Affirm Holdings (AFRM) IPO Halted: Examining The Impact Of Trump Tariffs

Table of Contents

The Trump Tariffs and Their Economic Ripple Effects

Understanding the Trump Tariff Policies:

The Trump administration's trade policies, characterized by aggressive tariffs on imported goods from various countries, significantly reshaped the global economic landscape. These protectionist measures aimed to boost domestic industries but resulted in widespread economic consequences.

- Specific examples: Significant tariffs were imposed on steel, aluminum, and various consumer goods from China and other nations.

- Industries affected: Manufacturing, agriculture, and technology sectors experienced substantial disruptions due to increased input costs and reduced export markets.

- Economic consequences: Short-term effects included increased prices for consumers and businesses, while long-term impacts included slower economic growth and increased trade tensions.

The Impact on Fintech and the Payment Processing Sector:

The fintech sector, including payment processing companies like Affirm, wasn't immune to the ripple effects of the trade war. Increased costs and supply chain disruptions significantly impacted their operations.

- Increased costs: Tariffs on imported components, software licenses, or server hardware directly raised operational expenses for many fintech companies.

- Supply chain disruptions: Disruptions in global supply chains led to delays in product delivery and increased uncertainty in procurement strategies.

- Investor sentiment: The overall economic uncertainty created by the trade war negatively affected investor sentiment, making it challenging for companies to secure funding and proceed with IPOs.

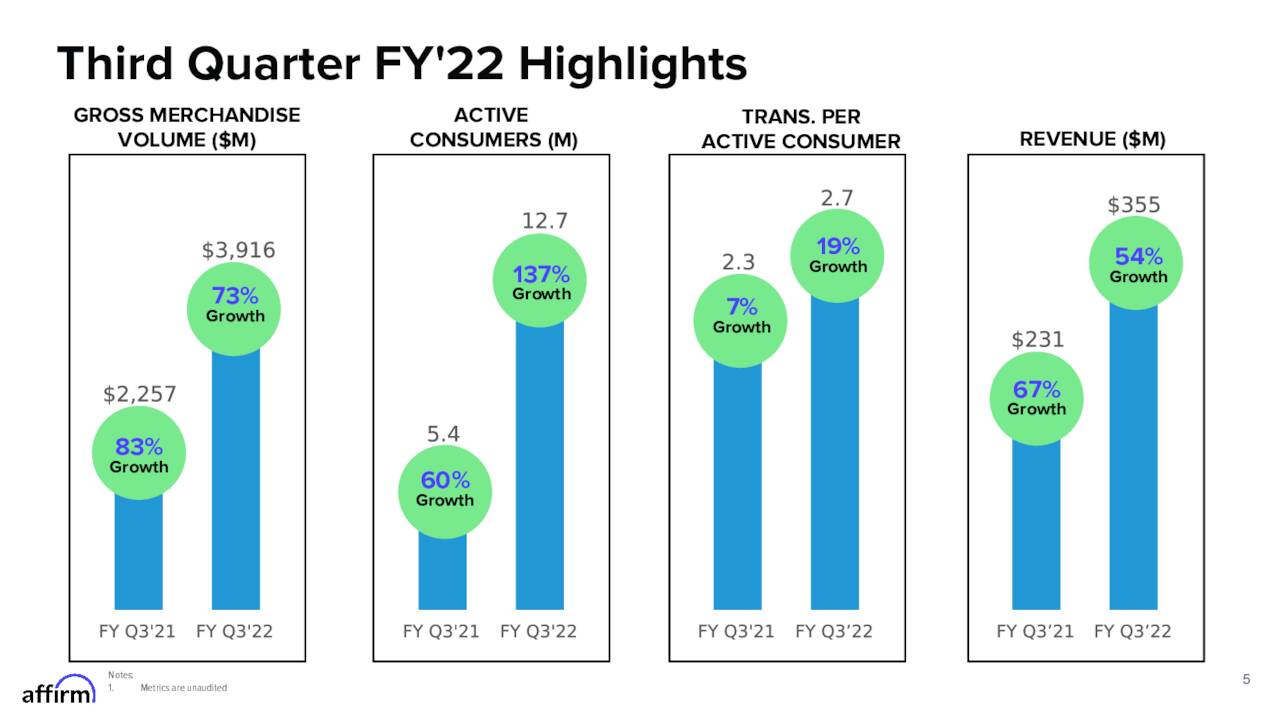

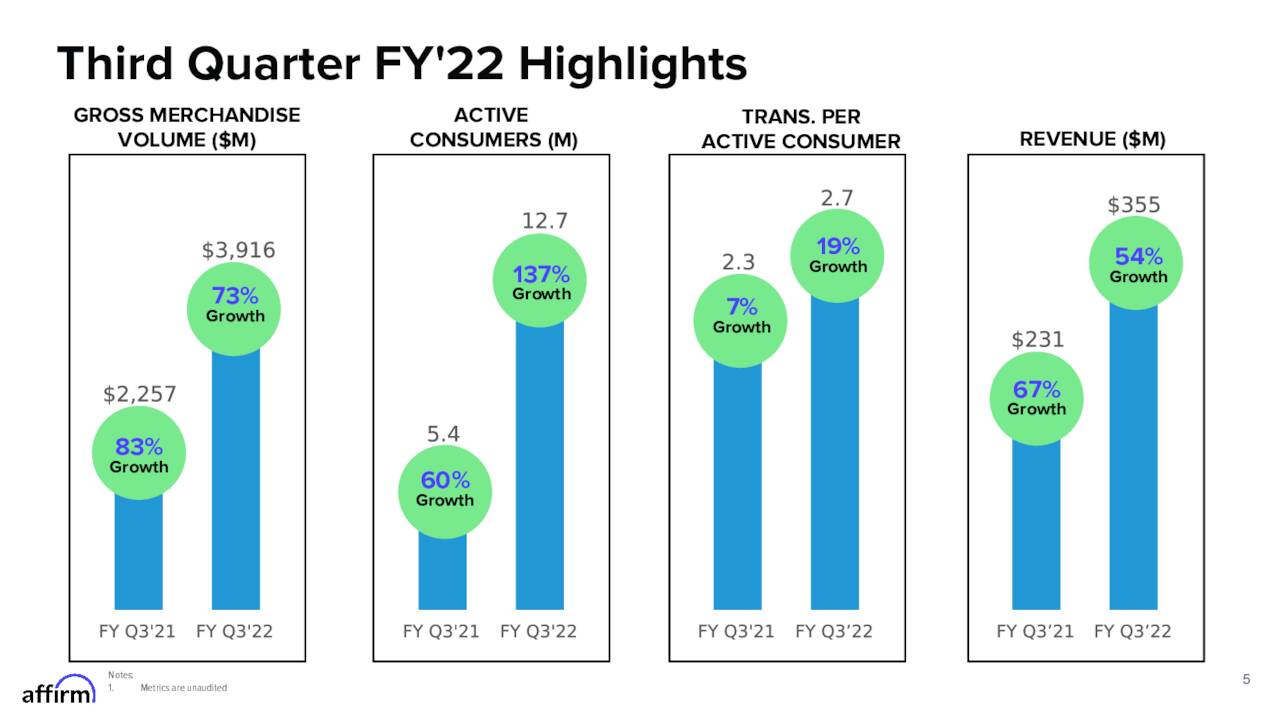

Affirm Holdings (AFRM) and its Vulnerability to Trade Tensions:

Affirm Holdings, operating in the buy-now-pay-later (BNPL) sector, is susceptible to macroeconomic shifts. While not directly involved in manufacturing, its operations are indirectly impacted by broader economic conditions.

- Supply chain analysis: Affirm's reliance on technology and potentially imported components for its infrastructure makes it vulnerable to cost increases resulting from tariffs.

- Impact on profitability: Higher operational costs, stemming from tariffs and supply chain issues, could directly reduce Affirm's profitability, making it less attractive to investors.

- Consumer spending impact: The trade war's effects on consumer confidence and disposable income could negatively affect consumer spending, a crucial driver of Affirm's business model.

Alternative Explanations for the AFRM IPO Delay

Market Conditions and Investor Sentiment:

Beyond the potential influence of Trump tariffs, several other factors could have contributed to the AFRM IPO delay.

- Market volatility: Periods of heightened market volatility and investor risk aversion can lead to companies postponing IPOs to secure better valuations.

- BNPL competition: The competitive landscape within the BNPL sector is intense, with several established players and new entrants. This competition could have influenced Affirm's IPO timing strategy.

- Company-specific factors: Internal factors such as strategic adjustments, financial performance reviews, or management changes could also play a role in an IPO delay.

Regulatory Scrutiny and Compliance:

Regulatory hurdles and compliance requirements are inherent in the IPO process, especially within the heavily regulated fintech industry.

- Regulatory changes: Changes in financial regulations or compliance standards could necessitate delays to ensure complete compliance before going public.

- Compliance challenges: Meeting all regulatory requirements is a complex and time-consuming process, potentially delaying the IPO timeline.

- Legal issues: Any pending legal issues or investigations could also influence a company's decision to postpone its IPO.

Conclusion: Assessing the Long-Term Implications for Affirm Holdings (AFRM)

While the exact reasons behind the Affirm Holdings (AFRM) IPO delay remain undisclosed, our analysis suggests that the lingering effects of Trump-era tariffs, coupled with broader market conditions and regulatory factors, likely played a significant role. The impact of increased operational costs, supply chain disruptions, and altered consumer spending patterns cannot be ignored. The long-term prospects of Affirm Holdings will depend on its ability to navigate these challenges and adapt to the evolving economic landscape. Its success hinges on maintaining profitability amidst increased competition within the BNPL market.

To stay informed about the Affirm Holdings (AFRM) IPO and its future trajectory, continue monitoring news and financial reports related to the company and broader trends in the fintech and trade sectors. Further research into the impact of trade policies on the initial public offering process of similar companies would provide valuable insights into this complex issue.

Featured Posts

-

Rachel Zegler Attends Snow White Spain Premiere Gal Gadots Absence Explained

May 14, 2025

Rachel Zegler Attends Snow White Spain Premiere Gal Gadots Absence Explained

May 14, 2025 -

Perspectives De Production D Eramet Pour 2025 Analyse Des Resultats Q1

May 14, 2025

Perspectives De Production D Eramet Pour 2025 Analyse Des Resultats Q1

May 14, 2025 -

Liverpools E60m Pursuit All Out Effort For Transfer Target

May 14, 2025

Liverpools E60m Pursuit All Out Effort For Transfer Target

May 14, 2025 -

The Deeper Meaning Behind That Suits La Ghost Scene

May 14, 2025

The Deeper Meaning Behind That Suits La Ghost Scene

May 14, 2025 -

Lindts Central London Chocolate Paradise A Sweet New Destination

May 14, 2025

Lindts Central London Chocolate Paradise A Sweet New Destination

May 14, 2025