Amundi DJIA UCITS ETF: NAV Explained

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. Essentially, it reflects the current market value of the underlying assets held within the ETF. For the Amundi DJIA UCITS ETF, which tracks the performance of the Dow Jones Industrial Average (DJIA), understanding the NAV is paramount to assessing its performance and your investment's worth.

The NAV calculation for the Amundi DJIA UCITS ETF involves several key components:

- Market Value of Underlying DJIA Stocks: This is the primary component, representing the total market value of all the 30 constituent stocks of the DJIA held by the ETF. Fluctuations in the DJIA directly impact this value.

- Expenses and Fees: The ETF incurs expenses, including management fees (expense ratio), administrative costs, and other operational expenses. These are deducted from the total asset value to arrive at the net asset value.

- Currency Conversion (if applicable): If the ETF holds assets denominated in currencies other than the ETF's base currency, currency exchange rates play a role in the NAV calculation.

Here's a simplified, step-by-step illustration of the Amundi DJIA UCITS ETF NAV calculation:

- Determine the market value of each DJIA stock held by the ETF.

- Sum the market values of all 30 DJIA stocks.

- Deduct the total expenses and fees for the period.

- Adjust for any currency conversions, if necessary.

- Divide the resulting net asset value by the total number of outstanding ETF shares. This gives you the NAV per share.

Accessing the Amundi DJIA UCITS ETF NAV Data

Finding the daily NAV for the Amundi DJIA UCITS ETF is straightforward. You can typically access this information through several channels:

- The Official Amundi Website: The most reliable source is usually the asset manager's official website. Amundi provides regular updates on the NAV of their ETFs.

- Financial News Websites: Many reputable financial news websites and portals provide real-time or delayed NAV data for various ETFs, including the Amundi DJIA UCITS ETF.

- Brokerage Platforms: If you hold the Amundi DJIA UCITS ETF through a brokerage account, the platform will usually display the current NAV alongside other relevant information.

The NAV is typically updated daily, reflecting the closing market prices of the underlying DJIA stocks. It's vital to check the NAV before making any buy or sell decisions to ensure you're getting a fair price. Understanding real-time NAV fluctuations allows you to make more informed trading choices.

How NAV Affects Your Investment in Amundi DJIA UCITS ETF

Changes in the Amundi DJIA UCITS ETF's NAV directly impact your investment returns. A rising NAV indicates an increase in the value of your holdings, while a falling NAV signifies a decrease. The relationship between the NAV and the ETF's share price is generally very close, although minor discrepancies (premiums or discounts) can occur due to market supply and demand.

- Premium to NAV: The ETF's market price trades above its NAV.

- Discount to NAV: The ETF's market price trades below its NAV.

Comparing the Amundi DJIA UCITS ETF's NAV performance to other similar ETFs tracking the DJIA or broader market indices helps you assess its relative performance and refine your investment strategy.

Understanding the Risks Associated with Amundi DJIA UCITS ETF and its NAV

Investing in the Amundi DJIA UCITS ETF, like any investment, carries inherent risks:

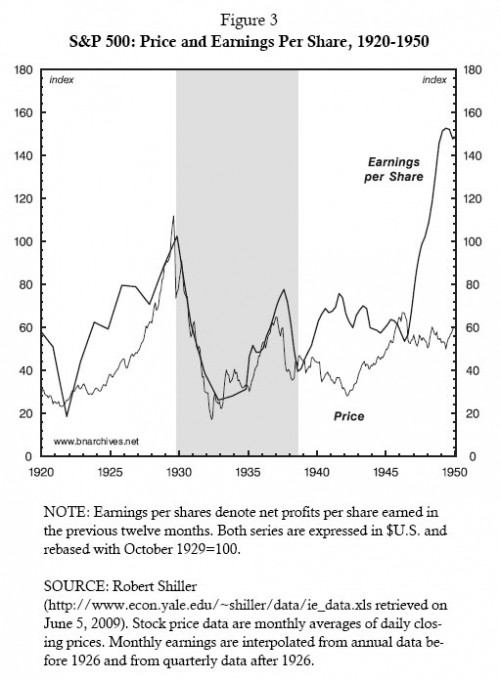

- Market Risk: The primary risk stems from fluctuations in the DJIA itself. Negative market movements directly impact the NAV, potentially leading to investment losses.

- Currency Risk: If the ETF holds assets in multiple currencies, exchange rate fluctuations can affect the NAV.

- Expense Ratio: The expense ratio, although relatively low for many ETFs, impacts long-term returns. A higher expense ratio eats into your overall profits.

Understanding these risks is crucial for making informed investment decisions and managing your portfolio effectively.

Conclusion: Making Informed Decisions with Amundi DJIA UCITS ETF NAV

Understanding the Amundi DJIA UCITS ETF's NAV is paramount for successful investing. This article has outlined how the NAV is calculated, where to find it, and how it affects your investment returns. Regularly monitoring the NAV of your Amundi DJIA UCITS ETF holdings, combined with a thorough understanding of the associated risks, allows you to make more informed investment decisions. Learn more about the Amundi DJIA UCITS ETF and its NAV to make informed investment decisions today! [Link to Amundi Website] [Link to relevant financial news source]

Featured Posts

-

Elektromobiliu Ikrovimas Su Porsche Naujas Centras Europoje

May 24, 2025

Elektromobiliu Ikrovimas Su Porsche Naujas Centras Europoje

May 24, 2025 -

Wrestle Mania 41 Golden Belt And Ticket Sales Begin Memorial Day Weekend

May 24, 2025

Wrestle Mania 41 Golden Belt And Ticket Sales Begin Memorial Day Weekend

May 24, 2025 -

China And Us Trade A Race Against Time Before Trade Truce Expires

May 24, 2025

China And Us Trade A Race Against Time Before Trade Truce Expires

May 24, 2025 -

Vervolg Snelle Marktbeweging Europese Aandelen Ten Opzichte Van Wall Street

May 24, 2025

Vervolg Snelle Marktbeweging Europese Aandelen Ten Opzichte Van Wall Street

May 24, 2025 -

New Ferrari Service Centre Now Open In Bengaluru

May 24, 2025

New Ferrari Service Centre Now Open In Bengaluru

May 24, 2025