$5000 Personal Loans For Bad Credit: No Credit Check Options

Table of Contents

Understanding Your Options for $5000 Loans with Bad Credit

Securing a loan with bad credit presents unique challenges. Lenders perceive borrowers with low credit scores as higher risk, leading to stricter approval processes and potentially higher interest rates. It's crucial to understand the difference between a "no credit check" loan and a "bad credit" loan. A "no credit check" loan might seem appealing, but these often come with extremely high interest rates and fees. A "bad credit" loan, while still carrying higher rates than loans for those with excellent credit, is generally a more transparent and regulated option.

- High-interest rates are common with bad credit loans: Expect to pay more in interest compared to someone with a good credit score. This is the price of higher risk for the lender.

- Shorter repayment terms are typical: This means your monthly payments will be higher. Carefully evaluate if you can comfortably manage these payments.

- Careful comparison shopping is crucial: Don't settle for the first offer you receive. Compare interest rates, fees, and repayment terms across multiple lenders.

- Understanding APR (Annual Percentage Rate) is vital: The APR reflects the total cost of borrowing, including interest and fees. Always compare APRs when comparing loans.

Exploring Loan Types: Beyond Traditional Banks

Traditional banks are often less forgiving of bad credit. However, several alternative lenders offer $5000 personal loans for bad credit.

Payday Loans

Payday loans are short-term, small-dollar loans designed to be repaid on your next payday. They're often characterized by:

- Very short repayment terms (often 2-4 weeks): This makes them incredibly expensive if you can't repay on time.

- High interest rates and fees: The APR on payday loans can be exorbitant, leading to a rapid accumulation of debt.

- Suitable for very small, short-term emergencies only: A $5000 payday loan is generally not advisable due to the high cost. Consider this option only for the smallest, most urgent needs.

Installment Loans

Installment loans offer longer repayment periods than payday loans, typically spanning several months or even years. This results in lower monthly payments, making them potentially more manageable:

- Longer repayment periods (months or years): This spreads the cost of the loan over time.

- Lower monthly payments than payday loans (but potentially higher overall interest): While monthly payments are lower, you'll pay more interest overall due to the longer repayment period.

- More manageable for larger loan amounts: Installment loans are generally better suited for larger loan amounts like $5000, especially for those with bad credit.

Online Lenders

Online lenders offer convenience and accessibility, but careful research is crucial.

- Convenient application process: Apply for a loan from the comfort of your home.

- Faster approval times (potentially): Online lenders often have quicker processing times compared to traditional banks.

- Increased risk of scams; careful research is crucial: Always verify the legitimacy of online lenders before submitting personal information. Check reviews and ensure they're licensed and reputable.

Credit Unions

Credit unions are member-owned financial institutions that often offer more favorable terms than traditional banks or payday lenders.

- Potentially lower interest rates than payday lenders: Credit unions are known for their competitive rates and member-focused approach.

- May offer more flexible repayment options: Credit unions might be more willing to work with borrowers who experience financial hardship.

- Membership requirements apply: You generally need to meet specific criteria to become a member of a credit union.

Factors Affecting Loan Approval & Interest Rates

Several factors influence your chances of approval and the interest rate you'll receive for a $5000 personal loan.

- Improving your credit score before applying: Work on improving your credit score by paying bills on time and reducing your debt.

- Providing proof of income and stable employment: Demonstrate your ability to repay the loan by providing documentation of your income and employment history.

- Having a low debt-to-income ratio: Lenders prefer borrowers with a manageable debt load.

- Choosing a loan amount you can comfortably repay: Don't borrow more than you can realistically afford to pay back.

Conclusion

Securing a $5000 personal loan with bad credit or no credit check requires careful consideration of various loan types and lenders. While options exist, remember that high interest rates are common. Prioritize responsible borrowing and compare lenders thoroughly before committing to a loan. Remember to research the legitimacy of any lender before providing personal information. Start your search for the best $5000 personal loan for your situation today! Don't let bad credit stop you from accessing the financial relief you need. Explore your options for $5000 personal loans for bad credit and find the right fit for your needs.

Featured Posts

-

Padre Luis Arraez 7 Day Concussion Il Stint

May 28, 2025

Padre Luis Arraez 7 Day Concussion Il Stint

May 28, 2025 -

Andersons Departure Reflecting On His Time With The Chicago White Sox

May 28, 2025

Andersons Departure Reflecting On His Time With The Chicago White Sox

May 28, 2025 -

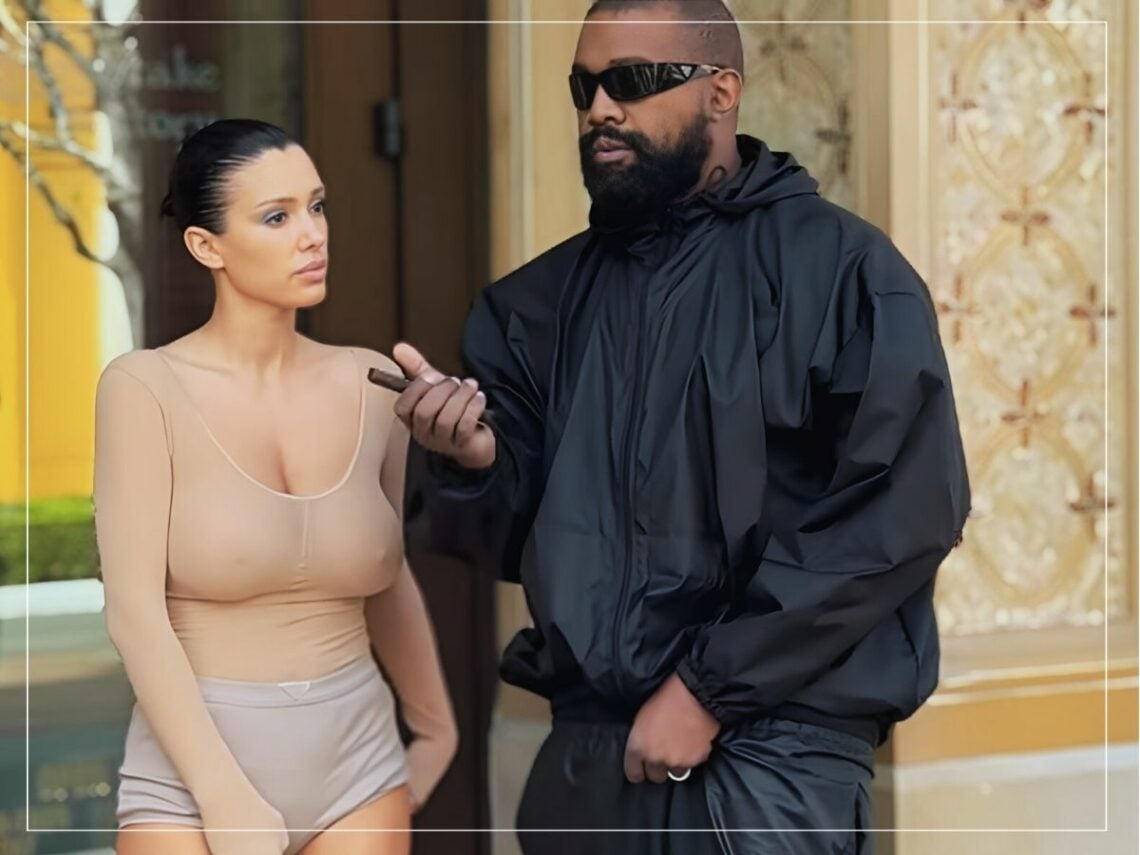

Kanye West And Bianca Censori Look Alike Spotted In La Reconciliation Rumors Swirl

May 28, 2025

Kanye West And Bianca Censori Look Alike Spotted In La Reconciliation Rumors Swirl

May 28, 2025 -

Mc Kenna Impresses Tuanzebe Positive Ipswich Town Weekly Player Review

May 28, 2025

Mc Kenna Impresses Tuanzebe Positive Ipswich Town Weekly Player Review

May 28, 2025 -

Arsenals Transfer Coup Key Signing Beats Real Madrid And Man Utd

May 28, 2025

Arsenals Transfer Coup Key Signing Beats Real Madrid And Man Utd

May 28, 2025