America's Market Outlook: Moody's 5% 30-Year Yield Prediction And Its Effect On Sales

Table of Contents

Understanding Moody's 5% 30-Year Yield Prediction

Moody's 5% 30-year yield prediction signifies a substantial increase in long-term interest rates. Several factors contribute to this forecast:

- Persistent Inflation: Elevated inflation rates, stubbornly resisting Federal Reserve efforts, necessitate higher interest rates to cool down the economy and curb price increases.

- Strong Economic Growth (potentially): While growth is slowing, a continued, albeit slower, pace of economic expansion could also contribute to higher rates. The Fed would aim to moderate, not halt, growth.

- Federal Reserve Policy: The Federal Reserve's monetary policy plays a crucial role. Their decisions on interest rate hikes directly influence the yield on Treasury bonds, impacting the overall cost of borrowing.

Historical Context: Historically, 30-year Treasury yields have fluctuated considerably. Comparing Moody's prediction to past trends reveals that a 5% yield represents a significant upward shift compared to the recent low-yield environment. [Insert relevant chart/graph comparing historical 30-year Treasury yields with Moody's prediction]. This shift signals a notable change in the long-term cost of borrowing.

Market Reaction: The initial market reaction to Moody's prediction was mixed. While some sectors experienced a dip, others remained relatively stable. Bond yields generally rose, reflecting the expectation of higher interest rates. Stock market fluctuations were observable, particularly in sectors highly sensitive to interest rate changes.

Impact on the Housing Market

The 30-year Treasury yield has a direct correlation with mortgage rates. A 5% yield translates to significantly higher mortgage rates, making homeownership less affordable.

- Mortgage Rates: Expect a considerable increase in mortgage rates, potentially pricing many prospective homebuyers out of the market.

- Housing Sales: A decline in both new and existing home sales is highly probable, leading to a slowdown in the housing market. Analysts are already predicting a downturn in sales volume. [Cite data from sources like NAR, Zillow etc.].

- Construction Industry: Reduced demand for new homes will negatively impact the construction industry, potentially leading to job losses and decreased investment in new housing projects.

Influence on Business Investment and Lending

Higher interest rates directly impact the cost of borrowing for businesses.

- Corporate Borrowing Costs: Increased borrowing costs make expansion plans, capital expenditures, and mergers & acquisitions less attractive for corporations. Companies may delay or cancel projects, impacting economic growth.

- Small Business Lending: Small businesses, often reliant on loans for operations and growth, are particularly vulnerable to higher interest rates. This could lead to reduced hiring and slower expansion.

- Consumer Spending: Higher interest rates translate to higher credit card and loan repayments, reducing disposable income and potentially dampening consumer spending. This will affect economic growth.

Effect on the Automotive Industry

The automotive industry is heavily reliant on financing.

- Auto Loan Rates: Higher 30-year Treasury yields will lead to higher auto loan interest rates, making car purchases more expensive.

- New Car Sales: Expect a decline in new car sales as consumers become more hesitant to take on larger loan payments.

- Used Car Market: The used car market might experience a temporary boost as consumers seek more affordable alternatives, but this is likely to be short-lived.

Overall Economic Implications and Mitigation Strategies

Moody's 5% 30-year yield prediction holds significant implications for the overall economy:

- Inflation Control: While higher interest rates aim to control inflation, the potential negative effects on economic growth raise concerns about a potential recessionary scenario.

- Economic Growth: The combination of reduced consumer spending, decreased business investment, and a cooling housing market could significantly slow down economic growth.

- Strategies for Businesses: Businesses can mitigate the negative impact by implementing cost-cutting measures, exploring alternative financing options, and focusing on operational efficiency. Diversification of revenue streams could also reduce vulnerability.

Conclusion: Navigating the Market with Moody's 5% 30-Year Yield Prediction

Moody's 5% 30-year yield prediction paints a complex picture for the US economy. The potential impact on housing, business investment, and consumer spending warrants careful attention. Understanding the implications of Moody's 30-year yield forecast is crucial for making informed decisions. To prepare for Moody's 5% 30-year yield prediction, businesses need to adapt and strategize to navigate the challenges presented by higher interest rates. Stay informed about economic trends and proactively implement strategies to mitigate the risks associated with Moody's interest rate prediction. By understanding these potential impacts, individuals and businesses can better position themselves to weather the economic storm.

Featured Posts

-

Analyzing Amorims Major Signing For Manchester United

May 20, 2025

Analyzing Amorims Major Signing For Manchester United

May 20, 2025 -

Jalkapallo Friisin Avauskokoonpano Yllaettaeae Kamara Ja Pukki Vaihdossa

May 20, 2025

Jalkapallo Friisin Avauskokoonpano Yllaettaeae Kamara Ja Pukki Vaihdossa

May 20, 2025 -

Todays Nyt Mini Crossword Solution March 13

May 20, 2025

Todays Nyt Mini Crossword Solution March 13

May 20, 2025 -

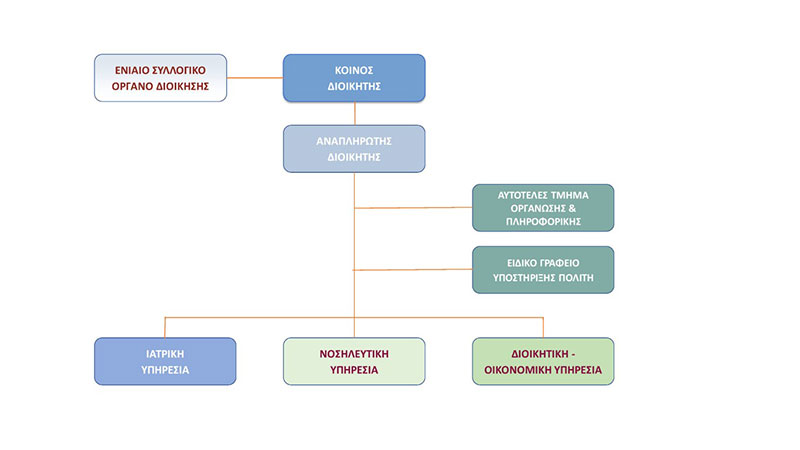

Efimeries Iatron Patras Savvatokyriako Pliris Lista

May 20, 2025

Efimeries Iatron Patras Savvatokyriako Pliris Lista

May 20, 2025 -

Snl Celebrates 50 Years With A Historic Season Finale

May 20, 2025

Snl Celebrates 50 Years With A Historic Season Finale

May 20, 2025