5 Essential Do's And Don'ts: Succeeding In The Private Credit Market

Table of Contents

Navigating the complex world of the private credit market can be challenging, but with the right knowledge and strategy, success is attainable. This article outlines five essential do's and don'ts to guide you toward thriving in this lucrative yet demanding sector. Understanding these key principles will significantly improve your chances of securing profitable deals and building a strong reputation within the private credit market.

<h2>Do: Thoroughly Undertake Due Diligence</h2>

Due diligence is paramount in the private credit market. Skipping this crucial step can lead to significant financial losses. A thorough process protects your investment and minimizes risk.

<h3>Assess Creditworthiness Rigorously:</h3>

- Perform comprehensive credit checks and background investigations on potential borrowers, utilizing tools like credit reports and background check services. Understanding a borrower's history is crucial in predicting their ability to repay.

- Analyze financial statements meticulously, paying close attention to cash flow projections, debt-to-equity ratios, and profitability trends. Look for inconsistencies or red flags that might indicate financial distress.

- Employ industry-standard credit scoring models (such as FICO or VantageScore, where applicable) and supplement them with qualitative assessments of the borrower's management team, industry position, and overall business strategy. A purely quantitative approach can be misleading.

- Independently verify all information provided by borrowers. Don't rely solely on self-reported data; contact third-party sources to corroborate information.

<h3>Evaluate Collateral Adequately:</h3>

- Thoroughly appraise the value of any collateral offered by borrowers. This might include real estate, equipment, inventory, or other assets. An accurate valuation is essential for determining the loan-to-value ratio.

- Consider potential market fluctuations and depreciation factors. Assets can lose value quickly, especially in volatile markets. Factor in potential depreciation when assessing collateral value.

- Engage experienced appraisers for complex or high-value assets. For specialized assets, professional appraisal is essential for accuracy.

- Develop clear documentation outlining the collateral's value and ownership. This documentation will be critical in case of default.

<h2>Do: Structure Deals Strategically</h2>

Strategic deal structuring is key to maximizing returns and minimizing risks in the private credit market. This includes securing favorable terms and diversifying your portfolio.

<h3>Negotiate Favorable Terms:</h3>

- Secure competitive interest rates and appropriate fees, considering the prevailing market conditions and the risk profile of the borrower.

- Implement robust covenants to protect your investment. These covenants might include restrictions on debt levels, capital expenditures, or dividend payments.

- Incorporate provisions for early repayment or default scenarios. These provisions outline the process for handling various outcomes, including penalties for early repayment or procedures for liquidation of collateral.

- Ensure clear and concise documentation covering all aspects of the agreement. A well-drafted loan agreement protects your interests and minimizes the potential for disputes.

<h3>Diversify Your Portfolio:</h3>

- Spread investments across various sectors and borrowers to mitigate risk. Don't put all your eggs in one basket. Diversification is a fundamental principle of successful investing.

- Consider geographical diversification to reduce regional economic impact. Diversify across different geographic locations to reduce your dependence on a single region's economic performance.

- Regularly review and rebalance your portfolio to optimize returns and reduce exposure. Market conditions change constantly, and your portfolio should adapt accordingly.

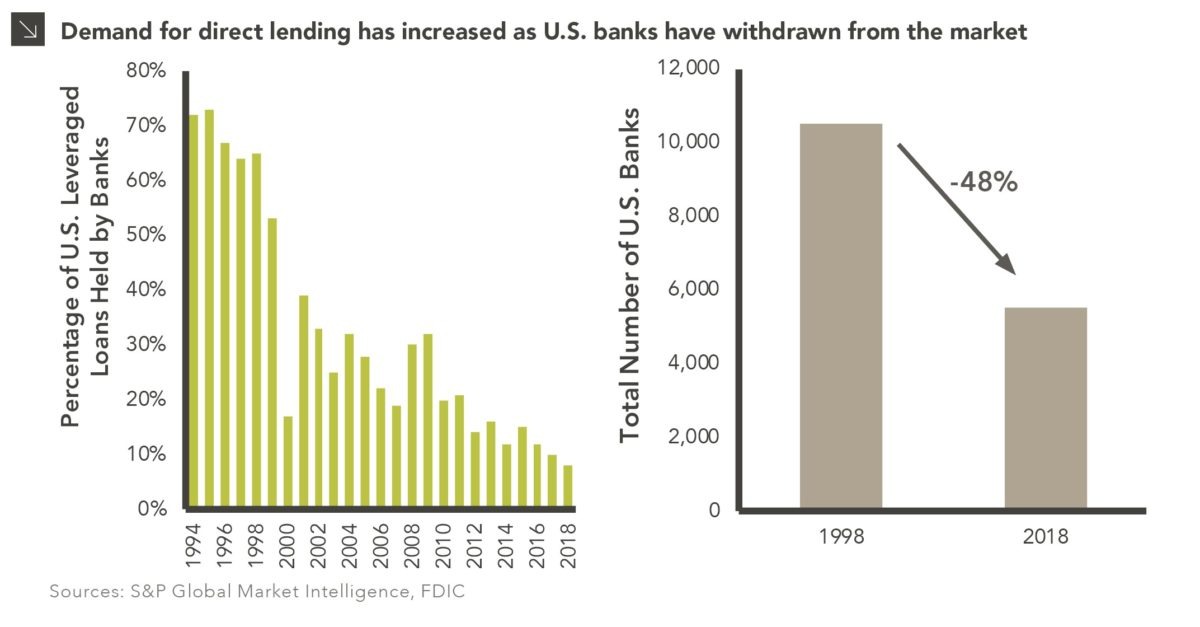

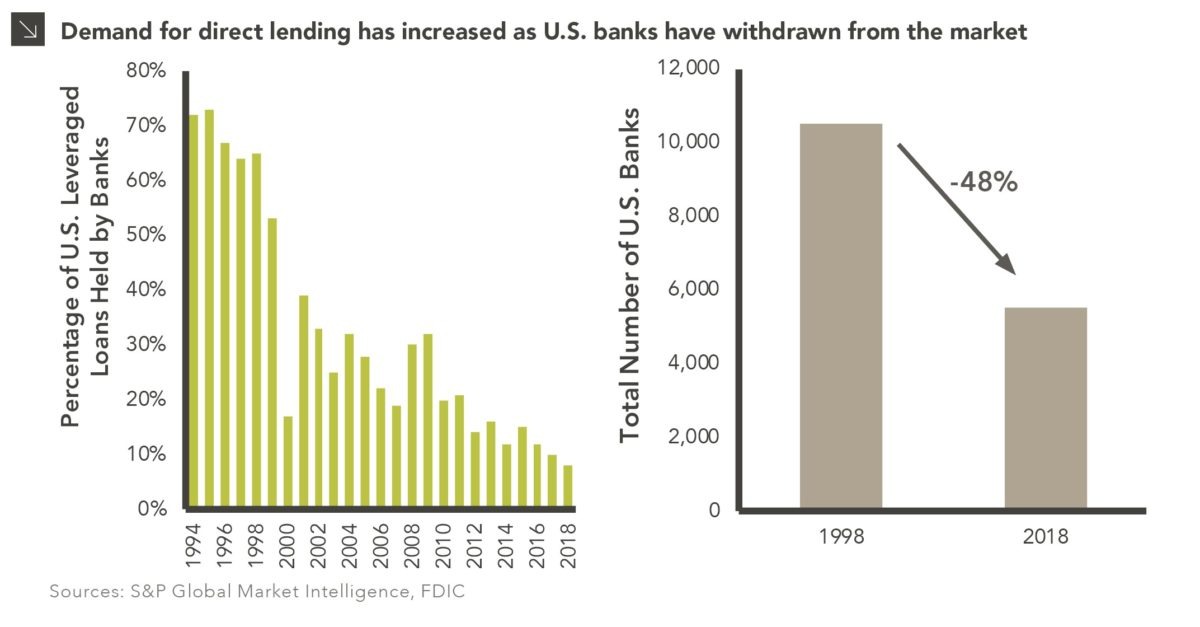

- Utilize different investment strategies within the private credit market (e.g., direct lending, fund investments). This approach allows for a range of risk and return profiles.

<h2>Don't: Neglect Legal and Regulatory Compliance</h2>

Compliance is non-negotiable in the private credit market. Ignoring regulations can lead to hefty fines and reputational damage.

<h3>Stay Updated on Regulations:</h3>

- Keep abreast of evolving laws and regulations related to private lending. The regulatory landscape is constantly changing, so stay informed.

- Ensure compliance with all applicable federal, state, and local regulations, including those concerning interest rates, lending practices, and consumer protection.

- Consult with legal professionals to address compliance questions and concerns. Seek expert legal advice to ensure full compliance.

- Maintain accurate records and documentation for audits and regulatory reviews. Meticulous record-keeping is essential for demonstrating compliance.

<h3>Overlook Risk Management:</h3>

- Implement a comprehensive risk management strategy to identify and mitigate potential threats. Proactive risk management is key to long-term success.

- Regularly monitor market conditions and economic indicators. Stay informed about the economic environment and its impact on your investments.

- Develop contingency plans for adverse events. Prepare for potential setbacks and have strategies in place to mitigate their impact.

- Conduct regular stress tests to assess portfolio resilience. Stress testing helps to identify vulnerabilities in your portfolio and improve its robustness.

<h2>Don't: Underestimate Relationship Building</h2>

Building strong relationships is essential for success in the private credit market. These relationships can lead to new deal flow and increased trust.

<h3>Cultivate Strong Borrower Relationships:</h3>

- Foster open communication and transparency with borrowers. Maintain consistent and honest communication.

- Build trust and mutual respect. Strong relationships are built on trust and mutual understanding.

- Provide responsive and supportive service. Be readily available to address borrower concerns.

- Actively manage relationships throughout the loan lifecycle. Maintain contact and build rapport throughout the loan's duration.

<h3>Network Within the Industry:</h3>

- Attend industry events and conferences. Networking events are invaluable for meeting potential partners and clients.

- Build relationships with other private credit lenders and intermediaries. These connections can provide access to deals and expertise.

- Leverage professional networks to access deal flow and expertise. Use your network to discover opportunities and seek advice from experienced professionals.

- Establish a strong reputation for integrity and professionalism. A positive reputation is invaluable in the private credit market.

<h2>Don't: Underprice Your Services</h2>

Pricing your services appropriately is crucial for profitability in the private credit market. Underpricing can undermine your business's financial viability.

<h3>Account for All Costs and Risks:</h3>

- Accurately assess all expenses related to origination, underwriting, and management. Factor in all costs associated with your services.

- Calculate appropriate risk premiums based on the inherent risks of each investment. Riskier investments should command higher returns.

- Factor in inflation and potential changes in interest rates. Consider the impact of inflation and fluctuating interest rates on your profitability.

- Ensure profitability while remaining competitive in the marketplace. Find a balance between profitability and competitiveness.

<h3>Charge Appropriate Fees:</h3>

- Structure fees that fairly compensate for your services and risk exposure. Your fees should reflect the value you provide and the risks you assume.

- Clearly define all fees and charges in loan agreements. Transparency is essential for building trust and avoiding disputes.

- Ensure transparency and avoid hidden costs. Hidden costs can damage your reputation and lead to distrust.

- Negotiate fees strategically, considering borrower needs and market conditions. Flexibility is important in negotiations, but always ensure profitability.

<h2>Conclusion</h2>

Success in the private credit market requires a multifaceted approach. By diligently performing due diligence, strategically structuring deals, adhering to regulations, building strong relationships, and pricing services appropriately, investors can significantly increase their chances of achieving profitable outcomes. Remember, understanding and implementing these five essential do's and don'ts is crucial for navigating this dynamic landscape. Don't delay – take action and start building your success in the private credit market today!

Featured Posts

-

Kentucky Derby 2025 Live Stream Find The Best Online Viewing Options

May 05, 2025

Kentucky Derby 2025 Live Stream Find The Best Online Viewing Options

May 05, 2025 -

Is Canelo Avoiding Crawford Benavidez Fight Hints At Mexican Disrespect

May 05, 2025

Is Canelo Avoiding Crawford Benavidez Fight Hints At Mexican Disrespect

May 05, 2025 -

Open Ai Facing Ftc Investigation A Deep Dive Into Chat Gpts Regulatory Challenges

May 05, 2025

Open Ai Facing Ftc Investigation A Deep Dive Into Chat Gpts Regulatory Challenges

May 05, 2025 -

3 Million In Undisclosed Nuclear Investments Examining Andrew Cuomos Holdings

May 05, 2025

3 Million In Undisclosed Nuclear Investments Examining Andrew Cuomos Holdings

May 05, 2025 -

Les Couleurs Du Temps By Cedric Klapisch A Successful Sale For Studiocanal At Cannes

May 05, 2025

Les Couleurs Du Temps By Cedric Klapisch A Successful Sale For Studiocanal At Cannes

May 05, 2025

Latest Posts

-

The Growing Problem Of Drug Addicted Rats In Houston

May 31, 2025

The Growing Problem Of Drug Addicted Rats In Houston

May 31, 2025 -

Houstons Rat Problem A New Dimension Of Drug Addiction

May 31, 2025

Houstons Rat Problem A New Dimension Of Drug Addiction

May 31, 2025 -

The Legacy Of Staten Islands Nonnas Timeless Italian Dishes

May 31, 2025

The Legacy Of Staten Islands Nonnas Timeless Italian Dishes

May 31, 2025 -

30 Days To Minimalism A Practical Guide To Decluttering

May 31, 2025

30 Days To Minimalism A Practical Guide To Decluttering

May 31, 2025 -

Experience Authentic Italian Staten Island Nonna Restaurants

May 31, 2025

Experience Authentic Italian Staten Island Nonna Restaurants

May 31, 2025