Amsterdam Stock Exchange Plunges 2% After Trump's Tariff Increase

Table of Contents

The Immediate Impact on the AEX Index

The AEX, Amsterdam's benchmark stock index, suffered a sharp 2% decline – its largest single-day drop in the last six months – immediately after the announcement of the new tariffs. The index closed at [Insert Closing Value] compared to [Insert Previous Day's Closing Value], representing a considerable loss for investors. This downturn wasn't evenly distributed across all sectors. The technology and financial sectors were particularly hard hit.

- AEX Index falls by 2%, the largest single-day drop in six months.

- ASML Holding, a major player in the semiconductor industry, saw its stock price decrease by 2.5%.

- ING Groep, a major Dutch financial institution, experienced a 3% drop in its share price.

- The energy sector, heavily reliant on global trade, also felt the impact, with Shell's stock price declining by 1.8%.

- The sector most vulnerable proved to be exports, particularly those heavily reliant on US trade relationships.

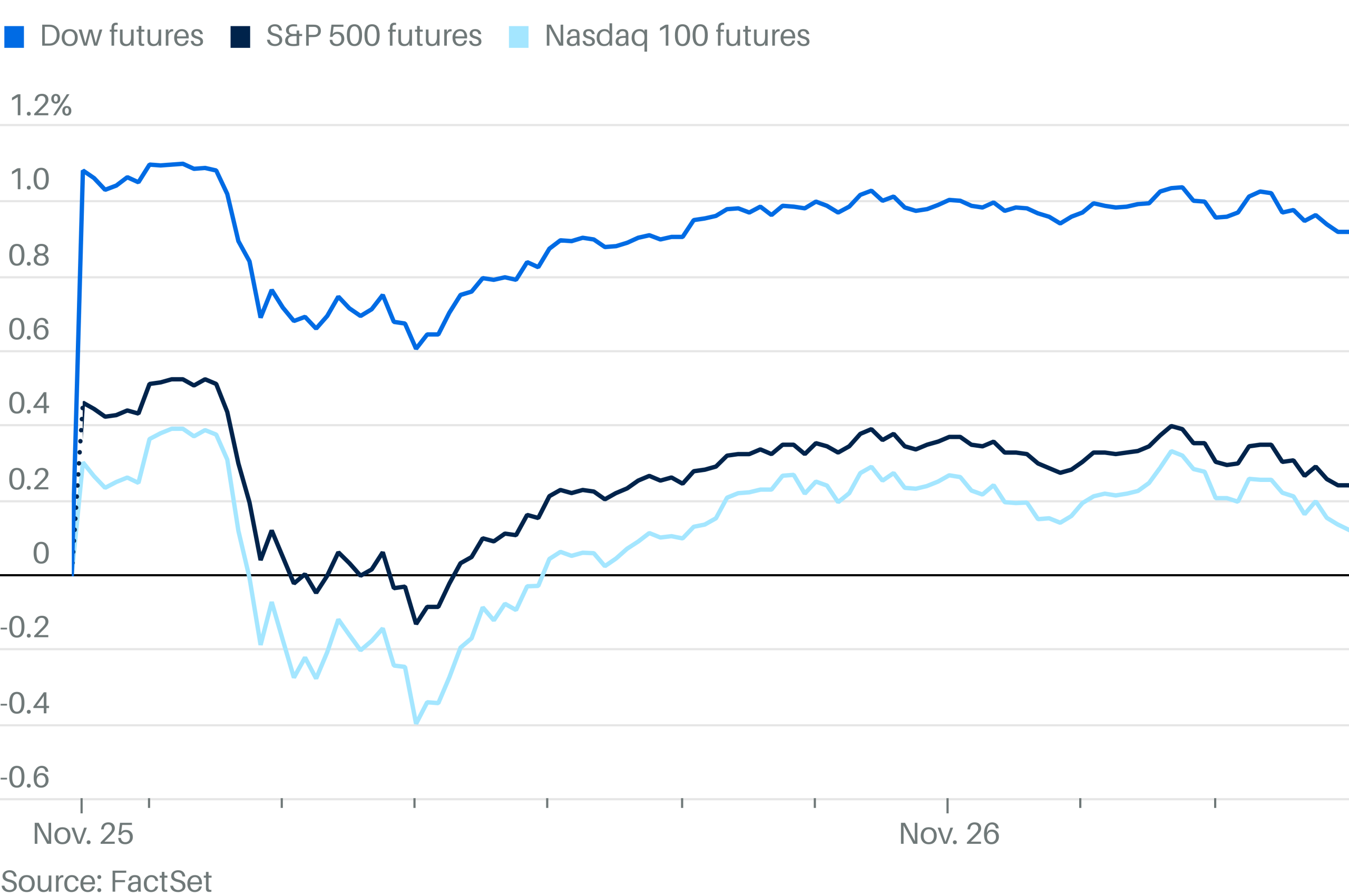

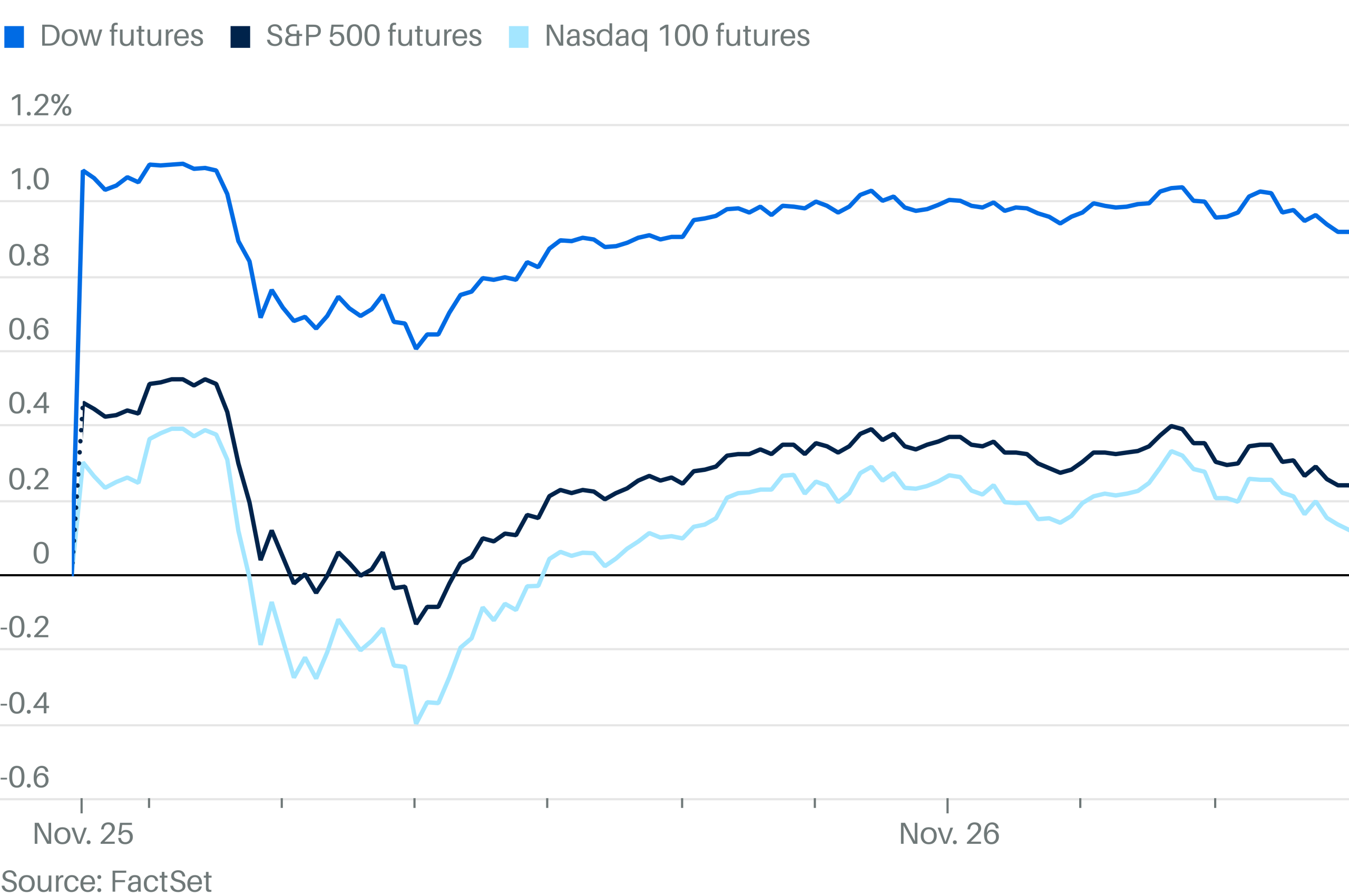

Global Market Reactions and Spillover Effects

The negative impact of Trump's tariff increase wasn't confined to the Amsterdam Stock Exchange. Other major European stock exchanges, including those in London, Frankfurt, and Paris, also experienced noticeable declines, though less severe than Amsterdam's. The Euro weakened against the US dollar, further reflecting the growing uncertainty in the market.

- Negative impact observed across European markets, with the FTSE 100 in London dropping by 1.5%.

- Euro weakens against the US dollar, falling to [Insert Exchange Rate].

- Increased volatility in global commodity markets, with oil prices slightly decreasing.

- Investor sentiment across the board displayed significant negative shifts as fear of escalating trade wars spread.

Analysis of Trump's Tariff Increase and its Implications

President Trump's tariff increase targets [Specify the goods affected by the tariff increase]. This directly impacts key Dutch export sectors, potentially leading to significant economic consequences for the Netherlands and the wider European Union. Economists predict a possible contraction in GDP growth and a potential escalation of the trade war with retaliatory tariffs from the EU.

- Tariffs target key Dutch export sectors, including agriculture and manufacturing.

- Potential for retaliatory tariffs from the EU, further exacerbating the trade war.

- Long-term implications for trade relations between the US and EU remain uncertain.

- Analysts at [Name of reputable financial institution] predict a slowdown in economic growth for the Netherlands in the next quarter.

Potential Strategies for Investors in the Wake of the Plunge

The recent plunge in the Amsterdam Stock Exchange presents both challenges and opportunities for investors. Navigating this uncertain market requires careful planning and diversification.

- Diversify portfolio across different asset classes: Reduce reliance on any single sector or region.

- Consider hedging strategies against further market volatility: Protect investments from further potential losses.

- Opportunities for long-term investors to buy undervalued stocks: The downturn could present buying opportunities for those with a long-term investment horizon.

- Consult a financial advisor: Seek professional advice tailored to your specific circumstances.

Conclusion: Navigating the Amsterdam Stock Exchange After the Tariff-Induced Plunge

The 2% drop in the Amsterdam Stock Exchange following Trump's tariff hike underscores the significant impact of trade policy on global markets. The subsequent reactions in other European markets and the weakening Euro further highlight the interconnectedness of the global economy. Understanding the implications of this tariff increase is crucial for investors seeking to navigate the current uncertainty. Stay updated on the latest developments affecting the Amsterdam Stock Exchange and make informed investment decisions by regularly monitoring market news and consulting with financial advisors. [Link to relevant financial news source]

Featured Posts

-

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025 -

Ferrari 296 Speciale Potencia Hibrida De 880 Cv Revelada

May 24, 2025

Ferrari 296 Speciale Potencia Hibrida De 880 Cv Revelada

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025 -

Mia Farrow And Sadie Sink A Broadway Encounter

May 24, 2025

Mia Farrow And Sadie Sink A Broadway Encounter

May 24, 2025 -

Nyt Mini Crossword Answers For March 12 2025

May 24, 2025

Nyt Mini Crossword Answers For March 12 2025

May 24, 2025