Addressing Investor Concerns: BofA On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

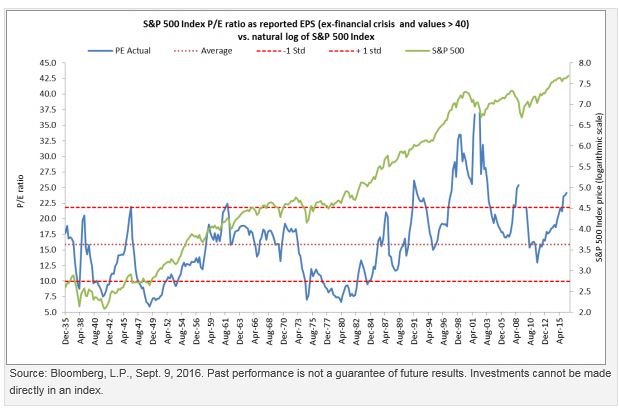

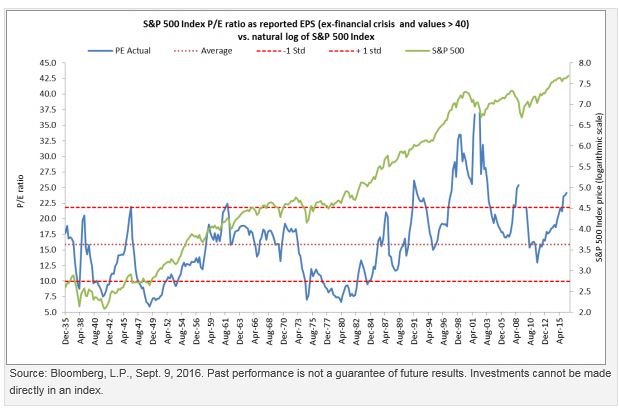

BofA's recent report offers a nuanced perspective on the current state of the stock market. While acknowledging the elevated valuations, they haven't declared an outright "overvalued" market. Their analysis suggests a more complex picture, influenced by several interacting factors. BofA points to historically low interest rates as a significant contributor to higher price-to-earnings (P/E) ratios. Strong corporate earnings, driven by post-pandemic recovery and sustained consumer demand, have also played a role in boosting valuations. However, the report also acknowledges the impact of inflation and ongoing geopolitical uncertainty, which introduce considerable risk into the equation.

- Key Metrics: BofA's analysis utilizes a range of metrics, including P/E ratios, price-to-sales ratios, and dividend yields, to assess valuations across different sectors.

- Sectoral Analysis: While the report doesn't explicitly name specific overvalued or undervalued companies, it highlights sectors showing particularly high or low valuations based on their analysis. For example, certain technology sectors might be identified as potentially overvalued, while others, like energy or healthcare, might appear more attractively priced relative to their fundamentals.

- Market Predictions: BofA's predictions regarding future market performance are cautious but not overly bearish. They anticipate continued volatility, suggesting a more measured approach to investment strategies.

Addressing Key Investor Concerns Regarding High Valuations

High stock market valuations naturally trigger anxiety among investors. The fear of a significant market correction is paramount, coupled with concerns about future returns in a high-valuation environment. BofA acknowledges these anxieties. However, their analysis doesn't advocate for immediate panic selling.

- Market Correction Risk: BofA's report addresses the risk of a market correction, acknowledging its possibility but emphasizing the difficulty in predicting its timing and severity. They suggest that corrections are a normal part of market cycles and historically haven't erased long-term gains.

- Long-Term Growth Outlook: Despite high valuations, BofA maintains a relatively positive long-term outlook for stock market growth. They highlight the potential for continued corporate earnings growth and the ongoing expansion of certain sectors as mitigating factors.

- Risk Management Strategies: BofA suggests several strategies for managing risk in this environment, including diversification across different asset classes and employing value investing principles to identify potentially undervalued opportunities.

Alternative Investment Strategies in Light of Elevated Stock Market Valuations (According to BofA)

Given the elevated stock market valuations, BofA suggests exploring alternative investment opportunities to potentially mitigate risk and diversify portfolios. This doesn't necessarily imply abandoning equities entirely, but rather finding a more balanced approach.

- Asset Allocation: BofA recommends a strategic asset allocation approach, adjusting the proportion of stocks, bonds, and other asset classes based on individual risk tolerance and investment goals.

- Alternative Asset Classes: The report highlights the potential of several alternative asset classes. These include high-quality bonds offering relatively stable returns, real estate which might offer inflation hedging properties, and strategically selected commodities.

- Risk and Benefits: BofA's recommendations emphasize the need to carefully weigh the risks and benefits of each alternative asset class. The report likely details the inherent volatility and liquidity considerations associated with these diverse investment options.

Conclusion: Navigating Elevated Stock Market Valuations with BofA's Guidance

BofA's analysis provides a valuable framework for understanding the complexities of elevated stock market valuations. Their report acknowledges investor concerns while offering a nuanced perspective on the current market conditions. By considering BofA's insights regarding market risks, long-term growth potential, and alternative investment strategies, investors can make more informed decisions. The suggested strategies, including diversification and careful asset allocation, can help mitigate risks associated with high valuations. Understand the complexities of elevated stock market valuations by reviewing BofA's comprehensive report and making informed decisions about your investment portfolio. [Link to BofA report (if available)]

Featured Posts

-

Giants Padres Game Prediction Padres Outright Victory Or A Close 1 Run Loss

May 16, 2025

Giants Padres Game Prediction Padres Outright Victory Or A Close 1 Run Loss

May 16, 2025 -

Colorado Rapids Win Calvin Harris Cole Bassett Goals Steffens Stellar Performance

May 16, 2025

Colorado Rapids Win Calvin Harris Cole Bassett Goals Steffens Stellar Performance

May 16, 2025 -

Boston Celtics Sold For 6 1 B Fans React To Private Equity Takeover

May 16, 2025

Boston Celtics Sold For 6 1 B Fans React To Private Equity Takeover

May 16, 2025 -

Climbing Everest With Anesthetic Gas A Risky Proposition

May 16, 2025

Climbing Everest With Anesthetic Gas A Risky Proposition

May 16, 2025 -

Roma Monza Partido En Directo

May 16, 2025

Roma Monza Partido En Directo

May 16, 2025