ABN Amro Facing Potential Fine Over Executive Bonuses

Table of Contents

The Allegations Against ABN Amro's Executive Bonus Scheme

The allegations against ABN Amro's executive bonus scheme center on claims that the bonuses paid were excessive, potentially violating both internal policies and external regulations. Critics argue that the risk management practices surrounding the bonus scheme were inadequate, leading to potentially inappropriate payouts. The core issue appears to be a disconnect between performance and reward.

- Specific details about the alleged violations: Reports suggest that the bonuses exceeded pre-determined regulatory limits, lacked sufficient transparency regarding their calculation methodology, and were awarded despite periods of poor financial performance or increased risk-taking by the bank.

- Relevant regulatory bodies involved: The Dutch Central Bank (De Nederlandsche Bank or DNB) and potentially the European Central Bank (ECB) are involved in the investigation, scrutinizing ABN Amro's practices against existing banking regulations concerning executive compensation.

- Official statements: While ABN Amro has yet to release a comprehensive public statement fully addressing the specifics of the allegations, initial responses have indicated cooperation with the regulatory bodies and a commitment to transparency. However, the lack of detailed information fuels ongoing speculation.

Potential Impact of the Fine on ABN Amro

The potential fine resulting from this controversy could significantly impact ABN Amro on multiple levels. The financial implications are substantial, potentially affecting profitability and shareholder confidence.

- Estimated amount of the potential fine: While the precise amount remains undisclosed, speculation within the financial press suggests a significant figure, potentially impacting ABN Amro's quarterly or annual earnings reports.

- Impact on shareholder value: A large fine could negatively affect shareholder value, leading to decreased share price and a loss of investor confidence. This impact extends beyond the immediate financial consequence of the fine itself.

- Potential effects on ABN Amro's credit rating: A significant fine could trigger a downgrade in ABN Amro's credit rating, increasing borrowing costs and potentially hindering future growth and investment opportunities.

- Damage to ABN Amro's brand image and customer trust: The negative publicity surrounding the controversy could erode public trust in ABN Amro, potentially impacting customer loyalty and attracting future business.

Wider Implications for the Banking Industry

The ABN Amro case has far-reaching implications for the banking industry and executive compensation practices across Europe and beyond. It may well set a precedent for future regulatory actions.

- Increased regulatory scrutiny of executive compensation: This case reinforces the trend of increasing regulatory scrutiny over executive pay packages within the financial sector. Expect more stringent rules and tighter enforcement to follow.

- Potential changes to banking regulations concerning bonuses: The outcome of this investigation may lead to changes in banking regulations regarding executive bonuses, perhaps introducing stricter limits or clearer guidelines to prevent future similar situations.

- Impact on executive compensation trends within the Dutch and European banking sectors: Other banks are likely to review their own bonus schemes in light of this controversy, potentially leading to a shift towards more performance-based and less lucrative bonus structures.

ABN Amro's Response and Future Actions

ABN Amro's official response so far has been largely reactive, focusing on cooperation with regulatory authorities and emphasizing a commitment to transparency. However, more proactive steps are expected.

- Statements released by ABN Amro executives: Initial statements have been carefully worded, emphasizing cooperation with the investigation but avoiding direct comment on the specifics of the allegations.

- Any internal investigations launched by the bank: It’s highly probable that ABN Amro has launched an internal investigation to determine the full extent of any wrongdoing and to implement corrective measures.

- Planned changes to the executive bonus scheme: We can expect significant changes to the executive bonus scheme. These may include stricter performance metrics, increased transparency, and potentially lower overall bonus payouts.

- Steps taken to improve risk management and transparency: To regain trust, ABN Amro will likely implement more robust risk management practices and improve transparency across all its financial operations.

Conclusion

The potential fine levied against ABN Amro underscores the critical importance of responsible executive compensation and robust risk management within the banking sector. This "ABN Amro executive bonuses fine" controversy highlights the urgent need for increased transparency and strict adherence to regulatory guidelines. The outcome of this case will undoubtedly influence future executive compensation practices, not only within ABN Amro but potentially across the wider financial industry.

Call to Action: Stay informed about the ongoing developments surrounding the ABN Amro executive bonuses fine and its impact on the banking sector. Follow reputable financial news sources for further analysis and insights into this important case. Search for "ABN Amro executive bonus scandal" or "ABN Amro regulatory fine" for more information.

Featured Posts

-

Abn Amro Investeert In Transferz Een Innovatief Digitaal Platform

May 21, 2025

Abn Amro Investeert In Transferz Een Innovatief Digitaal Platform

May 21, 2025 -

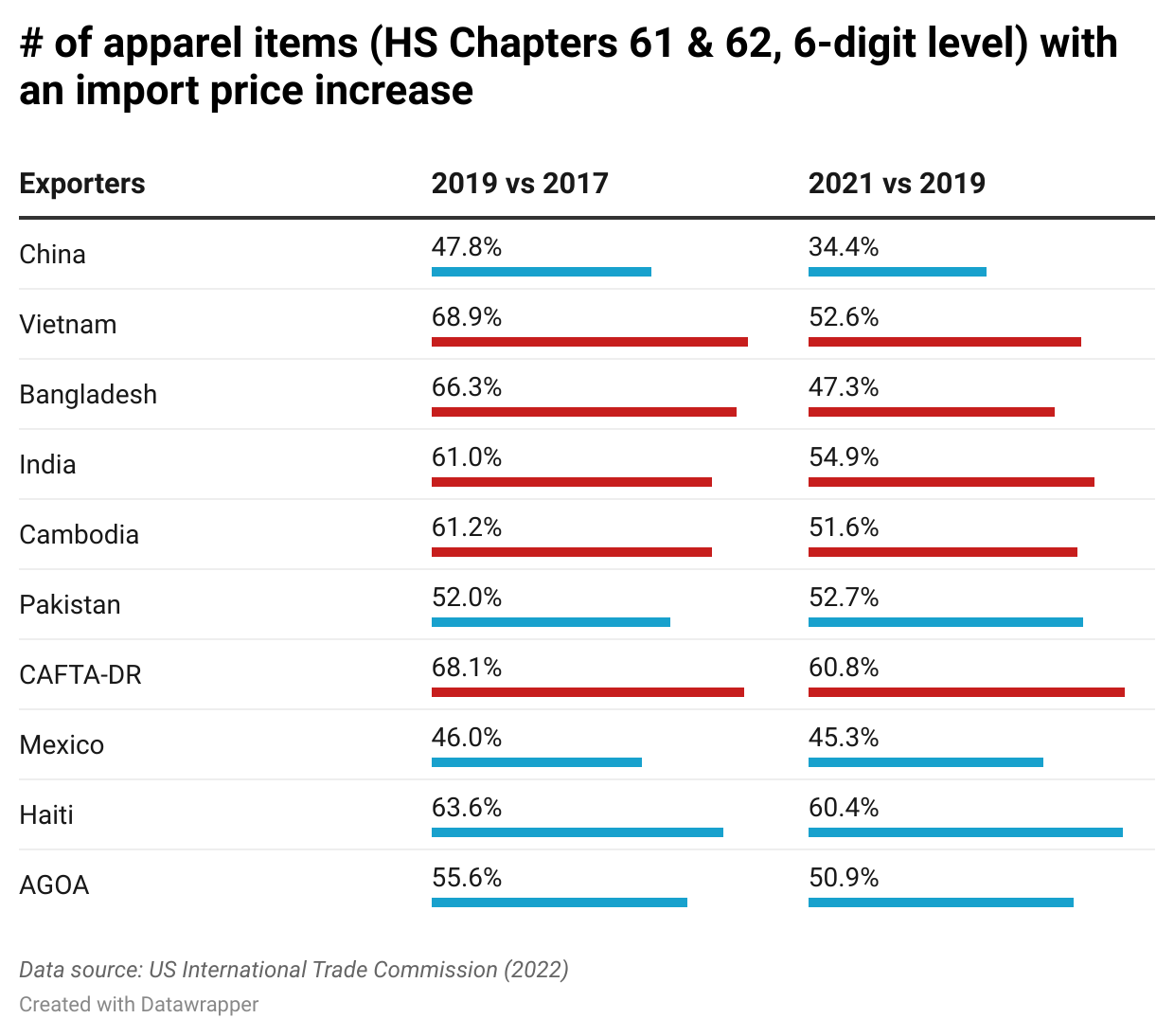

Abn Amro Impact Of Tariffs On Us Food Exports

May 21, 2025

Abn Amro Impact Of Tariffs On Us Food Exports

May 21, 2025 -

Nieuwe Directeur Hypotheken Bij Abn Amro Florius En Moneyou Welkom Karin Polman

May 21, 2025

Nieuwe Directeur Hypotheken Bij Abn Amro Florius En Moneyou Welkom Karin Polman

May 21, 2025 -

Female Pub Landlords Foul Mouthed Tirade After Employee Resignation

May 21, 2025

Female Pub Landlords Foul Mouthed Tirade After Employee Resignation

May 21, 2025 -

Bayern Munichs Bundesliga Celebrations Postponed Leverkusens Victory And Kanes Absence

May 21, 2025

Bayern Munichs Bundesliga Celebrations Postponed Leverkusens Victory And Kanes Absence

May 21, 2025