47% Spike In Indian Real Estate Investments: Q1 2024 Report Highlights

Table of Contents

Key Drivers of the 47% Investment Spike

Several factors contributed to the impressive 47% spike in Indian real estate investments during Q1 2024. These include:

-

Reduced Interest Rates: The Reserve Bank of India (RBI) implemented a series of interest rate cuts in Q1 2024, bringing down borrowing costs for home loans and commercial property financing. This made real estate investments significantly more attractive, stimulating demand and fueling the market's growth. For example, home loan interest rates dropped an average of 0.75% during this period, making mortgages more affordable for potential buyers.

-

Government Initiatives: The government played a crucial role in boosting investor confidence through various supportive policies and schemes. These include:

- Tax benefits on home loans and property purchases.

- Infrastructure development projects aimed at enhancing connectivity and accessibility.

- Initiatives to streamline the regulatory framework and improve transparency in the real estate sector. The implementation of RERA (Real Estate (Regulation and Development) Act) continues to improve transparency and protect buyer interests.

-

Increased Demand: A robust increase in demand from both domestic and international buyers further propelled investment growth. This surge in demand can be attributed to several factors:

- A rapidly growing population, leading to increased housing demand.

- Rapid urbanization and migration to urban centers.

- Improvements in infrastructure, making cities more livable and attractive for investment.

-

Improved Market Sentiment: A general positive shift in market sentiment, fueled by increased transparency and regulatory reforms, further bolstered investor confidence. Indices tracking real estate investor sentiment showed a significant upswing during Q1 2024, indicating a positive outlook for future growth in the Indian property investment sector.

Investment Trends in Different Sectors

Investment activity showed significant growth across various real estate sectors during Q1 2024:

Residential Real Estate

The residential sector witnessed a strong upswing, with considerable investment across all price segments:

- Luxury segment: High-end properties in prime locations experienced a surge in demand, driven by ultra-high-net-worth individuals.

- Mid-segment: This segment saw consistent growth, fueled by the increasing middle class and affordable home loan options.

- Affordable housing: Government initiatives promoting affordable housing played a key role in boosting this segment's growth. Sales figures for affordable housing units showed a particularly strong increase.

Commercial Real Estate

Investment in commercial real estate also showed robust growth:

- Office spaces: Demand for office spaces remained strong, driven by the growth of IT and other sectors. Prime office locations in major cities saw considerable investment activity.

- Retail spaces: The retail sector showed moderate growth, with investors focusing on strategically located properties with high footfall.

- Warehouses and logistics: Growth in e-commerce and supply chain modernization fueled investment in warehouse and logistics facilities.

Infrastructure Development

Significant investments were also directed towards infrastructure development projects, which indirectly impact real estate values:

- Improved road and rail networks enhance connectivity, boosting the value of properties in previously inaccessible areas.

- Government initiatives like the Bharatmala Project continue to drive investment in infrastructure, positively impacting the real estate landscape.

Geographic Distribution of Investments

Investment activity was widespread, with significant growth in both Tier 1 and Tier 2/3 cities:

Tier 1 Cities

Metropolitan areas like Mumbai, Delhi-NCR, Bengaluru, and Chennai witnessed the highest investment activity, driven by high demand and established infrastructure. Luxury high-rise developments in these cities attracted considerable investment.

Tier 2 & 3 Cities

Smaller cities and towns experienced a surge in investment, driven by affordability and improved connectivity:

- Improved infrastructure, particularly road and rail connectivity, is attracting investment to previously less-developed areas.

- Affordability compared to Tier 1 cities is making these locations increasingly attractive for both residential and commercial investments. Cities like Jaipur, Coimbatore, and Indore are showcasing strong growth.

Future Outlook for Indian Real Estate Investments

The future outlook for Indian real estate investments remains positive, although challenges exist:

Predictions for Q2 2024 and Beyond

Experts predict continued growth in the Indian real estate market, although the pace might moderate slightly compared to the exceptional growth in Q1 2024. The market is expected to remain robust, driven by sustained demand and positive government policies.

Potential Risks and Challenges

Potential risks and challenges include:

- Inflationary pressures could impact borrowing costs and investor sentiment.

- Regulatory changes could impact the market dynamics.

- Geopolitical factors could create uncertainty.

Opportunities for Investors

Despite potential challenges, the Indian real estate market presents lucrative opportunities for investors:

- Affordable housing segment continues to offer high growth potential.

- Tier 2 and 3 cities present attractive investment opportunities due to affordability and growth potential.

- Infrastructure projects offer strong long-term investment prospects.

Conclusion: Capitalizing on the Booming Indian Real Estate Market

The 47% spike in Indian real estate investments during Q1 2024 is a testament to the market's robust growth and positive outlook. Driven by reduced interest rates, government initiatives, increased demand, and improved market sentiment, the Indian real estate market presents substantial opportunities for investors. Investment trends across various sectors and geographical locations showcase a diverse and dynamic market. While potential risks exist, the long-term prospects for the Indian real estate market remain positive. By conducting thorough research and seeking professional advice, investors can effectively capitalize on the booming Indian real estate market and make informed decisions regarding Indian property investment and real estate market analysis. Don't miss this opportunity to explore the lucrative potential of Indian real estate investments!

Featured Posts

-

Cinema Con 2025 A Deep Dive Into The Warner Bros Pictures Showcase

May 17, 2025

Cinema Con 2025 A Deep Dive Into The Warner Bros Pictures Showcase

May 17, 2025 -

Deepfake Technology Challenged A Cybersecurity Experts Success Story Cnn Business

May 17, 2025

Deepfake Technology Challenged A Cybersecurity Experts Success Story Cnn Business

May 17, 2025 -

How To Find The Best Bitcoin And Crypto Casinos In 2025

May 17, 2025

How To Find The Best Bitcoin And Crypto Casinos In 2025

May 17, 2025 -

Watch Mariners Vs Cubs Spring Training Online Free Live Stream Guide

May 17, 2025

Watch Mariners Vs Cubs Spring Training Online Free Live Stream Guide

May 17, 2025 -

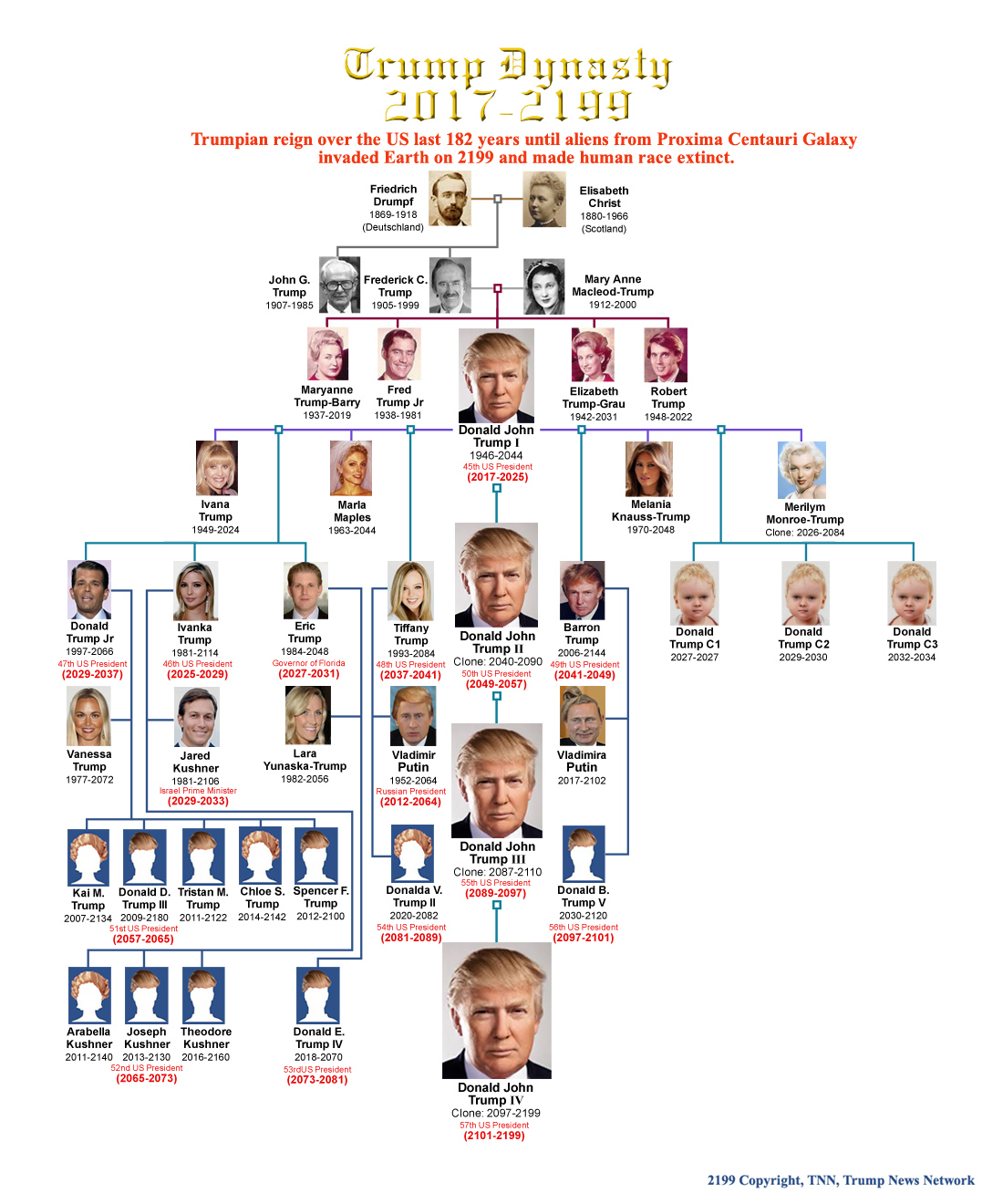

Trump Family Tree Relationships And Key Figures

May 17, 2025

Trump Family Tree Relationships And Key Figures

May 17, 2025

Latest Posts

-

The 10 Best Tv Shows That Ended Too Soon A Critical Look

May 17, 2025

The 10 Best Tv Shows That Ended Too Soon A Critical Look

May 17, 2025 -

Brasilien Und Die Vae Wirtschaftliche Chancen In Den Favelas

May 17, 2025

Brasilien Und Die Vae Wirtschaftliche Chancen In Den Favelas

May 17, 2025 -

Birlesik Arap Emirlikleri Devlet Baskani Ile Erdogan In Telefon Konusmasi Ele Alinan Konular

May 17, 2025

Birlesik Arap Emirlikleri Devlet Baskani Ile Erdogan In Telefon Konusmasi Ele Alinan Konular

May 17, 2025 -

Investitionen In Brasilianische Favelas Das Interesse Der Vereinigten Arabischen Emirate

May 17, 2025

Investitionen In Brasilianische Favelas Das Interesse Der Vereinigten Arabischen Emirate

May 17, 2025 -

Top 10 Tv Shows Cancelled Before Their Time Unfairly Axed

May 17, 2025

Top 10 Tv Shows Cancelled Before Their Time Unfairly Axed

May 17, 2025