Addressing Investor Concerns About High Stock Market Valuations: BofA

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's assessment of current stock market valuations is nuanced. While acknowledging the elevated levels compared to historical averages, they don't necessarily view them as uniformly unsustainable. However, they clearly identify potential risks and emphasize the need for cautious optimism. The firm uses a variety of metrics to gauge the market's health.

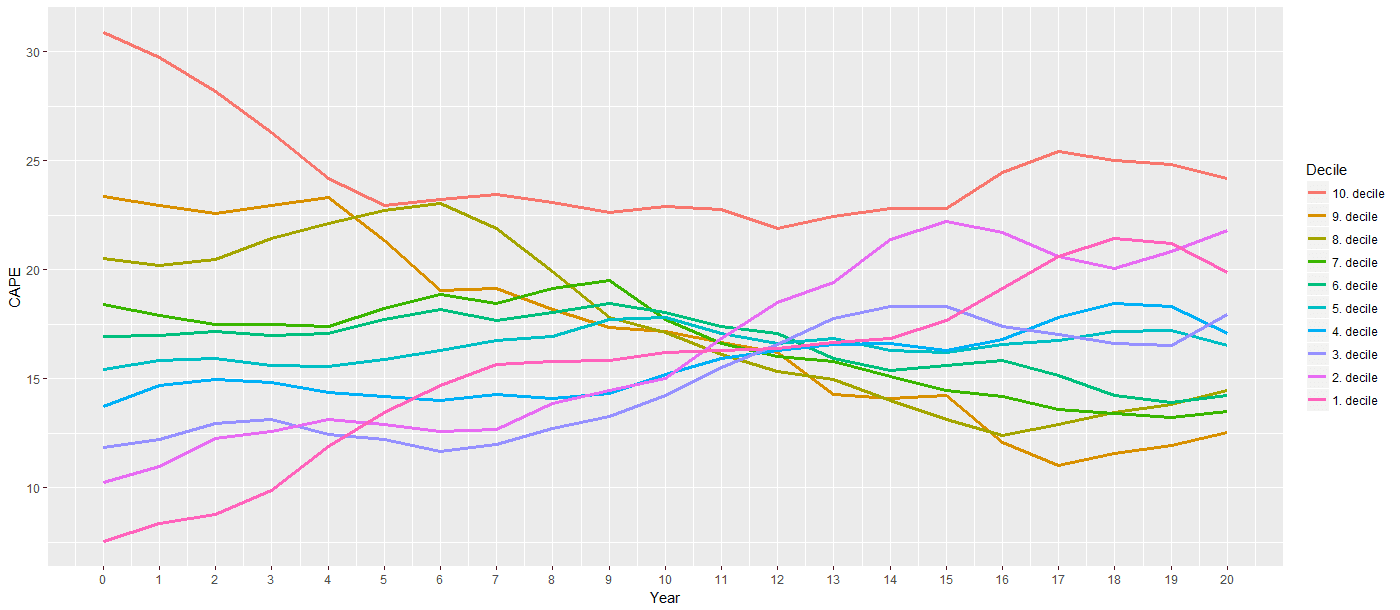

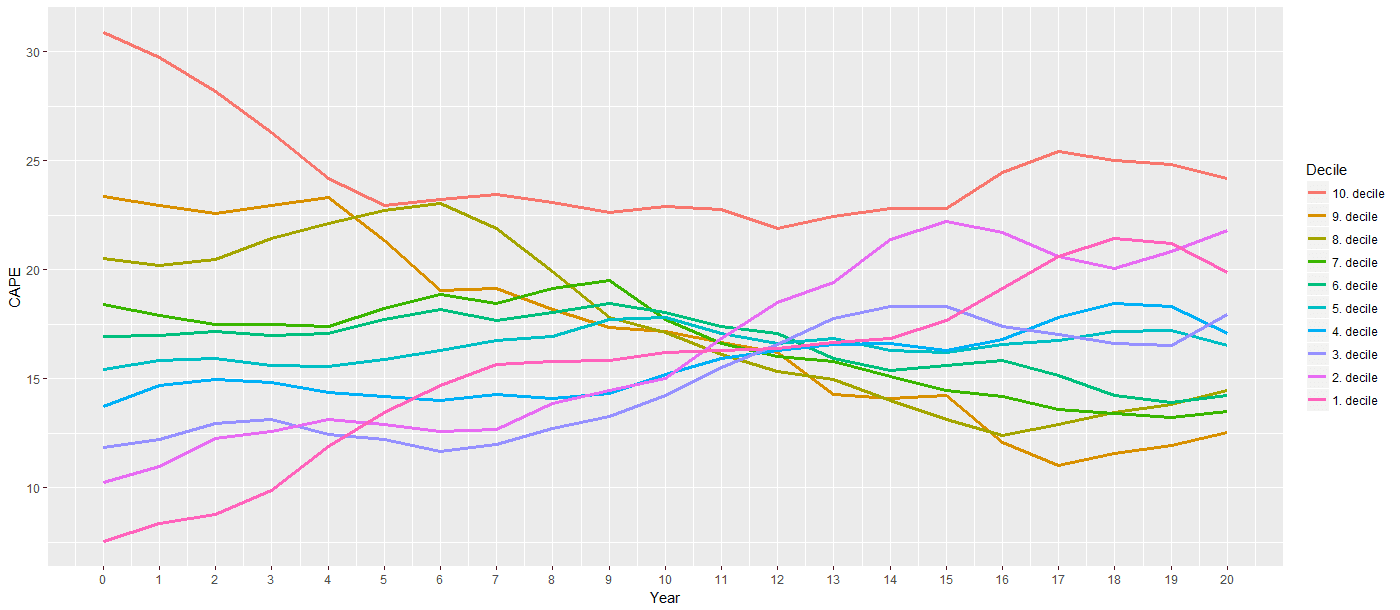

- Key metrics BofA uses to assess valuations: BofA utilizes several key indicators, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various sector-specific valuation metrics. These metrics help them compare current valuations to historical norms and identify potential overvaluation or undervaluation in specific sectors.

- BofA's identified potential risks associated with high valuations: The primary risks identified by BofA include the potential for market corrections, fueled by rising interest rates or unexpected economic downturns. Inflation, if it persists at elevated levels, poses a significant threat to corporate profitability and stock valuations. Geopolitical uncertainty also adds to the complexity.

- Specific sectors or asset classes BofA highlights: BofA's analysis often highlights specific sectors or asset classes that appear overvalued or undervalued based on their valuation models and market outlook. For example, they may point towards certain technology stocks as potentially overvalued while highlighting value opportunities in more cyclical sectors. This information is usually available in their regular market commentary and research reports.

Factors Contributing to High Valuations

Several macroeconomic factors contribute to the current high stock market valuations. Understanding these factors is essential for informed investment decisions.

- Low interest rates and their impact on valuations: Prolonged periods of low interest rates, particularly near-zero or negative rates in some developed economies, significantly impact valuations. Lower borrowing costs encourage companies to take on debt for expansion and investment, boosting earnings and driving up stock prices. Additionally, it makes bonds less attractive, driving investors toward higher-yielding assets like stocks.

- Quantitative easing and its effects on market liquidity: Quantitative easing (QE) programs implemented by central banks inject liquidity into the market, driving up asset prices, including stocks. This increased liquidity can support higher valuations, even in the absence of strong fundamental growth.

- Strong corporate earnings (or lack thereof): While strong corporate earnings can justify higher valuations, the relationship is not always straightforward. Sustained high earnings growth supports higher valuations, while a slowdown in earnings growth can lead to market corrections even with low interest rates. BofA's analysis incorporates earnings growth forecasts to determine the sustainability of current valuations.

- The influence of technological innovation and growth stocks on market indices: The remarkable growth of technology companies and the outsized influence of these "growth stocks" on major market indices contribute to elevated valuations. The potential for future innovation and high growth rates in these sectors often drives investor enthusiasm and pushes prices higher, potentially beyond what traditional valuation metrics might suggest.

BofA's Strategies for Managing Valuation Risks

BofA recommends several strategies to manage the risks associated with high stock market valuations. These are not necessarily mutually exclusive and can be implemented in combination.

- Diversification strategies: BofA strongly advocates for a diversified investment portfolio. This means spreading investments across various asset classes (stocks, bonds, real estate), geographies, and sectors to mitigate the risk of significant losses in any single area.

- Focus on value investing or other alternative investment approaches: Value investing, which focuses on identifying undervalued companies, can be a more resilient strategy in a high-valuation environment. Alternative investment approaches, such as focusing on companies with strong balance sheets and sustainable business models, can also help manage risk.

- Importance of a long-term investment horizon: BofA emphasizes the importance of a long-term investment approach. Market fluctuations are inevitable, and short-term market movements should not dictate long-term investment decisions. A long-term perspective allows investors to ride out market corrections and benefit from long-term growth.

- Hedging strategies to protect against market downturns: Hedging strategies, such as using options or other derivative instruments, can help limit potential losses during market downturns. These strategies are typically more complex and require a thorough understanding of the market and risk management.

Alternative Investment Opportunities

BofA's analysis implicitly suggests exploring alternative investment avenues to diversify away from the potentially overvalued equity market.

- Bonds and fixed-income securities: Bonds, particularly those with longer maturities, can offer a more stable return than equities in a high-valuation environment. However, it's important to consider interest rate risk.

- Real estate investment trusts (REITs): REITs offer exposure to the real estate market, which often has a lower correlation with equity markets. They can provide diversification and potentially stable income streams.

- Commodities: Commodities, such as gold or oil, can serve as a hedge against inflation and market uncertainty. However, commodity markets can be volatile.

- Private equity or venture capital: These alternative investments often offer higher potential returns but come with higher risks and lower liquidity.

Conclusion

BofA's analysis highlights that while high stock market valuations present potential risks, they don't necessarily signal an imminent market crash. However, it stresses the importance of cautious optimism and proactive risk management. The key takeaways emphasize the necessity of diversification, a long-term investment horizon, and considering alternative investment options. While BofA's insights on addressing concerns about high stock market valuations provide a valuable framework, remember to conduct your own thorough research and consider seeking professional financial advice tailored to your specific circumstances before making any investment decisions. Understanding and proactively managing the risks associated with high stock market valuations is crucial for long-term investment success.

Featured Posts

-

Supreme Court Decision Lees Presidential Candidacy In Jeopardy After Acquittal Reversal

May 03, 2025

Supreme Court Decision Lees Presidential Candidacy In Jeopardy After Acquittal Reversal

May 03, 2025 -

Newsround On Bbc Two Hd Full Tv Schedule And Episode Guide

May 03, 2025

Newsround On Bbc Two Hd Full Tv Schedule And Episode Guide

May 03, 2025 -

Nigel Farages Jimmy Savile Remark Public Reaction And Political Fallout

May 03, 2025

Nigel Farages Jimmy Savile Remark Public Reaction And Political Fallout

May 03, 2025 -

This Country A Travelers Diary

May 03, 2025

This Country A Travelers Diary

May 03, 2025 -

Affordable Housing Progress Tomatin Schoolchildren Participate In Groundbreaking Ceremony

May 03, 2025

Affordable Housing Progress Tomatin Schoolchildren Participate In Groundbreaking Ceremony

May 03, 2025