$800 Million Week 1? Analyzing The Potential Impact Of XRP ETF Approval

Table of Contents

First, a brief definition: XRP is a cryptocurrency designed for fast and efficient cross-border payments, operating on the Ripple network. An ETF, or Exchange-Traded Fund, is an investment fund traded on stock exchanges, offering investors exposure to a specific asset class, in this case, XRP.

The Current State of XRP and the ETF Landscape

XRP's Price History and Market Sentiment

XRP's price has experienced significant volatility, influenced by regulatory developments and market sentiment. Analyzing its price history leading up to a potential ETF approval is crucial. Below are key factors:

- Key Price Support and Resistance Levels: Identifying past support and resistance levels can help predict future price movements. A break above key resistance could signal a significant bullish trend.

- Major News Events Impacting XRP's Price: Regulatory announcements, partnerships, and technological upgrades have historically influenced XRP's price. Understanding these events provides valuable context.

- Current Market Capitalization: The current market cap of XRP helps gauge its overall value and potential growth. A larger market cap suggests greater potential for price appreciation.

[Insert Chart showing XRP's price history here]

The Regulatory Landscape Surrounding Crypto ETFs

The regulatory environment for crypto ETFs is constantly evolving, particularly in the US. The SEC's stance on crypto ETFs has been a significant hurdle.

- Challenges Faced by Crypto ETF Applications: Past rejections of Bitcoin and Ethereum ETF applications highlight the regulatory challenges, including concerns about market manipulation and investor protection.

- Potential Timeline for Approval: Predicting the timeline for XRP ETF approval is difficult, depending on the SEC's review process and any potential appeals.

- Impact of Different Regulatory Outcomes: Approval would likely lead to increased market participation and price appreciation. Rejection could trigger a bearish market response.

Investor Demand for an XRP ETF

Significant investor interest is anticipated should an XRP ETF gain approval.

- Pre-orders and Waiting Lists: The number of pre-orders and individuals on waiting lists provides a measure of potential demand.

- Survey Data Indicating Investor Demand: Surveys gauging investor interest in an XRP ETF can offer further insights into market appetite.

- Potential Institutional Investor Interest: Institutional investors' entry into the market through an ETF could significantly boost trading volume.

Estimating Week 1 Trading Volume: The $800 Million Prediction

Factors Influencing Potential Trading Volume

Several factors could contribute to a surge in trading volume following XRP ETF approval:

- FOMO (Fear of Missing Out): Once an ETF is approved, the fear of missing out could drive a substantial influx of new investors.

- Short Squeezes: Short sellers anticipating a price decline might be forced to buy back XRP, further increasing demand.

- Institutional Investments: Large-scale institutional investment through the ETF could significantly impact trading volume.

- Retail Investor Participation: Increased accessibility through an ETF may attract retail investors, bolstering trading activity.

Modeling Potential Trading Volume

Estimating the week-one trading volume requires careful modeling, considering several assumptions:

- Factors Considered: Models should incorporate XRP's current market cap, investor interest (gauged from pre-orders and surveys), and the capacity of trading platforms.

- Potential Limitations: Unforeseen market events, regulatory changes, or sudden shifts in investor sentiment could significantly affect the accuracy of any prediction.

Comparison with Other ETF Launches

Comparing the potential XRP ETF launch with previous successful ETF launches provides context:

- Successful ETF Launches and Their Initial Trading Volume: Analyzing data from other successful ETF launches of similar assets can offer a basis for comparison and help refine the $800 million prediction.

Potential Impact on the Broader Cryptocurrency Market

Ripple Effect on Other Cryptocurrencies

The approval of an XRP ETF could have a ripple effect across the cryptocurrency market:

- Potential Positive and Negative Correlations: XRP's price movement could positively or negatively influence other cryptocurrencies, depending on market dynamics.

- Potential Altcoin Season Possibilities: Increased investor interest in the crypto market could trigger a broader altcoin rally.

Impact on the Overall Crypto Market Sentiment

An XRP ETF approval could significantly impact the overall crypto market sentiment:

- Increased Institutional Adoption: Increased institutional adoption through ETFs could legitimize the crypto market and attract further investment.

- Regulatory Clarity: A successful XRP ETF could pave the way for approvals of other crypto ETFs, leading to greater regulatory clarity.

- Market Maturation: The introduction of ETFs could contribute to the overall maturation and professionalization of the crypto market.

Conclusion: The Future of XRP and ETF Approval

The $800 million week-one trading volume prediction for an XRP ETF is a bold estimate, dependent on numerous factors. While the potential is significant, uncertainty remains. Market behavior is complex and influenced by unpredictable events. Investing in XRP and XRP-related ETFs carries both potential benefits and risks. Thorough research and understanding of these risks are crucial.

Stay informed about the evolving landscape of XRP and ETF approval to make well-informed investment decisions. The potential is significant – don't miss out on the opportunity to learn more about XRP ETFs!

Featured Posts

-

Selling Sunset Star Accuses Landlords Of Price Gouging In Wake Of La Fires

May 07, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging In Wake Of La Fires

May 07, 2025 -

Seattle Mariners Cruise To 14 0 Victory Over Miami Marlins

May 07, 2025

Seattle Mariners Cruise To 14 0 Victory Over Miami Marlins

May 07, 2025 -

Nhl 25 Arcade Mode Makes A Comeback This Week

May 07, 2025

Nhl 25 Arcade Mode Makes A Comeback This Week

May 07, 2025 -

Why Powells Fed Risks Delaying Interest Rate Cuts An Analysis Of Trumps Influence

May 07, 2025

Why Powells Fed Risks Delaying Interest Rate Cuts An Analysis Of Trumps Influence

May 07, 2025 -

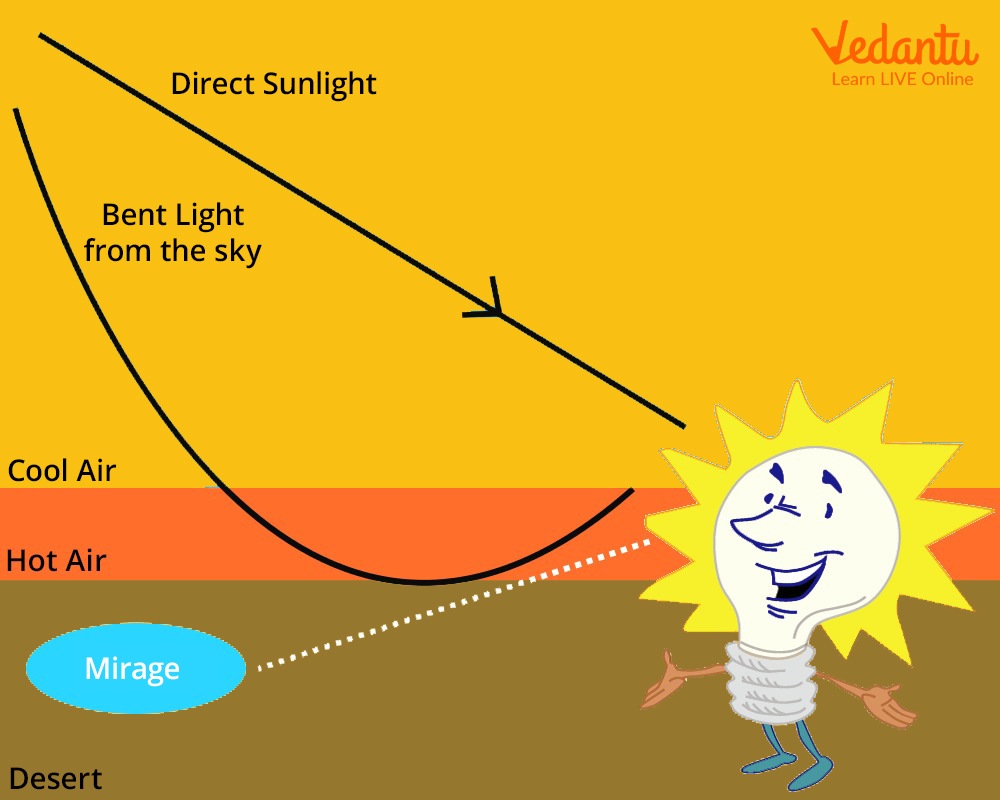

Exploring The Phenomenon Of The Glossy Mirage

May 07, 2025

Exploring The Phenomenon Of The Glossy Mirage

May 07, 2025