Activist Investor Fails In Bid To End Rio Tinto's Dual Listing

Table of Contents

The Activist Investor's Campaign and its Objectives

The activist investor, [Insert Activist Investor Name and Firm Name here], launched a campaign aimed at forcing Rio Tinto to abandon its dual listing structure. Their argument centered on the belief that a single listing would lead to increased efficiency, improved shareholder value, and a simplified corporate structure. They argued that the dual listing created unnecessary complexities and costs, diluting shareholder returns.

The potential benefits claimed by the activist investor included:

- Reduced administrative and compliance costs: Managing two listings incurs significant expenses related to regulatory filings, reporting, and shareholder communication.

- Enhanced corporate governance: A single listing could potentially simplify decision-making processes and improve transparency.

- Increased liquidity: A consolidated listing might enhance trading volume and potentially lead to a higher share price.

- Improved investor relations: A single point of contact for investors could streamline communications and enhance engagement.

Specific arguments used by the activist included claims of duplicated efforts, reduced market efficiency due to differing regulatory landscapes, and a perceived lack of focus resulting from the dual listing structure.

Rio Tinto's Response and Defense of the Dual Listing

Rio Tinto strongly defended its dual listing, emphasizing the strategic advantages it offered. The company argued that maintaining listings on both the London and Australian exchanges provided access to diverse pools of investors, offering a broader and more stable funding base. Furthermore, Rio Tinto highlighted the importance of maintaining a strong presence in both key markets, crucial for its global operations and stakeholder relationships.

Rio Tinto countered the activist's arguments by:

- Highlighting the benefits of diverse investor bases: Access to both UK and Australian investors provides greater financial stability and resilience to market fluctuations.

- Emphasizing the importance of maintaining a strong presence in both markets: This is essential for attracting talent, securing supply chains, and engaging with stakeholders in key regions.

- Addressing regulatory complexities: Rio Tinto showcased how it effectively manages the regulatory requirements associated with dual listings.

- Underlining strong corporate governance despite the dual listing: The company emphasized its robust governance structures and commitment to shareholder value.

Rio Tinto also actively engaged with shareholders, disseminating information about the benefits of the dual listing and addressing concerns raised by the activist investor.

The Voting Outcome and its Implications

The shareholder vote decisively rejected the activist investor's proposal. [Insert Percentage of votes for and against here]. The failure can be attributed to several factors, including:

- Insufficient shareholder support: Many shareholders likely recognized the value of Rio Tinto's dual listing structure and the potential risks associated with transitioning to a single listing.

- Compelling counter-arguments from Rio Tinto: The company successfully demonstrated the strategic advantages of its current listing structure.

- Effective shareholder engagement: Rio Tinto's proactive communication and engagement strategies played a crucial role in swaying shareholder opinion.

This outcome carries significant implications. It demonstrates the difficulty of successfully challenging well-established dual listings, particularly for companies with strong corporate governance and compelling justifications for their structure. It also suggests that future activist campaigns targeting dual-listed companies will need to develop more persuasive arguments and engage more effectively with shareholders.

The Future of Rio Tinto's Listing Structure and Shareholder Activism

It is highly unlikely that Rio Tinto will reconsider its dual listing strategy in the near future, given the overwhelming rejection of the activist investor's proposal. However, this event underscores the evolving landscape of shareholder activism and the importance of robust corporate governance.

Potential future developments include:

- Increased scrutiny of dual listings: This event may lead to increased scrutiny of dual listings by investors and regulators.

- More sophisticated activist investor strategies: Future campaigns may employ more nuanced approaches, targeting specific vulnerabilities within the dual listing structure.

- Enhanced shareholder engagement: Companies will likely prioritize more proactive and transparent communication with their shareholders.

This case study highlights the growing importance of shareholder engagement and effective communication in addressing activist investor concerns.

Analyzing the Failure of the Bid to End Rio Tinto's Dual Listing

In summary, the activist investor's campaign to end Rio Tinto's dual listing ultimately failed due to a lack of shareholder support and the company's strong defense of its current structure. The shareholder vote reaffirmed the strategic benefits of Rio Tinto's dual listing, showcasing the complexities involved in targeting such established structures. The outcome underscores the importance of robust corporate governance, proactive shareholder engagement, and the need for compelling arguments in successful activist campaigns.

What are your thoughts on the future of dual listings in light of this failed attempt? Share your insights in the comments below!

Featured Posts

-

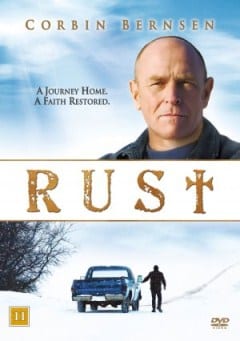

Rust Movie Review Examining The Production And Aftermath Of Tragedy

May 03, 2025

Rust Movie Review Examining The Production And Aftermath Of Tragedy

May 03, 2025 -

London Fashion Week Kate And Lila Mosss Stunning Matching Lbds

May 03, 2025

London Fashion Week Kate And Lila Mosss Stunning Matching Lbds

May 03, 2025 -

Rolls Royce Maintains 2025 Outlook Despite Tariff Challenges

May 03, 2025

Rolls Royce Maintains 2025 Outlook Despite Tariff Challenges

May 03, 2025 -

Saudi Arabias Abs Market Opening A Rule Change Bigger Than Spain

May 03, 2025

Saudi Arabias Abs Market Opening A Rule Change Bigger Than Spain

May 03, 2025 -

Fortnite Long Awaited Skins Restock In The Item Shop

May 03, 2025

Fortnite Long Awaited Skins Restock In The Item Shop

May 03, 2025