Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value (NAV)

Table of Contents

How is the Amundi DJIA UCITS ETF NAV Calculated?

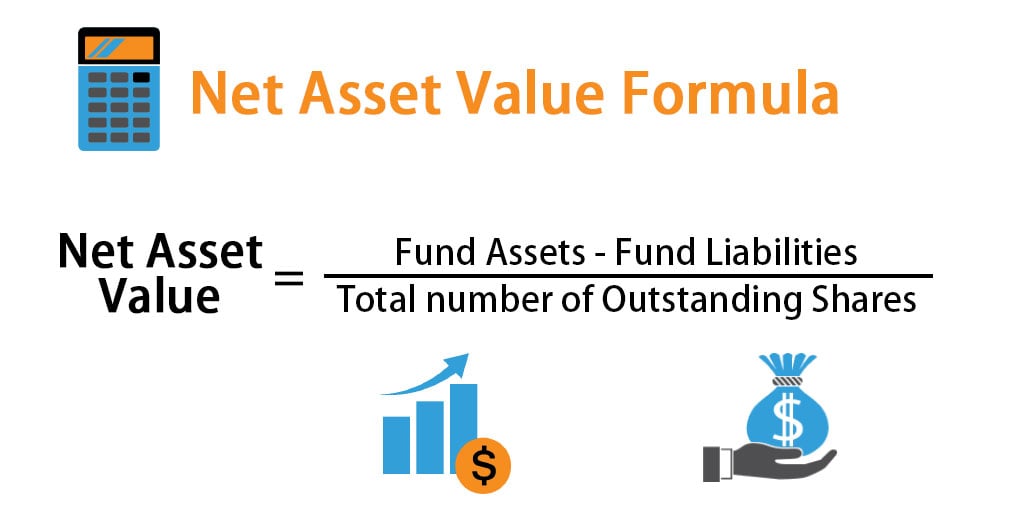

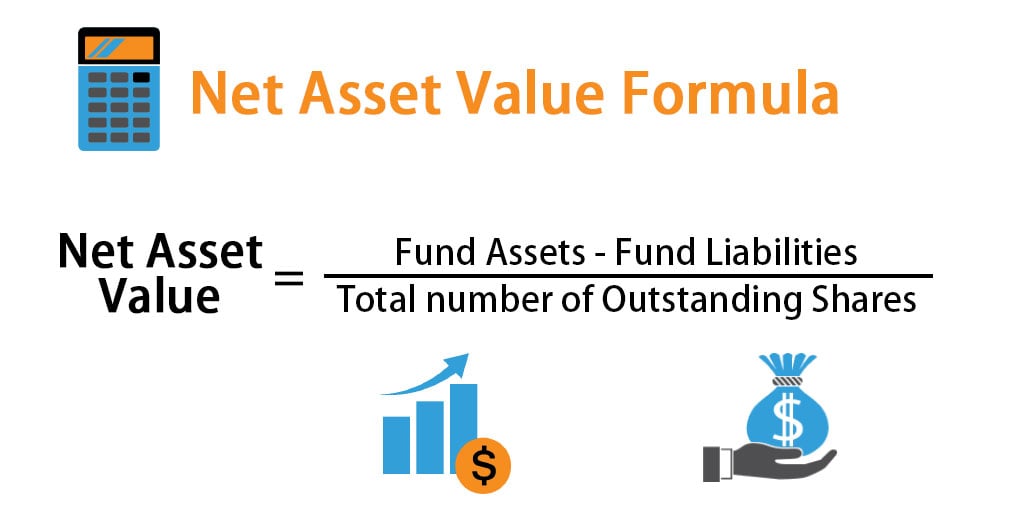

The Amundi DJIA UCITS ETF NAV, like any ETF's NAV, represents the net asset value of the fund's holdings per share. It's a crucial figure reflecting the underlying value of the ETF's portfolio. The calculation involves several key steps:

-

Determining the Market Value of Underlying Assets: This is the most significant component. The ETF's custodian bank determines the closing market prices of all the stocks comprising the Dow Jones Industrial Average that the Amundi DJIA UCITS ETF tracks. Each holding's market value is then calculated (number of shares × market price).

-

Accounting for Expenses and Liabilities: The total market value of the underlying assets is then adjusted for the fund's expenses, including management fees, and any other liabilities.

-

Calculating the NAV per Share: The net asset value (total assets minus liabilities) is then divided by the total number of outstanding ETF shares to arrive at the NAV per share. This figure is usually calculated daily, at the close of the market.

-

Currency Fluctuations: If the ETF holds assets denominated in currencies other than the ETF's base currency, exchange rate fluctuations will impact the NAV calculation. The custodian bank takes these fluctuations into account during the calculation process.

Factors Affecting Amundi DJIA UCITS ETF NAV

Several factors influence the daily fluctuations in the Amundi DJIA UCITS ETF NAV:

-

Movement of the Dow Jones Industrial Average (DJIA): The primary driver of the Amundi DJIA UCITS ETF NAV is the performance of the DJIA itself. An increase in the DJIA index generally leads to a rise in the ETF's NAV, and vice versa. This is because the ETF aims to replicate the DJIA's performance.

-

Currency Exchange Rate Fluctuations: Given the global nature of the Dow Jones Industrial Average components, changes in currency exchange rates can affect the NAV, particularly if a significant portion of the underlying assets is denominated in a currency different from the ETF's base currency.

-

Dividend Payouts from Underlying Stocks: When underlying companies in the DJIA pay dividends, this increases the fund’s assets and consequently impacts the NAV positively.

-

Management Fees and Expenses: The fund’s operating expenses, including management fees, reduce the overall assets of the fund, slightly decreasing the NAV.

-

Corporate Actions of Underlying Companies: Events such as stock splits, mergers, acquisitions, or spin-offs involving companies within the DJIA can affect the NAV, influencing the overall composition and value of the ETF’s holdings.

Accessing Amundi DJIA UCITS ETF NAV Information

Finding the Amundi DJIA UCITS ETF NAV is relatively straightforward:

-

Amundi's Official Website: The most reliable source is Amundi's official website, which typically provides up-to-date NAV information.

-

Financial News Websites and Data Providers: Reputable financial news sources and data providers such as Bloomberg, Yahoo Finance, and Google Finance usually list ETF NAV data, including for the Amundi DJIA UCITS ETF.

-

Brokerage Platforms: If you hold the Amundi DJIA UCITS ETF through a brokerage account, the platform will usually display the current and historical NAV.

-

ETF Data Aggregators: Several specialized ETF data aggregators provide comprehensive data on a wide range of ETFs, including NAV information for the Amundi DJIA UCITS ETF.

NAV vs. Market Price: Understanding the Difference

While closely related, the Amundi DJIA UCITS ETF NAV and its market price aren't always identical. The market price reflects the price at which the ETF shares are currently trading on the exchange. Several factors can cause discrepancies:

-

Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) creates a spread. This spread can lead to the market price temporarily deviating from the NAV.

-

Trading Volume: High trading volume generally leads to a market price closer to the NAV, while low trading volume can cause larger discrepancies.

Understanding this difference is crucial for making informed investment decisions. While the market price can fluctuate significantly throughout the trading day, the NAV provides a more accurate representation of the underlying asset value at a specific point in time.

Arbitrage Opportunities and NAV (Optional)

While less common with major ETFs like the Amundi DJIA UCITS ETF, significant discrepancies between NAV and market price can, in theory, create arbitrage opportunities for sophisticated investors. These opportunities typically involve simultaneously buying and selling the ETF to exploit temporary price inefficiencies. However, this requires a detailed understanding of market mechanics and carries risks.

Investing Wisely with Amundi DJIA UCITS ETF NAV Knowledge

Understanding Amundi DJIA UCITS ETF NAV is essential for effective investment strategies. Regularly monitoring the NAV allows you to track the performance of your investment and make informed decisions based on the underlying asset value. By understanding the factors influencing the NAV and knowing where to find this crucial data, you can effectively manage your Amundi DJIA UCITS ETF holdings and make the most of your investment. Gain a deeper understanding of your investment with our comprehensive guide on Amundi DJIA UCITS ETF NAV, or stay informed about your Amundi DJIA UCITS ETF holdings by regularly monitoring its NAV.

Featured Posts

-

Family Joy Dylan Dreyer And Husband Celebrate Good News

May 24, 2025

Family Joy Dylan Dreyer And Husband Celebrate Good News

May 24, 2025 -

Neal Mc Donough Would Damien Darhk Defeat Superman

May 24, 2025

Neal Mc Donough Would Damien Darhk Defeat Superman

May 24, 2025 -

Ferraris 10 Speed Demons Standard Production Cars Compared

May 24, 2025

Ferraris 10 Speed Demons Standard Production Cars Compared

May 24, 2025 -

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariff Concerns

May 24, 2025

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariff Concerns

May 24, 2025 -

Gucci Supply Chain Officer Massimo Vians Exit Analysis And Implications

May 24, 2025

Gucci Supply Chain Officer Massimo Vians Exit Analysis And Implications

May 24, 2025