ABN Amro's Bonus Scheme Under Investigation By Dutch Regulator: Risk Of Penalty

Table of Contents

Details of the ABN Amro Bonus Scheme Investigation

De Nederlandsche Bank (DNB) launched an investigation into ABN Amro's bonus scheme, focusing on potential inconsistencies with Dutch banking regulations and sound risk management practices. The investigation centers on several key aspects of the bonus structure, including the overall size of bonuses paid, the criteria used to determine bonus eligibility, and the alignment of the scheme with the bank's overall risk management strategy. The DNB's concern appears to be that the bonus structure may have incentivized excessive risk-taking, potentially jeopardizing the financial stability of the bank.

- Timeline of the investigation: The investigation commenced in [Insert Start Date if available], with ongoing assessments and data collection.

- Specific concerns raised by DNB: The DNB has expressed concerns about the lack of transparency in the bonus allocation process, insufficient consideration of the social impact of excessive risk-taking, and a potential disconnect between bonus payouts and long-term sustainable performance. They are also reportedly reviewing whether the bonuses adequately reflected the actual risks undertaken.

- Statements from ABN Amro regarding the investigation: ABN Amro has publicly stated its commitment to cooperating fully with the DNB investigation and to upholding the highest standards of ethical conduct and regulatory compliance. [Insert any specific statements released by ABN Amro if available].

- Preliminary findings or conclusions released by DNB: At this time, the DNB has not publicly released any preliminary findings or conclusions regarding the investigation. However, the seriousness of the investigation suggests potential violations of Dutch banking regulations.

Potential Penalties Facing ABN Amro

If found non-compliant with Dutch banking regulations governing executive compensation and risk management, ABN Amro faces a range of potential penalties. These could significantly impact the bank's financial standing and reputation.

- Financial penalties (fines): The DNB has the authority to impose substantial financial penalties, the amount of which would depend on the severity of the non-compliance. These fines could run into millions, even billions, of euros.

- Reputational damage and loss of investor confidence: A finding of non-compliance could severely damage ABN Amro's reputation, potentially leading to a loss of investor confidence and a negative impact on its share price.

- Changes to compensation structures mandated by DNB: The DNB may mandate significant changes to ABN Amro's bonus scheme, forcing the bank to restructure its compensation practices to align with regulatory requirements and sound risk management principles.

- Potential impact on executive compensation: High-level executives may face clawback of previously awarded bonuses if found to be linked to activities deemed non-compliant with regulatory expectations.

- Possibility of legal action from employees or shareholders: Depending on the outcome of the investigation, there is a possibility of legal action from employees who feel unfairly treated or from shareholders who suffered financial losses due to the bank's actions.

Wider Implications for the Banking Sector in the Netherlands

The ABN Amro bonus scheme investigation has significant implications for the entire Dutch banking sector. It signals a heightened focus on regulatory oversight of compensation practices and a stricter approach to ensuring ethical and responsible banking.

- Impact on future bonus structures in Dutch banks: Other Dutch banks are likely to review their own bonus schemes in light of this investigation, proactively adjusting their structures to minimize potential risks of non-compliance.

- Increased pressure on banks to demonstrate responsible compensation practices: This investigation highlights the growing pressure on banks to demonstrate that their compensation structures align with responsible risk management practices and promote long-term sustainable growth.

- Potential for changes in banking regulations related to bonuses: The DNB's actions might lead to further changes in Dutch banking regulations concerning bonuses, potentially introducing stricter guidelines and greater transparency requirements.

- Increased focus on aligning bonuses with long-term sustainability and risk management: The investigation underscores the increasing importance of aligning compensation structures with long-term sustainability goals and robust risk management frameworks.

Comparison with Other Recent Banking Bonus Scandals

While specifics differ, the ABN Amro case echoes similar concerns seen in other banking bonus scandals globally. The consistent theme is a need for stronger regulatory oversight and a greater emphasis on aligning compensation structures with responsible risk management and sustainable business practices.

Conclusion

The ABN Amro bonus scheme investigation by the DNB highlights the growing scrutiny of banking compensation practices and the potential for severe penalties for non-compliance. The investigation's outcome will likely influence future bonus structures not only at ABN Amro but across the Dutch banking sector, leading to increased transparency and a stronger focus on responsible risk management. The DNB's concerns regarding excessive risk-taking, lack of transparency, and insufficient consideration of social impact underscore the need for a fundamental shift in how banking bonuses are structured and awarded.

Stay informed about the ongoing developments in the ABN Amro bonus scheme investigation. Continue to follow this critical issue as the Dutch regulator's findings could set a precedent for future bonus structures within the banking industry. Search for updates on the "ABN Amro bonus scheme investigation" and related keywords to stay abreast of the latest developments.

Featured Posts

-

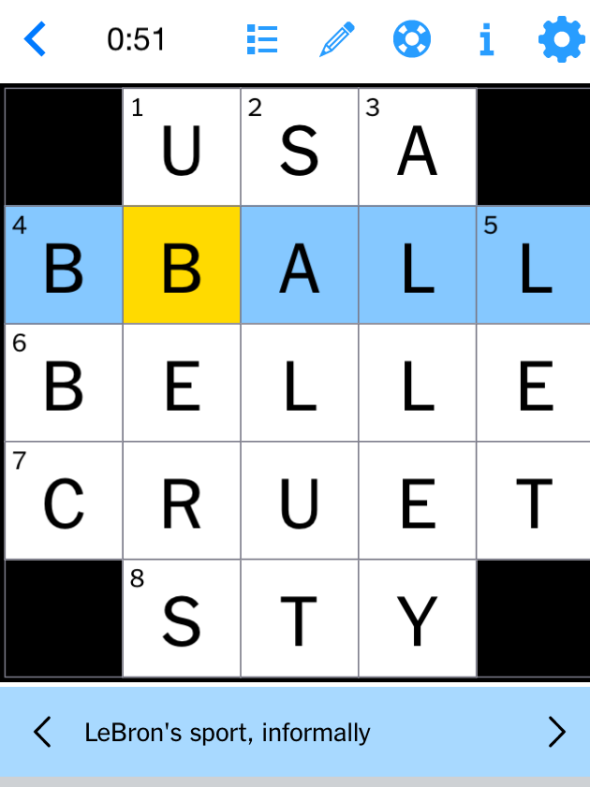

Nyt Mini Crossword Puzzle Solutions April 26 2025 Hints

May 21, 2025

Nyt Mini Crossword Puzzle Solutions April 26 2025 Hints

May 21, 2025 -

Significant Drop In Bp Chief Executives Salary Down 31

May 21, 2025

Significant Drop In Bp Chief Executives Salary Down 31

May 21, 2025 -

Southern French Alps Experience Unexpected Late Season Snow

May 21, 2025

Southern French Alps Experience Unexpected Late Season Snow

May 21, 2025 -

March 24 2025 Nyt Mini Crossword Complete Solutions And Hints

May 21, 2025

March 24 2025 Nyt Mini Crossword Complete Solutions And Hints

May 21, 2025 -

Trans Australia Run The Pursuit Of A New World Record

May 21, 2025

Trans Australia Run The Pursuit Of A New World Record

May 21, 2025