Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and how is it calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

Definition: Understanding Net Asset Value

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the underlying value of the 30 constituent companies of the Dow Jones Industrial Average that the ETF holds. It's a key indicator of the ETF's intrinsic worth, providing a snapshot of the investment's value at a specific point in time. Understanding NAV is fundamental for assessing performance and making informed investment choices.

Calculation: Deconstructing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Calculating the NAV for the Amundi Dow Jones Industrial Average UCITS ETF involves several steps:

- Aggregating Holdings Value: The ETF's holdings comprise shares of the 30 companies in the Dow Jones Industrial Average. The market value of each holding is determined by multiplying the number of shares owned by the ETF by the current market price of each share. These individual values are then summed to obtain the total market value of the portfolio.

- Currency Conversions: As the Dow Jones Industrial Average is a US-based index, any holdings in other currencies need to be converted to the base currency of the ETF (likely EUR, given it's a UCITS ETF) using prevailing exchange rates. These conversions impact the final NAV calculation.

- Deduction of Expenses: Management fees, administrative expenses, and other operating costs are deducted from the total asset value before the NAV is calculated. This ensures the NAV accurately reflects the net value available to investors.

Frequency of Calculation: Staying Up-to-Date

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is typically calculated and published daily, reflecting the closing market prices of its underlying assets. This daily update provides investors with a current measure of their investment's value.

Why is understanding the Amundi Dow Jones Industrial Average UCITS ETF's NAV important for investors?

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for several reasons:

- Performance Tracking: Changes in the NAV directly reflect the ETF's performance. A rising NAV indicates positive performance, while a falling NAV indicates negative performance, allowing investors to easily track their investment's progress over time.

- Buy and Sell Decisions: The NAV is a crucial factor in buy and sell decisions. Investors may choose to buy when the NAV is considered undervalued relative to their assessment and sell when the NAV reaches a target price or shows signs of overvaluation.

- Risk Assessment: Fluctuations in the NAV indicate the level of risk associated with the investment. Large swings in the NAV suggest higher volatility and potentially higher risk, while smaller changes suggest lower volatility and potentially lower risk.

- Comparison with other ETFs: Comparing the NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF with other ETFs tracking similar indices (like other Dow Jones Industrial Average ETFs or broader US market indices) allows investors to benchmark performance and assess the relative value of their investment.

Where to find the Amundi Dow Jones Industrial Average UCITS ETF's NAV and how to interpret it.

Official Sources: Reliable Information

Several reliable sources provide the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF:

- Amundi's Website: The official website of Amundi is the primary source for accurate and up-to-date NAV information.

- Financial News Websites: Major financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) typically list ETF NAVs, including that of the Amundi Dow Jones Industrial Average UCITS ETF.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV alongside other key investment data.

Interpreting NAV Changes: Understanding Market Signals

- Positive NAV Changes: An increase in the NAV indicates that the value of the underlying assets has increased, reflecting positive market sentiment and potentially strong performance by the constituent companies.

- Negative NAV Changes: A decrease in the NAV signals a decline in the value of the underlying assets, reflecting negative market sentiment, potential company-specific issues, or broader market downturns.

Visualizing NAV Trends: Charting Your Course

Using charts and graphs to visualize NAV changes over time provides a clearer picture of the ETF's performance trends, helping investors identify patterns and make informed decisions. Many online resources offer tools to create such charts.

Factors Affecting NAV: The Bigger Picture

Numerous factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

- Macroeconomic Factors: Interest rate changes, inflation levels, and overall economic growth all impact market sentiment and consequently, the NAV.

- Company-Specific Events: Earnings reports, mergers and acquisitions, and other company-specific news directly affect the value of individual holdings and thus, the overall NAV.

- Global Market Trends: Geopolitical events, global economic conditions, and investor sentiment can significantly influence the NAV.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is paramount for successful investment management. By diligently tracking NAV fluctuations, analyzing the contributing factors, and comparing performance against benchmarks, investors can make well-informed decisions, optimize their portfolio allocation, and effectively manage risk. Regularly check the NAV of your Amundi Dow Jones Industrial Average UCITS ETF holdings using reliable sources to ensure you stay informed and make strategic investment choices. Mastering the concept of Net Asset Value will empower you to maximize your returns from this important ETF.

Featured Posts

-

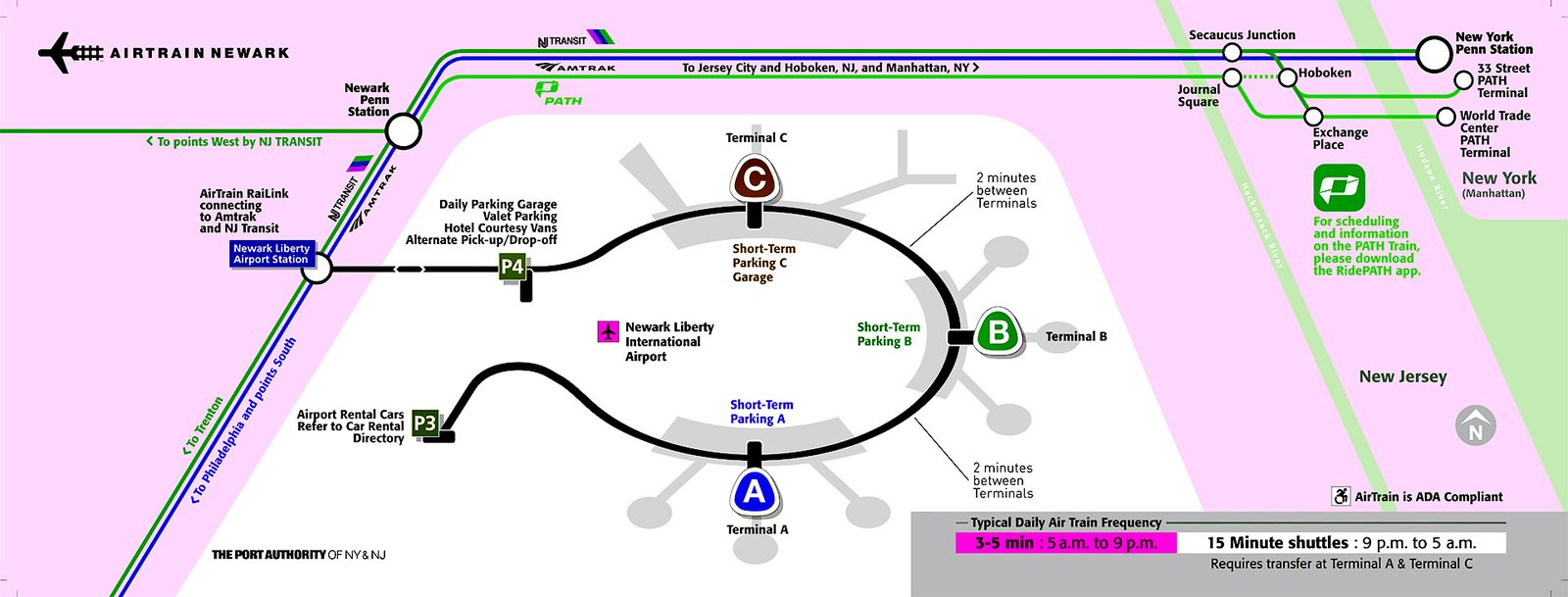

Failed Air Traffic Control Policy Newark Airports Ongoing Crisis

May 24, 2025

Failed Air Traffic Control Policy Newark Airports Ongoing Crisis

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Performers After Leak Ticket Details Inside

May 24, 2025

Glastonbury 2025 Lineup Confirmed Performers After Leak Ticket Details Inside

May 24, 2025 -

Memorial Day 2025 In Michigan Your Guide To Open Businesses And Activities

May 24, 2025

Memorial Day 2025 In Michigan Your Guide To Open Businesses And Activities

May 24, 2025 -

Best Us Beaches 2025 Dr Beachs Top 10 Ranking

May 24, 2025

Best Us Beaches 2025 Dr Beachs Top 10 Ranking

May 24, 2025 -

Demnas Appointment At Gucci Expectations And Impact

May 24, 2025

Demnas Appointment At Gucci Expectations And Impact

May 24, 2025