400% XRP Price Jump: Investment Opportunities And Risks

Table of Contents

Factors Contributing to the 400% XRP Price Surge

Several interconnected factors contributed to the dramatic 400% XRP price surge. Understanding these elements is crucial for anyone considering investing in XRP.

Positive Ripple News and Developments

Positive developments surrounding Ripple and its ongoing legal battle with the SEC significantly influenced the XRP price jump.

- Positive Legal Developments: Favorable rulings or statements in the SEC lawsuit against Ripple have consistently boosted investor confidence and driven up the price of XRP. Any perceived progress towards a positive resolution can trigger significant price increases.

- Strategic Partnerships and Collaborations: Ripple's ongoing partnerships with financial institutions globally are viewed positively by the market. Announcements of new collaborations or integrations can fuel positive market sentiment and lead to increased demand for XRP.

- Growing Adoption: Increased adoption of Ripple's technology by financial institutions for cross-border payments has bolstered XRP's value proposition. Wider acceptance and utilization of XRP within the financial industry directly translates into increased demand and price appreciation.

- Positive Market Sentiment: Overall positive sentiment in the cryptocurrency market can easily translate into increased investment in altcoins like XRP, magnifying price movements.

Broader Cryptocurrency Market Trends

The broader cryptocurrency market plays a significant role in influencing XRP's price.

- Bitcoin's Price Movement: Bitcoin's price often acts as a barometer for the entire cryptocurrency market. Positive movements in Bitcoin's price tend to spill over into altcoins like XRP, leading to increased interest and investment.

- Altcoin Season: Periods of heightened activity and price increases in altcoins, often referred to as "altcoin season," can dramatically boost XRP's price as investors diversify their portfolios.

- Overall Investor Confidence: A surge in investor confidence in the cryptocurrency market as a whole significantly impacts the price of XRP. Increased belief in the long-term potential of cryptocurrencies fuels investment in various assets, including XRP.

Speculative Trading and FOMO

Speculative trading and the fear of missing out (FOMO) play a substantial role in driving rapid price increases in volatile cryptocurrencies like XRP.

- Speculative Trading: The rapid price increase of XRP attracts speculative traders looking for quick profits. This influx of buyers further pushes the price upwards, creating a self-fulfilling prophecy.

- Social Media Hype and Influencer Marketing: Positive social media buzz and endorsements from influential figures in the crypto space can significantly influence trading decisions and lead to sudden price surges driven by FOMO.

- Pump and Dump Schemes: While ethically questionable, pump and dump schemes, where coordinated efforts artificially inflate the price before a sudden sell-off, can cause extreme volatility and sharp price swings. This represents a significant risk for less informed investors.

Investment Opportunities Presented by the XRP Price Jump

The 400% XRP price jump presents both challenges and opportunities for investors.

Potential for High Returns

The potential for significant profits is a major draw for investors in XRP, especially following such a dramatic price surge. However, this potential must be carefully weighed against the inherent risks.

- High Returns: If the price continues to rise, investors who entered at lower prices stand to make substantial profits.

- Risk Management and Diversification: It’s crucial to remember that significant gains also come with significant losses. Diversification and risk management are paramount to protect your investment portfolio.

Strategic Entry and Exit Points

Timing the market is notoriously difficult, yet strategic entry and exit points are crucial for maximizing potential gains and minimizing losses.

- Challenges of Market Timing: Predicting the exact peak and trough of XRP’s price is nearly impossible.

- Investment Strategies: Dollar-cost averaging, a strategy that involves investing fixed amounts at regular intervals, can help mitigate the risk of investing at a market peak.

- Profit Targets and Stop-Loss Orders: Setting realistic profit targets and stop-loss orders is crucial for risk management and protecting your investment from significant losses.

Risks Associated with Investing in XRP After a 400% Price Jump

While the potential for high returns is enticing, investing in XRP after a 400% price jump carries significant risks.

High Volatility and Price Correction

The cryptocurrency market is notoriously volatile, and XRP is no exception.

- Cryptocurrency Volatility: Sharp price corrections are common in the crypto market. A 400% increase is highly unlikely to be sustained without significant corrections.

- Investing at a Market Peak: Investing at the peak of a price surge significantly increases the risk of substantial losses if a correction occurs.

- High Risk Investment: XRP, like most cryptocurrencies, is considered a high-risk investment.

Regulatory Uncertainty

The ongoing legal uncertainty surrounding Ripple and the SEC lawsuit presents a major risk to XRP investors.

- SEC Lawsuit: The outcome of the SEC lawsuit could significantly impact XRP's price and future prospects.

- Regulatory Changes: Changes in cryptocurrency regulations globally could negatively impact the value of XRP.

- Ripple Legal Risk: The ongoing legal battles represent a considerable uncertainty that should be considered by potential investors.

Security Risks

The decentralized nature of cryptocurrencies introduces unique security risks.

- Cryptocurrency Exchange Hacks: Cryptocurrency exchanges are vulnerable to hacking, and losses due to exchange hacks can be substantial.

- Wallet Security: Securely storing your XRP in a well-protected digital wallet is essential to prevent theft or loss.

- Phishing Scams: Be vigilant against phishing scams aimed at stealing your cryptocurrency.

Conclusion: Navigating the XRP Landscape After a 400% Price Surge

The 400% XRP price jump presents a complex investment scenario with significant potential for both high returns and substantial losses. Understanding the factors that contributed to this surge, carefully analyzing the opportunities, and fully acknowledging the associated risks are crucial for making informed investment decisions. Thorough research and a clear understanding of your risk tolerance are paramount. Before investing in XRP or any other volatile cryptocurrency, conduct extensive research, assess your risk tolerance realistically, and consider consulting a financial advisor. Responsible investing in volatile cryptocurrencies like XRP requires careful planning and a well-defined strategy. Remember to only invest what you can afford to lose.

Featured Posts

-

Ripple Xrp Sees Sharp Increase After Us Presidents Trump Related Post

May 08, 2025

Ripple Xrp Sees Sharp Increase After Us Presidents Trump Related Post

May 08, 2025 -

Kripto Lider Kripto Para Yatirimlarinda Yeni Bir Perspektif

May 08, 2025

Kripto Lider Kripto Para Yatirimlarinda Yeni Bir Perspektif

May 08, 2025 -

Saturday Night Live The Night Counting Crows Took Off

May 08, 2025

Saturday Night Live The Night Counting Crows Took Off

May 08, 2025 -

Lahwr Ky Panch Ahtsab Edaltyn Khtm Bqyh Edaltwn Ka Mstqbl

May 08, 2025

Lahwr Ky Panch Ahtsab Edaltyn Khtm Bqyh Edaltwn Ka Mstqbl

May 08, 2025 -

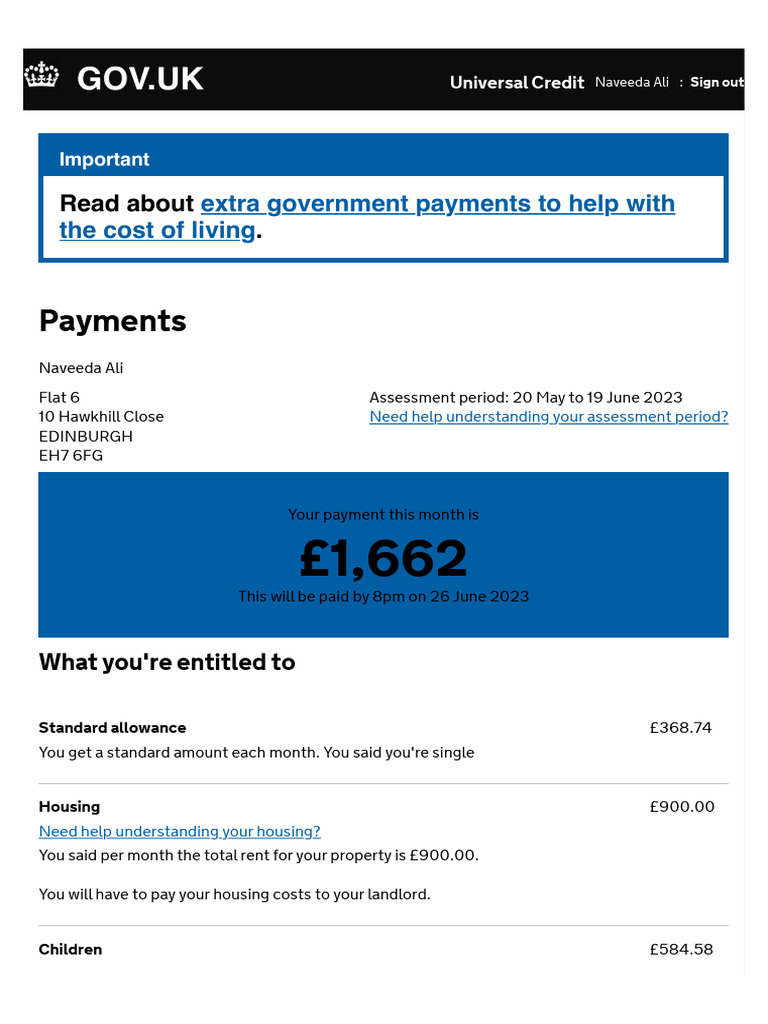

Missed Universal Credit Payments How To Claim A Refund

May 08, 2025

Missed Universal Credit Payments How To Claim A Refund

May 08, 2025

Latest Posts

-

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025 -

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025 -

Abc Promo Features Tnt Announcers Hilarious Take On Jayson Tatum

May 08, 2025

Abc Promo Features Tnt Announcers Hilarious Take On Jayson Tatum

May 08, 2025 -

Dwp Universal Credit Claiming Back Overpaid Hardship Payments

May 08, 2025

Dwp Universal Credit Claiming Back Overpaid Hardship Payments

May 08, 2025 -

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025