Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

How the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is Calculated

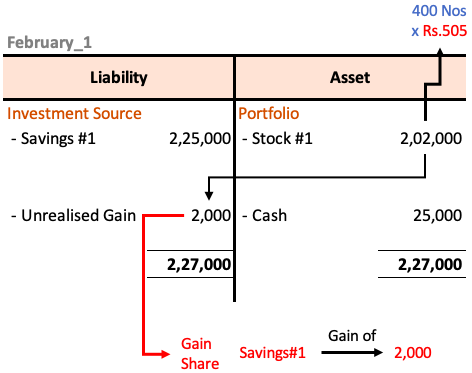

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF represents the per-share value of the fund's underlying assets. Calculating the NAV involves a precise process:

-

Determining the Market Value of Holdings: This is the most significant component. The fund manager assesses the current market price of each stock within the Dow Jones Industrial Average that the ETF tracks. This value is updated daily, reflecting market fluctuations.

-

Accounting for Liabilities: The fund incurs expenses such as management fees, administrative costs, and other liabilities. These are subtracted from the total market value of holdings.

-

Calculating Total Net Asset Value: The total net asset value is obtained by subtracting the total liabilities from the total market value of the ETF's assets.

-

Determining NAV per Share: Finally, the total net asset value is divided by the total number of outstanding ETF shares to arrive at the NAV per share.

The fund manager, Amundi, plays a vital role in ensuring accurate and timely NAV calculation, adhering to strict regulatory guidelines and industry best practices for asset valuation. This rigorous process ensures transparency and accuracy in reflecting the true value of your investment in the Amundi Dow Jones Industrial Average UCITS ETF.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the daily NAV fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF:

-

Market Volatility: The most significant factor is the overall movement of the stock market. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV. This is because the ETF mirrors the performance of the Dow Jones Industrial Average.

-

Dow Jones Industrial Average Performance: Individual stock performance within the Dow Jones Industrial Average directly impacts the ETF's NAV. Strong performance by constituent companies boosts the NAV, while underperformance diminishes it.

-

Currency Exchange Rates: Since the ETF may hold assets denominated in different currencies, fluctuations in exchange rates can affect the NAV, particularly if the ETF is denominated in a currency other than the underlying assets.

-

Dividends and Corporate Actions: Dividend payments from the underlying companies increase the cash holdings of the ETF, which can positively affect the NAV. Corporate actions like stock splits or mergers can also lead to adjustments in the NAV.

Understanding these factors is essential for anticipating potential NAV fluctuations and making informed investment decisions related to the Amundi Dow Jones Industrial Average UCITS ETF.

Importance of Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Regularly monitoring the NAV of your Amundi Dow Jones Industrial Average UCITS ETF investment offers several key advantages:

-

Tracking Investment Performance: The NAV provides a clear picture of your investment’s growth or decline over time. Comparing the NAV at different points helps assess the performance of your portfolio.

-

Identifying Potential Buying or Selling Opportunities: By comparing the NAV to the ETF's market price, you can identify potential discrepancies. A significant discount (NAV is lower than market price) could indicate a buying opportunity, while a premium (NAV is higher than market price) may suggest a potential selling opportunity.

-

Informed Investment Decisions: Consistent NAV monitoring enables you to make more informed decisions about buying, selling, or holding the ETF based on its value relative to the market.

-

Performance Analysis and Comparisons: Tracking NAV allows you to compare the performance of the Amundi Dow Jones Industrial Average UCITS ETF against other similar ETFs or investment options, facilitating a comparative performance analysis for your portfolio management.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Accessing the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Reliable sources include:

-

Amundi's Website: The official Amundi website typically provides up-to-date NAV information for all their ETFs, including this one.

-

Financial News Sources: Many reputable financial news websites and portals publish daily ETF NAV data.

-

Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV alongside other key investment information.

The frequency of NAV updates is typically daily, reflecting the closing market prices of the underlying assets. However, remember that time zone differences might lead to slight variations in the reporting times of the NAV depending on your location.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Understanding the Net Asset Value (NAV) is fundamental to successful investing in the Amundi Dow Jones Industrial Average UCITS ETF. This guide has explored NAV calculation, the various factors influencing its fluctuations, and the importance of regular monitoring. By consistently tracking the NAV and understanding its implications, you can make better-informed investment decisions, optimize your portfolio, and gain a clearer understanding of your investment performance within the context of market dynamics and the Dow Jones Industrial Average. Stay informed about your investments! Regularly monitor the Net Asset Value (NAV) of your Amundi Dow Jones Industrial Average UCITS ETF to make confident investment decisions.

Featured Posts

-

Carmen Joy Crookes Latest Musical Offering

May 24, 2025

Carmen Joy Crookes Latest Musical Offering

May 24, 2025 -

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Philips Shareholders 2025 Annual General Meeting Agenda Released

May 24, 2025

Philips Shareholders 2025 Annual General Meeting Agenda Released

May 24, 2025 -

Mamma Mia The Hottest New Ferrari Hot Wheels Sets

May 24, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Sets

May 24, 2025 -

Jonathan Groffs Broadway Return A Tony Hopeful Just In Time

May 24, 2025

Jonathan Groffs Broadway Return A Tony Hopeful Just In Time

May 24, 2025