Amsterdam Stocks Suffer 7% Drop As Trade War Anxiety Rises

Table of Contents

Trade War Uncertainty: The Primary Culprit

Escalating global trade tensions are the primary driver behind the recent downturn in Amsterdam stocks. Investor confidence is fragile in the face of unpredictable trade policies and retaliatory tariffs. The US-China trade war, along with evolving EU trade policies, directly impact Amsterdam's economic landscape and its stock market performance. These international disputes create a climate of uncertainty, making investors hesitant to commit capital.

- Tariffs and Trade Restrictions: Tariffs imposed on Dutch exports by trading partners significantly impact the profitability of Amsterdam-based companies, particularly those heavily reliant on international trade. This directly translates to lower earnings and reduced stock valuations.

- Impact on Export-Oriented Businesses: Amsterdam has a robust export sector. Trade restrictions and increased costs associated with navigating trade barriers hamper the growth and profitability of these businesses, leading to reduced investment and job losses.

- Decreased Consumer Spending and Investment: The uncertainty surrounding trade wars creates a ripple effect, impacting consumer confidence and reducing overall spending and investment. This dampened economic activity directly translates into lower demand for goods and services, further impacting company performance and stock prices.

Impact on Key Amsterdam Sectors

The recent stock market drop hasn't affected all sectors equally. Technology, finance, and tourism – key pillars of the Amsterdam economy – have been particularly hard hit.

- Specific Company Examples: Several prominent technology firms in Amsterdam have seen their share prices decline significantly, reflecting the impact of trade tensions on global technology supply chains and consumer spending. Similarly, financial institutions are facing increased uncertainty and volatility in the market, leading to reduced profits. The tourism sector, heavily reliant on international travel, is also suffering due to reduced consumer spending and potential travel restrictions.

- Sector Vulnerabilities: The vulnerability of these sectors stems from their reliance on international trade and consumer confidence. Uncertainty regarding future trade policies makes it difficult for these businesses to plan for the future and invest in growth.

- Government Responses: The Dutch government has announced some measures to mitigate the economic impact of the trade war, including financial aid packages for affected businesses and initiatives to support exports. However, the effectiveness of these measures remains to be seen.

Investor Sentiment and Market Volatility

The prevailing negative investor sentiment is a major contributor to the market downturn. Fear and uncertainty are driving investors to sell off assets and seek safer investments.

- Market Volatility: The increased market volatility makes it challenging for investors to predict future returns, leading to a flight from riskier assets. This volatility impacts both short-term and long-term investment strategies.

- Foreign Investment: The trade war uncertainty is deterring foreign investment in Amsterdam, further weakening the market. International investors are hesitant to commit capital in a climate of such instability.

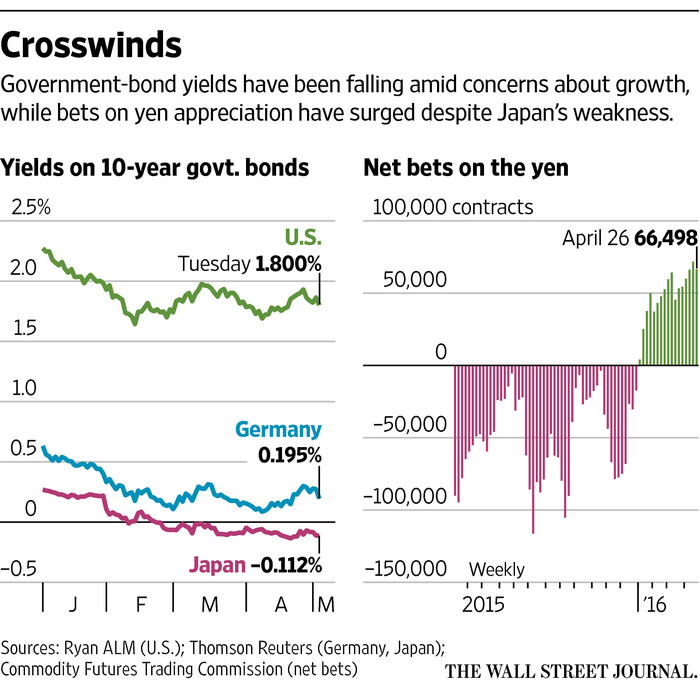

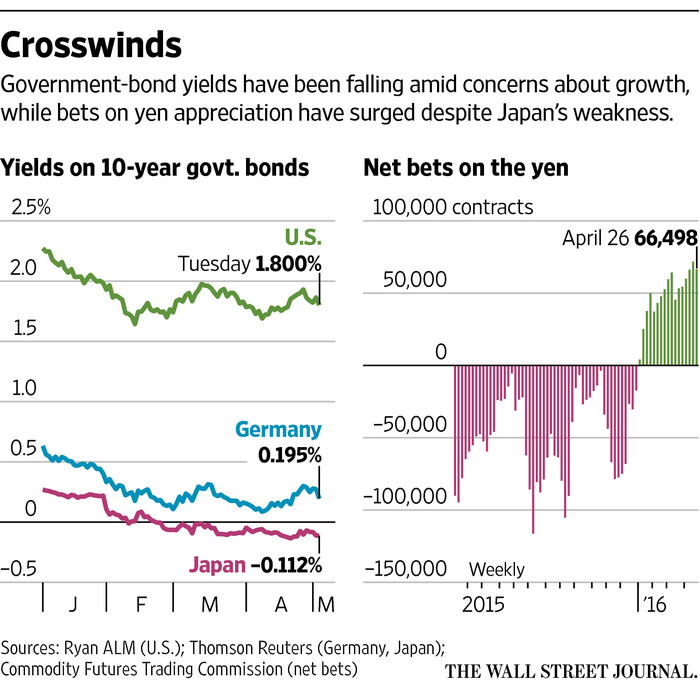

- Investor Behavior: Investors are adopting defensive strategies, selling off stocks and moving their assets into safer havens, such as government bonds or gold, contributing to the downward pressure on Amsterdam stocks.

Potential Future Scenarios and Recovery Strategies

Predicting the future of the Amsterdam stock market is challenging. However, several scenarios are possible:

- Optimistic Scenario: A resolution to the trade disputes could quickly restore investor confidence, leading to a market rebound.

- Pessimistic Scenario: Further escalation of trade tensions could lead to a more prolonged and severe downturn, impacting various sectors and the overall economy.

- Neutral Scenario: A period of prolonged uncertainty and volatility could persist, with slow and gradual market recovery.

To mitigate the impact of trade war anxiety, several strategies are available:

- Investment Diversification: Diversifying investments across different asset classes and geographic regions can help mitigate the impact of trade war uncertainty.

- Company Strategies: Companies can implement cost-cutting measures, explore new markets, and enhance their supply chain resilience to navigate the challenges.

- Government Intervention: Government intervention, such as targeted financial support and regulatory changes, can play a vital role in stabilizing the market and supporting affected businesses.

Conclusion: Navigating the Storm: Understanding Amsterdam Stocks and Trade War Anxiety

The 7% drop in Amsterdam stocks highlights the significant impact of trade war anxiety on the Dutch economy. The uncertainty surrounding global trade policies has negatively impacted investor sentiment, market volatility, and various key sectors in Amsterdam. Monitoring the situation closely and understanding the risks involved in investing in Amsterdam stocks during this period is crucial. Stay informed about developments in the global trade landscape and their impact on Amsterdam stocks. Further research into individual company performance and the implementation of appropriate investment strategies are essential to mitigate the risks associated with trade war anxieties. For more information on navigating these market conditions, consider exploring resources dedicated to international finance and investment strategies. [Link to relevant resources, if applicable]

Featured Posts

-

M56 Traffic Delays Collision Near Cheshire Deeside Border

May 24, 2025

M56 Traffic Delays Collision Near Cheshire Deeside Border

May 24, 2025 -

Chto My Nasleduem Dostizheniya Pokoleniya I Perspektivy Buduschego

May 24, 2025

Chto My Nasleduem Dostizheniya Pokoleniya I Perspektivy Buduschego

May 24, 2025 -

En Akilli Burclar Zeka Ve Basarida Yuekselenler

May 24, 2025

En Akilli Burclar Zeka Ve Basarida Yuekselenler

May 24, 2025 -

Maryland University Selects Kermit The Frog For 2025 Commencement

May 24, 2025

Maryland University Selects Kermit The Frog For 2025 Commencement

May 24, 2025 -

Brest Urban Trail Les Visages De La Course Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail Les Visages De La Course Benevoles Artistes Et Partenaires

May 24, 2025