30% Drop For Palantir: Time To Buy? Analysis And Outlook.

Table of Contents

Understanding the 30% Palantir Stock Drop

Factors Contributing to the Decline

Several factors likely contributed to Palantir's recent 30% stock price drop. Understanding these factors is crucial for assessing the current investment opportunity. Key contributing elements include:

- Market-wide Corrections: The broader stock market's recent volatility has impacted many tech stocks, including Palantir. The tech sector downturn has seen significant corrections impacting valuations across the board.

- Disappointing Earnings Reports: While Palantir has shown revenue growth, its recent earnings reports might have fallen short of analyst expectations, leading to sell-offs. Lowered future guidance from the company may have also negatively influenced investor sentiment. Analyzing Palantir earnings reports and comparing them to forecasts is vital for understanding the situation.

- Negative News and Uncertainty: Negative news concerning contract wins, increased competition from established players in the big data analytics market, or regulatory hurdles could contribute to investor anxieties. Uncertainty about the company's future trajectory can also drive prices down.

- Analyst Downgrades and Sell-offs: Analyst downgrades often trigger significant sell-offs, amplifying the downward pressure on the stock price. These downgrades reflect analyst concerns about the company's future performance.

Analyzing Palantir's Fundamentals

Despite the recent stock price volatility, it's vital to analyze Palantir's underlying fundamentals. This includes examining:

- Palantir Revenue Growth: Examining the trajectory of Palantir revenue provides insight into the company's ability to generate income and sustain growth.

- Profitability and Debt Levels: Assessing profitability and debt levels reveals the financial health and sustainability of the company. Healthy financials provide a more solid foundation for long-term growth.

- Competitive Landscape: Palantir operates in a competitive market. Evaluating its market position and competitive advantages is crucial to assess its long-term survival and success. Understanding its competitive advantage in the big data analytics market is essential.

- Long-Term Growth Potential: Palantir's future growth potential hinges on its ability to innovate, secure new contracts, and expand its market share. Examining its pipeline of projects and technological advancements sheds light on future prospects. The PLTR stock forecast relies heavily on this factor.

Is it Time to Buy PLTR Stock? A Valuation and Risk Assessment

Evaluating Palantir's Current Valuation

Determining whether the current Palantir stock price represents a fair valuation requires a thorough assessment. Consider:

- Historical Performance: Compare the current price to Palantir's historical performance to understand its volatility and growth trends.

- Valuation Metrics: Utilize valuation metrics such as the price-to-earnings (P/E) ratio to assess whether the current price is justified given the company's earnings and growth prospects. A comparison with industry peers provides valuable context.

- Growth Potential: Factor in the company's potential for future growth. High growth potential can justify a higher valuation. Consider the PLTR stock price target forecasts from various analysts.

Assessing the Risks Associated with Investing in Palantir

Investing in Palantir carries inherent risks. Consider:

- Tech Sector Volatility: The tech sector is known for its volatility. Palantir is not immune to market fluctuations.

- Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts, which can be subject to political and budgetary changes.

- Intense Competition: Palantir faces strong competition from established players in the big data analytics market.

- Uncertainty in Future Growth: The future growth of Palantir depends on factors such as securing new contracts, technological innovation, and maintaining a competitive edge.

Outlook and Investment Strategy for Palantir

Short-Term and Long-Term Outlook for PLTR

The outlook for Palantir depends on several factors. A short-term perspective might focus on immediate earnings reports and market sentiment. A long-term outlook considers the company's long-term growth potential and its ability to adapt to the evolving big data landscape. Potential catalysts could be significant new contract wins or the successful launch of new products. Headwinds might include intensified competition or unexpected regulatory changes. Analyzing Palantir's future growth and the PLTR stock outlook requires a comprehensive approach.

Potential Investment Strategies

Depending on your risk tolerance and investment goals, several strategies could be considered:

- Buy-and-Hold: This strategy involves buying and holding the stock for the long term, irrespective of short-term price fluctuations. Suitable for long-term investors with high risk tolerance.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. This helps mitigate the risk of investing a lump sum at a high price point.

Always conduct thorough due diligence before making any investment decisions. Seek professional financial advice if needed.

Conclusion: Should You Buy Palantir After its 30% Drop?

Palantir's 30% stock price drop presents a complex investment scenario. While factors like market corrections, disappointing earnings, and competitive pressures contributed to the decline, Palantir's underlying fundamentals – revenue growth and long-term growth potential in the big data analytics sector – should also be considered. The decision to buy Palantir stock depends on your risk tolerance, investment horizon, and a comprehensive understanding of the company's prospects. Carefully evaluate the information presented, conduct your own research, and perhaps seek professional financial advice before making any investment decisions concerning Palantir stock. Remember, this analysis is for informational purposes only and not financial advice. Make informed decisions about your Palantir investment.

Featured Posts

-

Billionaires Favorite Etf Projected 110 Growth In 2025

May 09, 2025

Billionaires Favorite Etf Projected 110 Growth In 2025

May 09, 2025 -

Bitcoin Madenciliginin Gelecegi Azalan Karlilik Ve Yeni Stratejiler

May 09, 2025

Bitcoin Madenciliginin Gelecegi Azalan Karlilik Ve Yeni Stratejiler

May 09, 2025 -

Is The Attorney Generals Fox News Presence A Cause For Concern

May 09, 2025

Is The Attorney Generals Fox News Presence A Cause For Concern

May 09, 2025 -

Police Make Arrest Following Elizabeth City Weekend Shooting Incident

May 09, 2025

Police Make Arrest Following Elizabeth City Weekend Shooting Incident

May 09, 2025 -

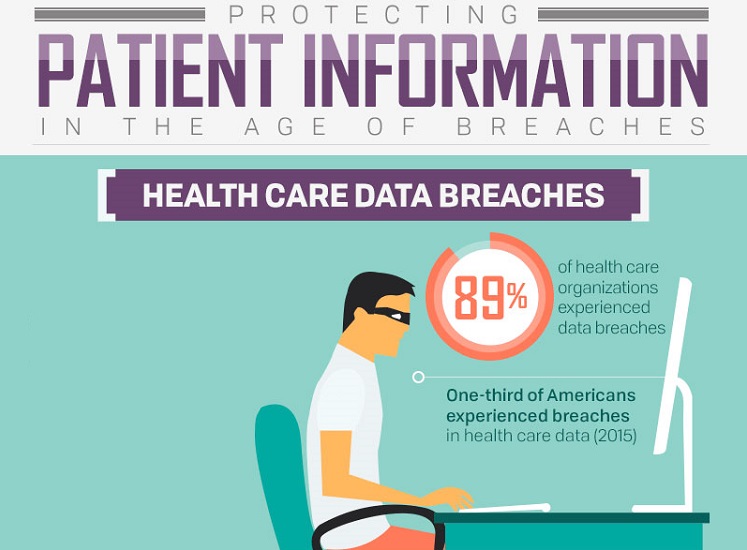

Nottingham Hospital Data Breach Over 90 Nhs Staff Accessed Victim Records

May 09, 2025

Nottingham Hospital Data Breach Over 90 Nhs Staff Accessed Victim Records

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025