£22.7 Million In Banksy Print Sales: A Market Overview

Table of Contents

The Rise of Banksy Prints as a Collectible Investment

Banksy prints have become highly sought-after collectibles and a compelling investment strategy, offering potentially high returns. Several factors contribute to their rising value and desirability in the art market:

-

Limited Edition Nature: Banksy's prints are often released in limited editions, creating inherent scarcity that fuels demand. The smaller the edition size, the higher the potential value. This is a fundamental principle of art investment, mirroring the value increases seen in other limited-edition collectibles.

-

Increasing Scarcity and Demand: As more collectors seek Banksy's work, and fewer prints become available, the value naturally increases. This supply and demand dynamic is a key driver of price appreciation in any collectible market, including Banksy print sales.

-

Banksy's Elusive Nature and Rebellious Image: Banksy's anonymity and rebellious spirit add to the mystique surrounding his art, further enhancing its desirability among collectors. This aura of exclusivity elevates the perceived value and desirability of his pieces.

-

Historical Context and Cultural Significance: Banksy's art often reflects social and political commentary, contributing to its long-term cultural significance. This enduring relevance ensures continued interest from collectors and investors. The historical context surrounding specific prints can dramatically affect their price.

-

Examples of Significant Print Sales and Price Appreciation: Several Banksy prints have sold for astronomical sums at auction, demonstrating the significant return on investment (ROI) possible in this market. Tracking these sales provides valuable insights into price trends and potential future growth.

Key Factors Influencing Banksy Print Prices

Several key factors determine the price of a Banksy print within the Banksy art market:

-

Rarity and Edition Size: As mentioned, the smaller the edition size, the higher the value. Rare prints, particularly those from early editions, command significantly higher prices. Understanding edition sizes is crucial for Banksy print investment.

-

Print Condition: The condition of a Banksy print significantly impacts its value. A mint condition print, free from damage, will fetch a far higher price than a damaged one. Professional grading and certification are critical.

-

Authenticity and Verification Processes: Authenticating Banksy prints is crucial, given the prevalence of forgeries. Using reputable authentication services and acquiring prints from established galleries or auction houses is vital for minimizing risk. The importance of verified provenance cannot be overstated in the Banksy art market.

-

Current Market Trends and Demand Fluctuations: Like any market, the price of Banksy prints is subject to fluctuations based on current trends and overall market sentiment. Staying informed about current trends is important.

-

Historical Significance of Specific Prints: Prints associated with significant events or cultural moments typically command higher prices. Understanding the history and context surrounding individual pieces can influence investment decisions.

Analyzing the £22.7 Million Figure: Data and Trends

The £22.7 million figure representing Banksy print sales signifies a remarkable surge in the market. To understand this figure fully, we need to consider:

-

Source of the Data: This figure likely comes from a compilation of data from various reputable auction houses and sales reports specializing in the art market. The specific source influences the validity and scope of the number.

-

Specific Prints Contributing to the Total: Identifying the specific prints contributing to this impressive total allows for a granular analysis of which works are driving the market and which are in high demand.

-

Comparison to Previous Years' Sales Figures: Analyzing year-over-year growth patterns reveals the trajectory of the Banksy print market and the speed of its expansion.

-

Geographical Distribution of Buyers: Understanding where buyers are located (e.g., the strong UK market, growing US and Asian markets) provides insights into market dynamics and potential future growth areas.

-

Predictions for Future Market Growth: Based on current trends, experts are predicting continued, albeit potentially volatile, growth in the Banksy print market. However, understanding the risks is crucial.

Navigating the Banksy Print Market: Risks and Opportunities

Investing in Banksy prints presents significant opportunities, but also notable risks:

-

Risks of Counterfeiting and Authentication Challenges: The high value of Banksy prints makes them a target for forgers. Thorough due diligence and authentication are critical. Buying from reputable sources mitigates this risk.

-

Market Volatility and Potential for Price Drops: The art market, including Banksy prints, is subject to volatility. Prices can fluctuate, and there's a risk of short-term price drops. A long-term strategy is recommended.

-

Importance of Due Diligence and Reputable Sources: Only purchase Banksy prints from established auction houses, reputable galleries, or trusted dealers with proven expertise in Banksy's artwork. This is essential for avoiding forgeries.

-

Strategies for Minimizing Risk: Conduct thorough research, utilize authentication services, and diversify your investment portfolio to mitigate risks. Never invest more than you can afford to lose.

-

Long-Term Investment Potential vs. Short-Term Gains: Banksy prints are considered a long-term investment; while short-term gains are possible, a longer investment horizon generally offers better returns and mitigates market fluctuations.

Conclusion

The £22.7 million figure in Banksy print sales undeniably reflects a burgeoning and lucrative market. The factors driving this growth—limited editions, increasing scarcity, and Banksy's cultural impact—are powerful. However, investors must carefully consider the risks, particularly those related to authentication and market volatility. By conducting thorough due diligence and working with reputable sources, you can navigate this exciting market and potentially reap significant rewards. To further your understanding of the Banksy art market and the opportunities it presents, explore resources dedicated to art investment and consult with experts before investing in Banksy prints. The potential of the Banksy print market is undeniable, offering savvy investors the chance to capitalize on a unique and dynamic art phenomenon.

Featured Posts

-

Dubai Hosts First Ever Banksy Art Exhibition World News

May 31, 2025

Dubai Hosts First Ever Banksy Art Exhibition World News

May 31, 2025 -

Nu Cau Thu Cau Long Viet Nam Khat Vong Top 20 The Gioi Tai Dau Truong Dong Nam A

May 31, 2025

Nu Cau Thu Cau Long Viet Nam Khat Vong Top 20 The Gioi Tai Dau Truong Dong Nam A

May 31, 2025 -

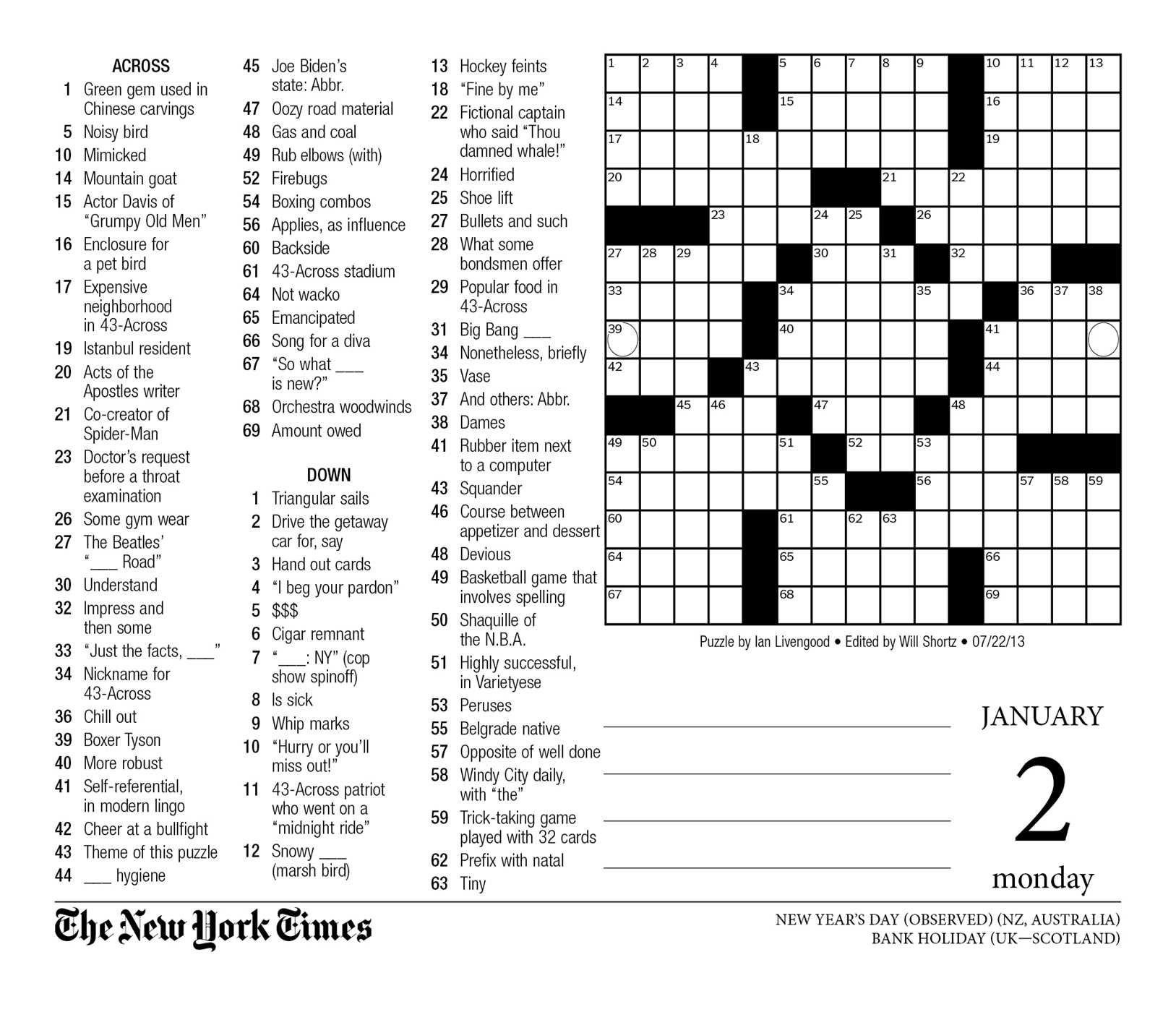

Solve The Nyt Mini Crossword Wednesday April 9 Clues And Answers

May 31, 2025

Solve The Nyt Mini Crossword Wednesday April 9 Clues And Answers

May 31, 2025 -

Nyt Mini Crossword Answers For Thursday April 10 2024

May 31, 2025

Nyt Mini Crossword Answers For Thursday April 10 2024

May 31, 2025 -

Americas Military Decline Chinas Rise In Military Power

May 31, 2025

Americas Military Decline Chinas Rise In Military Power

May 31, 2025