A Place In The Sun: Navigating The Overseas Property Market

Table of Contents

Researching Your Ideal Overseas Property Location

Before you even start browsing online property portals, you need a clear vision of what you’re looking for. This involves careful consideration of your needs and a thorough market analysis.

Defining Your Needs and Wants

Your search for the perfect overseas property begins with self-reflection. Consider these crucial aspects:

- Budget Considerations: Determine a realistic budget, encompassing not only the purchase price but also legal fees, taxes, renovation costs, and ongoing maintenance expenses. Explore various financing options, including international and local mortgages. Understanding your financial capabilities is paramount in the overseas property market.

- Lifestyle Preferences: What kind of lifestyle are you seeking? Do you prefer a bustling city center or a tranquil countryside retreat? Consider the climate, culture, proximity to amenities (schools, hospitals, transportation), and overall atmosphere.

- Investment Goals: Are you buying for personal use, as a rental investment, or a combination of both? Consider the rental income potential, capital appreciation prospects, and the long-term value of the property in the overseas property market.

Examples of Popular Overseas Property Locations:

- Spain (Costa Brava, Canary Islands)

- Portugal (Algarve, Lisbon)

- Italy (Tuscany, Amalfi Coast)

- Greece (Crete, Mykonos)

- France (Provence, Côte d'Azur)

Thorough Market Research

Once you’ve defined your needs, it’s time for in-depth market research.

- Analyzing Property Prices and Trends: Research current property prices and historical trends in your chosen location. Identify any upward or downward trends to inform your investment strategy. Websites specializing in international real estate can provide valuable data.

- Understanding Local Regulations and Legal Requirements: Familiarize yourself with the legal framework governing property ownership in your chosen country. This includes building permits, planning regulations, and tax laws.

- Investigating the Local Economy and its Stability: A stable local economy is crucial for long-term investment success. Research the economic outlook, job market, and tourism sector in your chosen location.

Resources for Property Market Research:

- Online real estate portals (e.g., Rightmove, Zoopla, international equivalents)

- Local real estate agents

- Government websites and statistical agencies

Securing Financing for Your Overseas Property Purchase

Securing the necessary financing is a critical step in the overseas property buying process.

Exploring Financing Options

Several options exist for financing your overseas property purchase:

- Mortgages from International Banks: Many international banks offer mortgages for overseas properties, offering competitive interest rates and flexible repayment terms.

- Mortgages from Local Banks: Local banks in your chosen country might provide more favorable terms and a deeper understanding of the local market.

- Cash Purchases: If you have the funds available, a cash purchase can streamline the process and potentially lead to better negotiating power.

Factors Influencing Mortgage Approval:

- Credit score

- Down payment

- Loan-to-value ratio (LTV)

- Proof of income and employment

Understanding Currency Exchange Rates

Fluctuations in currency exchange rates can significantly impact your purchase price.

- The Impact of Fluctuating Exchange Rates: Exchange rate movements can either increase or decrease the cost of your property in your home currency.

- Strategies for Mitigating Currency Risk: Consider using currency hedging strategies to protect yourself against unfavorable exchange rate movements.

- Resources for Tracking Currency Exchange Rates: Stay updated on exchange rates through reputable financial websites and currency conversion tools.

Working with Local Professionals in the Overseas Property Market

Enlisting the help of experienced local professionals is crucial for a smooth and successful transaction.

Finding a Reputable Real Estate Agent

A local, licensed real estate agent is invaluable in the overseas property market.

- Importance of Using a Local, Licensed Agent: A local agent possesses in-depth knowledge of the local market, legal requirements, and cultural nuances.

- Questions to Ask Potential Agents: Ask about their experience, client testimonials, and their understanding of the specific area you're interested in.

- Red Flags to Watch Out For: Be wary of agents who pressure you into a quick decision or those who seem overly evasive.

Legal and Tax Advice

Seek independent legal and tax advice throughout the process.

- Engaging a Solicitor or Lawyer: Engage a solicitor or lawyer specializing in international property law to review contracts, ensure legal compliance, and protect your interests.

- Understanding Local Property Taxes and Other Legal Obligations: Understand the tax implications of property ownership in your chosen country.

- The Importance of Legal Due Diligence: Thorough legal due diligence is essential to avoid potential pitfalls and protect your investment.

Due Diligence and Legal Processes in the Overseas Property Market

Thorough due diligence is paramount to avoid costly mistakes and ensure a secure purchase.

Property Inspections and Surveys

Before committing to a purchase, conduct a thorough inspection.

- Thorough Inspection of the Property: Identify any potential structural issues, maintenance needs, or hidden problems.

- Importance of Independent Surveys: An independent surveyor can provide an objective assessment of the property's condition.

- Checklists for Property Inspections: Create a comprehensive checklist to ensure all aspects of the property are carefully examined.

Understanding the Purchase Agreement

Carefully review all legal documentation before signing.

- Careful Review of All Contracts and Legal Documents: Do not sign any documents until you fully understand their implications.

- Seeking Independent Legal Advice: Have your lawyer review all contracts and documents before you sign them.

- Key Clauses to Look Out For: Pay close attention to clauses related to payment terms, completion dates, and responsibilities.

Conclusion: Making Your Dream of Overseas Property a Reality

Buying overseas property involves several key steps: thorough research, securing financing, engaging local professionals, and meticulous due diligence. However, the rewards—a stunning property, a rewarding investment, or a dream lifestyle—make the effort worthwhile. Begin your journey towards owning your "place in the sun" by starting your overseas property search today. Explore the exciting world of the overseas property market and find your perfect investment. Remember to always seek expert advice and conduct thorough due diligence throughout the process.

Featured Posts

-

Palisades Fire A Comprehensive List Of Celebrities Who Lost Homes

May 03, 2025

Palisades Fire A Comprehensive List Of Celebrities Who Lost Homes

May 03, 2025 -

Tulsa Winter Weather Report Data Driven Insights

May 03, 2025

Tulsa Winter Weather Report Data Driven Insights

May 03, 2025 -

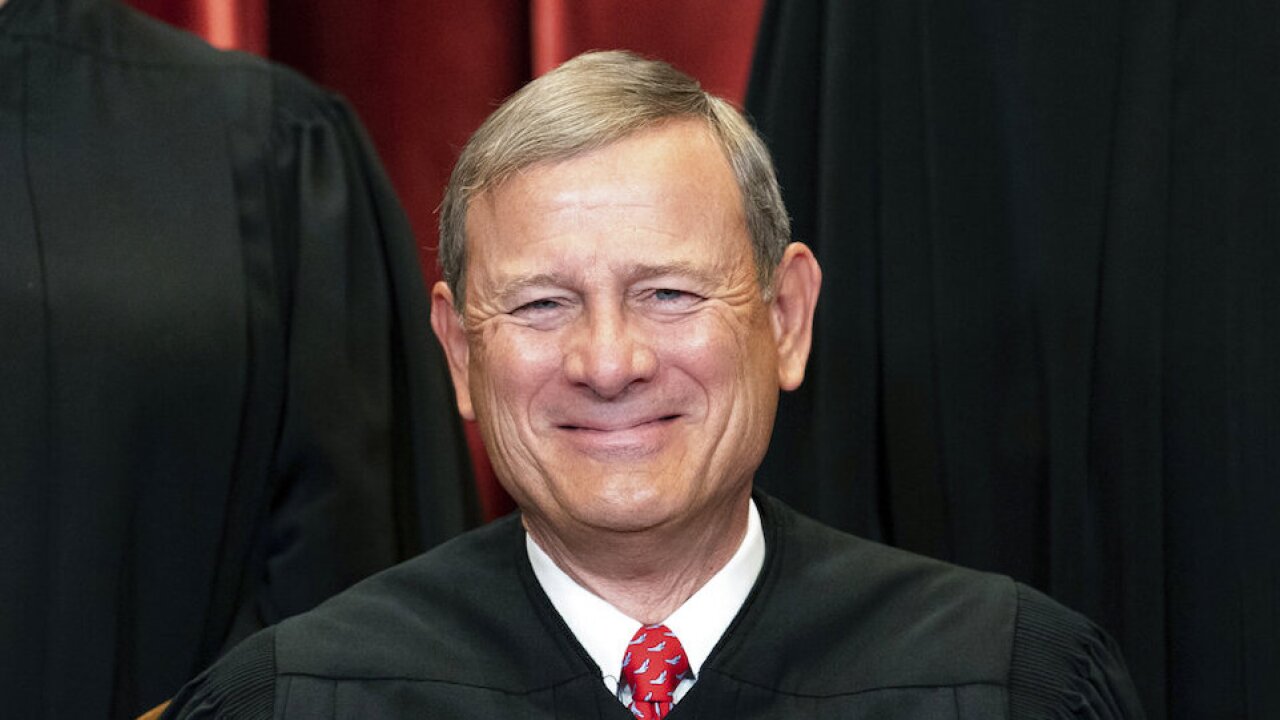

Chief Justice Roberts Three Cases Chipping Away At Church State Separation

May 03, 2025

Chief Justice Roberts Three Cases Chipping Away At Church State Separation

May 03, 2025 -

Graeme Sounesss Double Channel Swim Inspired By Islas Fight

May 03, 2025

Graeme Sounesss Double Channel Swim Inspired By Islas Fight

May 03, 2025 -

The Reform Uk Farming Policy A Detailed Examination

May 03, 2025

The Reform Uk Farming Policy A Detailed Examination

May 03, 2025