$40-$50 Oil: Goldman Sachs Analyzes Trump's Public Statements

Table of Contents

This price range holds significant weight. For oil-producing nations, it can mean the difference between economic prosperity and hardship. For the global economy, it influences inflation, consumer spending, and overall growth. Goldman Sachs, renowned for its sharp market analysis, offers valuable perspective on how Trump's words potentially impacted this delicate equilibrium.

Trump's Statements and their Market Impact

Identifying Key Statements

Former President Trump frequently commented on oil prices, often via Twitter. These statements, while sometimes seemingly offhand, can significantly influence market sentiment. Let's examine some examples:

- June 2019: "Oil prices are too high, OPEC must do something!" (Paraphrased from a tweet). This statement, made amidst rising tensions in the Middle East, caused a temporary dip in oil futures.

- August 2020: In an interview, Trump expressed his desire for lower oil prices, suggesting it would benefit American consumers. This coincided with a period of low demand due to the COVID-19 pandemic.

- October 2018: A speech mentioning the importance of energy independence, implicitly advocating for lower oil import costs. This caused a slight increase in US shale oil producer stocks.

Analyzing the immediate market reactions to these statements reveals a pattern: Trump's pronouncements frequently caused short-term price fluctuations, reflecting investors' sensitivity to his opinions.

Goldman Sachs' Interpretation

Goldman Sachs' analysis likely considered several factors when interpreting Trump's statements. Their report probably acknowledged the immediate market impact, but also assessed the broader context—the ongoing trade wars, the state of the global economy, and OPEC's production policies.

- Key Findings: Goldman Sachs' report may have quantified the impact of Trump's statements on oil price volatility. They might have highlighted the increased uncertainty introduced by these pronouncements, possibly showing increased price swings in correlation with his statements.

- Contextual Factors: The analysts likely considered the political climate and Trump’s stated economic policies, potentially concluding that his statements were influenced by a desire to keep domestic gas prices low for political advantage. This would shape their interpretation of his motives and the longevity of any market effect.

Economic Implications of $40-$50 Oil

Impact on Oil Producing Nations

Sustained oil prices in the $40-$50 range would have profound consequences for oil-producing nations.

- Reduced Revenue: OPEC members, Russia, and US shale producers would experience significant reductions in government revenue, impacting their budgets and potentially leading to austerity measures.

- Investment Slowdown: Lower oil prices discourage investment in new exploration and production projects, potentially hindering long-term oil supply. This could lead to future price instability.

- Economic Instability: Countries heavily reliant on oil exports could face economic instability, potentially leading to social unrest.

Data illustrating the impact would show a correlation between oil prices and GDP growth rates in major oil-producing economies.

Global Economic Consequences

Lower oil prices generally have a positive impact on global economic growth. However, the effects are complex and vary across sectors.

- Lower Transportation Costs: Reduced fuel costs benefit consumers and businesses, potentially boosting consumer spending and economic activity.

- Increased Manufacturing Output: Lower energy costs reduce production expenses, leading to higher output and potentially lower prices for manufactured goods.

- Reduced Inflation: Lower oil prices contribute to lower inflation rates, which is generally beneficial for economic stability.

However, very low oil prices can also negatively impact oil-producing countries, leading to economic downturns that can affect global trade. Indicators like inflation rates and consumer confidence indices would reflect these effects.

Political Considerations and Uncertainty

Trump's Political Agenda

Trump's statements on oil prices may have been driven by various political considerations.

- Domestic Political Advantage: Lower gas prices generally benefit consumers, potentially boosting public approval ratings.

- Economic Policy Objectives: Trump's desire for US energy independence likely influenced his pronouncements on oil prices.

- International Relations: His statements might have been used as tools in negotiations with OPEC and other countries.

Expert opinions from political analysts would provide deeper insights into Trump's motivations.

Geopolitical Instability

Geopolitical factors significantly influence oil prices, adding to the uncertainty surrounding Trump’s pronouncements.

- Middle East Tensions: Conflicts and political instability in oil-producing regions invariably impact global oil supply and prices.

- International Sanctions: Sanctions against oil-producing nations can disrupt supply and increase prices.

- OPEC Policies: OPEC's production decisions have a major influence on global oil supply and prices.

Analyzing relevant data on geopolitical events would reveal the interplay between these factors and oil price volatility.

Conclusion: Understanding the Impact of Trump's Statements on $40-$50 Oil

Goldman Sachs' analysis of Trump's public statements on $40-$50 oil likely highlighted the significant impact of political pronouncements on the volatile oil market. The analysis likely emphasized the need to consider both economic and political factors when predicting oil prices. The interplay of political agendas, geopolitical events, and economic realities creates a complex landscape, making accurate forecasting challenging.

To stay informed on this crucial issue, follow Goldman Sachs' future analyses on oil price predictions and other insightful reports. Further research into "$40-$50 oil price analysis," "Goldman Sachs oil predictions," and "Trump's impact on oil market" will provide a more comprehensive understanding of this multifaceted topic.

Featured Posts

-

Los Angeles Dodgers A Comprehensive Offseason Review

May 15, 2025

Los Angeles Dodgers A Comprehensive Offseason Review

May 15, 2025 -

Nouveautes Ge Force Now 21 Jeux Integres Ce Mois Ci

May 15, 2025

Nouveautes Ge Force Now 21 Jeux Integres Ce Mois Ci

May 15, 2025 -

Tracking The Progress Of Dodgers Prospects Kim Outman And Sauers Development

May 15, 2025

Tracking The Progress Of Dodgers Prospects Kim Outman And Sauers Development

May 15, 2025 -

Lafcs Mls Priorities Home Match Against San Jose

May 15, 2025

Lafcs Mls Priorities Home Match Against San Jose

May 15, 2025 -

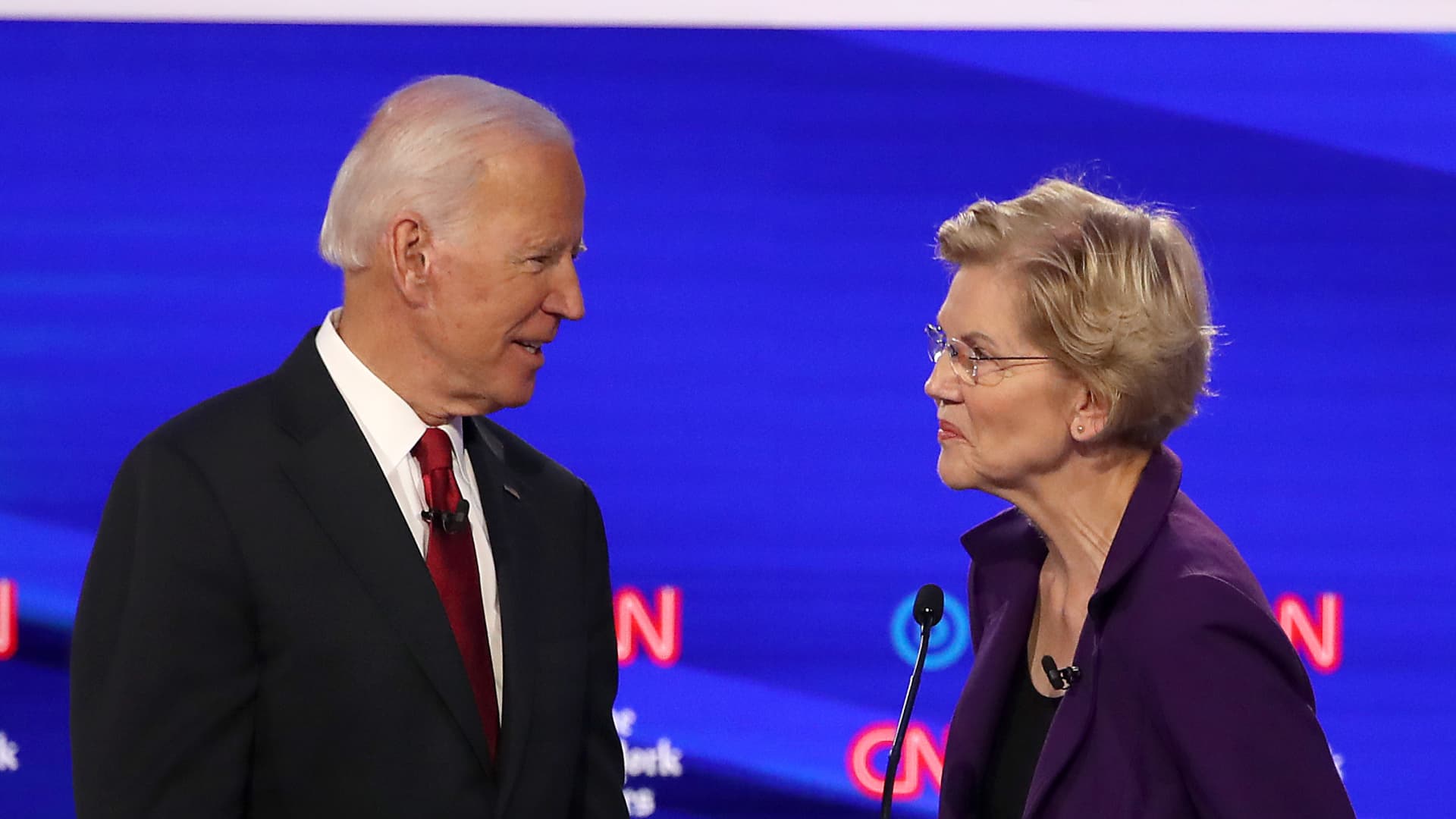

Elizabeth Warrens Defense Of Bidens Mental Fitness Falls Flat

May 15, 2025

Elizabeth Warrens Defense Of Bidens Mental Fitness Falls Flat

May 15, 2025