Addressing Investor Concerns: BofA's Take On High Stock Market Valuations

Table of Contents

High stock market valuations are a significant concern for many investors. This article delves into Bank of America's (BofA) recent analysis of this issue, exploring their insights and offering potential strategies for navigating these challenging market conditions. We'll examine BofA's perspective on factors driving valuations, potential risks, and their recommendations for investors. Understanding BofA's assessment of high stock market valuations is crucial for informed decision-making in today's market.

BofA's Assessment of Current Market Valuations

BofA's assessment of current market valuations utilizes a multi-faceted approach, considering various factors beyond simple price-to-earnings ratios. Their analysis goes beyond headline numbers to provide a more nuanced understanding of the market's health.

-

Methodologies: BofA employs a combination of quantitative and qualitative methods. This includes analyzing various valuation metrics, comparing them to historical data, and considering macroeconomic indicators. Their analysts also incorporate qualitative factors, such as investor sentiment and geopolitical events, into their overall assessment.

-

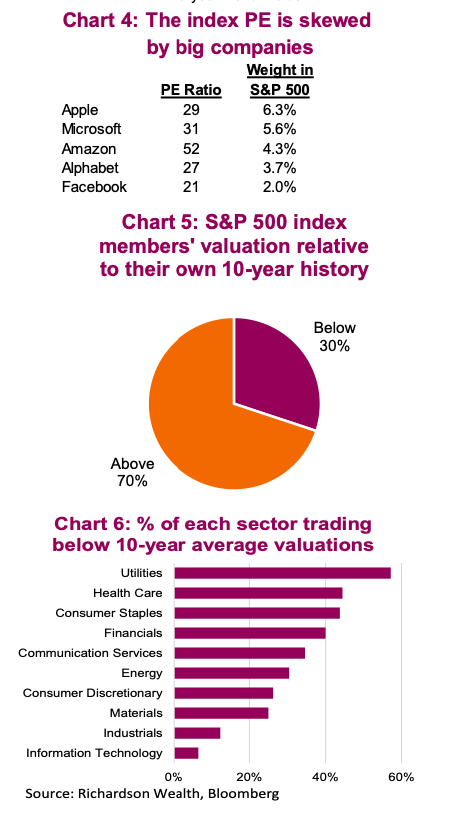

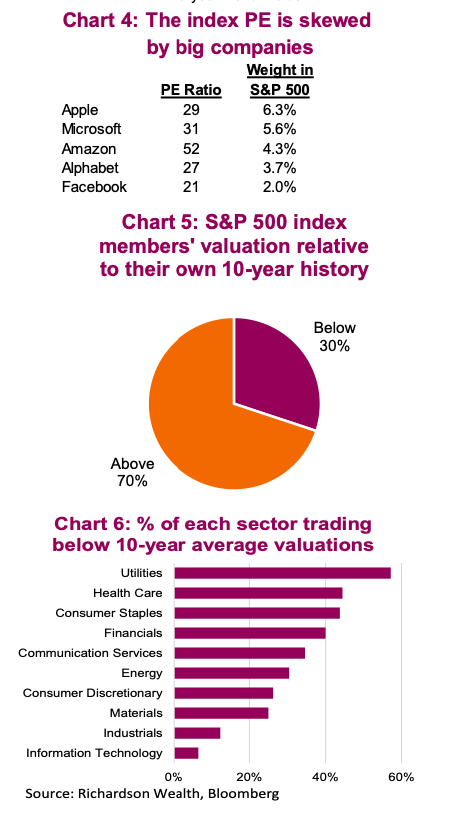

Key Metrics: BofA utilizes several key valuation ratios, including:

- Price-to-Earnings Ratio (P/E): A comparison of a company's stock price to its earnings per share. High P/E ratios often indicate high valuations.

- Cyclically Adjusted Price-to-Earnings Ratio (Shiller PE): This ratio uses inflation-adjusted earnings over a longer period, providing a more stable measure of valuation.

- Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue, offering another perspective on valuation, especially useful for companies with fluctuating earnings.

-

BofA's Conclusion: While the specific conclusions vary based on the timeframe and specific metrics used, BofA's general assessment often reflects a cautious outlook regarding current valuations. Their reports usually highlight that while certain sectors may appear undervalued, the overall market shows signs of being richly priced relative to historical averages.

Factors Contributing to High Stock Market Valuations

Several factors have contributed to the elevated valuations observed in the stock market. BofA's analysis identifies several key elements:

-

Low Interest Rates and Monetary Policy: Years of low interest rates and quantitative easing (QE) by central banks have pushed investors towards higher-yielding assets, including stocks. This increased demand has driven up prices.

-

Economic Growth and Inflation: Periods of strong economic growth, even with moderate inflation, can fuel higher valuations as companies experience increased profits and revenue. However, high inflation also erodes purchasing power and can negatively impact investor sentiment.

-

Technological Advancements and Innovation: The rapid pace of technological innovation continues to create exciting new investment opportunities, driving investor interest and potentially justifying higher valuations for certain tech stocks.

-

Investor Sentiment and Market Psychology: Positive investor sentiment, fueled by factors like media coverage and social media trends, can create "market bubbles" where valuations are disconnected from fundamental economic data.

Potential Risks Associated with High Valuations

Investing in a potentially overvalued market carries inherent risks. BofA highlights several key concerns:

-

Market Corrections and Downturns: High valuations often precede market corrections or even larger downturns. A sharp decline in prices can lead to significant portfolio losses.

-

Increased Volatility: Overvalued markets tend to exhibit higher volatility, meaning prices can swing dramatically in short periods. This increased uncertainty makes investment decision-making more challenging.

-

Impact on Long-Term Returns: While long-term investments typically weather market fluctuations, consistently high valuations can potentially diminish long-term returns, as future growth may not keep pace with current prices.

BofA's Recommendations for Investors

Navigating a market with high valuations requires a prudent approach. BofA's recommendations often include:

-

Diversification: Investors should diversify their portfolios across asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. A diversified approach reduces exposure to any single market segment.

-

Risk Management: Implement robust risk management techniques, including setting stop-loss orders and regularly reviewing portfolio performance. Understanding your risk tolerance is crucial.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is vital. Short-term market fluctuations should not dictate long-term investment strategies.

-

Selective Stock Picking: Focus on fundamentally sound companies with strong earnings potential and sustainable competitive advantages. Avoid chasing speculative investments.

Conclusion

This article has summarized BofA's analysis of high stock market valuations, highlighting key contributing factors, associated risks, and their recommended investor strategies. Understanding BofA's perspective is crucial for making informed investment decisions in this dynamic market environment. Addressing investor concerns regarding high stock market valuations requires a proactive approach, incorporating diversification and risk management into your investment strategy.

Call to Action: Stay informed about market developments and continue to monitor BofA's insights on addressing investor concerns related to high stock market valuations. Understanding these valuations is critical for effective investment planning. Learn more about BofA's market analysis and financial planning tools today!

Featured Posts

-

Baumunfall In Stemwede Autofahrer Aus Bad Essen Eingeklemmt

May 24, 2025

Baumunfall In Stemwede Autofahrer Aus Bad Essen Eingeklemmt

May 24, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Overnight

May 24, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Overnight

May 24, 2025 -

Record Highs On The Horizon Frankfurt Equities And The Daxs Continued Ascent

May 24, 2025

Record Highs On The Horizon Frankfurt Equities And The Daxs Continued Ascent

May 24, 2025 -

Planning Your Country Escape Tips For A Relaxing And Rewarding Experience

May 24, 2025

Planning Your Country Escape Tips For A Relaxing And Rewarding Experience

May 24, 2025 -

Chto My Nasleduem Dostizheniya Pokoleniya I Perspektivy Buduschego

May 24, 2025

Chto My Nasleduem Dostizheniya Pokoleniya I Perspektivy Buduschego

May 24, 2025