5 Key Actions To Secure A Private Credit Industry Job

Table of Contents

1. Network Strategically Within the Private Credit Industry

Networking is paramount in the private credit industry. Building strong relationships can open doors to unadvertised roles and provide invaluable insights.

1.1 Leverage LinkedIn Effectively

Your LinkedIn profile is your digital resume. Optimize it to attract recruiters and industry professionals.

- Keyword Optimization: Incorporate relevant keywords such as "private credit," "direct lending," "fund manager," "credit analyst," "debt financing," "leveraged finance," "private debt," "structured finance," and "alternative lending."

- Active Engagement: Don't just create a profile; actively participate. Join relevant groups like "Private Equity & Venture Capital," "Alternative Investments," and industry-specific groups. Comment thoughtfully on posts, share insightful articles, and participate in discussions.

- Targeted Connections: Connect with recruiters specializing in private credit placements. Research firms known for their private credit activities and connect with professionals working there.

- Complete Profile: Ensure your profile is complete, including a professional headshot, a compelling summary highlighting your skills and experience, and a detailed work history.

1.2 Attend Industry Events and Conferences

Networking in person is invaluable. Attend conferences like SuperReturn, PEI events, and smaller, regional industry gatherings.

- Preparation is Key: Prepare talking points and a concise elevator pitch summarizing your skills and career aspirations. Practice your pitch to ensure it's compelling and memorable.

- Meaningful Interactions: Focus on quality over quantity. Engage in genuine conversations, learn about attendees' roles and experiences, and exchange contact information.

- Follow Up: After the event, send personalized follow-up emails to individuals you connected with, reinforcing your interest and potentially suggesting further conversations.

1.3 Informational Interviews

Informational interviews are a powerful tool for gaining insights and making connections.

- Identify Targets: Research professionals working in private credit firms that interest you.

- Prepare Thoughtful Questions: Prepare questions that demonstrate your genuine interest in their career path and the private credit industry. Avoid asking questions easily answered online.

- Build Rapport: Focus on building a relationship, not just extracting information. Express your enthusiasm and show your genuine interest in their work.

2. Master the Essential Skills for Private Credit Roles

Private credit roles demand specific skills. Developing proficiency in these areas is crucial.

2.1 Financial Modeling Proficiency

Strong financial modeling skills are essential.

- Excel Mastery: Become proficient in Excel, including advanced functions like VBA and data manipulation techniques.

- Specialized Software: Familiarize yourself with industry-standard financial modeling software.

- Model Building: Practice building complex models for leveraged buyouts (LBOs), debt structuring, and credit analysis.

- Certifications: Consider pursuing relevant certifications such as the Financial Modeling & Valuation Analyst (FMVA) to demonstrate your expertise.

2.2 Credit Analysis Expertise

A deep understanding of credit risk is vital.

- Financial Statement Analysis: Master the art of analyzing financial statements, identifying key ratios and trends.

- Industry Research: Develop the ability to conduct thorough industry research to assess the creditworthiness of borrowers.

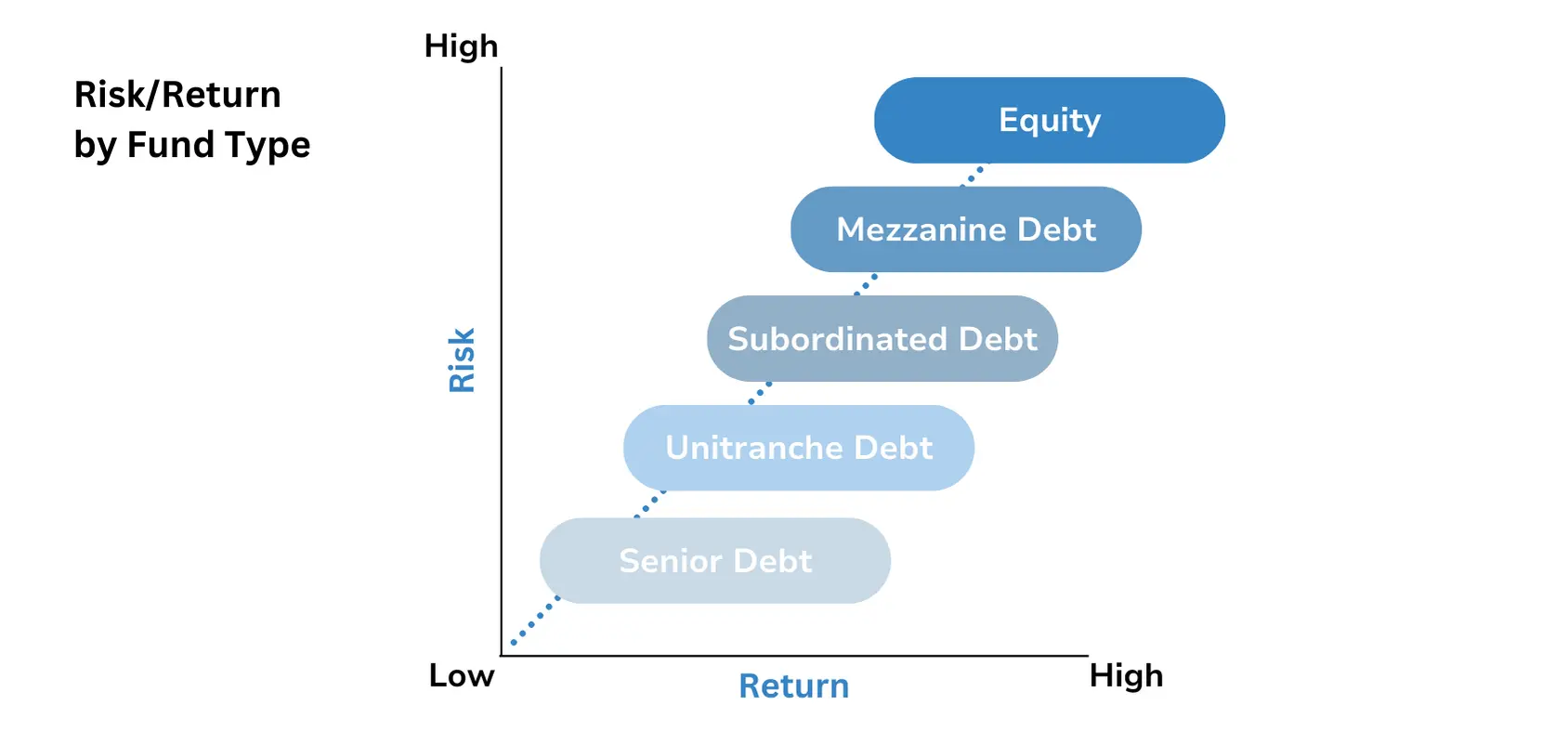

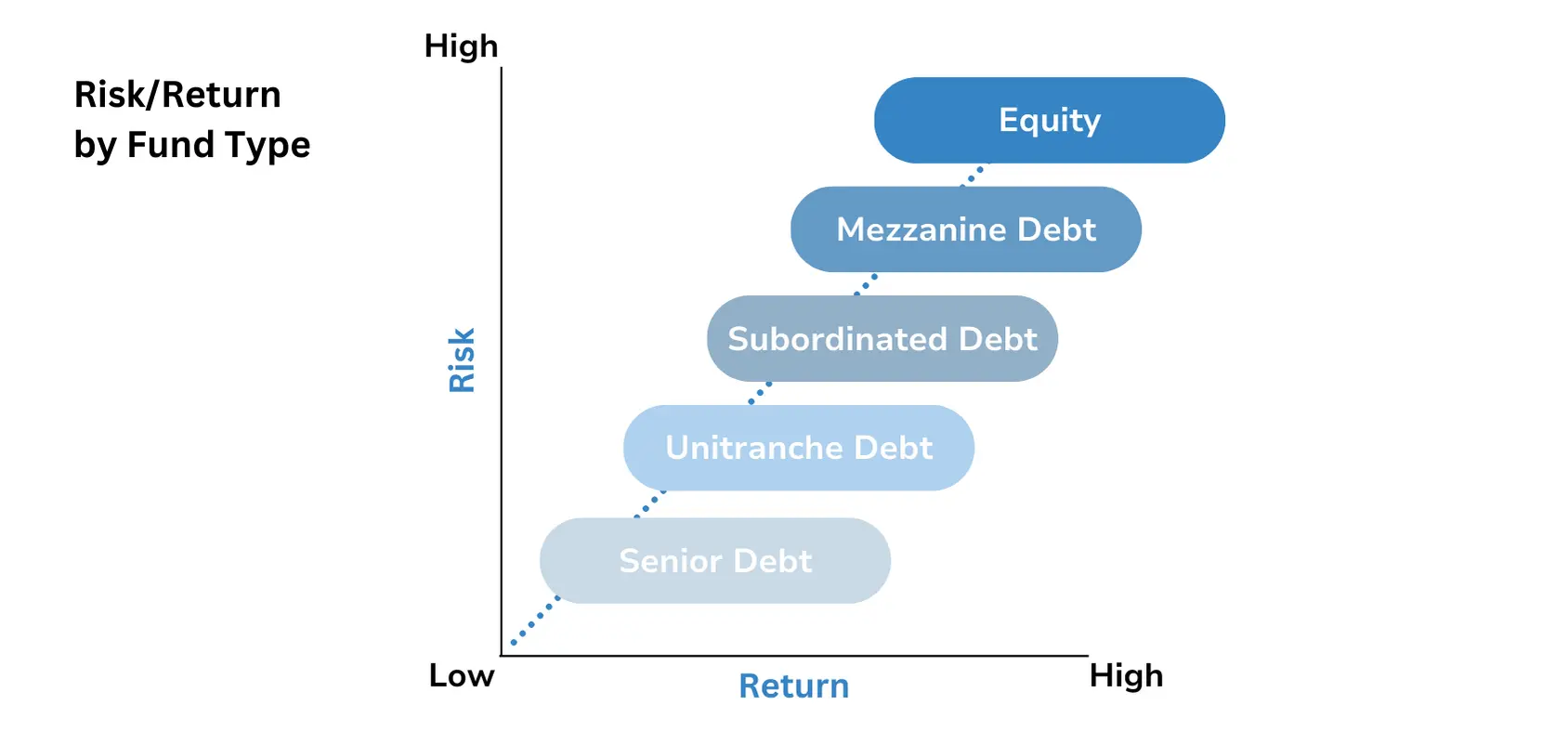

- Credit Products: Familiarize yourself with various credit products, including term loans, revolving credit facilities, mezzanine debt, and other private credit instruments.

- Regulatory Landscape: Stay updated on regulatory changes affecting the private credit market.

2.3 Strong Communication and Presentation Skills

The ability to communicate complex financial information clearly and concisely is crucial.

- Written Communication: Develop strong writing skills to prepare clear and concise reports and memos.

- Verbal Communication: Practice presenting complex financial information to both technical and non-technical audiences.

- Storytelling: Learn to weave narratives that effectively convey insights derived from your analysis.

3. Tailor Your Resume and Cover Letter to Private Credit Jobs

Your resume and cover letter are your first impression. Tailor them to each specific job application.

- Keyword Optimization: Incorporate relevant keywords from the job description.

- Quantifiable Achievements: Quantify your accomplishments using metrics to showcase your impact.

- Customization: Customize your resume and cover letter for each application, highlighting the skills and experience most relevant to the specific role.

- Proofreading: Meticulously proofread for any grammatical errors or typos.

4. Prepare for the Private Credit Interview Process

The interview process is rigorous. Thorough preparation is essential.

4.1 Technical Interview Preparation

Expect technical questions about financial modeling, credit analysis, and valuation.

- Practice Questions: Practice answering common technical interview questions, including case studies.

- Firm Research: Research the firm and the interviewer before the interview.

- Technical Skills: Brush up on your technical skills, such as discounted cash flow (DCF) analysis, LBO modeling, and credit risk assessment.

4.2 Behavioral Interview Preparation

Behavioral interviews assess your soft skills.

- STAR Method: Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Example Preparation: Prepare examples that demonstrate your teamwork, problem-solving, and communication skills.

5. Gain Relevant Experience Through Internships or Entry-Level Positions

Relevant experience is crucial.

- Internships: Seek internships in finance, accounting, or investment banking.

- Entry-Level Roles: Consider entry-level positions in financial institutions, even if not directly in private credit.

- Transferable Skills: Highlight transferable skills from previous roles that are relevant to private credit.

Conclusion

Securing a private credit industry job requires a multifaceted approach. By focusing on these five key actions – strategic networking, mastering essential skills, tailoring your application materials, preparing for interviews, and gaining relevant experience – you significantly increase your chances of success. Don't delay; start implementing these strategies today to advance your career in the competitive yet rewarding world of private credit. Remember, actively pursuing these steps will put you on the path to landing your dream private credit industry job.

Featured Posts

-

Tulsa School District Closure Inclement Weather Wednesday

May 02, 2025

Tulsa School District Closure Inclement Weather Wednesday

May 02, 2025 -

International Harry Potter Day Where To Buy Official Harry Potter Products Online

May 02, 2025

International Harry Potter Day Where To Buy Official Harry Potter Products Online

May 02, 2025 -

The Role That Cost Arsenal The Title Sounesss Analysis

May 02, 2025

The Role That Cost Arsenal The Title Sounesss Analysis

May 02, 2025 -

Riot Platforms Inc Early Warning Report And Proxy Statement

May 02, 2025

Riot Platforms Inc Early Warning Report And Proxy Statement

May 02, 2025 -

100 Year Old Actress Priscilla Pointer Passes Away

May 02, 2025

100 Year Old Actress Priscilla Pointer Passes Away

May 02, 2025