Activision Blizzard Merger: FTC's Appeal Could Halt Microsoft Deal

Table of Contents

The FTC's Antitrust Concerns Regarding the Activision Blizzard Merger

The FTC's core argument hinges on the potential for the merger to stifle competition within the gaming market. The commission argues that Microsoft, already a significant player with its Xbox console and Game Pass subscription service, acquiring Activision Blizzard – home to iconic franchises like Call of Duty, World of Warcraft, and Candy Crush – would grant Microsoft excessive market power. This, the FTC contends, could lead to anti-competitive practices, harming consumers in several ways.

- Reduced Competition: The FTC fears that Microsoft could leverage its control over Activision Blizzard's titles, particularly Call of Duty, to exclude competitors or disadvantage them. This could lead to higher prices, fewer choices, and less innovation in the gaming market.

- Exclusionary Practices: Concerns exist that Microsoft might make Activision Blizzard games exclusive to its Xbox ecosystem, denying players on other platforms access to popular titles. This would effectively lock consumers into the Microsoft ecosystem.

- Market Domination: The combined entity would control a vast library of popular games and a large portion of the gaming market, potentially leading to a monopoly or near-monopoly situation. This could reduce incentives for Microsoft to innovate and improve its products and services.

Microsoft's Defense and Proposed Solutions

Microsoft has vigorously defended the merger, arguing that it will benefit gamers through increased competition and wider access to games. Their defense rests on several key pillars:

- Expanded Game Pass: Microsoft insists the merger will allow them to expand their Game Pass subscription service, offering more value to subscribers. This, they argue, increases competition with other subscription services.

- Licensing Agreements: To address the FTC's concerns about Call of Duty exclusivity, Microsoft has offered long-term licensing agreements to ensure the game remains available on rival platforms like PlayStation.

- Increased Innovation: Microsoft argues that the merger will foster innovation and lead to the development of new and exciting gaming experiences, ultimately benefiting consumers.

Microsoft presents the merger as a win-win scenario for gamers and the industry. However, the FTC remains unconvinced.

The Appeal Process and Potential Outcomes

The FTC's appeal process is complex and multi-layered, potentially involving multiple stages and legal battles.

- Legal Proceedings: The appeal will likely involve detailed legal arguments, expert testimony, and potentially, a court hearing.

- Possible Outcomes: Three primary outcomes are possible: the FTC's appeal could succeed, leading to the merger being blocked; the appeal could be dismissed, allowing the merger to proceed; or a negotiated settlement could be reached between Microsoft and the FTC.

- Uncertain Timeline: The timeframe for the appeal process remains uncertain, with potential delays extending the uncertainty surrounding the deal.

The outcome of this legal battle will significantly impact the future of the gaming industry.

Impact on the Gaming Industry and Consumers

The success or failure of the merger could have profound and far-reaching consequences:

- Game Prices: If the merger proceeds and leads to reduced competition, there's a risk that game prices could increase.

- Game Availability: Exclusivity deals could limit the availability of certain games on competing platforms, potentially restricting consumer choice.

- Innovation: A lack of competition could stifle innovation, leading to less variety and potentially lower quality in gaming experiences.

- Impact on Developers: The merger could significantly alter the competitive landscape for independent game developers, potentially impacting their opportunities and bargaining power.

Conclusion: The Future of the Activision Blizzard Merger Remains Uncertain

The FTC's appeal against the Microsoft-Activision Blizzard merger presents a critical juncture for the gaming industry. The outcome will significantly impact competition, pricing, and innovation in the gaming market. While Microsoft argues the merger will benefit consumers, the FTC's concerns about market dominance and anti-competitive practices remain substantial. The appeal process is complex and its timeline uncertain, but its resolution will undoubtedly shape the future of gaming for years to come. Keep checking back for updates on this crucial development in the Activision Blizzard merger and the FTC's ongoing legal challenge.

Featured Posts

-

Is Betting On The Los Angeles Wildfires A Sign Of Societal Shift

Apr 29, 2025

Is Betting On The Los Angeles Wildfires A Sign Of Societal Shift

Apr 29, 2025 -

Watch Lionel Messis Inter Miami Mls Matches Live Stream Guide Schedule And Betting

Apr 29, 2025

Watch Lionel Messis Inter Miami Mls Matches Live Stream Guide Schedule And Betting

Apr 29, 2025 -

Texas Woman Dies In Wrong Way Crash Near Minnesota North Dakota Border

Apr 29, 2025

Texas Woman Dies In Wrong Way Crash Near Minnesota North Dakota Border

Apr 29, 2025 -

Ambanis Reliance Q Quarter Number Earnings Positive Implications For Indian Large Cap Stocks

Apr 29, 2025

Ambanis Reliance Q Quarter Number Earnings Positive Implications For Indian Large Cap Stocks

Apr 29, 2025 -

Hudsons Bay Closing Sales Up To 70 Off At Remaining Stores

Apr 29, 2025

Hudsons Bay Closing Sales Up To 70 Off At Remaining Stores

Apr 29, 2025

Latest Posts

-

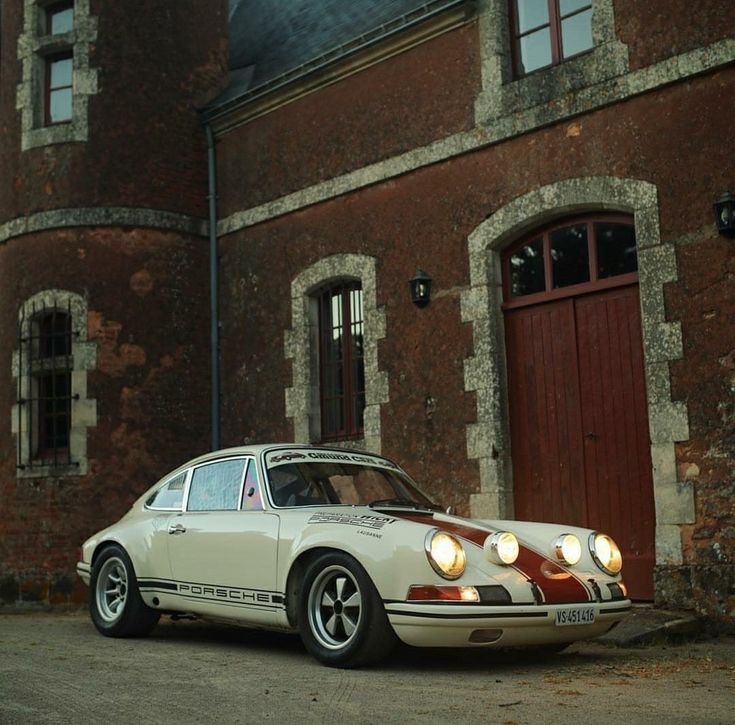

Rekordiniai Porsche Pardavimai Lietuvoje 2024 Metais

Apr 29, 2025

Rekordiniai Porsche Pardavimai Lietuvoje 2024 Metais

Apr 29, 2025 -

Appeal For Information Missing British Paralympian In Las Vegas

Apr 29, 2025

Appeal For Information Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Porsche Pardavimai Lietuvoje 2024 M 33

Apr 29, 2025

Porsche Pardavimai Lietuvoje 2024 M 33

Apr 29, 2025 -

Missing Person British Paralympian Last Seen In Las Vegas A Week Ago

Apr 29, 2025

Missing Person British Paralympian Last Seen In Las Vegas A Week Ago

Apr 29, 2025 -

2024 Metais Porsche Pardavimu Augimas Lietuvoje

Apr 29, 2025

2024 Metais Porsche Pardavimu Augimas Lietuvoje

Apr 29, 2025