5 Crucial Dos And Don'ts For Private Credit Job Seekers

Table of Contents

DO: Tailor Your Resume and Cover Letter for Each Private Credit Role

Generic applications rarely cut it in a highly selective field like private credit. Each resume and cover letter must be meticulously tailored to the specific requirements and keywords of each job description. This shows you understand the role and the company's needs.

- Showcase Relevant Skills: Highlight your experience in financial modeling, valuation, underwriting, credit analysis, due diligence, and portfolio management. Quantify your achievements whenever possible. Did you increase portfolio performance by X%? Did you successfully complete Y number of due diligence projects? Use numbers to demonstrate your impact.

- Highlight Transferable Skills: Even if you haven't worked directly in private credit, transferable skills from other finance roles are valuable. Experience in investment banking, asset management, or accounting can be highly relevant. Emphasize these skills and connect them to the requirements of the private credit role.

- Incorporate Keywords: Carefully review the job description and incorporate relevant keywords into your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application and increases your chances of getting noticed.

- Demonstrate Software Proficiency: Mention your proficiency in essential software such as Bloomberg Terminal, Argus, Excel, and PowerPoint. These tools are indispensable in private credit, so demonstrating mastery is key.

DON'T: Neglect Networking in the Private Credit Industry

The private credit industry is relationship-driven. Networking is not just beneficial; it's crucial for finding hidden opportunities and gaining a competitive edge.

- Attend Industry Events: Private credit conferences and networking events provide invaluable opportunities to connect with professionals and learn about potential job openings.

- Leverage LinkedIn: Optimize your LinkedIn profile and actively connect with professionals in private credit. Engage in relevant groups and participate in discussions.

- Informational Interviews: Reach out to individuals working in private credit for informational interviews. These conversations can provide insights into the industry, potential job openings, and invaluable advice.

- Work with Recruiters: Partner with recruiters specializing in private credit placements. They often have access to unadvertised positions and can provide valuable guidance throughout the job search process.

DO: Prepare Thoroughly for Private Credit Interviews

Private credit interviews are rigorous and demanding. Thorough preparation is essential to demonstrate your technical expertise and analytical skills.

- Practice Behavioral Questions: Prepare for behavioral questions that assess your personality, teamwork skills, and problem-solving abilities. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Master Technical Questions: Expect questions on DCF modeling, LBO modeling, credit ratios, and other technical aspects of private credit. Practice your answers and be prepared to explain your thought process clearly.

- Prepare Case Studies: Many private credit interviews involve case studies analyzing potential investments. Practice solving these case studies to demonstrate your analytical and problem-solving abilities.

- Showcase Strong Analytical Skills: Private credit requires strong analytical and problem-solving skills. Use examples from your previous experience to showcase these abilities during the interview.

DON'T: Underestimate the Importance of Financial Modeling Skills

Financial modeling is the cornerstone of private credit analysis. Strong modeling skills are essential for success in this field.

- Master Different Modeling Types: Become proficient in various modeling techniques, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other valuation methods used in private credit.

- Build a Portfolio: Create a portfolio of your best financial models to showcase your skills during interviews. This demonstrates your experience and expertise.

- Seek Additional Training: If your modeling skills need improvement, consider taking additional training courses or workshops to enhance your proficiency. Many online resources offer excellent training.

DO: Follow Up After Every Interview and Application

Following up demonstrates your interest and professionalism, enhancing your chances of securing a job offer.

- Send Thank-You Notes: Always send a personalized thank-you note after each interview, reiterating your interest and highlighting key points from the conversation.

- Follow Up on Applications: If you haven't heard back within a reasonable timeframe, politely follow up on your application to demonstrate your continued interest.

- Professional Persistence: Persistence is key. Don't be discouraged by rejections. Learn from each experience and continue applying and networking.

Conclusion: Land Your Dream Private Credit Job

Securing a private credit job requires a strategic approach encompassing targeted resumes, effective networking, thorough interview preparation, strong financial modeling skills, and consistent follow-up. By following these dos and don'ts, you'll significantly improve your chances of landing your dream role in this exciting and rewarding field. Ready to unlock your potential in private credit? Apply these tips and watch your career soar!

Featured Posts

-

Gemeente Kampen Start Kort Geding Tegen Enexis Wegens Stroomnetaansluiting

May 02, 2025

Gemeente Kampen Start Kort Geding Tegen Enexis Wegens Stroomnetaansluiting

May 02, 2025 -

Descubra A Mini Camera Chaveiro Funcionalidades E Melhores Lojas

May 02, 2025

Descubra A Mini Camera Chaveiro Funcionalidades E Melhores Lojas

May 02, 2025 -

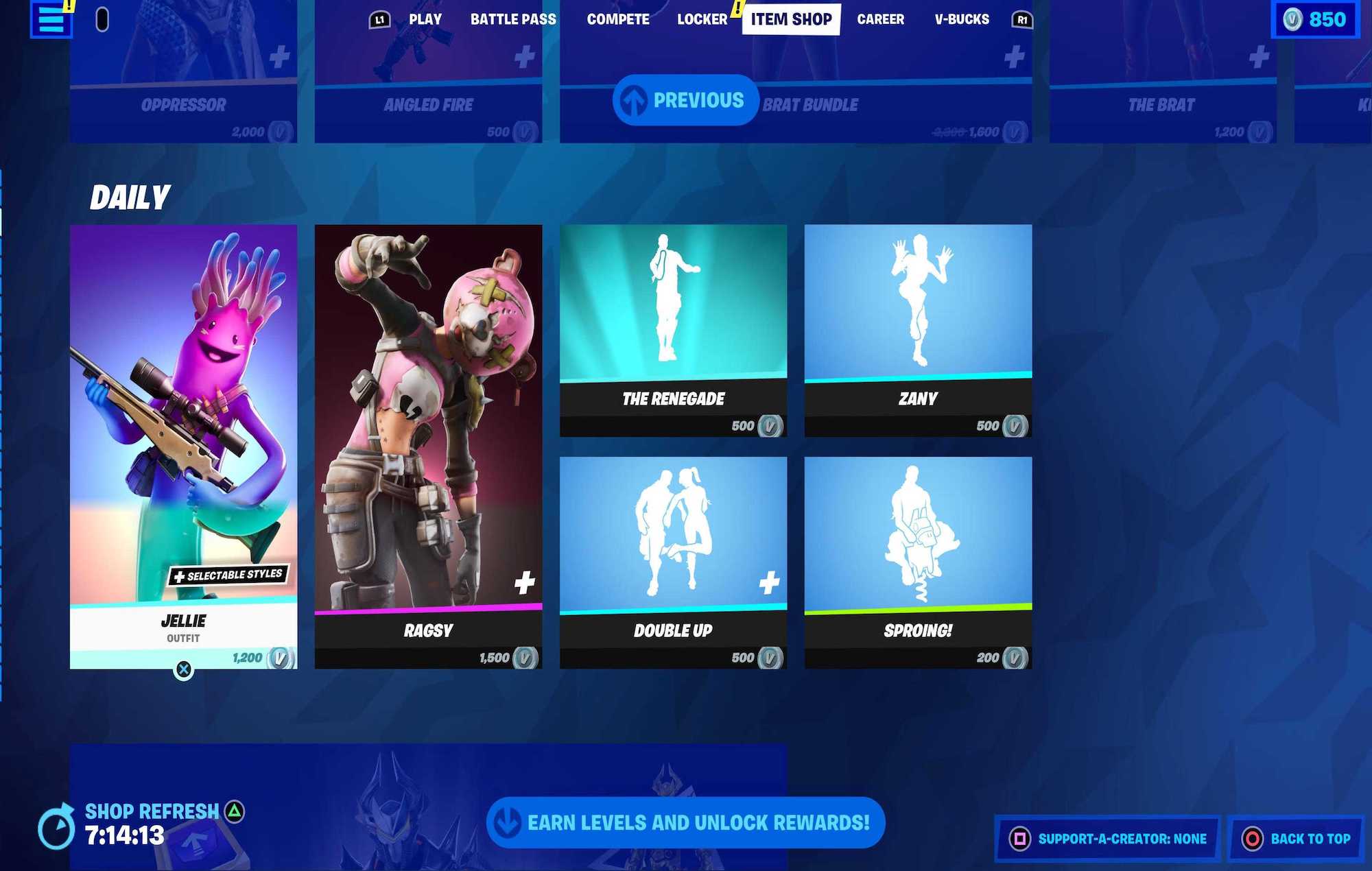

Fortnites Item Shop Highly Requested Skins Back After 1000 Days

May 02, 2025

Fortnites Item Shop Highly Requested Skins Back After 1000 Days

May 02, 2025 -

Long Awaited Kashmir Rail Link Finally Opens Pm Modis Inauguration Details

May 02, 2025

Long Awaited Kashmir Rail Link Finally Opens Pm Modis Inauguration Details

May 02, 2025 -

End Of School Desegregation Order A Turning Point In Education Policy

May 02, 2025

End Of School Desegregation Order A Turning Point In Education Policy

May 02, 2025