$194 Billion In Losses: The Impact Of Trump Inauguration Donations On Tech Billionaires

Table of Contents

Political Alignment and Investor Sentiment

Donations to the Trump inauguration by tech billionaires were met with mixed reactions, significantly impacting investor sentiment and public perception. The perceived alignment with a controversial administration created a ripple effect throughout the tech industry. Investors, particularly those with socially progressive leanings, began to reconsider their investments in companies associated with these individuals. This shift in investor preference stemmed from several key factors:

- Negative media coverage of donations and potential conflicts of interest: News outlets extensively covered the donations, raising concerns about potential conflicts of interest and the influence of political contributions on policy decisions. This negative press fueled public distrust and impacted brand reputation.

- Shift in investor preference towards companies with more socially progressive stances: The Trump administration's policies on issues such as climate change, immigration, and LGBTQ+ rights alienated a significant portion of the population, leading investors to favor companies with more socially responsible practices. ESG (Environmental, Social, and Governance) investing gained significant traction, prioritizing companies with strong ethical and social commitments.

- Impact on stock prices and market capitalization: The resulting negative publicity and shift in investor sentiment directly impacted the stock prices and market capitalization of companies linked to these billionaires. This decrease in valuation contributed significantly to the overall $194 billion loss.

Policy Changes and Regulatory Scrutiny

The Trump administration implemented several policies that negatively affected tech companies, exacerbating the financial losses experienced by the billionaires who had donated to his inauguration. These policies created uncertainty and increased operational costs, ultimately diminishing valuations.

- Antitrust investigations: Increased regulatory scrutiny and antitrust investigations targeting major tech companies led to legal battles and uncertainty, impacting stock prices and diverting resources away from innovation and growth.

- Immigration policies: Changes to immigration policies hindered the tech industry's access to skilled labor, impacting innovation and growth. The difficulty in attracting and retaining international talent significantly impacted many tech companies' bottom lines.

- Changes to tax laws: Although some tax cuts were beneficial to businesses, certain aspects of the tax reform negatively impacted some sectors of the tech industry, contributing to decreased profitability.

Public Backlash and Brand Reputation

The public reaction to the donations significantly influenced brand perception and impacted the revenue and market share of the involved tech companies. Negative publicity and boycotts played a significant role in the financial losses.

- Examples of public backlash against specific tech companies: Several tech companies faced intense public criticism, boycotts, and calls for divestment in response to the donations made by their leadership. This resulted in damaged brand reputation and a significant loss of customer loyalty.

- Analysis of social media trends and consumer sentiment: Social media platforms became a battleground for public opinion, with widespread condemnation of the donations influencing consumer behavior. The shift in public sentiment was clearly reflected in sales figures and market research data.

- Quantifiable data demonstrating the impact of boycotts on sales and profits: Studies have shown a direct correlation between the negative publicity surrounding the donations and a decrease in sales and profits for some affected companies. Specific data on sales decline, lost market share, and decreased customer engagement could help quantify the financial impact of the boycotts.

The Long-Term Effects on Tech Billionaires and the Industry

The $194 billion loss had long-term consequences for the affected tech billionaires and the broader tech industry. The impact extends beyond immediate financial losses, affecting philanthropic activities, corporate social responsibility strategies, and investment in innovation.

- Long-term implications for philanthropic activities: The significant financial setbacks impacted the philanthropic activities of several billionaires, limiting their ability to support various causes and initiatives.

- Changes in corporate social responsibility strategies: Many tech companies re-evaluated their corporate social responsibility (CSR) strategies in response to the public backlash, making efforts to align themselves more closely with progressive social values.

- Impact on innovation and investment in the tech sector: The financial losses and increased regulatory scrutiny could potentially have a chilling effect on innovation and investment in certain sectors of the tech industry.

Understanding the $194 Billion Loss: A Call to Action

This analysis reveals a complex interplay between political donations, policy changes, investor sentiment, and the significant financial losses experienced by tech billionaires following the Trump inauguration. The $194 billion loss highlights the multifaceted nature of the impact and underscores the interconnectedness of political donations, policy, and market forces. Understanding the impact of political donations on tech billionaires is crucial. Further research into this complex issue will help shed light on the interplay between politics and the economy. Continue exploring the impact of political contributions on the tech industry and learn more about the financial consequences of political alignment.

Featured Posts

-

Katya Jones Hints At Bbc Departure After Wynne Evans Betrayal

May 09, 2025

Katya Jones Hints At Bbc Departure After Wynne Evans Betrayal

May 09, 2025 -

Putins Victory Day Ceasefire Hope For Peace Or Propaganda

May 09, 2025

Putins Victory Day Ceasefire Hope For Peace Or Propaganda

May 09, 2025 -

Dakota Johnson Por Que El Bolso Hereu Es El Accesorio Perfecto

May 09, 2025

Dakota Johnson Por Que El Bolso Hereu Es El Accesorio Perfecto

May 09, 2025 -

Post Trade Deadline Power Rankings 2025 Nhl Playoff Predictions

May 09, 2025

Post Trade Deadline Power Rankings 2025 Nhl Playoff Predictions

May 09, 2025 -

Second Wave Of Anti Trump Protests Sweeps Anchorage

May 09, 2025

Second Wave Of Anti Trump Protests Sweeps Anchorage

May 09, 2025

Latest Posts

-

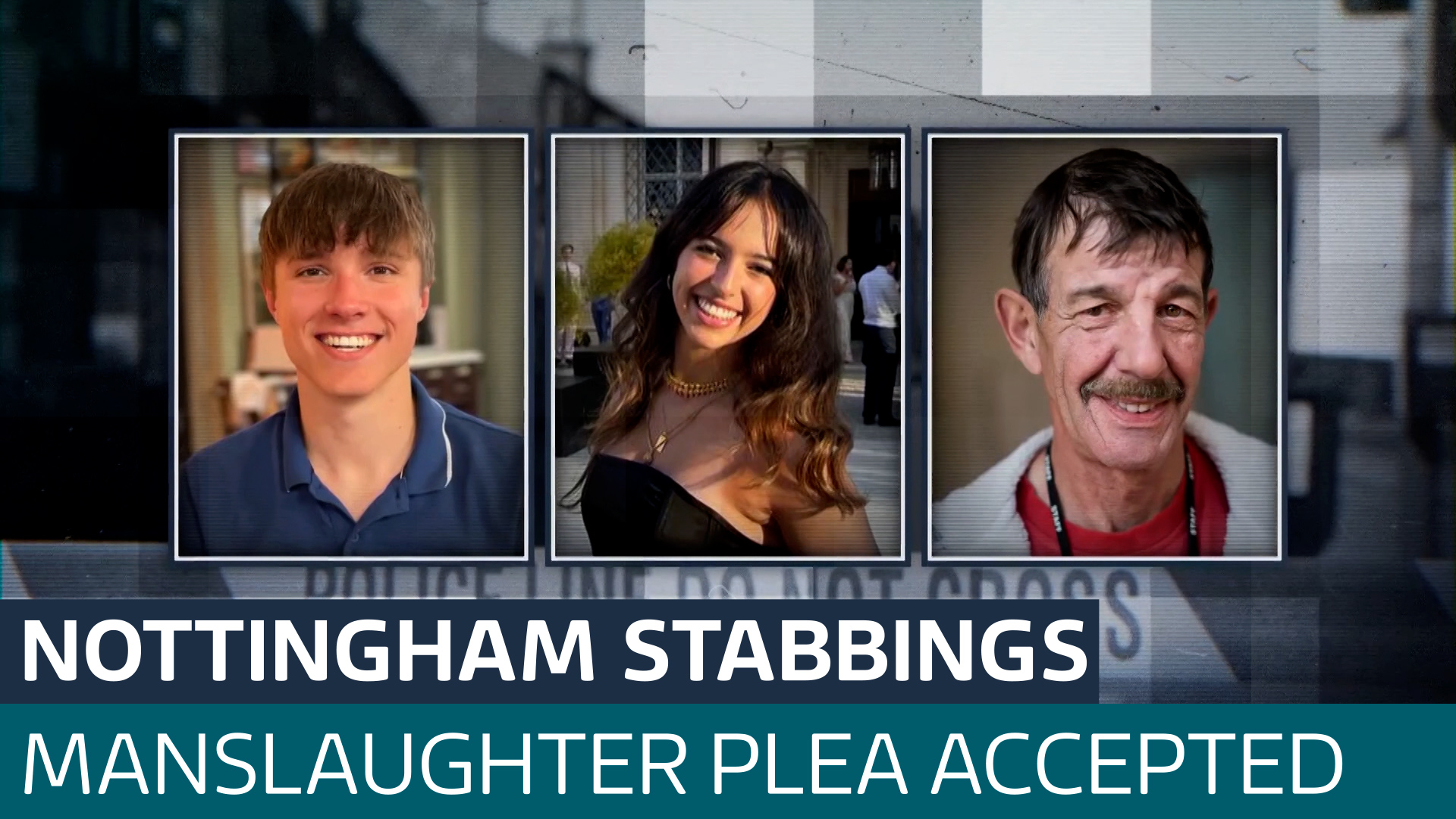

Nottingham A And E Records Accessed Illegally Families Of Stabbing Victims Demand Justice

May 09, 2025

Nottingham A And E Records Accessed Illegally Families Of Stabbing Victims Demand Justice

May 09, 2025 -

Nhs Data Breach In Nottingham Stabbing Victims Families Demand Answers

May 09, 2025

Nhs Data Breach In Nottingham Stabbing Victims Families Demand Answers

May 09, 2025 -

Families Furious After Nhs Staff Accessed A And E Records Of Nottingham Stabbing Victims

May 09, 2025

Families Furious After Nhs Staff Accessed A And E Records Of Nottingham Stabbing Victims

May 09, 2025 -

Nottingham Hospital Data Breach Families Outraged By Access To Loved Ones A And E Records

May 09, 2025

Nottingham Hospital Data Breach Families Outraged By Access To Loved Ones A And E Records

May 09, 2025 -

Data Breach Nhs Staff Face Inquiry Over Access To Nottingham Victim Records

May 09, 2025

Data Breach Nhs Staff Face Inquiry Over Access To Nottingham Victim Records

May 09, 2025