Accounting Giant PwC Faces Scrutiny: Bangkok Post Reports On Withdrawals Amidst Scandals

Table of Contents

Bangkok Post's Revelations and Their Impact

The Bangkok Post's investigations have unearthed several troubling incidents implicating PwC in serious professional misconduct. These revelations have shaken investor confidence and cast doubt on the reliability of financial reporting for numerous companies previously audited by PwC.

-

Specific examples of scandals reported: The Bangkok Post articles highlight alleged audit failures in several high-profile cases, including instances of overlooking significant financial irregularities and conflicts of interest. Specific details regarding these cases are still emerging but include accusations of overlooking fraudulent activities in publicly listed companies and failing to adequately identify and report material misstatements in financial statements.

-

Number of clients withdrawing services: While the exact number remains undisclosed, the Bangkok Post reports indicate a significant exodus of clients, suggesting a widespread erosion of trust in PwC's services. The sheer volume of withdrawals points towards a systemic issue rather than isolated incidents.

-

Nature of alleged misconduct: Allegations range from overlooking significant accounting discrepancies to accusations of deliberate negligence and potential complicity in fraudulent activities. The reported misconduct involves a variety of alleged failures, including inadequate due diligence, insufficient audit procedures, and a lack of transparency.

The implications of these revelations are far-reaching. Investor confidence in the integrity of financial statements audited by PwC has been severely damaged, leading to increased market volatility and potentially impacting investment decisions. Furthermore, the potential for legal repercussions, including class-action lawsuits and regulatory fines, looms large for PwC.

The Scale of Client Withdrawals and its Financial Implications

The outflow of clients from PwC is substantial, representing a significant blow to the firm's revenue and reputation. While precise figures remain confidential, industry analysts suggest the loss of revenue could reach hundreds of millions of dollars.

-

Examples of significant clients who have withdrawn their business: Although specific client names are often kept confidential due to non-disclosure agreements, reports suggest that major corporations across various sectors have severed ties with PwC.

-

Sectors most affected by the withdrawals: The impact spans various sectors, including finance, technology, and real estate. This broad impact underlines the pervasive nature of the crisis affecting PwC’s global reputation and client base.

-

Geographical impact: While the Bangkok Post’s reporting focuses on the impact within Thailand, the repercussions are likely to be felt globally, given PwC’s international presence. The impact on PwC’s regional and global offices is a cause for concern.

The financial losses extend beyond immediate revenue reduction. PwC is likely to face substantial legal fees defending itself against lawsuits and regulatory investigations. Moreover, the damage to employee morale and potential job losses could further exacerbate the crisis.

PwC's Response and Damage Control Efforts

PwC has issued public statements acknowledging the seriousness of the allegations and expressing commitment to addressing the issues. They have initiated internal investigations and pledged to improve internal controls and audit procedures.

-

Public statements issued by PwC: These statements generally express regret over the reported incidents and emphasize a commitment to upholding ethical standards and restoring public trust. However, the lack of specific details and concrete action plans have been criticized by many stakeholders.

-

Internal investigations launched: PwC has announced internal reviews to ascertain the extent of the problems and determine accountability. The results and any consequences of these investigations remain undisclosed.

-

Steps taken to improve internal controls and audit procedures: PwC has committed to strengthening its internal controls, enhancing its audit methodologies, and implementing new training programs for its auditors. The efficacy of these measures remains to be seen.

The credibility of PwC's response is currently under scrutiny. Whether these damage control efforts will suffice to restore public confidence remains to be seen.

Independent Investigations and Regulatory Scrutiny

Independent investigations into PwC's conduct are likely, given the gravity of the allegations. Relevant financial authorities, both in Thailand and potentially internationally, will almost certainly initiate regulatory scrutiny and potentially impose significant penalties.

-

Specific regulatory bodies involved: Depending on the jurisdiction, this could include the Securities and Exchange Commission (SEC), financial audit authorities, and other relevant government bodies.

-

Potential penalties that could be imposed: Penalties could range from substantial fines to operational restrictions, suspension of licenses, and even criminal charges in extreme cases.

-

Precedents for similar cases: Numerous cases of accounting scandals have led to significant regulatory action against accounting firms, serving as potential precedents for the PwC situation. These cases highlight the potential consequences of professional negligence and misconduct.

Conclusion

The Bangkok Post's reporting on PwC's involvement in multiple scandals reveals a serious crisis for the accounting giant. The scale of client withdrawals and the potential financial and reputational repercussions are significant. PwC's response, while acknowledging the issues, needs to demonstrate concrete and decisive action to restore trust. The ongoing investigations and potential regulatory actions will play a crucial role in shaping the future of PwC and the broader accounting industry. Stay informed about the ongoing developments in the PwC scandal and the implications for corporate governance and financial transparency. Follow further reporting on the PwC accounting scandal to understand its ramifications for businesses and investors worldwide. Keep abreast of updates on the PwC situation and its effect on the accounting profession.

Featured Posts

-

Mhairi Black And The Complexities Of Protecting Women And Girls From Misogyny

Apr 29, 2025

Mhairi Black And The Complexities Of Protecting Women And Girls From Misogyny

Apr 29, 2025 -

Zombie Buildings In Chicago A Deep Dive Into The Office Real Estate Crisis

Apr 29, 2025

Zombie Buildings In Chicago A Deep Dive Into The Office Real Estate Crisis

Apr 29, 2025 -

Sveti Valentin Iva Ekimova Prisstva Na Kontsert Na Dscherya Si

Apr 29, 2025

Sveti Valentin Iva Ekimova Prisstva Na Kontsert Na Dscherya Si

Apr 29, 2025 -

Louisville Storm Debris Removal A Guide For Residents

Apr 29, 2025

Louisville Storm Debris Removal A Guide For Residents

Apr 29, 2025 -

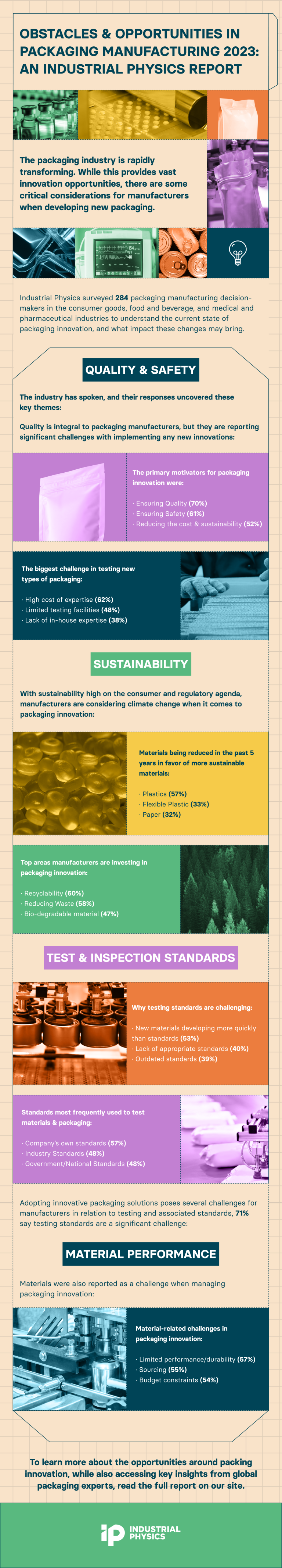

All American Manufacturing Obstacles And Opportunities

Apr 29, 2025

All American Manufacturing Obstacles And Opportunities

Apr 29, 2025

Latest Posts

-

Amanda Owens Response To The Demands Of Farm Life

Apr 30, 2025

Amanda Owens Response To The Demands Of Farm Life

Apr 30, 2025 -

Our Yorkshire Farm Amanda Owen Breaks Down In Emotional Farewell

Apr 30, 2025

Our Yorkshire Farm Amanda Owen Breaks Down In Emotional Farewell

Apr 30, 2025 -

Amanda Owens Tearful Goodbye To Our Yorkshire Farm

Apr 30, 2025

Amanda Owens Tearful Goodbye To Our Yorkshire Farm

Apr 30, 2025 -

Our Yorkshire Farm Amanda Owens Emotional Farewell

Apr 30, 2025

Our Yorkshire Farm Amanda Owens Emotional Farewell

Apr 30, 2025 -

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025