Addressing Elevated Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's analysis provides a nuanced perspective on the current state of the market, examining both the positive aspects of growth and the potential pitfalls of overvalued stocks. Their assessment considers various factors to paint a comprehensive picture.

Identifying Overvalued Sectors

BofA's research identifies several sectors exhibiting potentially unsustainable high stock valuations. These sectors have experienced rapid growth, often fueled by technological advancements or shifting consumer behavior, leading to inflated price-to-earnings (P/E) and price-to-sales (P/S) ratios.

- Technology: The tech sector remains a key area of concern, with many companies trading at exceptionally high multiples despite potential future growth uncertainties. This is partly due to sustained investor interest in innovative technologies.

- Consumer Discretionary: The consumer discretionary sector, encompassing companies that benefit from consumer spending, has also seen elevated valuations. This is influenced by factors such as pent-up demand following periods of economic uncertainty, but also carries risks if consumer spending patterns change.

BofA's analysis uses various valuation multiples, including P/E ratios, P/S ratios, and other metrics specific to individual sectors, to pinpoint potential overvaluation. These metrics compare a company's stock price relative to its earnings or sales, providing insights into whether a company is trading at a premium compared to its historical performance or peers. Understanding these metrics is crucial for assessing individual stock valuations within the broader context of market valuation analysis.

Macroeconomic Factors Influencing Valuations

Several macroeconomic forces significantly influence current market valuations, shaping investor sentiment and driving stock prices.

- Interest Rates: Rising interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting company profitability, thus influencing valuations.

- Inflation: High inflation erodes purchasing power and can lead to increased input costs for companies, affecting profit margins and stock prices. It also increases the attractiveness of bonds relative to stocks.

- Economic Growth: The overall health of the economy is a fundamental driver of stock market valuations. Strong economic growth tends to support higher valuations, while slower growth can trigger downward pressure.

The interplay between these factors creates a complex dynamic that requires careful analysis. For example, higher interest rates might curb inflation but simultaneously slow economic growth, leading to uncertain impacts on overvalued stocks. BofA's analysis carefully considers these interactions to arrive at a comprehensive assessment.

Potential Risks and Opportunities

While the market exhibits signs of elevated valuations, BofA's assessment identifies both risks and opportunities.

- Potential Risks:

- Market Corrections: Elevated valuations increase the vulnerability of the market to sudden corrections driven by shifting investor sentiment or macroeconomic shocks.

- Inflation Risk: Persistent high inflation could negatively impact corporate profits and lead to a decline in stock prices.

- Economic Downturn: A slowing economy could further depress valuations, impacting even seemingly robust sectors.

- Potential Opportunities:

- Undervalued Sectors: Within the broader market, BofA's analysis may identify undervalued sectors or specific companies offering attractive entry points.

- Strategic Stock Picking: Focusing on companies with strong fundamentals and sustainable growth prospects can mitigate some of the risks associated with high stock valuations.

BofA's Strategies for Navigating Elevated Valuations

BofA advocates for a cautious and strategic approach to investing in the current market environment. Their recommendations emphasize diversification and defensive strategies.

Portfolio Diversification Strategies

Mitigating risk in a market characterized by elevated stock market valuations hinges on robust portfolio diversification.

- Asset Allocation: Diversifying across different asset classes, such as stocks, bonds, and real estate, helps reduce overall portfolio volatility.

- Geographic Diversification: Spreading investments across different geographic markets can help mitigate the impact of regional economic downturns.

- Sector Diversification: Diversifying across different sectors limits exposure to any single sector's underperformance.

BofA's recommendations on asset allocation will vary depending on individual investor risk tolerance and financial goals. However, the core principle of diversification remains paramount.

Defensive Investment Approaches

Defensive investment strategies play a crucial role in navigating periods of elevated valuations.

- Value Investing: Focusing on companies trading below their intrinsic value can provide a margin of safety in a potentially volatile market.

- Dividend Investing: Companies with a history of paying consistent dividends can offer a steady income stream, mitigating some of the risks associated with capital appreciation.

- Bond Allocation: Bonds can act as a ballast in a portfolio, offering stability during periods of market uncertainty. However, rising interest rates may reduce bond prices, necessitating a careful review of bond yields relative to risk tolerance.

Active vs. Passive Management

The choice between active and passive investment management becomes crucial when dealing with overvalued stocks.

- Active Management: Active managers aim to outperform the market by identifying undervalued securities and timing the market. This approach requires greater expertise and is not always successful.

- Passive Management: Passive management involves tracking a market index, offering diversification and lower fees. This approach may be preferred in a high-valuation market to avoid the potential risks of underperforming active strategies.

Conclusion

BofA's analysis highlights the complexity of the current market landscape, characterized by elevated stock market valuations. Understanding the macroeconomic factors influencing these valuations, identifying potentially overvalued sectors, and adopting diversified and defensive investment strategies are crucial for managing portfolio risk. Key takeaways include the importance of diversification across assets, sectors, and geographies; the utilization of defensive investment approaches; and a careful consideration of active versus passive management strategies. By understanding these factors and employing the appropriate strategies, investors can better navigate this challenging environment and effectively address elevated stock market valuations. To learn more about BofA's research and detailed investment recommendations for managing high stock valuations, explore their comprehensive reports and resources available online.

Featured Posts

-

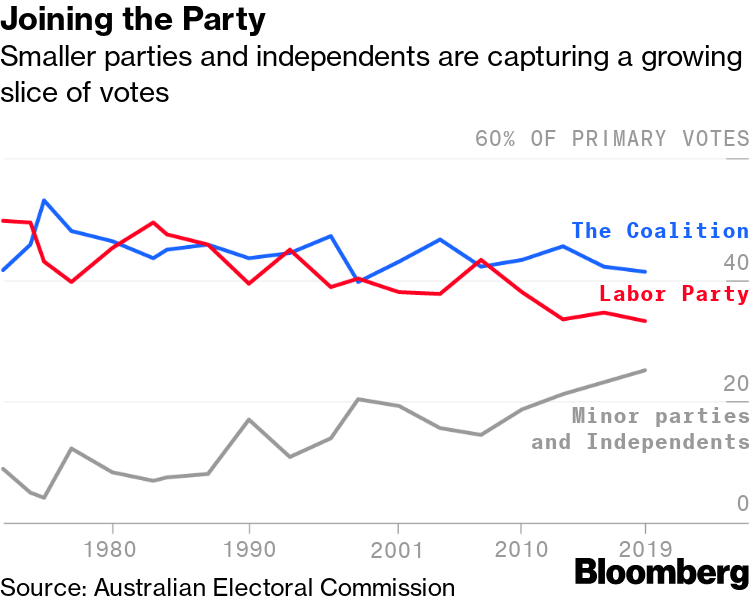

Australia Votes National Election As Barometer Of Global Political Trends

May 05, 2025

Australia Votes National Election As Barometer Of Global Political Trends

May 05, 2025 -

Aritzia Adjusts To Trump Tariffs Without Raising Prices

May 05, 2025

Aritzia Adjusts To Trump Tariffs Without Raising Prices

May 05, 2025 -

Louisiana Derby 2025 A Guide To Odds Contenders And Kentucky Derby Prospects

May 05, 2025

Louisiana Derby 2025 A Guide To Odds Contenders And Kentucky Derby Prospects

May 05, 2025 -

Gary Mars Argument Why Western Canada Holds The Key To National Prosperity Mark Carney

May 05, 2025

Gary Mars Argument Why Western Canada Holds The Key To National Prosperity Mark Carney

May 05, 2025 -

Security Row Prince Harry Says King Charles Has Cut Him Off

May 05, 2025

Security Row Prince Harry Says King Charles Has Cut Him Off

May 05, 2025

Latest Posts

-

Nhl Roundup Panthers Comeback Victory Avalanches Crushing Defeat

May 05, 2025

Nhl Roundup Panthers Comeback Victory Avalanches Crushing Defeat

May 05, 2025 -

Oilers Vs Habs Your Morning Coffee Game Day Preview

May 05, 2025

Oilers Vs Habs Your Morning Coffee Game Day Preview

May 05, 2025 -

Nhl Playoffs Breaking Down The First Round Matchups

May 05, 2025

Nhl Playoffs Breaking Down The First Round Matchups

May 05, 2025 -

Florida Panthers Dramatic Comeback Avalanches Rout Nhl Game Recap

May 05, 2025

Florida Panthers Dramatic Comeback Avalanches Rout Nhl Game Recap

May 05, 2025 -

Will The Oilers Bounce Back A Morning Coffee Look At Oilers Vs Habs

May 05, 2025

Will The Oilers Bounce Back A Morning Coffee Look At Oilers Vs Habs

May 05, 2025