Addressing Stock Market Valuation Anxiety: Insights From BofA

Table of Contents

Understanding Current Stock Market Valuations According to BofA

Bank of America's recent reports offer a nuanced perspective on current stock market valuations. While specific data points change frequently, BofA generally assesses valuations relative to historical averages and incorporates various economic indicators. Their analysis often involves a blend of quantitative and qualitative factors, going beyond simple metrics to understand the broader market context.

- Key Indicators Used by BofA: BofA's valuation analysis typically includes a range of market indicators, such as Price-to-Earnings ratios (P/E), Price-to-Sales ratios (P/S), dividend yields, and cyclically adjusted price-to-earnings ratio (CAPE). These metrics help to assess whether stocks are trading at historically high or low levels relative to their earnings or sales.

- Sector-Specific Insights: BofA often highlights specific sectors or companies that they believe are currently overvalued or undervalued based on their assessment. For instance, in periods of high inflation, BofA may flag certain sectors as potentially overvalued due to higher input costs impacting future profitability. Conversely, they might identify undervalued sectors poised for growth in a changing economic climate. It's crucial to note that these assessments are dynamic and evolve based on market conditions.

- BofA's Perspective on Risks and Opportunities: BofA's reports frequently outline the potential risks and opportunities presented by the current market environment. This includes considerations such as interest rate hikes, inflation, geopolitical uncertainty, and technological disruptions. Understanding BofA's assessment of these risks and opportunities allows investors to make more informed decisions. For example, a report might highlight the potential risks associated with high inflation and suggest strategies to mitigate those risks.

BofA's Strategies for Managing Valuation Anxiety

BofA's recommendations for managing investment anxiety center on building a robust, long-term investment strategy. This approach helps to weather market fluctuations and reduce the emotional impact of short-term volatility.

- Long-Term Investing and Diversification: BofA consistently emphasizes the importance of adopting a long-term investment horizon. This means focusing on your long-term financial goals rather than reacting to daily market movements. Diversification across asset classes and geographies is a cornerstone of this approach, helping to spread risk and cushion potential losses.

- Dollar-Cost Averaging (DCA): BofA likely advocates for dollar-cost averaging (DCA), a strategy where investors invest a fixed amount of money at regular intervals, regardless of market fluctuations. This reduces the risk of investing a lump sum at a market peak.

- Risk Tolerance Assessment: Understanding your own risk tolerance is critical. BofA likely stresses the need to align your investment strategy with your individual risk profile. Investors with a lower risk tolerance might opt for a more conservative portfolio, while those with a higher risk tolerance might be comfortable with more aggressive investments.

- Professional Financial Advice: Seeking professional financial guidance is recommended. A financial advisor can assist in creating a personalized investment plan that takes your individual circumstances, goals, and risk tolerance into account.

The Role of Diversification in Reducing Stock Market Valuation Anxiety

Diversification is a powerful tool for managing risk and reducing anxiety related to stock valuations. By spreading your investments across various asset classes, geographies, and sectors, you mitigate the impact of any single investment performing poorly.

- Asset Class Diversification: BofA would likely advise including a mix of assets in your portfolio, such as stocks, bonds, real estate, and potentially alternative investments. This reduces your dependence on any single asset class.

- Geographical Diversification: Investing in companies and assets from different countries reduces the impact of economic or political events in any single nation.

- Sector Diversification: Concentrating investments in only one or two sectors exposes your portfolio to significant risk if that sector underperforms. Diversification across various sectors (e.g., technology, healthcare, consumer staples) is crucial for mitigating this risk.

Seeking Professional Financial Advice

Addressing anxieties around stock market valuation often benefits from professional guidance. A financial advisor provides invaluable support in navigating these complex issues.

- Personalized Investment Plan: A financial advisor will help create a personalized investment plan tailored to your specific needs, goals, and risk tolerance. This plan outlines a clear path for achieving your financial objectives.

- Regular Portfolio Reviews: Regular portfolio reviews and adjustments ensure your investment strategy remains aligned with your goals and the evolving market conditions.

- Emotional Support: A financial advisor serves as a trusted source of information and support, offering reassurance and guidance during periods of market volatility. This emotional support can help to reduce investment anxiety significantly.

Conclusion

Understanding stock market valuations, adopting a long-term perspective, diversifying your investments, and seeking professional financial advice are crucial for managing stock market valuation anxieties. BofA's insights emphasize the importance of a well-defined investment strategy aligned with your risk tolerance and financial goals. Don't let stock market valuation anxiety control your investment decisions. Use BofA's insights to create a robust investment strategy that aligns with your risk tolerance and financial goals. Learn more about effectively managing your stock market valuation anxieties by researching BofA's market reports and consulting with a financial advisor today.

Featured Posts

-

Anthony Edwards Injury Status Latest News On Timberwolves Guard

Apr 29, 2025

Anthony Edwards Injury Status Latest News On Timberwolves Guard

Apr 29, 2025 -

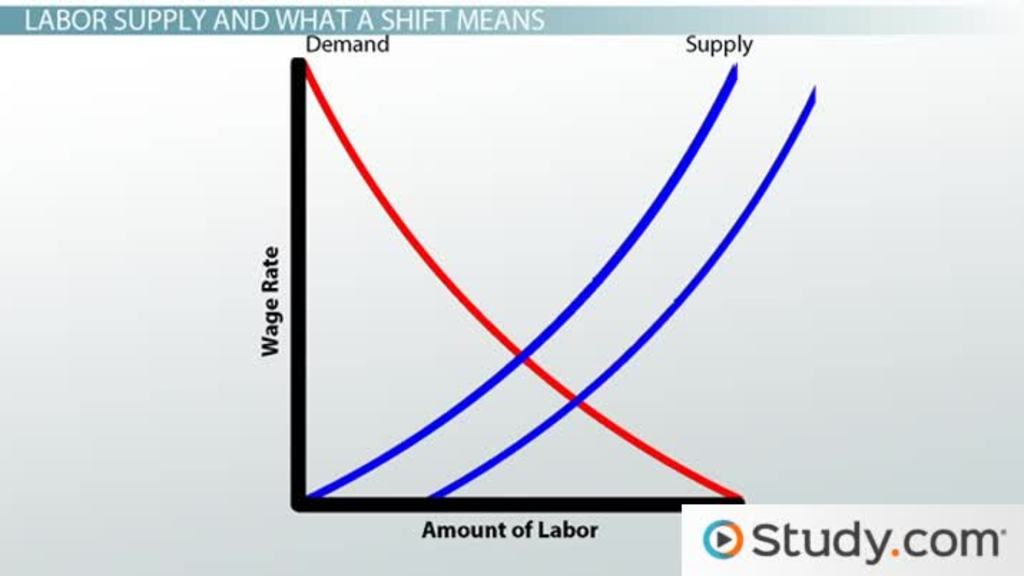

Minnesota Immigrant Job Market Shifts Higher Wages Reported

Apr 29, 2025

Minnesota Immigrant Job Market Shifts Higher Wages Reported

Apr 29, 2025 -

Stock Market Valuation Concerns Bof A Offers A Contrarian View

Apr 29, 2025

Stock Market Valuation Concerns Bof A Offers A Contrarian View

Apr 29, 2025 -

La Fire Victims Face Price Gouging Reality Tv Star Highlights Landlord Exploitation

Apr 29, 2025

La Fire Victims Face Price Gouging Reality Tv Star Highlights Landlord Exploitation

Apr 29, 2025 -

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025

Latest Posts

-

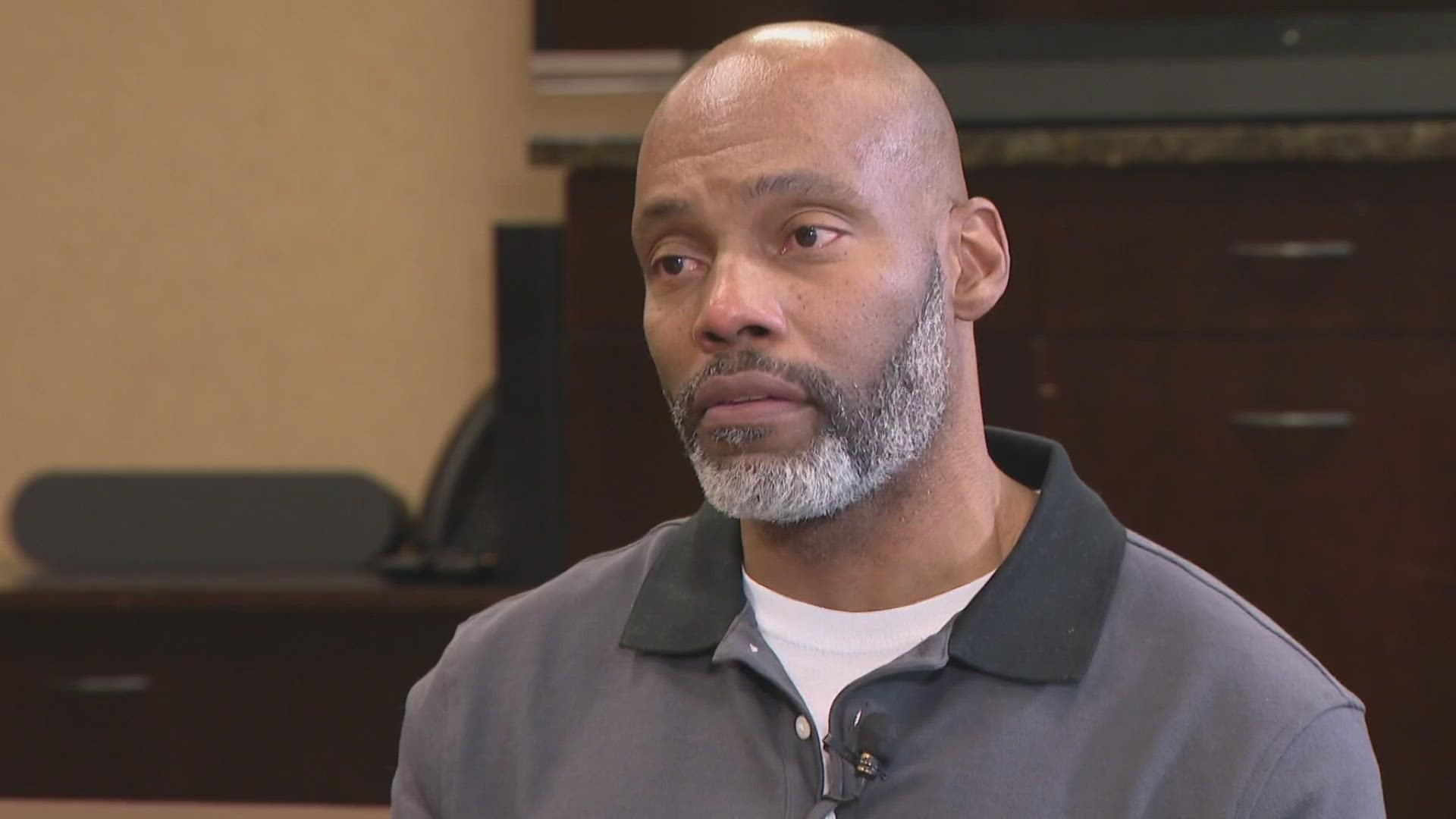

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025 -

Parole Hearing Looms For Ohio Doctor Convicted Of Killing Wife 36 Years Ago

Apr 29, 2025

Parole Hearing Looms For Ohio Doctor Convicted Of Killing Wife 36 Years Ago

Apr 29, 2025 -

36 Years Later Ohio Doctors Son Confronts Fathers Past Ahead Of Parole Hearing

Apr 29, 2025

36 Years Later Ohio Doctors Son Confronts Fathers Past Ahead Of Parole Hearing

Apr 29, 2025 -

Son Grapples With Emotion As Ohio Doctor Convicted Of Wifes Murder Faces Parole

Apr 29, 2025

Son Grapples With Emotion As Ohio Doctor Convicted Of Wifes Murder Faces Parole

Apr 29, 2025 -

Ohio Doctors Parole Hearing Sons Struggle 36 Years After Mothers Murder

Apr 29, 2025

Ohio Doctors Parole Hearing Sons Struggle 36 Years After Mothers Murder

Apr 29, 2025