A Guide To Financing A 270MWh BESS Project In Belgium

Table of Contents

Understanding Belgian Renewable Energy Policies and Incentives for BESS

Belgium offers a supportive policy environment for renewable energy projects, including significant incentives for BESS installations. These incentives are designed to accelerate the deployment of energy storage and contribute to the nation's decarbonization goals. Understanding these policies is crucial for securing funding for your 270MWh BESS project.

-

Government Support Schemes and Subsidies: The Belgian government, through various regional and federal agencies, offers grants, subsidies, and tax benefits to promote energy storage projects. These incentives often depend on project size, technology used, and location.

-

Tax Incentives and Exemptions: Several tax incentives are available for BESS installations, potentially reducing the overall project cost. These might include accelerated depreciation, tax credits, or exemptions from certain taxes.

-

Regional and Local Initiatives: In addition to federal-level support, regional governments in Flanders, Wallonia, and Brussels often have their own programs specifically targeting renewable energy and energy storage projects. These initiatives can provide additional funding opportunities or streamlined permitting processes.

Bullet Points:

- Specific examples of Belgian government programs: The Flemish government's "Vlaamse Energiepremie" program, among others, could offer relevant support.

- Relevant legislation: The Belgian Energy Act and associated decrees provide the legal framework for BESS installations.

- Potential tax benefits: Consult with a tax advisor to understand the specific tax implications and potential benefits for your project.

Keywords: Belgian renewable energy subsidies, BESS incentives Belgium, energy storage tax benefits Belgium.

Exploring Funding Sources for a 270MWh BESS Project

Securing financing for a 270MWh BESS project requires a multi-faceted approach, leveraging both public and private funding sources. A well-structured financing strategy is essential for success.

Public Funding Opportunities

Numerous public funding organizations at both the Belgian and EU levels offer grants, loans, and subsidies specifically targeted at renewable energy and energy storage projects.

-

Belgian Institutions: Several federal and regional agencies in Belgium offer funding opportunities for energy storage projects. These agencies often have dedicated programs for large-scale BESS installations.

-

EU Institutions: The European Investment Bank (EIB), European Regional Development Fund (ERDF), and other EU institutions provide substantial funding for renewable energy projects, including energy storage. Access to these funds often requires competitive application processes.

Bullet Points:

- Specific funding organizations: European Investment Bank (EIB), VITO (Flemish Institute for Technological Research), SPW (Wallonia Public Service).

- Application processes and eligibility criteria: Thoroughly research the specific requirements and deadlines for each funding opportunity.

Keywords: BESS grants Belgium, EU funding for energy storage, public sector financing for BESS.

Private Financing Options

Private sector funding plays a significant role in financing large-scale BESS projects. Several avenues can be explored, including:

-

Bank Loans: Traditional bank loans can provide a substantial portion of the financing, particularly for projects with strong creditworthiness and robust financial projections.

-

Project Finance: Project finance structures, involving multiple lenders and investors, are frequently used for large infrastructure projects like BESS, sharing risks and rewards amongst participants.

-

Equity Investment: Private equity firms and other investors may provide equity financing in exchange for a stake in the project, offering a combination of capital and expertise.

Bullet Points:

- Illustrative examples of financial structures: Debt-to-equity ratios, mezzanine financing, limited partnerships.

- Potential investors: Infrastructure funds, private equity firms specialized in renewable energy.

Keywords: BESS project finance, private equity for energy storage, bank loans for BESS projects.

Structuring the Financing Deal: Key Considerations

Structuring a successful financing deal for your 270MWh BESS project requires careful consideration of various factors:

-

Risk Mitigation Strategies: Implementing robust risk mitigation strategies is crucial. This might include insurance policies covering specific risks, such as equipment failure, power outages, or regulatory changes.

-

Power Purchase Agreements (PPAs): Securing long-term PPAs or other revenue streams is critical for demonstrating the project's financial viability to lenders and investors. PPAs guarantee a predictable revenue stream, reducing the financial risk for investors.

-

Due Diligence and Negotiation: A thorough due diligence process is necessary to assess the project's technical, environmental, and financial feasibility. Negotiating favorable terms with lenders and investors is also critical.

Bullet Points:

- Risk assessment methodologies: Using quantitative and qualitative methods to identify and assess project risks.

- Types of insurance: Property insurance, liability insurance, operational interruption insurance.

- PPA structuring considerations: Price, volume, duration, and indexation mechanisms.

Keywords: BESS risk management, power purchase agreements Belgium, BESS project due diligence.

Navigating Regulatory and Permitting Processes in Belgium

Navigating the regulatory and permitting processes in Belgium is vital for a successful BESS project. This requires careful planning and adherence to the established regulations:

-

Regulatory Framework: Understanding the Belgian regulatory framework for BESS installations is paramount. This includes relevant legislation pertaining to grid connection, environmental impact assessments, and safety standards.

-

Permitting Process: The permitting process involves obtaining necessary approvals from various authorities, which may include regional environmental agencies, grid operators, and local planning authorities.

-

Environmental Impact Assessments: Depending on the project's scale and location, an environmental impact assessment (EIA) may be required to assess the potential environmental effects of the BESS installation. Grid connection studies and approvals are also necessary.

Bullet Points:

- Relevant Belgian regulations: Consult relevant federal and regional regulations related to energy storage.

- Permitting authorities: Identify the responsible authorities for issuing the necessary permits.

- Timeline estimations: Develop a realistic timeline for the permitting process.

Keywords: BESS regulations Belgium, grid connection for BESS, environmental permits for BESS.

Conclusion: Securing Funding for Your 270MWh BESS Project in Belgium

Securing funding for a 270MWh BESS project in Belgium involves a comprehensive approach encompassing a deep understanding of Belgian renewable energy policies, exploration of diverse funding sources (both public and private), and careful navigation of the regulatory landscape. This requires a robust business plan, a well-structured financial model, and effective risk management. By effectively leveraging the available incentives, navigating the permitting process efficiently, and presenting a compelling investment opportunity, you can significantly enhance your chances of securing the necessary funding. The long-term benefits and potential returns on investment for BESS projects in Belgium are substantial, given the growing importance of energy storage in the country's energy transition. Start planning your 270MWh BESS project financing strategy today by researching the available resources and contacting the relevant funding organizations. Keywords: BESS financing Belgium, 270MWh BESS investment, secure BESS funding.

Featured Posts

-

England Womens World Cup Final Preview Spain Match Prediction And Potential Lineups

May 03, 2025

England Womens World Cup Final Preview Spain Match Prediction And Potential Lineups

May 03, 2025 -

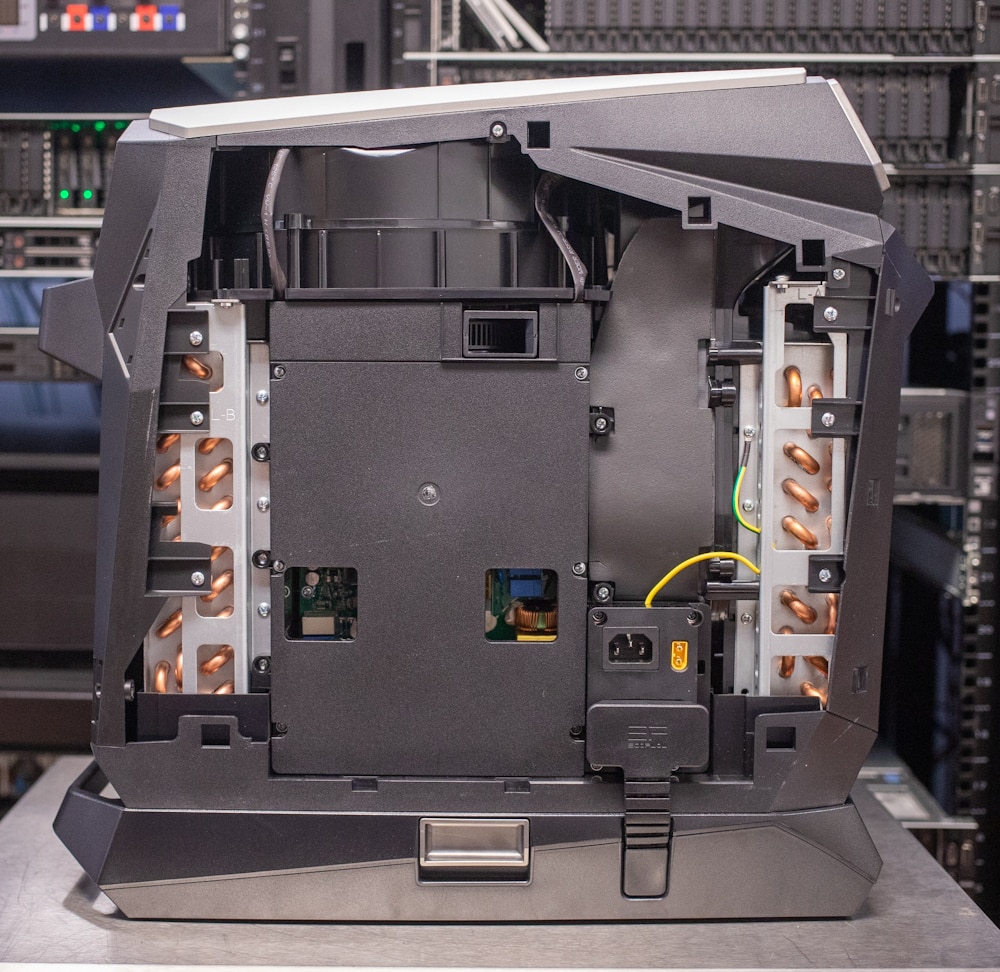

Eco Flow Wave 3 Review Strengths Weaknesses And Verdict

May 03, 2025

Eco Flow Wave 3 Review Strengths Weaknesses And Verdict

May 03, 2025 -

Could A Smart Ring Prove Your Faithfulness

May 03, 2025

Could A Smart Ring Prove Your Faithfulness

May 03, 2025 -

Pm Modis France Visit Key Highlights Ai Summit And Business Engagement

May 03, 2025

Pm Modis France Visit Key Highlights Ai Summit And Business Engagement

May 03, 2025 -

Is A Place In The Sun Right For You Assessing Your Overseas Property Needs

May 03, 2025

Is A Place In The Sun Right For You Assessing Your Overseas Property Needs

May 03, 2025