25% WestJet Stake Sale To Foreign Airlines Signals Onex Investment Success

Table of Contents

Onex Corporation's Successful Investment in WestJet

Onex Corporation's investment in WestJet has proven to be a remarkably successful venture. Their initial investment, the exact details of which remain partially undisclosed, marked a significant step in WestJet's trajectory. Onex's investment strategy typically involves identifying undervalued assets with high growth potential, implementing operational improvements, and then realizing significant returns through strategic exits like this sale. The WestJet acquisition aligns perfectly with this strategy. This "WestJet stake sale" represents a substantial return on their initial investment, highlighting Onex's expertise in identifying and capitalizing on opportunities within the transportation sector.

- Initial investment amount and date: While the precise figures remain confidential, reports suggest the initial investment occurred several years ago, with Onex gradually acquiring a majority stake.

- Key milestones in Onex's ownership of WestJet: These include operational improvements, fleet expansions, and route diversification, all contributing to increased profitability.

- Estimated profit margin for Onex: The 25% stake sale is expected to yield a considerable profit for Onex, significantly exceeding their initial investment, solidifying this as a highly successful private equity play.

- Comparison with other Onex investments: This WestJet deal reflects Onex's consistent track record of successful investments and strategic exits in various industries, further enhancing their reputation as a shrewd investor.

Implications of Foreign Airline Investment in WestJet

The foreign airlines acquiring the 25% stake in WestJet – the identities of which are yet to be fully disclosed publicly – represent a strategic move with considerable implications. Their investment suggests an acknowledgement of WestJet's strength as a reputable airline and a belief in its growth prospects within both domestic and international markets.

- Names and countries of origin of the foreign airlines: As details are released, we will update this section with the official names of the airlines involved and their respective home countries. Initial reports suggest airlines from Europe and Asia are key participants in this transaction.

- Their market share and competitive landscape: These airlines, already established players in their home markets, likely see synergies with WestJet's existing network, creating opportunities for code-sharing, route expansions, and enhanced customer loyalty programs.

- Potential synergies between WestJet and the foreign airlines: This collaboration could unlock access to new routes and customer bases, enriching the travel options for both airline networks.

- Anticipated impact on WestJet's routes and services: We can anticipate an expansion of international routes, potentially leading to increased competition and a more dynamic air travel landscape within Canada and beyond. Further benefits might include improvements to in-flight services and baggage handling, reflecting best practices from the foreign partners.

The Future of WestJet and its Ownership Structure

Following the "WestJet stake sale," Onex Corporation will retain a significant but reduced ownership stake in WestJet. The precise percentage will be revealed upon finalization of the deal. This restructuring positions WestJet for future growth and strategic alliances. The remaining ownership structure leaves room for further investment and possible acquisitions.

- Percentage of ownership held by Onex after the sale: This figure is crucial in understanding the continued influence of Onex on WestJet's strategic direction.

- Potential future investors or acquisitions: The new ownership structure may attract other investors or open the door for future mergers or acquisitions within the airline industry.

- WestJet's projected growth and market share: The sale is expected to fuel WestJet's expansion plans, potentially leading to increased market share within Canada and internationally.

- Effect on competition within the Canadian and international airline markets: The influx of foreign investment might intensify competition, driving innovation and potentially benefiting air travelers through lower fares or improved services.

Conclusion

The WestJet stake sale marks a significant milestone, showcasing Onex Corporation's shrewd investment strategy and highlighting the growing global interest in the Canadian airline market. The deal promises a bright future for WestJet, promising expansion, strategic alliances, and enhanced competitiveness within the international arena. This "WestJet Stake Sale" serves as a compelling case study in successful private equity investment and strategic partnerships within the airline industry. To stay informed about Onex Corporation's investment strategies, the future of WestJet, or other key developments in the airline industry, search for terms like "WestJet investment," "Onex portfolio," or "Canadian airline industry."

Featured Posts

-

Benny Blanco Cheating Allegations 10 Revealing Photos

May 11, 2025

Benny Blanco Cheating Allegations 10 Revealing Photos

May 11, 2025 -

Rethinking Middle Management Their Vital Contribution To Modern Organizations

May 11, 2025

Rethinking Middle Management Their Vital Contribution To Modern Organizations

May 11, 2025 -

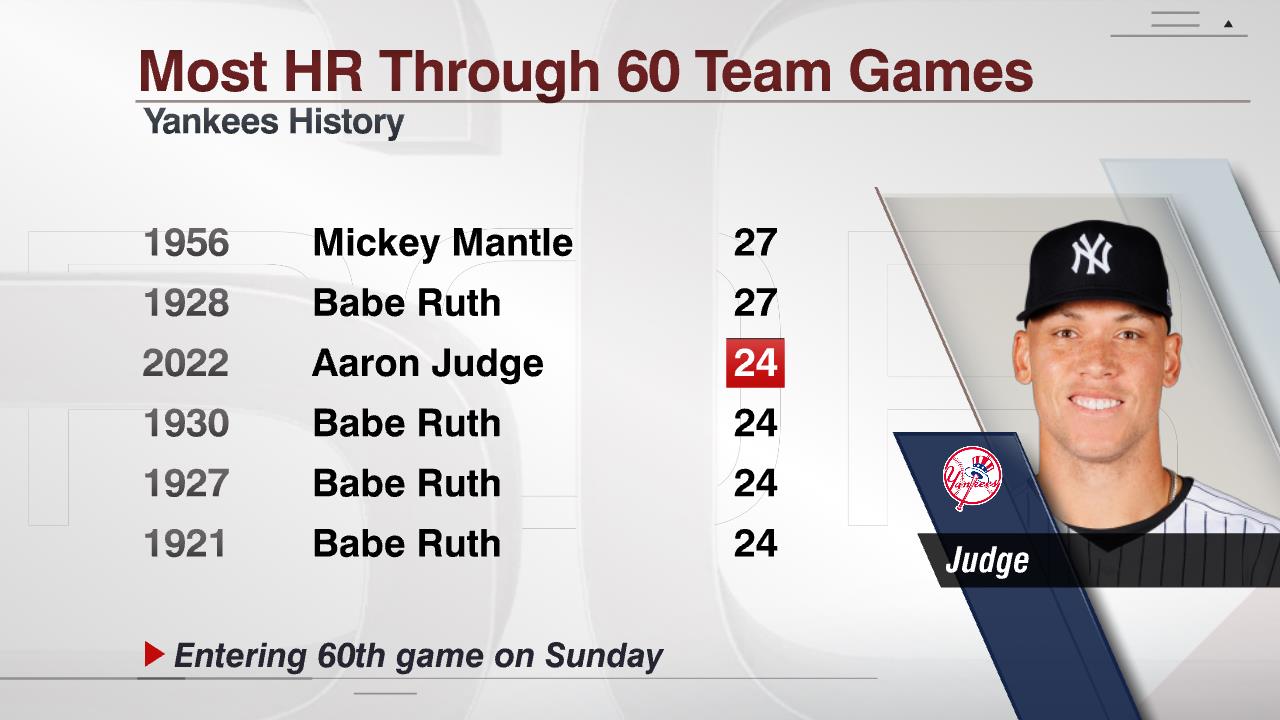

Predicting Aaron Judges 2024 Performance A Yankees Magazine Analysis

May 11, 2025

Predicting Aaron Judges 2024 Performance A Yankees Magazine Analysis

May 11, 2025 -

Mtv Vs Cbs The Vma Simulcast And The Future Of Music Awards

May 11, 2025

Mtv Vs Cbs The Vma Simulcast And The Future Of Music Awards

May 11, 2025 -

Aaron Judges 2025 Outlook Key Performance Indicators For Yankees Fans

May 11, 2025

Aaron Judges 2025 Outlook Key Performance Indicators For Yankees Fans

May 11, 2025