5 Key Actions To Secure A Private Credit Role

Table of Contents

Securing a private credit role is highly competitive, but with the right strategy, you can significantly increase your chances of success. This article outlines five key actions that will dramatically improve your application and interview performance, helping you land that coveted private credit position. We’ll explore everything from honing essential skills to effectively networking within the industry.

Master Essential Skills for Private Credit Roles

The private credit industry demands a unique blend of financial acumen, analytical skills, and communication prowess. To stand out, you need to master specific skills crucial for success.

Deep Understanding of Financial Modeling and Analysis

Proficiency in financial modeling and analysis is paramount in private credit. This goes beyond basic spreadsheet skills.

- Proficiency in Excel (including advanced functions like VBA): You'll be building complex models, automating processes, and performing intricate calculations. Mastering VBA is a significant advantage.

- Experience with financial modeling software (e.g., Bloomberg Terminal, Argus): Familiarity with industry-standard software is essential for efficient data analysis and report generation. Bloomberg Terminal, in particular, is widely used for market data and analysis within the private credit space.

- Understanding of discounted cash flow (DCF) analysis, LBO modeling, and credit metrics: These are foundational tools for evaluating investment opportunities and assessing credit risk. A deep understanding of these methodologies is crucial for making informed investment decisions.

- Relevant Certifications (e.g., CFA, CAIA): While not always mandatory, certifications like the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA) demonstrate a commitment to professional excellence and significantly enhance your credentials.

Credit Risk Assessment and Underwriting Expertise

Assessing and managing credit risk is the core function of a private credit professional.

- Ability to analyze financial statements: You need to be able to dissect financial statements (balance sheets, income statements, cash flow statements) to identify key trends, assess profitability, and understand a company's financial health.

- Assess creditworthiness: This involves evaluating a borrower's ability and willingness to repay debt, considering factors such as credit history, collateral, and industry conditions.

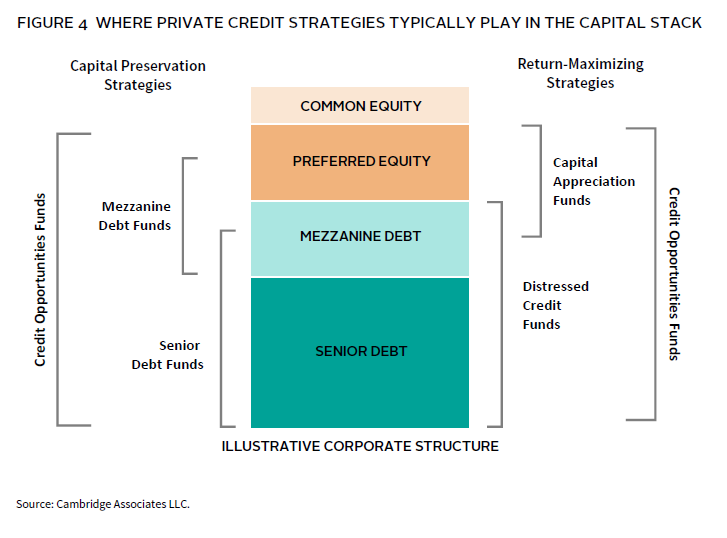

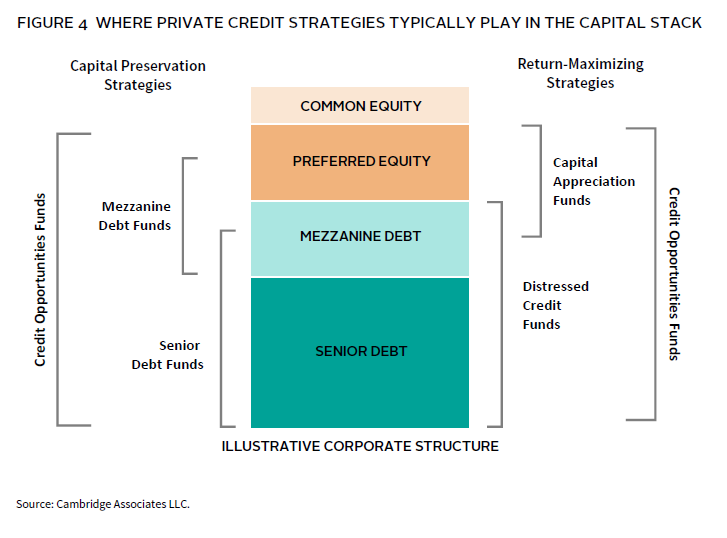

- Understand various credit structures (e.g., senior secured, subordinated debt): Private credit involves a variety of complex credit structures. You must understand the nuances of each structure and their implications for risk and return.

- Experience with due diligence processes: Thorough due diligence is critical in private credit. Experience with financial due diligence, legal due diligence, and operational due diligence will be highly valued.

- Familiarity with different credit rating agencies: Understanding how credit rating agencies assess risk and the implications of credit ratings is vital for making informed investment decisions.

Strong Communication and Presentation Skills

Effectively communicating complex financial information is crucial for success in private credit.

- Ability to clearly articulate complex financial information, both verbally and in writing: You'll need to explain your analysis and recommendations to both technical and non-technical audiences, including senior management and investors.

- Proficiency in creating compelling presentations: The ability to create clear, concise, and visually appealing presentations is essential for conveying key findings and securing buy-in from stakeholders.

- Experience in presenting to senior management or investors: Practice your presentation skills and tailor your communication style to different audiences.

Network Strategically Within the Private Credit Industry

Networking is critical for securing a private credit role. Building relationships within the industry can open doors to opportunities you might not otherwise find.

Attend Industry Events and Conferences

Industry events are excellent opportunities to meet potential employers and learn about new developments.

- Relevant conferences and networking events: Research and attend conferences like SuperReturn, PEI's Global Private Equity Forum, and industry-specific events focused on direct lending or private debt.

- Engage in conversations and exchange business cards: Don't just attend; actively participate. Engage in conversations, exchange business cards, and follow up afterward.

Leverage LinkedIn and Online Platforms

LinkedIn is a powerful tool for networking and job searching.

- Optimize LinkedIn profile: Make sure your profile is complete, professional, and keyword-rich, highlighting your experience in relevant areas like private credit, financial modeling, and credit analysis.

- Actively engage in relevant groups and discussions: Participate in discussions, share insightful comments, and build your online presence.

- Connect with professionals in private credit: Reach out to individuals working in private credit firms and start building your network.

Informational Interviews and Mentorship

Informational interviews can provide valuable insights and potential job leads.

- Reach out to professionals for informational interviews: Contact individuals working in private credit and ask for 30 minutes of their time to learn about their experience and the industry.

- Seek mentorship from experienced individuals: A mentor can provide guidance, support, and valuable career advice.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count.

Highlight Relevant Experience and Skills

Tailor your resume and cover letter to each specific job description.

- Quantify achievements whenever possible: Instead of simply stating your responsibilities, quantify your accomplishments using metrics and numbers. For example, instead of "Managed a portfolio of loans," write "Managed a $50 million portfolio of loans, resulting in a 10% reduction in delinquencies."

- Use action verbs: Start your bullet points with strong action verbs to showcase your accomplishments.

Showcase Your Understanding of Private Credit

Demonstrate your knowledge of the industry.

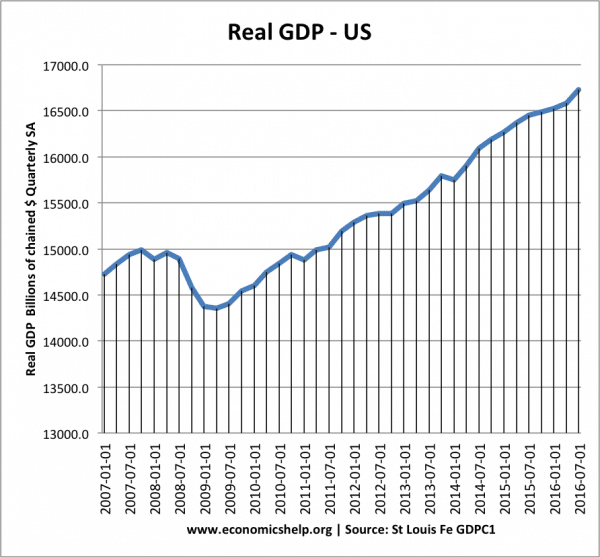

- Demonstrate knowledge of market trends and investment strategies: Stay up-to-date on current market conditions and investment strategies within the private credit space.

- Mention relevant coursework or projects: Highlight any relevant coursework, projects, or extracurricular activities that demonstrate your understanding of private credit principles.

- Include keywords related to private credit: Incorporate relevant keywords throughout your resume and cover letter, such as "direct lending," "private equity," "distressed debt," "senior secured loans," "subordinated debt," etc.

Proofread Meticulously

Errors can cost you the job.

- Ensure your resume and cover letter are free of grammatical errors and typos: Proofread carefully, and even better, have someone else proofread your documents.

Ace the Private Credit Interview

Preparation is key to a successful interview.

Prepare for Technical and Behavioral Questions

Anticipate common questions.

- Research common interview questions: Research common interview questions for private credit roles and practice your answers.

- Practice answering technical questions using the STAR method (Situation, Task, Action, Result): This structured approach helps you provide concise and compelling answers.

- Prepare examples of your behavioral strengths and weaknesses: Be ready to discuss your strengths and weaknesses using specific examples.

Ask Thoughtful Questions

Asking insightful questions demonstrates your interest and engagement.

- Prepare insightful questions about the firm, the role, and the team: Research the firm beforehand and formulate questions that demonstrate your understanding of their investment strategy and culture.

Follow Up After the Interview

A thank-you note reinforces your interest.

- Send a thank-you note expressing your gratitude and reiterating your interest: Send a personalized thank-you note within 24 hours of your interview.

Build Your Private Credit Knowledge Continuously

The private credit landscape is constantly evolving. Continuous learning is essential.

Stay Updated on Market Trends

Stay abreast of industry news and developments.

- Regularly read industry publications: Follow leading publications such as Private Debt Investor, Private Equity International, and others relevant to the private credit space.

- Attend webinars and conferences: Continuously update your knowledge by attending webinars and conferences.

- Follow key influencers on social media: Follow key thought leaders and influencers on social media platforms like LinkedIn and Twitter.

Pursue Further Education or Certifications

Enhance your expertise.

- Consider pursuing relevant certifications (CFA, CAIA): These certifications can significantly boost your career prospects.

- Consider further education: Consider pursuing an MBA or other advanced degrees to further enhance your expertise in finance and investment management.

Conclusion

Securing a private credit role requires dedication, preparation, and strategic action. By mastering essential skills, networking effectively, crafting a compelling application, acing the interview, and continuously expanding your knowledge, you significantly increase your chances of success. Remember to consistently apply these five key actions to secure your desired private credit role. Start building your career in private credit today!

Featured Posts

-

The Silent Divorce How To Spot The Warning Signs Before Its Too Late

Apr 28, 2025

The Silent Divorce How To Spot The Warning Signs Before Its Too Late

Apr 28, 2025 -

Eva Longorias Culinary Encounter A World Renowned Chefs Fishermans Stew

Apr 28, 2025

Eva Longorias Culinary Encounter A World Renowned Chefs Fishermans Stew

Apr 28, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Announcements

Apr 28, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcements

Apr 28, 2025 -

Silent Divorce Are These Subtle Signs Showing Up In Your Marriage

Apr 28, 2025

Silent Divorce Are These Subtle Signs Showing Up In Your Marriage

Apr 28, 2025 -

Driving The Overseas Highway A Florida Keys Adventure

Apr 28, 2025

Driving The Overseas Highway A Florida Keys Adventure

Apr 28, 2025

Latest Posts

-

The Us Economy Under Pressure Examining The Impact Of The Canadian Travel Boycott

Apr 28, 2025

The Us Economy Under Pressure Examining The Impact Of The Canadian Travel Boycott

Apr 28, 2025 -

Assessing The Economic Fallout A Fed Snapshot Of The Canadian Travel Boycott

Apr 28, 2025

Assessing The Economic Fallout A Fed Snapshot Of The Canadian Travel Boycott

Apr 28, 2025 -

Real Time Analysis The Economic Effects Of A Canadian Travel Boycott On The Us

Apr 28, 2025

Real Time Analysis The Economic Effects Of A Canadian Travel Boycott On The Us

Apr 28, 2025 -

The Auto Industrys Growing Revolt Against Electric Vehicle Regulations

Apr 28, 2025

The Auto Industrys Growing Revolt Against Electric Vehicle Regulations

Apr 28, 2025 -

Ev Mandate Backlash Car Dealerships Renew Their Resistance

Apr 28, 2025

Ev Mandate Backlash Car Dealerships Renew Their Resistance

Apr 28, 2025