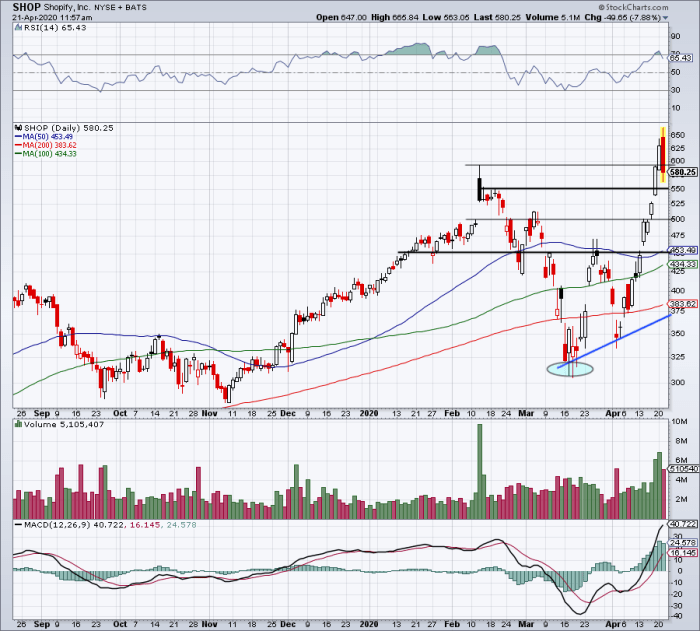

14%+ Shopify Stock Rally On Nasdaq 100 Inclusion News

Table of Contents

The Nasdaq 100 Inclusion: A Catalyst for Growth

Being included in the Nasdaq 100, an index of the 100 largest non-financial companies listed on the Nasdaq Stock Market, is a monumental achievement. This inclusion represents a significant milestone for Shopify, signifying its growth and stability within the global technology landscape. The impact of this event on the Shopify share price is undeniable.

The enhanced visibility and investor attention brought about by Nasdaq 100 inclusion are invaluable. This translates into:

- Increased trading volume: Index fund rebalancing following Shopify's addition resulted in a surge in trading volume, directly impacting the Shopify stock price.

- Attraction of passive investment: Numerous index funds tracking the Nasdaq 100 were compelled to purchase Shopify shares, creating significant buying pressure. This influx of passive investment is a major contributor to the Shopify stock rally.

- Enhanced credibility and market recognition: Inclusion in the Nasdaq 100 lends immediate credibility and reinforces Shopify's position as a leading player in the e-commerce space, further boosting investor confidence.

The Nasdaq 100 is a benchmark index, heavily followed by institutional investors and analysts worldwide. Membership signifies a level of financial success and stability that attracts significant capital. This effect is demonstrably clear in the recent Shopify stock rally.

Shopify's Strong Q2 Earnings: A Contributing Factor

Shopify's inclusion in the Nasdaq 100 wasn't the sole driver of the stock price surge. Its robust Q2 earnings report played a crucial role in fueling investor excitement and contributing to the impressive 14%+ increase in the Shopify share price.

Key performance indicators (KPIs) from the Q2 report showcased impressive growth and exceeded market expectations:

- Analysis of Q2 earnings report: The report highlighted strong revenue growth, exceeding analyst predictions, and demonstrated continued growth in subscriber numbers, indicating a healthy expansion of the Shopify merchant base.

- Discussion of growth drivers: Shopify Payments and Shopify Plus, key components of Shopify's ecosystem, exhibited significant growth, demonstrating the diversification and strength of Shopify's revenue streams.

- Comparison to previous quarters' performance and industry benchmarks: Compared to previous quarters, Q2 results showcased a consistent upward trend, outperforming many competitors in the e-commerce sector, reinforcing investor confidence in Shopify's long-term growth potential. This strong performance directly supported the Shopify stock rally.

Market Sentiment and Investor Confidence in Shopify

The market sentiment surrounding Shopify, and the e-commerce sector as a whole, is overwhelmingly positive. This optimism, combined with strong Q2 earnings and Nasdaq 100 inclusion, created a perfect storm for the Shopify stock rally.

- Positive analyst ratings and price target increases: Following the Q2 earnings and Nasdaq 100 announcement, several leading financial analysts increased their price targets for Shopify stock, further boosting investor confidence.

- Factors influencing investor sentiment: While macroeconomic conditions can influence market sentiment, the positive news surrounding Shopify significantly outweighed any negative impacts.

- Influence of competitor performance: While competitor performance always plays a role, Shopify's strong Q2 results and Nasdaq 100 inclusion overshadowed any negative news from rivals, solidifying its position as a market leader.

Long-Term Growth Prospects for Shopify

Shopify's position as a dominant player in the e-commerce market presents significant long-term growth opportunities:

- Expansion into new markets and product offerings: Shopify continues to expand its global reach and offer new services to its merchants, fueling sustainable growth.

- Technological innovation and competition in the e-commerce space: While competition exists, Shopify's commitment to innovation and its comprehensive platform gives it a significant competitive edge.

- Potential impact of economic downturns on consumer spending: While economic uncertainty is a risk, Shopify's position in the essential e-commerce sector mitigates the potential impact.

Conclusion

The significant Shopify stock rally exceeding 14% is attributable to a confluence of positive factors. The inclusion in the Nasdaq 100 index provided unparalleled visibility and attracted significant investment, while Shopify's strong Q2 earnings demonstrated robust financial health and future growth potential. Positive market sentiment and investor confidence further fueled this remarkable increase in the Shopify share price.

Are you interested in learning more about the potential of Shopify stock and how to navigate the volatile e-commerce market? Stay informed on future market movements and consider diversifying your investment portfolio with high-growth stocks like Shopify. Monitor the Shopify share price and its performance within the Nasdaq 100 for continued investment opportunities. Learn more about investing in Shopify stock today!

Featured Posts

-

New Aussie Player Daria Kasatkina Celebrates First Day Wta Ranking Update

May 14, 2025

New Aussie Player Daria Kasatkina Celebrates First Day Wta Ranking Update

May 14, 2025 -

Did Political Correctness Doom Snow White Analyzing The Films Commercial Failure

May 14, 2025

Did Political Correctness Doom Snow White Analyzing The Films Commercial Failure

May 14, 2025 -

Captain America Brave New World Disney Streaming Date Confirmed

May 14, 2025

Captain America Brave New World Disney Streaming Date Confirmed

May 14, 2025 -

Ted Blacks Underutilized Ability In Suits La Episode 2

May 14, 2025

Ted Blacks Underutilized Ability In Suits La Episode 2

May 14, 2025 -

Planning A May Trip Best Places To Visit This Month

May 14, 2025

Planning A May Trip Best Places To Visit This Month

May 14, 2025