology sector, another key export driver, also faces challenges as its products become less competitive in global markets due to tariffs.

-

Keyword optimization: Export revenue, retaliatory tariffs, international trade, global competitiveness, Ontario agriculture, technology exports.

Investment Uncertainty and Reduced Business Confidence

-

Tariffs create uncertainty, discouraging investment: The unpredictability associated with tariff changes creates significant uncertainty for businesses considering investment and expansion in Ontario. This uncertainty discourages both domestic and foreign investment, hindering economic growth and job creation.

-

Impact on job growth and economic stability: Reduced investment translates to fewer jobs and slower economic growth. Businesses may postpone expansion plans, delay hiring, or even relocate operations to regions with more favorable trade policies. This negatively affects Ontario’s economic stability and long-term prospects.

-

Keyword optimization: Foreign investment, business confidence, economic uncertainty, job security, Ontario economic growth, investment climate.

The Indirect Impact on Ontario Consumers

The impact of tariffs extends beyond businesses; they directly affect Ontario consumers through increased prices and reduced choice.

Increased Prices for Goods and Services

-

Tariffs lead to higher prices for consumer goods: When import costs rise due to tariffs, these costs are often passed on to consumers in the form of higher prices for goods and services. This reduces consumer purchasing power, impacting household budgets and overall consumer spending.

-

Examples of everyday items affected by tariffs: Numerous everyday items, from clothing and electronics to food and furniture, can see price increases due to tariffs on imported components or finished products. This contributes to inflation and reduces the affordability of essential goods.

-

Keyword optimization: Consumer prices, inflation, cost of living, purchasing power, consumer spending, price increases.

Reduced Consumer Choice

-

Tariffs limit the availability of certain goods and services: Tariffs can restrict the import of certain goods, limiting consumer choice and potentially impacting product quality. Consumers may be forced to buy more expensive or lower-quality alternatives.

-

Discussion of the potential for substitution effects and market distortion: Tariffs can distort market forces, leading to substitution effects where consumers switch to less desirable alternatives. This can also lead to reduced competition and potentially higher prices in the long run.

-

Keyword optimization: Product availability, market competition, import restrictions, consumer choice, market distortion, substitution effects.

The Role of Provincial and Federal Policy in Addressing the Tariff Impact

Addressing the negative impact of tariffs requires a coordinated effort between the provincial and federal governments.

Provincial Initiatives to Mitigate the Effects

-

Discussion of existing or potential provincial programs: Ontario can implement programs to support businesses affected by tariffs, such as targeted tax breaks, subsidies for affected industries, and initiatives promoting trade diversification. These measures can help businesses adapt to the changing economic landscape.

-

Exploration of potential tax breaks, subsidies, or trade diversification strategies: The provincial government can explore various strategies, including tax incentives for businesses investing in domestic production, subsidies for research and development to increase competitiveness, and programs to support the exploration of new export markets.

-

Keyword optimization: Provincial support, economic stimulus, business assistance programs, trade diversification, Ontario government initiatives.

The Need for Federal-Provincial Cooperation

-

Analysis of the necessity for collaborative efforts: Effectively addressing the tariff issue requires strong collaboration between the federal and provincial governments. The federal government plays a critical role in negotiating international trade agreements and shaping national trade policy. Provincial initiatives need to be aligned with these broader federal policies.

-

Discussion of potential strategies for negotiation and trade policy reform: Federal and provincial governments should work together to advocate for fairer trade practices internationally and pursue trade policy reforms that mitigate the negative impact of tariffs. This could include actively engaging in international negotiations to reduce tariffs and promote free trade.

-

Keyword optimization: Federal-provincial relations, trade policy, international negotiations, economic cooperation, trade agreement negotiations.

Conclusion

The $14.6 billion deficit in Ontario underscores the serious economic consequences of tariffs. Their impact extends beyond increased costs; they reduce business investment, diminish consumer choice, and create overall economic instability. Addressing this challenge demands a comprehensive approach, including targeted provincial initiatives to support businesses and robust federal-provincial cooperation on trade policy. By acknowledging how tariffs negatively affect Ontario's finances, we can work towards mitigating their damaging effects and fostering a more resilient and prosperous economy. Learn more about how tariffs impact the Ontario economy and advocate for responsible trade policies to reduce the impact of Ontario's deficit caused by tariffs.

Featured Posts

-

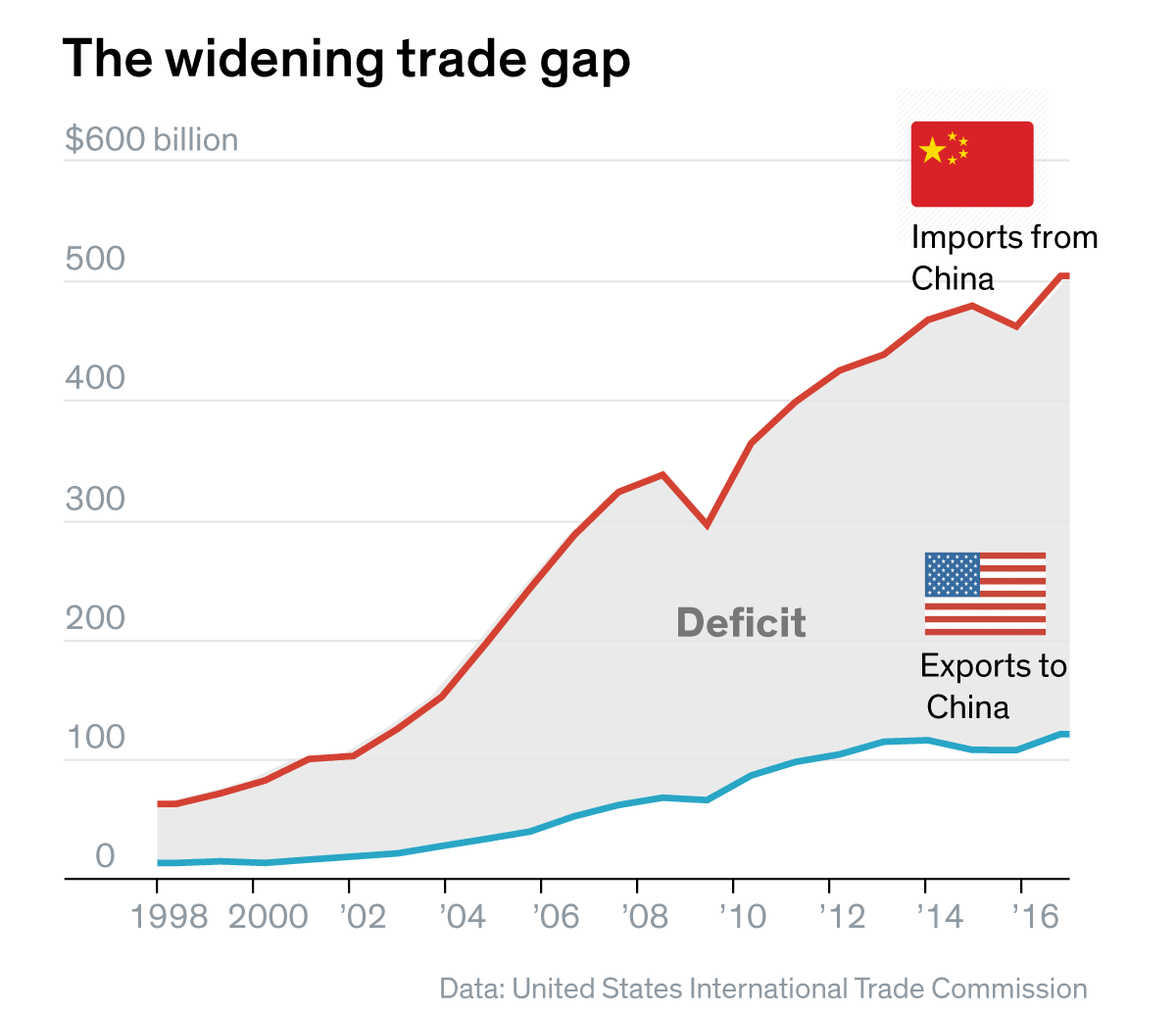

Should I Refinance My Federal Student Loans In 2024 Or Current Year

May 17, 2025

Should I Refinance My Federal Student Loans In 2024 Or Current Year

May 17, 2025 -

When Should You Refinance Federal Student Loans

May 17, 2025

When Should You Refinance Federal Student Loans

May 17, 2025 -

Low Lobster Prices And Global Economic Turmoil Impact Atlantic Canadas Fishing Industry

May 17, 2025

Low Lobster Prices And Global Economic Turmoil Impact Atlantic Canadas Fishing Industry

May 17, 2025 -

Exploring The Reebok X Angel Reese Sneaker Line

May 17, 2025

Exploring The Reebok X Angel Reese Sneaker Line

May 17, 2025 -

Navigating Homeownership While Paying Off Student Loans

May 17, 2025

Navigating Homeownership While Paying Off Student Loans

May 17, 2025

Latest Posts

-

Veteran Springfield Councilman Appointed To Missouri Education Board

May 17, 2025

Veteran Springfield Councilman Appointed To Missouri Education Board

May 17, 2025 -

Acidente Com Onibus Universitario Detalhes Sobre O Ocorrido

May 17, 2025

Acidente Com Onibus Universitario Detalhes Sobre O Ocorrido

May 17, 2025 -

Numero De Vitimas Em Acidente Com Onibus Universitario Aumenta

May 17, 2025

Numero De Vitimas Em Acidente Com Onibus Universitario Aumenta

May 17, 2025 -

Grave Acidente Com Onibus Universitario Atualizacoes E Informacoes

May 17, 2025

Grave Acidente Com Onibus Universitario Atualizacoes E Informacoes

May 17, 2025 -

Springfield Councilman Appointed To Missouri State Board Of Education

May 17, 2025

Springfield Councilman Appointed To Missouri State Board Of Education

May 17, 2025