Accelerating Digital Transformation At Deutsche Bank: An IBM Success Story

Table of Contents

The Challenges Facing Deutsche Bank Before Transformation

Before its transformation, Deutsche Bank faced numerous hurdles common to large financial institutions. Outdated infrastructure and legacy systems created inefficiencies, hindering agility and scalability. The bank needed to modernize its technology stack to compete effectively and deliver superior customer experiences. These challenges included:

- Slow and cumbersome processes: Manual processes and outdated systems resulted in significant delays in transactions and operational inefficiencies.

- Lack of agility and scalability: The existing infrastructure struggled to adapt to changing market demands and rapid growth.

- Data silos and integration issues: Data was scattered across various systems, making it difficult to gain a holistic view and derive actionable insights.

- Security vulnerabilities: Outdated systems posed significant security risks, making the bank vulnerable to cyber threats.

- Poor customer experience: Customers faced frustrating experiences due to slow response times, complex processes, and limited digital access.

IBM's Solutions and Technological Implementation

To overcome these challenges, Deutsche Bank partnered with IBM, leveraging its expertise in cloud computing, AI, and data analytics. The implementation strategy involved a phased approach, focusing on key areas for maximum impact. IBM provided a comprehensive suite of solutions, including:

- IBM Cloud Platform: Migrating critical workloads to the cloud enhanced scalability, agility, and cost-efficiency.

- IBM Watson: Leveraging AI capabilities for improved fraud detection, risk management, and customer service.

- IBM Garter (Assuming this is a relevant IBM technology): (Add details about the specific role of this technology in the transformation process. If this is incorrect, replace it with an accurate IBM technology used). This technology helped automate processes and improve decision-making.

- Specific security and compliance solutions: IBM provided robust security solutions to enhance Deutsche Bank's security posture and meet regulatory compliance requirements.

Key Results and Benefits Achieved

The digital transformation initiative yielded significant positive results for Deutsche Bank. The partnership with IBM led to quantifiable improvements in various key performance indicators (KPIs):

- Percentage increase in operational efficiency: (Insert quantified percentage improvement. For example: A 25% increase in operational efficiency was achieved through streamlined processes and automated workflows).

- Cost savings achieved: (Insert quantified cost savings. For example: The bank realized annual cost savings of €X million through optimized resource utilization and reduced infrastructure costs).

- Improved customer satisfaction scores: (Insert quantified improvement in customer satisfaction scores. For example: Customer satisfaction scores increased by Y points, reflecting a more seamless and efficient customer experience).

- Enhanced security posture and reduced risk: The implementation of robust security solutions significantly reduced the bank's vulnerability to cyber threats.

- Faster time-to-market for new products and services: The enhanced agility and scalability enabled Deutsche Bank to launch new products and services more quickly, gaining a competitive advantage.

Case Study: Specific Examples of Transformation Success

One notable success was the modernization of Deutsche Bank's trading platform. By leveraging IBM Cloud and AI capabilities, the bank significantly improved transaction speeds, reduced latency, and enhanced the overall trading experience. This resulted in increased trading volumes and improved profitability. Another area of significant improvement was the customer onboarding process. Automation and digitalization streamlined the process, reducing onboarding time and enhancing the customer experience. (Include a quote here from a Deutsche Bank executive or IBM representative to add credibility and impact. For example: "The partnership with IBM has been instrumental in our digital transformation journey. The improvements in efficiency and customer experience have been truly transformative," said [Name and Title] at Deutsche Bank.)

Future Outlook and Continued Digital Transformation

Deutsche Bank continues its digital transformation journey, with ongoing plans to leverage emerging technologies such as blockchain and quantum computing. The partnership with IBM is expected to continue, fostering further innovation and growth. The long-term vision is to achieve digital excellence across all aspects of the bank's operations, enhancing customer experiences and driving sustained growth.

Conclusion: The Power of Partnership in Digital Transformation

The Deutsche Bank and IBM partnership stands as a compelling example of successful digital transformation in the financial services industry. By addressing critical challenges, implementing cutting-edge technologies, and focusing on quantifiable results, Deutsche Bank has significantly improved its operational efficiency, customer experience, and security posture. This success underscores the importance of strategic technology partnerships in achieving ambitious digital transformation goals. Learn more about how IBM can help your organization achieve successful digital transformation and explore similar IBM success stories in the financial sector. [Link to relevant IBM resources].

Featured Posts

-

Andre Agassi Un Nuevo Capitulo Lejos De La Raqueta

May 30, 2025

Andre Agassi Un Nuevo Capitulo Lejos De La Raqueta

May 30, 2025 -

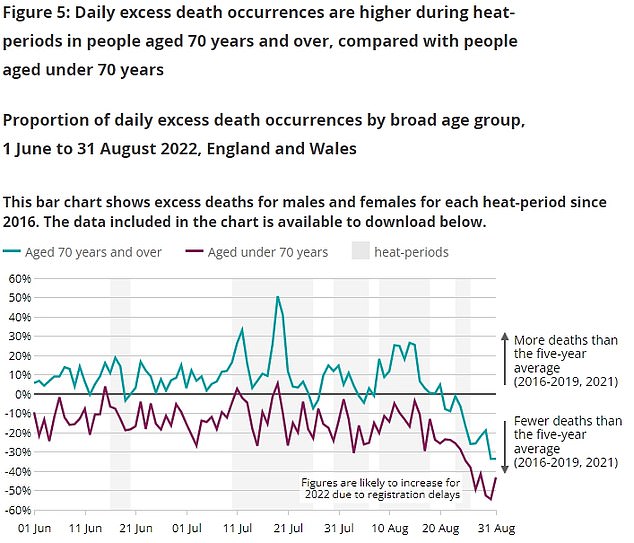

Rising Temperatures Rising Deaths 311 Fatalities In Englands Heatwave

May 30, 2025

Rising Temperatures Rising Deaths 311 Fatalities In Englands Heatwave

May 30, 2025 -

San Diego To Experience Cool Wet And Windy Conditions

May 30, 2025

San Diego To Experience Cool Wet And Windy Conditions

May 30, 2025 -

Real Madrids 90m Pursuit Of Man United Star A Detailed Report

May 30, 2025

Real Madrids 90m Pursuit Of Man United Star A Detailed Report

May 30, 2025 -

A Locals Guide To The Best Neighborhoods In Paris

May 30, 2025

A Locals Guide To The Best Neighborhoods In Paris

May 30, 2025