ABN Amro's Bonus System: Investigation And Potential Penalties

Table of Contents

The Nature of the Investigation

The investigation into ABN Amro's bonus system centers around alleged violations of regulations and internal policies concerning the awarding of employee bonuses. While specific details remain partially undisclosed pending the investigation's conclusion, allegations suggest irregularities in the design and implementation of the bonus structure, potentially leading to excessive risk-taking and non-compliance with regulations aimed at curbing excessive executive compensation and promoting responsible risk management within the Dutch banking sector.

The investigation is primarily being led by the Autoriteit Financiële Markten (AFM), the Dutch Authority for the Financial Markets, with potential involvement from De Nederlandsche Bank (DNB), the Dutch central bank, and even the European Central Bank (ECB), given the potential cross-border implications of any misconduct. Public statements from ABN Amro have been limited, primarily acknowledging the ongoing investigation and expressing cooperation with the regulatory bodies.

- Specific Allegations: The exact nature of the alleged violations remains largely confidential. However, reports suggest concerns about bonuses potentially being awarded without adequate consideration of risk management implications or proper alignment with the bank's overall strategic objectives.

- Regulatory Bodies Involved: The AFM is leading the investigation, with the DNB and potentially the ECB playing supporting roles depending on the scope of the alleged violations and their potential impact on the wider European financial system.

- Timeline of Events: The investigation began [Insert Start Date if known, otherwise use phrasing like "in recent months" or "following an internal whistleblower report"]. The timeline is still unfolding, with ongoing data collection and analysis by the regulatory bodies.

Potential Penalties Facing ABN Amro

The potential penalties facing ABN Amro are substantial and multifaceted. The consequences extend far beyond simple financial fines, impacting the bank's reputation, share price, and overall stability.

- Financial Penalties: Potential financial penalties could range from tens of millions to potentially billions of Euros, depending on the severity of the alleged violations and the findings of the investigation. The size of any fine will be influenced by factors like the extent of the misconduct, the bank's level of cooperation, and the impact on the financial system.

- Reputational Damage: Even without substantial fines, the reputational damage could be significant. A tarnished reputation can erode customer trust, making it harder to attract and retain clients, ultimately impacting profitability and long-term growth. This reputational harm extends beyond individual customers to impact relationships with institutional investors and other financial partners.

- Share Price Impact: The investigation and potential penalties are likely to negatively impact ABN Amro's share price. Investor confidence can be shaken by news of regulatory scrutiny and potential misconduct, leading to a sell-off and decreased market valuation.

- Executive Consequences: Executives involved in the design and implementation of the bonus scheme could face individual penalties, including dismissals, legal action, and reputational damage to their careers within the financial services industry.

ABN Amro's Response and Risk Management

ABN Amro has publicly stated its commitment to cooperating fully with the regulatory investigation. The bank has initiated internal reviews to assess its bonus system and risk management frameworks. These reviews aim to identify any weaknesses or failures and to implement necessary corrective measures. However, the effectiveness of these actions remains to be seen and will be subject to scrutiny by the regulatory bodies.

- Official Statement: ABN Amro's official statement emphasizes cooperation and a commitment to improving its compliance measures and risk management practices.

- Internal Reviews: The bank has reportedly conducted internal audits to fully understand the scope of the alleged violations and to identify any systemic issues within its bonus system and risk management processes.

- Changes to the Bonus System: Expected changes to the bonus system likely include stricter guidelines for bonus awards, increased oversight, and greater alignment with overall risk management objectives. These changes aim to ensure future bonus structures are aligned with responsible banking practices and comply with relevant regulations.

- Adequacy of Risk Management: The investigation highlights potential deficiencies in ABN Amro's risk management framework. The effectiveness of the implemented changes will be critical in preventing similar issues from recurring in the future and will form a key part of the regulatory assessment.

Conclusion

The investigation into ABN Amro's bonus system reveals serious concerns about potential regulatory violations and significant risk management failures. The potential penalties, including substantial financial fines and reputational damage, underscore the gravity of the allegations. ABN Amro's response, while emphasizing cooperation and internal review, will be judged by the effectiveness of its actions in rectifying the identified issues and preventing future recurrence. The outcome of this investigation will have significant implications for ABN Amro, its employees, and the broader Dutch and European financial landscape. Stay informed about the ongoing investigation into the ABN Amro bonus system; further developments and the final outcome will have significant implications. Continue to follow reputable news sources for updates on the ABN Amro bonus system investigation and its consequences.

Featured Posts

-

Les Cordistes Acteurs Cles De La Construction Des Tours Nantaises

May 21, 2025

Les Cordistes Acteurs Cles De La Construction Des Tours Nantaises

May 21, 2025 -

Teletoon S Spring Lineup Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025

Teletoon S Spring Lineup Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025 -

Apples Llm Siri A Comeback Strategy

May 21, 2025

Apples Llm Siri A Comeback Strategy

May 21, 2025 -

Fox News Faces Defamation Suit From Ray Epps Over Jan 6th Coverage

May 21, 2025

Fox News Faces Defamation Suit From Ray Epps Over Jan 6th Coverage

May 21, 2025 -

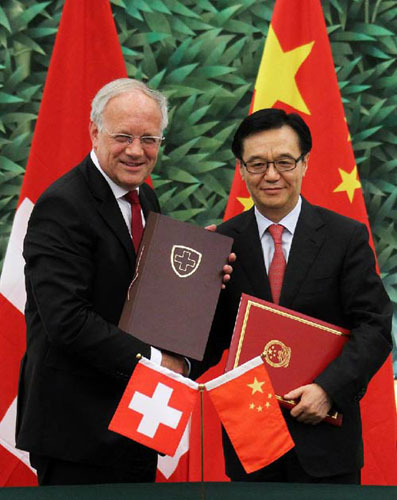

Switzerland And China Advocate For Tariff Dialogue

May 21, 2025

Switzerland And China Advocate For Tariff Dialogue

May 21, 2025