AAPL Stock: Analysis Of Upcoming Price Levels

Table of Contents

AAPL Financial Performance & Valuation

Analyzing AAPL's financial health is crucial for predicting future AAPL stock price levels. We'll examine revenue growth, earnings, and key valuation metrics to understand the company's intrinsic value.

Revenue & Earnings Growth

Apple's revenue streams are diverse, contributing to its resilience.

- iPhone: Remains the primary revenue driver, though growth rates may fluctuate based on product cycles.

- Services: A consistently growing segment, fueled by subscriptions to Apple Music, iCloud, and the App Store.

- Mac: Shows strong performance, benefiting from the increasing demand for high-performance computing.

- Wearables, Home, and Accessories: This segment continues to expand, driven by the popularity of Apple Watch and AirPods.

Comparing year-over-year growth rates to industry benchmarks reveals Apple's performance relative to competitors. While past performance doesn't guarantee future results, consistent growth indicates a healthy financial foundation for AAPL. However, potential risks, such as supply chain disruptions or economic downturns, could impact future earnings.

Price-to-Earnings Ratio (P/E) and Other Key Metrics

Valuation metrics provide insights into whether AAPL is overvalued or undervalued.

- P/E Ratio: Comparing AAPL's current P/E ratio to its historical average and competitors helps determine if it's trading at a premium or discount. A high P/E ratio can suggest investor optimism about future growth, while a low ratio may indicate undervaluation.

- PEG Ratio: This metric considers both the P/E ratio and the company's growth rate, providing a more comprehensive valuation picture.

- Price-to-Sales Ratio: This ratio assesses the company's valuation relative to its revenue, offering an alternative perspective to the P/E ratio.

Analyzing these metrics together offers a more nuanced understanding of AAPL's valuation and potential impact on future AAPL stock price levels.

Market Trends and Macroeconomic Factors

External factors significantly influence AAPL stock price levels. Understanding market sentiment and macroeconomic conditions is vital.

Overall Market Sentiment

The overall health of the stock market plays a considerable role.

- Market Indices: The performance of major indices like the S&P 500 and NASDAQ significantly influences investor confidence and overall market sentiment.

- Interest Rates and Inflation: Rising interest rates and inflation can negatively impact tech stocks, including AAPL, by increasing borrowing costs and reducing consumer spending.

- Investor Sentiment: Positive investor sentiment towards the tech sector generally benefits AAPL, while negative sentiment can lead to price declines.

Industry Competition and Technological Disruptions

AAPL faces competition and potential disruptions.

- Key Competitors: Samsung and Google pose significant competition in various markets, impacting AAPL's market share and growth potential.

- Technological Disruptions: The emergence of new technologies like AR/VR and AI presents both opportunities and threats, impacting AAPL’s future innovation and market dominance.

- Competitive Advantages: AAPL’s strong brand, loyal customer base, and innovative ecosystem provide competitive advantages, but maintaining these advantages requires continuous investment in R&D.

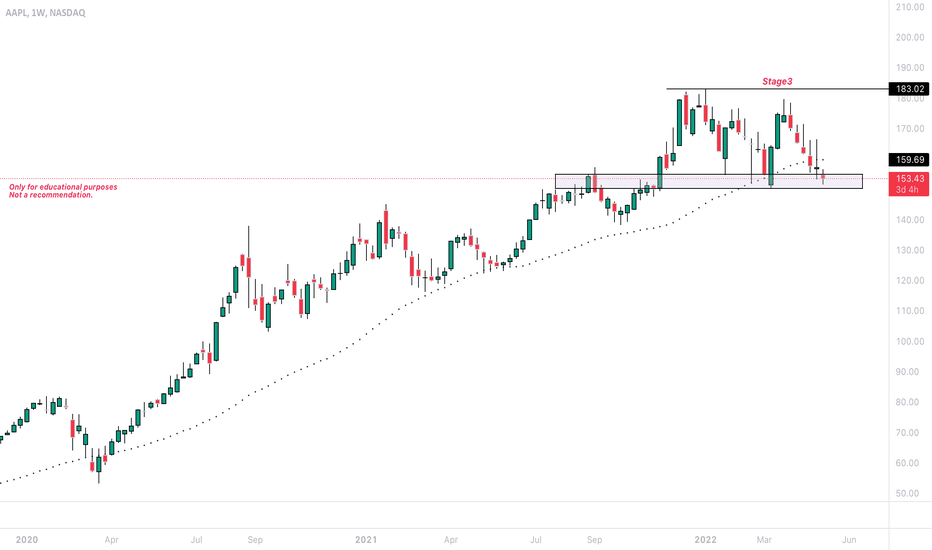

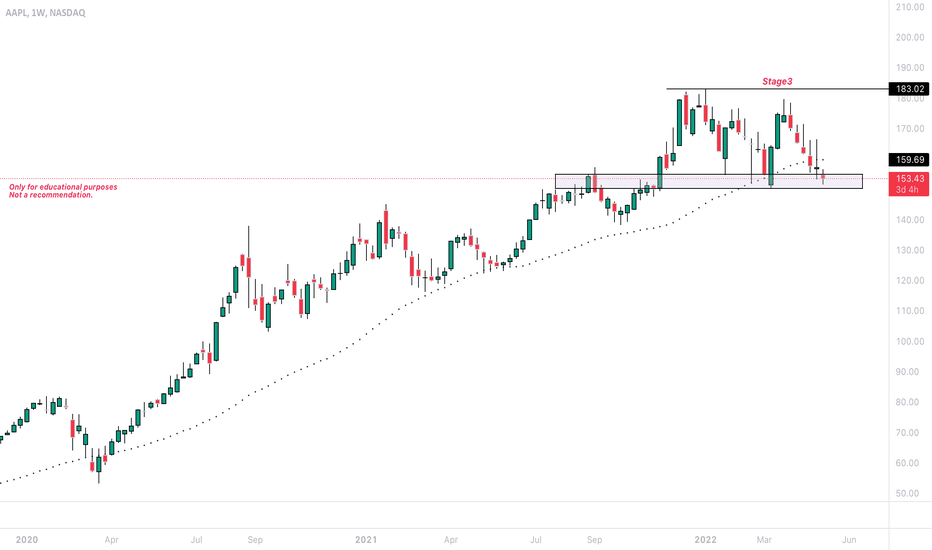

Technical Analysis of AAPL Stock Chart

Technical analysis provides insights into potential future price movements based on chart patterns and indicators.

Support and Resistance Levels

Identifying support and resistance levels is key to predicting AAPL stock price levels.

- Chart Interpretation: Support levels represent price points where buying pressure is strong, while resistance levels indicate where selling pressure is significant.

- Breakouts: Breakouts above resistance levels often signal bullish momentum, while breakdowns below support can indicate bearish trends.

- Technical Indicators: Moving averages and RSI are valuable tools for confirming trends and identifying potential reversals.

Trend Analysis and Chart Patterns

Analyzing trends and patterns helps predict the likely price trajectory.

- Uptrend, Downtrend, Sideways: Identifying the current trend is fundamental.

- Chart Patterns: Recognizing patterns like head and shoulders or double bottoms can provide clues about potential future price movements. For example, a double bottom pattern might suggest a potential upward reversal.

- Implications: Understanding these patterns helps anticipate potential support and resistance levels, giving insights into possible AAPL stock price levels.

Conclusion: Forecasting Future AAPL Stock Price Levels and Investment Strategy

Our analysis suggests that AAPL's strong financial performance, coupled with its innovative capabilities, positions it for continued growth. However, macroeconomic factors and industry competition could impact its trajectory. Based on our financial, market, and technical analysis, a potential price range for AAPL in the short-term might be between [Insert realistic range], while the long-term trajectory depends heavily on continued innovation and market conditions. Remember, this is an analysis and not financial advice. Monitor AAPL stock price levels closely, conduct your own thorough research, and consider your personal risk tolerance before making investment decisions. Stay informed about future AAPL stock price movements to make the best choices for your portfolio.

Featured Posts

-

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 24, 2025

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 24, 2025 -

Airplane Safety Data Visualizing The Risks Of Flying

May 24, 2025

Airplane Safety Data Visualizing The Risks Of Flying

May 24, 2025 -

Paris Economic Slowdown Analysis Of The Luxury Goods Sectors Role March 7 2025

May 24, 2025

Paris Economic Slowdown Analysis Of The Luxury Goods Sectors Role March 7 2025

May 24, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Les Dernieres Innovations

May 24, 2025

Amsterdam Accueille Le Ces Unveiled Europe Les Dernieres Innovations

May 24, 2025 -

Significant Drop In Amsterdam Stock Exchange Aex Index Down 4

May 24, 2025

Significant Drop In Amsterdam Stock Exchange Aex Index Down 4

May 24, 2025