Amsterdam Stock Market: Three Days Of Major Losses Totaling 11%

Table of Contents

Analyzing the Three Days of Decline: A Day-by-Day Breakdown

Day 1: Initial Shock and Key Sector Impacts

- Percentage Drop: The Amsterdam AEX index fell by 4.2% on Day 1, marking the beginning of a significant market downturn.

- Sectors Hit Hardest: The technology, energy, and financial sectors were particularly hard hit, experiencing disproportionately large losses.

- Reasons for Impact: The technology sector suffered due to concerns about rising interest rates and decreased investor confidence in growth stocks. The energy sector felt the pressure of fluctuating oil prices and geopolitical instability. Financial institutions faced increased uncertainty surrounding potential loan defaults. This initial shock highlighted the interconnectedness of the global and Amsterdam Stock Market. The increased stock market volatility became immediately apparent.

Day 2: Contagion and Investor Sentiment

- Percentage Drop: Day 2 saw a further decline of 3.8%, intensifying the market downturn.

- Spread of Losses: The losses from Day 1 spread to other sectors, including consumer goods and healthcare, as market panic intensified.

- Negative Sentiment: Negative news headlines and reports of further economic uncertainty fueled negative investor sentiment, leading to a sharp decrease in trading volume as many investors opted to stay on the sidelines. This further contributed to the Amsterdam AEX index decline.

Day 3: Attempts at Recovery and the Closing Figures

- Percentage Change: Day 3 saw a slight recovery, with a 3% increase in the Amsterdam AEX index. This modest rebound, however, wasn't enough to offset the substantial losses from the previous two days.

- Attempts at Stabilization: While no direct intervention by the Netherlands central bank was immediately announced, market analysts observed subtle shifts in monetary policy signaling a potential future response to the market downturn.

- Closing Figures: The three-day period resulted in an overall loss of 11% for the Amsterdam Stock Market, highlighting the severity of the situation.

Understanding the Underlying Causes of the Amsterdam Stock Market Crash

Global Economic Factors

The current global economic climate played a significant role in the Amsterdam Stock Market's decline. Global recession fears, fueled by persistent inflationary pressures and ongoing geopolitical risk, have created widespread uncertainty. Rising interest rates in major economies also contributed to the sell-off, reducing the attractiveness of riskier assets.

Specific Factors Affecting the Netherlands

Besides global factors, several specific issues impacted the Netherlands. The ongoing energy crisis in Europe, coupled with a cooling housing market, significantly impacted investor confidence. Government policy decisions regarding energy subsidies and housing regulations also played a role, adding to the existing Dutch economy challenges. The Netherlands central bank's monetary policy, aligned with the European Union impact, also added further pressure.

Potential Implications and Future Outlook for the Amsterdam Stock Market

Short-Term Implications

The short-term implications of this market crash are significant. Investors experienced substantial losses, and businesses face challenges securing funding. The potential for job losses and business failures is a major concern, adding to the existing economic fallout. Short-term investment strategies are likely to focus on risk mitigation.

Long-Term Outlook

The long-term outlook for the Amsterdam Stock Market remains uncertain. While a full market recovery is anticipated, the timeline is unclear. The resilience of the Dutch economy and the effectiveness of any government interventions will be crucial determinants. Experts suggest the long-term investment climate will depend on successfully navigating global economic headwinds and addressing domestic challenges. Continued analysis of the market correction will provide crucial insights. Positive economic growth will ultimately fuel market recovery.

Conclusion: Navigating the Volatility of the Amsterdam Stock Market

The three-day decline in the Amsterdam Stock Market highlights the interconnectedness of global and local economic factors. The sharp drop, driven by a combination of global uncertainties and specific challenges facing the Netherlands, resulted in significant losses for investors and raised concerns about the country's economic outlook. Understanding the intricacies of the Amsterdam Stock Market is essential for navigating its volatility.

Key takeaways include the severity of the 11% loss, the impact of global economic uncertainty and domestic challenges, and the uncertain, yet hopeful, long-term outlook.

Stay updated on the latest developments in the Amsterdam Stock Market by following reputable financial news sources. Understanding the dynamics of the Amsterdam Stock Market is crucial for making informed investment decisions.

Featured Posts

-

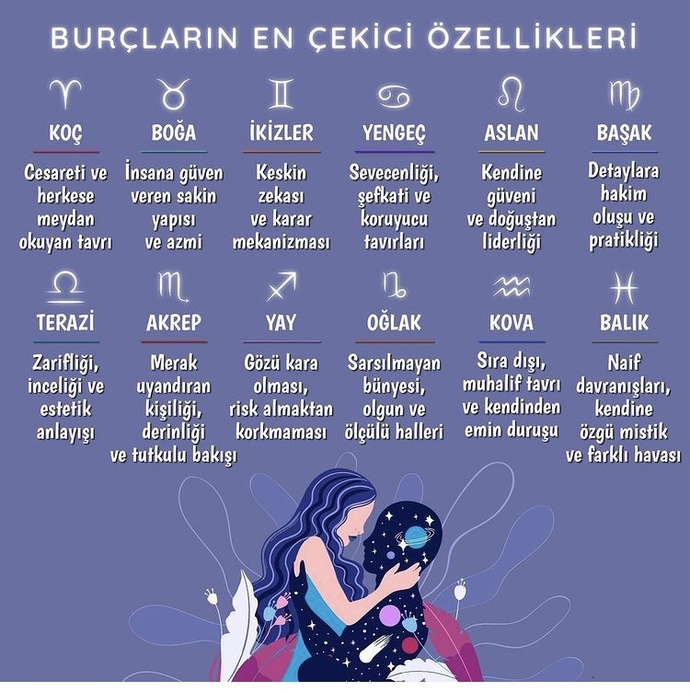

Zeka Duenyasinda Burclarin Siralamasi En Akilci Burclar

May 24, 2025

Zeka Duenyasinda Burclarin Siralamasi En Akilci Burclar

May 24, 2025 -

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Best Of Bangladesh In Europe 2nd Edition A Platform For Collaboration And Development

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition A Platform For Collaboration And Development

May 24, 2025 -

The Top 10 Us Beaches For 2025 A Dr Beach Ranking

May 24, 2025

The Top 10 Us Beaches For 2025 A Dr Beach Ranking

May 24, 2025 -

Your Escape To The Country Choosing The Right Location And Lifestyle

May 24, 2025

Your Escape To The Country Choosing The Right Location And Lifestyle

May 24, 2025