Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV & Investment Implications

Table of Contents

2.1 Daily NAV Calculation and its Significance

The daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF represents the net value of the ETF's underlying assets per share. It's calculated at the end of each trading day by taking the total market value of all the holdings in the ETF's portfolio (the 30 stocks comprising the Dow Jones Industrial Average), subtracting liabilities, and dividing by the total number of outstanding shares.

-

Importance of Daily NAV: The daily NAV is a critical indicator of the ETF's performance. It reflects the overall value of your investment and helps you track your gains or losses. Monitoring daily NAV fluctuations provides insights into the ETF's performance against the Dow Jones Industrial Average itself.

-

Factors Affecting NAV Fluctuations: Several factors influence the daily NAV, including:

- Market Movements: The primary driver of NAV changes is the performance of the Dow Jones Industrial Average. Positive market movements generally lead to an increase in NAV, while negative movements result in a decrease.

- Currency Exchange Rates: If the ETF holds assets denominated in currencies other than the base currency of the ETF, fluctuations in exchange rates can impact the NAV.

- Dividend Distributions: Dividend payments from the underlying stocks reduce the NAV of the ETF, reflecting the distribution of profits to shareholders.

2.2 Accessing the Daily NAV

Finding the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. You can access this information from various reliable sources:

- Amundi Website: The official Amundi website is the most reliable source for the daily NAV. Look for the ETF's fact sheet or the dedicated page for this specific ETF.

- Financial News Portals: Major financial news websites and portals like Yahoo Finance, Google Finance, and Bloomberg typically provide real-time or end-of-day NAV data for popular ETFs.

- Brokerage Platforms: If you hold this ETF through a brokerage account, the platform will usually display the current NAV alongside other key information about your holdings.

The NAV is typically updated at the close of the market each trading day, although some platforms may offer intraday NAV estimates.

2.3 Investment Implications of Daily NAV Changes

Daily NAV changes significantly impact investment decisions. While the ETF share price often closely tracks the NAV, there can be minor discrepancies.

-

Buy, Sell, Hold Decisions: While not a sole determinant, consistent upward NAV trends may be viewed as a positive buy signal, while consistent downward trends may suggest considering selling, depending on your investment strategy and risk tolerance. A "hold" strategy might be suitable during periods of moderate NAV fluctuation.

-

NAV and ETF Share Price: The ETF share price fluctuates throughout the trading day and can differ slightly from the NAV due to supply and demand. However, over time, the share price generally converges with the NAV.

-

Long-Term vs. Short-Term Investors: Long-term investors are typically less concerned with short-term NAV fluctuations and focus on the overall long-term growth potential. Short-term traders, on the other hand, may use daily NAV changes to make quick trading decisions.

-

Risk Management: Monitoring NAV helps in risk management. By tracking changes, investors can adjust their holdings based on their risk appetite and investment goals.

2.4 Comparing the Amundi Dow Jones Industrial Average UCITS ETF with Other Dow Jones ETFs

Several ETFs track the Dow Jones Industrial Average. It's essential to compare them to find the best fit for your investment needs. Key factors to compare include:

| Feature | Amundi Dow Jones Industrial Average UCITS ETF | Competitor ETF 1 | Competitor ETF 2 |

|---|---|---|---|

| Expense Ratio | (Insert Expense Ratio) | (Insert Expense Ratio) | (Insert Expense Ratio) |

| Tracking Error | (Insert Tracking Error Data) | (Insert Tracking Error) | (Insert Tracking Error) |

| AUM | (Insert Assets Under Management) | (Insert AUM) | (Insert AUM) |

| Dividend Yield | (Insert Dividend Yield) | (Insert Dividend Yield) | (Insert Dividend Yield) |

(Note: Replace the bracketed information with actual data from competing ETFs.)

Conclusion: Making Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Monitoring the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for effective investment management. Understanding how the NAV is calculated, its accessibility, and its investment implications empowers you to make informed decisions. Regularly reviewing the daily NAV fluctuations, coupled with a thorough understanding of your risk tolerance and investment horizon, allows for optimal investment strategies. To learn more about the Amundi Dow Jones Industrial Average UCITS ETF NAV and make informed investment choices, further research is encouraged. Visit the Amundi website (insert link here) to access detailed information and monitor the Amundi Dow Jones Industrial Average UCITS ETF NAV, Dow Jones Industrial Average ETF NAV, and other relevant data points.

Featured Posts

-

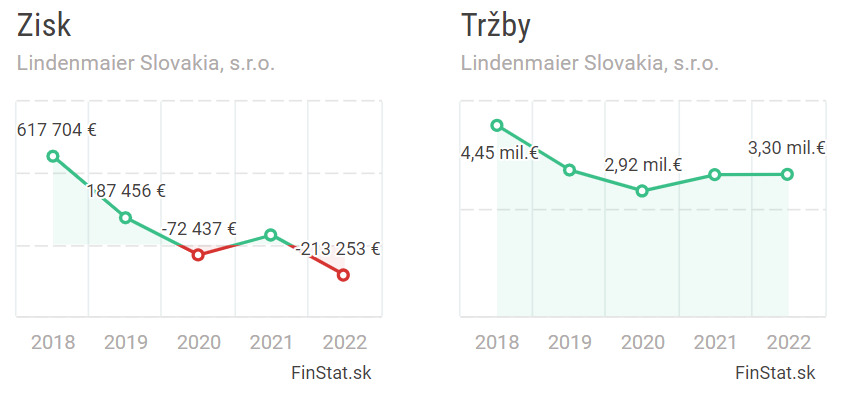

Nemecke Firmy A Prepustanie Dosledky Hospodarskeho Spomalenia Na H Nonline Sk

May 24, 2025

Nemecke Firmy A Prepustanie Dosledky Hospodarskeho Spomalenia Na H Nonline Sk

May 24, 2025 -

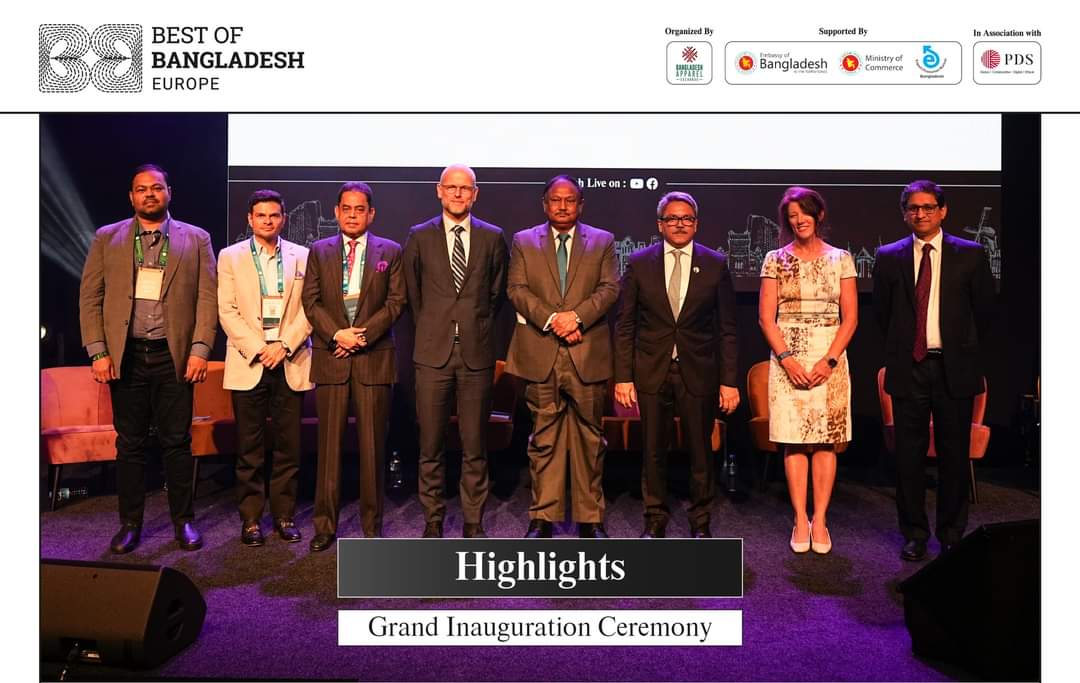

Promoting Bangladesh Europe Collaboration The 2nd Edition Of Best Of Bangladesh

May 24, 2025

Promoting Bangladesh Europe Collaboration The 2nd Edition Of Best Of Bangladesh

May 24, 2025 -

A Conversation With Jonathan Groff Exploring Asexuality

May 24, 2025

A Conversation With Jonathan Groff Exploring Asexuality

May 24, 2025 -

Live Updates Pedestrian Struck By Vehicle On Princess Road

May 24, 2025

Live Updates Pedestrian Struck By Vehicle On Princess Road

May 24, 2025 -

Horoscopo De La Semana Del 4 Al 10 De Marzo De 2025 Que Te Deparan Los Astros

May 24, 2025

Horoscopo De La Semana Del 4 Al 10 De Marzo De 2025 Que Te Deparan Los Astros

May 24, 2025