ABN Amro: Dutch Central Bank Investigates Bonus Practices

Table of Contents

The Scope of the DNB Investigation

The DNB investigation into ABN Amro's bonus structure is a significant development with potential ramifications for the bank and the broader financial sector in the Netherlands. The specifics of the investigation remain partially undisclosed, but it's understood that the DNB is scrutinizing various aspects of ABN Amro's compensation system. This includes not only the overall payout amounts but also the methodology used to calculate bonuses and the alignment of these payouts with long-term sustainable performance goals. The regulatory compliance of the bonus system is a central focus of the investigation.

- The investigation focuses on potential breaches of regulatory guidelines regarding responsible remuneration practices. This relates to the European Union's and Dutch national regulations aiming to prevent excessive risk-taking incentivized by bonus structures.

- Specific concerns may include the alignment of bonuses with long-term sustainable performance goals. The DNB is likely examining whether the short-term focus of bonus structures might outweigh considerations for long-term stability and responsible banking practices.

- The DNB is likely examining whether the bonus system encourages excessive risk-taking. This is a crucial aspect, as bonuses tied to short-term gains can incentivize risky behavior that might jeopardize the bank's financial health.

- The timeline of the investigation and the potential consequences are yet to be determined. However, the investigation signals a serious concern from the DNB regarding ABN Amro's bonus practices and their compliance with existing financial regulations. The potential for financial penalties is significant.

Potential Implications for ABN Amro

If irregularities are found during the DNB investigation, ABN Amro faces significant consequences. These implications extend far beyond potential financial penalties, impacting the bank's reputation and its relationship with stakeholders.

- Financial penalties could include significant fines. The severity of any fines will depend on the nature and extent of any violations discovered.

- Reputational damage could lead to loss of customers and difficulty attracting talent. A negative association with non-compliance can severely damage the bank's public image, leading to decreased customer confidence and difficulty attracting and retaining skilled employees.

- Shareholder confidence could plummet, impacting the bank's stock price. Negative news related to regulatory investigations often leads to decreased investor confidence and a subsequent drop in stock value.

- The investigation may lead to changes in ABN Amro's bonus structure and internal governance. Even if no significant violations are found, the investigation may push ABN Amro to reform its bonus system to better align with regulatory expectations and best practices.

Wider Implications for the Dutch Banking Sector

The DNB's investigation of ABN Amro's bonus practices has wider implications for the Dutch banking sector. It signals a potential shift toward stricter oversight and reform within the industry.

- The investigation could trigger a review of bonus practices across other Dutch banks. This domino effect could lead to a widespread reassessment of compensation models and risk management strategies within the Netherlands’ financial institutions.

- It could lead to tighter regulatory oversight of executive compensation. The DNB might introduce more stringent regulations concerning bonus structures, aiming to prevent excessive risk-taking and promote more responsible banking.

- This might result in changes to Dutch banking regulations related to bonuses and risk management. New legislation or revised guidelines could emerge from this investigation, impacting all financial institutions operating within the Netherlands.

- The overall goal is likely to promote financial stability and prevent excessive risk-taking. This investigation is a part of a broader effort by regulatory bodies to enhance the stability and resilience of the financial system.

Comparison to International Practices

The ABN Amro situation needs to be viewed within the context of international banking regulations and global bonus practices. While the specific details of Dutch regulations regarding executive compensation differ, the underlying principles align with international standards like those found in the Basel Accords and European Union banking directives. Many countries are grappling with similar issues of ensuring that bonus structures do not encourage excessive risk-taking. Comparing the specifics of Dutch regulations to those in other jurisdictions – such as the UK, the US, or other EU member states – will provide valuable insights into the effectiveness and stringency of different approaches to regulating executive compensation in the financial sector.

Conclusion

The Dutch Central Bank's investigation into ABN Amro's bonus practices underscores the persistent scrutiny of executive compensation within the global financial sector. The potential repercussions for ABN Amro are substantial, encompassing hefty financial penalties and significant reputational harm. Moreover, the investigation could propel broader reforms within the Dutch banking sector and contribute to the ongoing international dialogue concerning responsible executive remuneration. Stay informed about the developments in the ABN Amro bonus investigation and the implications for the Dutch banking sector. Regularly check back for updates on this crucial development in Dutch financial regulations and the future of ABN Amro's bonus practices.

Featured Posts

-

79 Manazerov Uprednostnuje Osobne Stretnutia Buducnost Home Officu

May 21, 2025

79 Manazerov Uprednostnuje Osobne Stretnutia Buducnost Home Officu

May 21, 2025 -

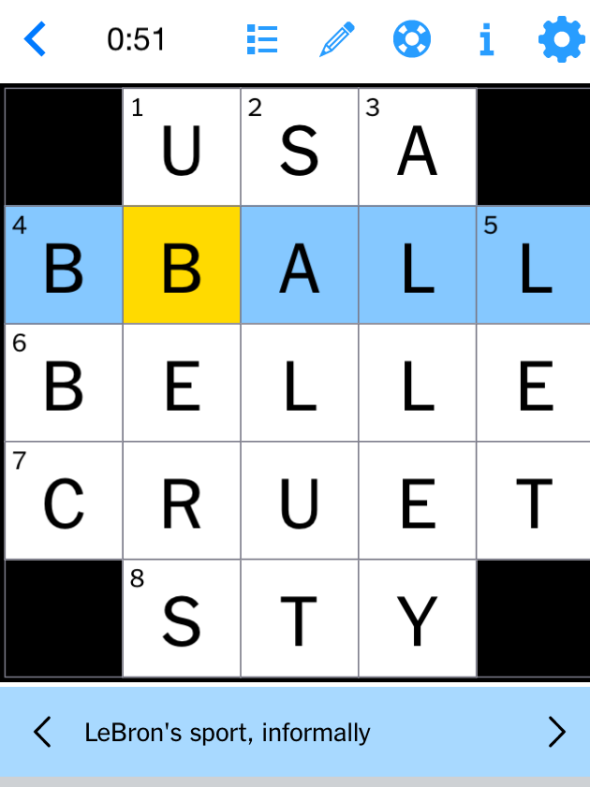

Complete Guide Nyt Mini Crossword Answers March 13 2025

May 21, 2025

Complete Guide Nyt Mini Crossword Answers March 13 2025

May 21, 2025 -

Real Madrid Ancelotti Den Sonra Yeni Teknik Direktoer Kim Olacak

May 21, 2025

Real Madrid Ancelotti Den Sonra Yeni Teknik Direktoer Kim Olacak

May 21, 2025 -

Abn Amro Voorspelt Stijging Huizenprijzen Rentedaling In Zicht

May 21, 2025

Abn Amro Voorspelt Stijging Huizenprijzen Rentedaling In Zicht

May 21, 2025 -

Benjamin Kaellman Potentiaali Ja Odotukset Huuhkajissa

May 21, 2025

Benjamin Kaellman Potentiaali Ja Odotukset Huuhkajissa

May 21, 2025