Amsterdam Stock Market Opens 7% Lower: Trade War Fears Dominate

Table of Contents

Trade War Fears as the Primary Catalyst

The primary catalyst behind this dramatic decline in the Amsterdam Stock Exchange is the intensifying US-China trade war. Escalating trade tensions, characterized by the imposition of new tariffs and trade restrictions, are creating a climate of profound economic uncertainty. This uncertainty is not confined to the US and China; it's a global phenomenon impacting even seemingly distant markets like the Netherlands. The recent announcement of [insert specific example of a new tariff or trade restriction] further fueled the market's downward spiral. Keywords: US-China trade relations, tariffs, trade disputes, global trade, economic sanctions.

- Specific examples of new tariffs or trade restrictions: The recent increase in tariffs on [specific product category] by the US government, and the subsequent retaliatory measures imposed by China, are significant contributing factors.

- Statements from key political figures or economists regarding the situation: Experts like [Name of economist/political figure] have warned that the current trajectory of the trade war could lead to a global economic slowdown. Their statements highlight the growing concern amongst financial analysts.

- Mention the impact of uncertainty on business investment and consumer confidence: The pervasive uncertainty is dampening business investment and eroding consumer confidence, creating a negative feedback loop that exacerbates the market decline.

Impact on Key Sectors of the Amsterdam Stock Market

The impact of the trade war is not uniform across all sectors of the Amsterdam Stock Market. Export-oriented industries and technology companies, significant components of the AEX index, have been particularly hard hit. These sectors are highly vulnerable because of their reliance on international trade and global supply chains. Disruptions caused by tariffs and trade restrictions directly translate into reduced sales and profitability for these businesses. Keywords: AEX index components, sector performance, export-dependent businesses, technological stocks, investment strategy.

- Performance data for specific companies or sectors: [Company X], a major player in the [sector] sector, saw its stock price decline by [percentage] today, reflecting the broader market trend.

- Quotes from analysts explaining the sector-specific impacts: Analysts at [Financial institution] predict that the export-oriented sectors will continue to face headwinds in the coming months.

- Predictions for future performance of these sectors: The outlook for these vulnerable sectors remains uncertain, dependent on the future trajectory of the trade war and any potential government interventions.

Investor Sentiment and Market Volatility

The Amsterdam Stock Market crash reflects a broader shift in investor sentiment. A wave of risk aversion has swept through the markets, leading to heightened market volatility. Investors are reacting to the uncertainty by selling off assets perceived as riskier and seeking refuge in safer investments, such as government bonds. This flight to safety further contributes to the market's downward pressure. Keywords: investor confidence, market volatility, risk aversion, safe haven assets, investment portfolio.

- Data illustrating increased volatility (e.g., increased trading volume, wider price swings): Trading volume on the AEX has increased significantly today, indicating heightened anxiety amongst investors.

- Analysis of investor behavior patterns: The current market behavior is consistent with periods of heightened uncertainty and risk aversion.

- Expert opinions on the likely duration of market volatility: Experts believe that the market volatility will likely persist until there is greater clarity regarding the future of the US-China trade relations.

Potential Short-Term and Long-Term Consequences

The 7% drop in the Amsterdam Stock Exchange is more than a simple market fluctuation; it points to potential short-term and long-term consequences for the Dutch economy and the global market. In the short term, we could see further market declines and an economic slowdown. Long-term implications might include shifts in global trade patterns, forcing businesses to re-evaluate their supply chains and investment strategies. Keywords: economic forecast, market prediction, long-term investment, global economic outlook, economic recession.

- Expert predictions on the market's recovery timeline: Analysts are divided on the market's recovery timeline, with some predicting a rebound in the near future and others forecasting a more prolonged period of uncertainty.

- Discussion of potential government responses or interventions: The Dutch government might consider implementing measures to mitigate the negative impacts of the trade war on the national economy.

- Exploration of alternative investment opportunities: Investors are increasingly exploring alternative investment opportunities, seeking assets less vulnerable to the ongoing trade disputes.

Conclusion: Navigating the Amsterdam Stock Market Decline Amidst Trade War Fears

The 7% plunge in the Amsterdam Stock Market underscores the significant impact of escalating trade war anxieties on even seemingly insulated markets. The primary factor driving this sharp decline is the ongoing US-China trade conflict, creating uncertainty that's rippling across global markets and impacting key sectors in the Netherlands. This situation highlights the interconnectedness of the global economy and the need for investors to remain vigilant. To navigate this turbulent period effectively, stay updated on Amsterdam Stock Market news and follow expert analysis to make informed investment decisions. Keywords: Amsterdam Stock Exchange, AEX index, trade war impact, investment advice, market analysis, financial news. Understanding the complexities of the trade war and its impact on global markets is crucial for making sound investment choices in the current climate. Stay informed and adapt your investment strategy accordingly.

Featured Posts

-

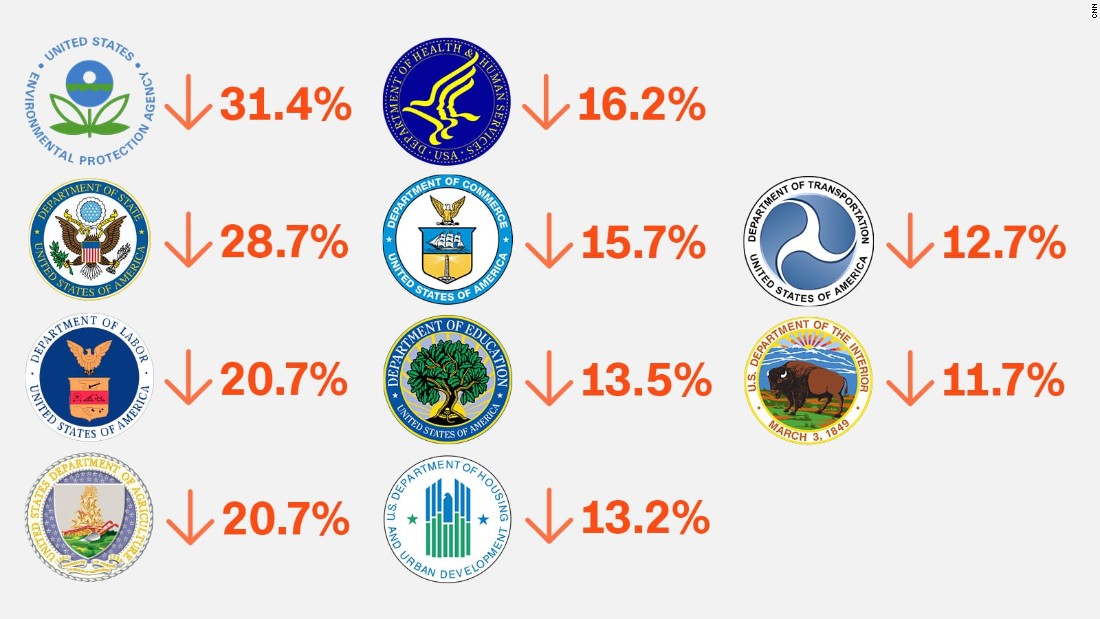

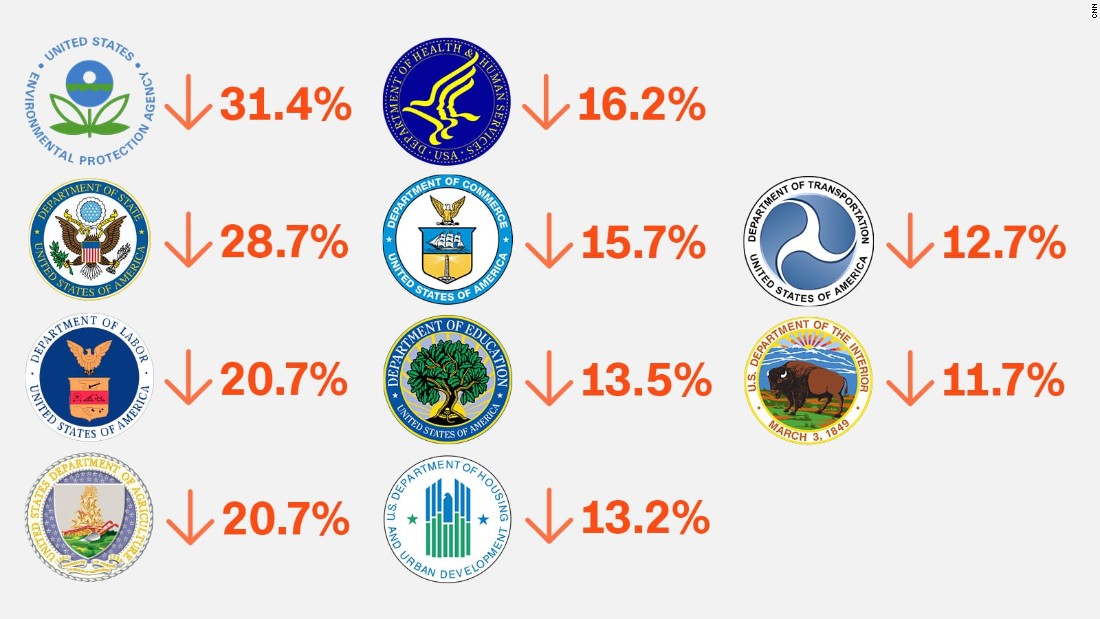

Saving Our Museums The Urgent Need For Funding After Trumps Budget Cuts

May 24, 2025

Saving Our Museums The Urgent Need For Funding After Trumps Budget Cuts

May 24, 2025 -

Changes To Italian Citizenship Law Great Grandparent Lineage Explained

May 24, 2025

Changes To Italian Citizenship Law Great Grandparent Lineage Explained

May 24, 2025 -

The Importance Of Middle Managers A Key To Employee Engagement And Productivity

May 24, 2025

The Importance Of Middle Managers A Key To Employee Engagement And Productivity

May 24, 2025 -

Impact Of Slowing Growth Sse Reduces Spending By 3 Billion

May 24, 2025

Impact Of Slowing Growth Sse Reduces Spending By 3 Billion

May 24, 2025 -

Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025

Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025

Latest Posts

-

From Scatological Data To Podcast Insights Ai Digest For Repetitive Documents

May 24, 2025

From Scatological Data To Podcast Insights Ai Digest For Repetitive Documents

May 24, 2025 -

Saving Our Museums The Urgent Need For Funding After Trumps Budget Cuts

May 24, 2025

Saving Our Museums The Urgent Need For Funding After Trumps Budget Cuts

May 24, 2025 -

Funding Crisis How Trumps Budget Impacts Museum Education And Outreach

May 24, 2025

Funding Crisis How Trumps Budget Impacts Museum Education And Outreach

May 24, 2025 -

Analyzing The Impact Of Trumps Cuts On Museum Programming And Accessibility

May 24, 2025

Analyzing The Impact Of Trumps Cuts On Museum Programming And Accessibility

May 24, 2025 -

The Future Of Museum Programs In The Wake Of Trumps Budget Decisions

May 24, 2025

The Future Of Museum Programs In The Wake Of Trumps Budget Decisions

May 24, 2025