2% Share Drop For LVMH After Q1 Sales Figures Fall Short

Table of Contents

Q1 Sales Figures: A Detailed Look

The Q1 2024 results revealed a concerning underperformance across several key LVMH divisions. Analyzing the specific areas of weakness is essential to grasp the full extent of the problem.

Underperformance Across Key Divisions

LVMH's Q1 results showcased a less-than-stellar performance across its portfolio. Several key divisions experienced noticeable sales drops compared to expectations:

- Fashion & Leather Goods: A reported X% decrease in sales, primarily attributed to [mention specific reasons, e.g., weaker demand for a specific product line, regional slowdowns]. This division, usually a major revenue driver for LVMH, felt the impact most keenly.

- Wines & Spirits: A Y% decline in sales, potentially impacted by [mention specific reasons, e.g., changes in consumer preferences, increased competition, or regional economic factors].

- Perfumes & Cosmetics: Experienced a Z% decrease, suggesting a softening in demand for luxury beauty products, possibly due to [mention specific reasons, e.g., increased price sensitivity amongst consumers, or a shift in consumer preference to other brands].

- Regional Discrepancies: Significant variations were observed across different geographical markets. [Mention specific regions that underperformed, e.g., Europe, Asia, etc., and briefly explain the contributing factors].

This uneven performance across divisions highlights the complexities within the luxury goods market and the challenges LVMH faces in navigating this environment. The LVMH Q1 results paint a picture of a luxury goods sector facing headwinds.

Comparison to Analyst Expectations

The discrepancy between actual LVMH sales and analyst forecasts was substantial. Analysts had predicted revenue of [predicted revenue figure], but LVMH reported only [actual revenue figure], a shortfall of [percentage or numerical difference]. This significant gap triggered a sharp market reaction, with the LVMH share price immediately reflecting investor concern regarding the company's LVMH earnings and future LVMH revenue forecast. The market clearly reacted negatively to this unexpected underperformance, raising further questions about the LVMH financial performance and the overall strength of the luxury goods market.

Factors Contributing to the Decline in LVMH Sales

Several interconnected factors contributed to the disappointing LVMH sales figures. Understanding these nuances is key to predicting future performance and the overall health of the luxury goods sector.

Global Economic Slowdown

The global economic slowdown played a significant role in the reduced demand for luxury goods.

- Inflation and Recessionary Fears: Rising inflation and growing concerns about a potential recession led to decreased consumer spending, especially on discretionary items like luxury goods.

- Reduced Consumer Confidence: Uncertainty about the economic outlook impacted consumer confidence, making high-end purchases less appealing to many.

- Regional Variations: The impact of the economic slowdown varied across regions, with [mention specific regions and the impact on LVMH's sales there].

The global luxury market is intrinsically linked to global economic health; therefore, the recent macroeconomic headwinds directly affected consumer purchasing power, impacting LVMH sales negatively.

Increased Competition

The luxury goods market is highly competitive, and LVMH is facing increasing pressure from rival brands.

- Aggressive Marketing Strategies: Competitors are employing increasingly aggressive marketing strategies to attract consumers, including [mention specific examples, e.g., targeted digital campaigns, celebrity endorsements, innovative product launches].

- Market Share Shifts: Some evidence suggests that LVMH may be losing market share to certain competitors, particularly in [mention specific product categories or regions]. Analyzing competitor strategies and LVMH’s response is crucial.

This intense competition is a factor that should be carefully monitored, as it directly relates to LVMH's ability to maintain its dominant position in the luxury market.

Supply Chain Disruptions

While supply chain disruptions have eased somewhat in recent months, lingering effects continue to impact the luxury goods industry.

- Logistics Bottlenecks: Although the severity has lessened, some logistics bottlenecks persist, impacting delivery times and potentially hindering sales.

- Raw Material Costs: Fluctuations in raw material prices continue to pose challenges, affecting production costs and potentially impacting profitability.

Supply chain issues remain a relevant factor in the luxury goods industry, requiring continuous monitoring and proactive solutions from LVMH and other industry players. The LVMH supply chain, like that of many other luxury goods companies, has been tested in recent years.

Investor Reaction and Market Outlook

The news of LVMH's disappointing Q1 sales figures triggered a wave of reactions in the financial markets.

Share Price Volatility

The immediate impact on LVMH's share price was a sharp 2% drop, reflecting investor concern about the company's future performance. This volatility underscores the market's sensitivity to any signs of weakness in the luxury sector. The LVMH stock price continues to be closely watched by investors.

Analyst Predictions for the Future

Analyst predictions for LVMH's future performance are mixed. Some analysts maintain a positive outlook, citing LVMH's strong brand portfolio and long-term growth potential. However, others have expressed caution, pointing to the ongoing global economic uncertainties and the intensified competition within the luxury market. The LVMH share price forecast depends largely on future economic conditions and the company’s ability to adapt to the evolving market landscape. Monitoring LVMH’s future outlook will be important for investors.

Conclusion

The 2% share drop experienced by LVMH following its disappointing Q1 2024 sales figures highlights the challenges facing the luxury goods industry. The underperformance across several key divisions, coupled with the impact of the global economic slowdown, increased competition, and lingering supply chain issues, created a perfect storm that significantly impacted LVMH sales. The market's reaction underscores investor concerns about the company's short-term prospects and the overall health of the luxury market. Monitoring future developments in LVMH sales, LVMH performance, and LVMH market share will be crucial in gauging the company’s ability to navigate these challenges and regain its momentum. Stay informed about future LVMH financial news to make well-informed decisions.

Featured Posts

-

Child Sex Crimes Columbus Man Receives Guilty Verdict

May 24, 2025

Child Sex Crimes Columbus Man Receives Guilty Verdict

May 24, 2025 -

La Fires Price Gouging Accusations Target Landlords Says Selling Sunsets Stars Name

May 24, 2025

La Fires Price Gouging Accusations Target Landlords Says Selling Sunsets Stars Name

May 24, 2025 -

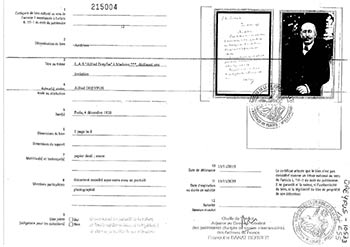

130 Years On Renewed Efforts To Honor Alfred Dreyfus

May 24, 2025

130 Years On Renewed Efforts To Honor Alfred Dreyfus

May 24, 2025 -

Umgebung Essener Uniklinikum Aktuelle Geschehnisse

May 24, 2025

Umgebung Essener Uniklinikum Aktuelle Geschehnisse

May 24, 2025 -

Dazi Trump Al 20 Sull Ue Conseguenze Per Nike Lululemon E Altri Brand

May 24, 2025

Dazi Trump Al 20 Sull Ue Conseguenze Per Nike Lululemon E Altri Brand

May 24, 2025