30-Year Treasury Yield At 5%: Implications For The US Market And Selling Strategies

Table of Contents

Implications for the Bond Market

A 5% 30-year Treasury yield has profound implications for the bond market, affecting both borrowing costs and bond valuations.

Increased Borrowing Costs

Higher bond yields translate directly into increased borrowing costs for corporations and governments.

- Increased interest expense for businesses: Companies will face higher costs when issuing corporate bonds, potentially impacting profitability and capital expenditure plans. This could lead to reduced investment and slower economic growth.

- Reduced government spending capacity: The US government will also experience higher interest expense on its debt, potentially limiting its ability to fund social programs and infrastructure projects. This could lead to increased pressure on fiscal policy.

- Potential slowdown in economic growth: The combined effect of higher borrowing costs for both the public and private sectors could dampen economic expansion, leading to a potential slowdown in economic activity.

Keywords: corporate bonds, municipal bonds, government debt, interest rate risk, bond yields

Bond Prices and Valuation

The relationship between bond yields and prices is inverse. As yields rise, bond prices fall, and vice versa. A 5% 30-year Treasury yield signifies lower bond prices for existing bonds.

- Lower bond prices: Investors holding bonds purchased at lower yields will likely experience capital losses as their bond values adjust to reflect the new market yield.

- Potential capital losses for bondholders: Existing bondholders may face losses if they need to sell their bonds before maturity. This is especially true for bonds with longer durations.

- Opportunities for new bond purchases at higher yields: On the other hand, new bond purchases offer the potential for higher yields, providing attractive returns for investors willing to lock in their capital for a longer period.

Keywords: bond valuation, bond pricing, yield curve, duration, capital appreciation, interest rate risk

Impact on the Stock Market

The rise in the 30-year Treasury yield also significantly impacts the stock market, primarily through higher discount rates and altered investor sentiment.

Higher Discount Rates

Higher bond yields influence stock valuations through discounted cash flow (DCF) analysis. The higher the discount rate (reflecting the higher risk-free rate offered by bonds), the lower the present value of future earnings.

- Lower present value of future earnings: Higher discount rates reduce the perceived value of future corporate profits, leading to lower stock prices.

- Potential downward pressure on stock prices: This effect can be particularly pronounced for growth stocks, which rely heavily on future earnings expectations.

- Sector-specific impacts: Certain sectors, like utilities and real estate, are more sensitive to interest rate changes and might experience a more pronounced decline in valuations.

Keywords: stock valuation, discounted cash flow, equity markets, market capitalization, P/E ratio, interest rates

Investor Sentiment and Allocation

The rise in the 30-year Treasury yield can shift investor sentiment and allocation strategies.

- Shift from equities to bonds: Investors may move funds from higher-risk equities to lower-risk bonds, seeking the higher yields offered by fixed-income securities.

- Increased demand for fixed-income securities: The increased attractiveness of bonds could lead to higher demand and potentially further price increases in the bond market.

- Potential market volatility: The shift in investor sentiment can create market volatility, as investors adjust their portfolios and rebalance their asset allocation.

Keywords: asset allocation, portfolio diversification, risk management, investor behavior, market volatility, bond yields

Selling Strategies in a High-Yield Environment

Navigating a high-yield environment requires strategic adjustments to your investment approach.

Tactical Asset Allocation

Adjusting your portfolio allocation is crucial in a 5% 30-year Treasury yield environment.

- Reducing equity exposure: Consider reducing your equity holdings to mitigate potential losses from declining stock prices.

- Increasing bond holdings: Increase your allocation to bonds to take advantage of higher yields and improve portfolio stability.

- Considering alternative investments: Explore alternative investments like real estate or commodities that may offer inflation hedges.

Keywords: tactical asset allocation, strategic asset allocation, portfolio rebalancing, alternative investments, bond yields

Options Strategies

Options trading offers tools to manage interest rate risk and potentially profit from yield movements.

- Covered calls: Generate income and potentially reduce risk by selling covered call options on your stock holdings.

- Protective puts: Protect against potential losses in your stock portfolio by buying protective put options.

- Interest rate swaps: Use interest rate swaps to hedge against changes in interest rates and manage your exposure to bond yields.

Keywords: options trading, hedging strategies, risk management, covered calls, protective puts, interest rate swaps

Laddered Bond Portfolios

Diversifying bond holdings across maturities is key to mitigating risk.

- Reduced interest rate risk: A laddered portfolio reduces your exposure to interest rate fluctuations by staggering maturities.

- Stable income generation: This strategy provides a stable stream of income over time.

- Potential for capital appreciation in certain market conditions: Depending on market conditions, you could potentially benefit from capital appreciation on some of your bond holdings.

Keywords: bond portfolio management, laddered portfolio, interest rate risk management, bond diversification, 30-year Treasury yield

Conclusion

The 5% 30-year Treasury yield significantly impacts the US market, influencing borrowing costs, asset valuations, and investor behavior. Understanding these implications is critical for adapting your investment strategy. The key takeaways are the increased borrowing costs, the inverse relationship between bond yields and prices, the impact on stock valuations via higher discount rates, and the necessity for strategic portfolio adjustments. To effectively manage your investments in a high 30-year Treasury yield environment, consider implementing tactical asset allocation strategies, exploring options trading for risk management, and building a diversified, laddered bond portfolio. Seek professional financial advice to optimize your portfolio with a 5% yield strategy and adapt your investment strategy to the current 30-year Treasury yield environment, ensuring your financial goals remain on track.

Featured Posts

-

Rey Fenixs Wwe Smack Down Debut Ring Name Revealed

May 20, 2025

Rey Fenixs Wwe Smack Down Debut Ring Name Revealed

May 20, 2025 -

Amazon Spring Sale 2025 Deep Discounts On Hugo Boss Perfumes For Him And Her

May 20, 2025

Amazon Spring Sale 2025 Deep Discounts On Hugo Boss Perfumes For Him And Her

May 20, 2025 -

Railroad Bridge Accident Leaves Two Adults Dead Children Injured One Missing

May 20, 2025

Railroad Bridge Accident Leaves Two Adults Dead Children Injured One Missing

May 20, 2025 -

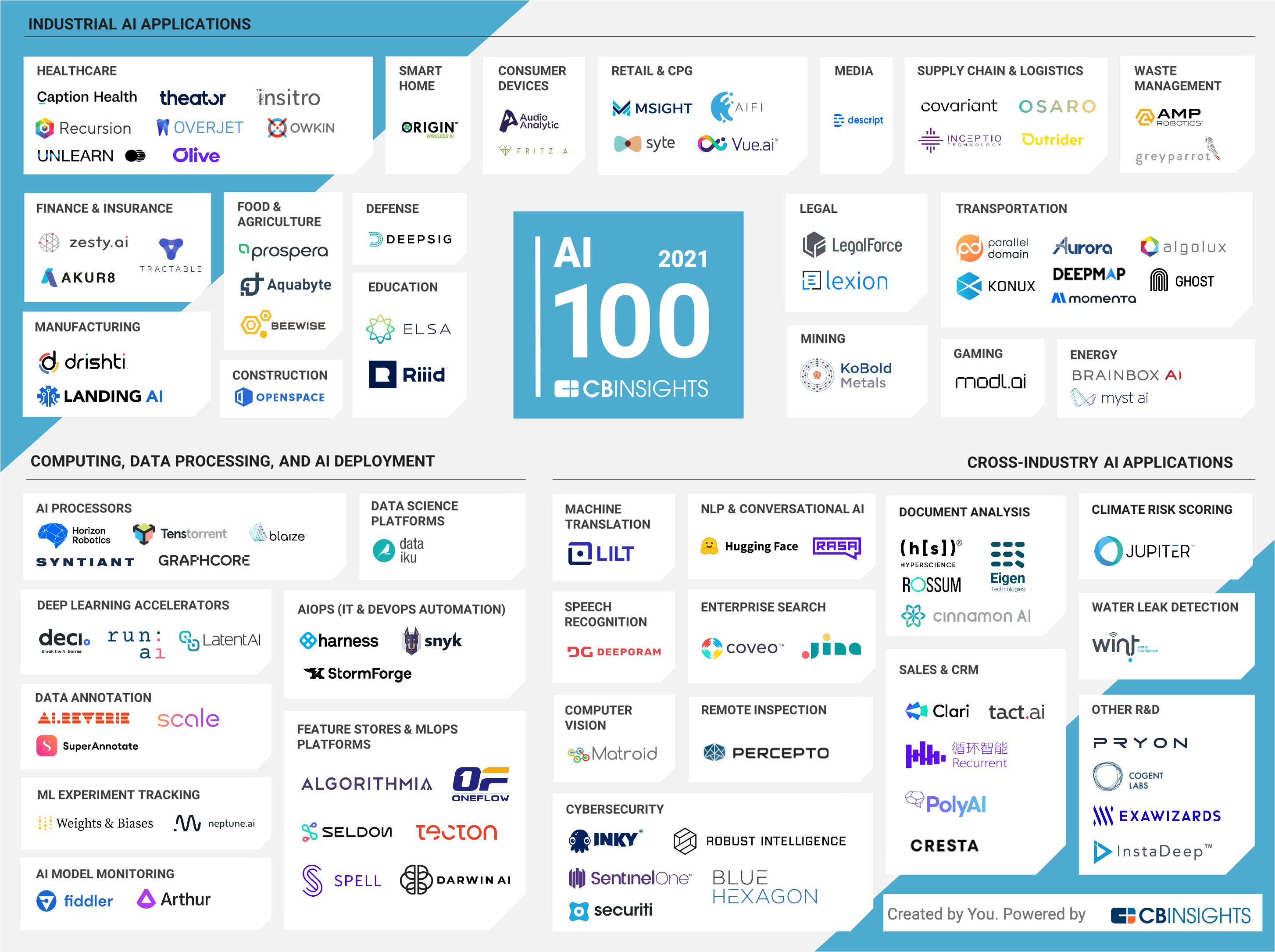

12 Promising Ai Stocks Insights From Reddit

May 20, 2025

12 Promising Ai Stocks Insights From Reddit

May 20, 2025 -

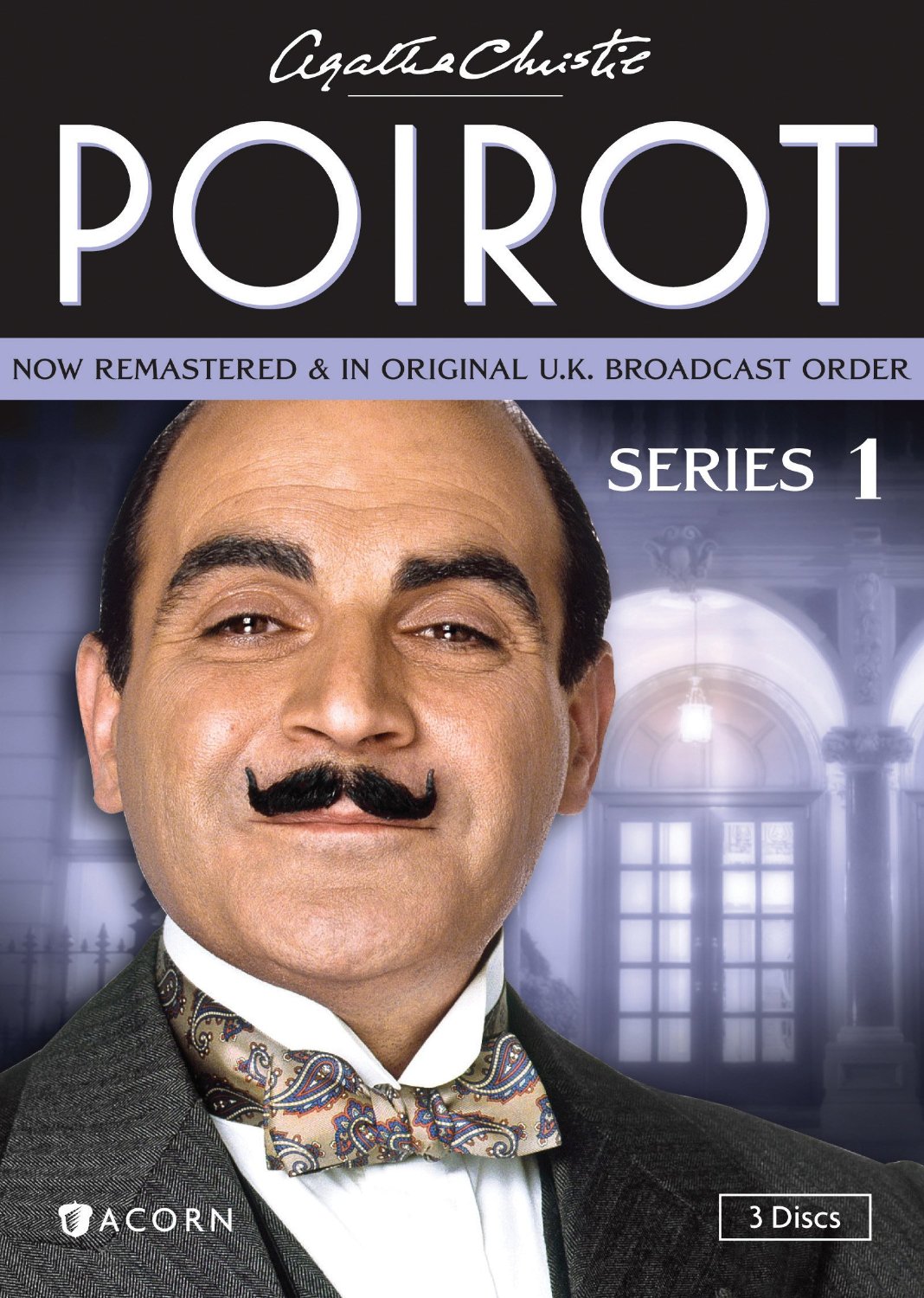

Agatha Christies Poirot Character Analysis And Evolution

May 20, 2025

Agatha Christies Poirot Character Analysis And Evolution

May 20, 2025