Amundi Dow Jones Industrial Average UCITS ETF: How Net Asset Value (NAV) Impacts Your Investment

Table of Contents

What is the Amundi Dow Jones Industrial Average UCITS ETF and its NAV Calculation?

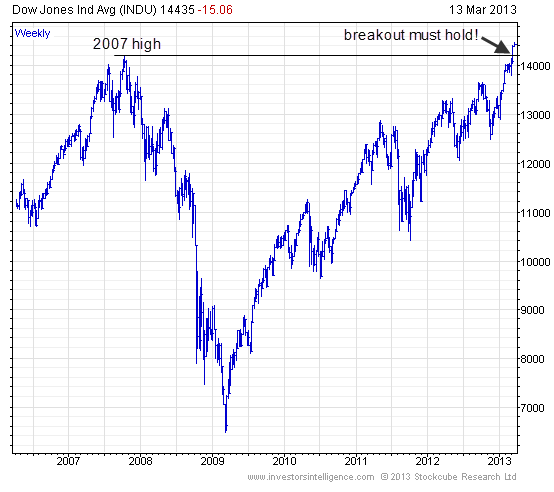

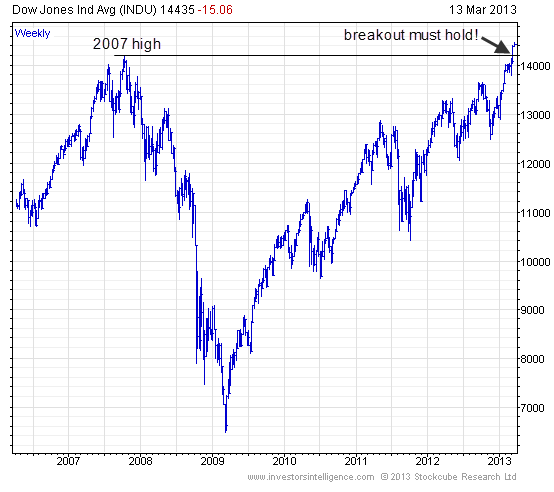

The Amundi Dow Jones Industrial Average UCITS ETF is an index fund designed to track the performance of the Dow Jones Industrial Average (DJIA). This means the ETF's portfolio aims to mirror the composition and weighting of the 30 large-cap U.S. companies that make up the DJIA. The Net Asset Value (NAV) represents the net value of the ETF's underlying assets, per share.

The daily NAV calculation for this ETF is a complex process, but essentially it involves:

- Determining the market value of all assets: This includes the current market price of each of the 30 stocks held within the ETF's portfolio, along with any other assets, such as cash holdings.

- Subtracting liabilities: Liabilities include any expenses associated with running the ETF, such as management fees and operational costs.

- Dividing by the total number of outstanding shares: This calculation results in the NAV per share.

The components included in the NAV calculation are:

- Assets: Market value of the 30 constituent stocks of the DJIA, plus any cash or other assets held by the ETF.

- Liabilities: Management fees, administrative expenses, and any other outstanding obligations.

You can find the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF on the Amundi website, major financial news websites, and through your brokerage account.

- Daily NAV updates: The NAV is typically calculated and published at the close of each trading day.

- Transparency in NAV reporting: Amundi provides transparent reporting of the ETF's NAV, adhering to regulatory requirements.

- Impact of market fluctuations on NAV: The NAV will fluctuate daily reflecting the price changes of the underlying stocks within the DJIA.

- Currency considerations: As the underlying assets are primarily US dollar-denominated, currency fluctuations between the USD and your local currency can impact your return.

How NAV Fluctuations Affect Your Investment in the Amundi Dow Jones Industrial Average UCITS ETF

The share price of the Amundi Dow Jones Industrial Average UCITS ETF generally closely tracks its NAV. While ideally they should be the same, small discrepancies might occur due to supply and demand in the secondary market. Significant deviations are rare and typically indicate market inefficiencies or high trading volumes.

- Short-term vs. long-term NAV changes: Short-term NAV fluctuations are common due to daily market movements. Long-term NAV changes reflect the overall performance of the DJIA.

- Impact of dividends on NAV: When the underlying companies in the DJIA pay dividends, the NAV of the ETF will typically decrease by the amount distributed to shareholders.

- Understanding risk associated with NAV fluctuations: NAV fluctuations reflect the inherent risk associated with investing in the stock market. However, this risk is mitigated by the diversification provided by holding a broad index like the DJIA.

- Strategies for managing NAV fluctuations: A long-term investment horizon is typically the best strategy to ride out short-term market volatility. Dollar-cost averaging can help manage risk by purchasing shares at regular intervals, regardless of the NAV.

Using NAV to Make Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Analyzing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for evaluating its performance and making informed investment choices.

By comparing the NAV to the ETF's market price, you can identify potential buying or selling opportunities. While not always possible, a discount (market price below NAV) might present a buying opportunity, while a premium (market price above NAV) might signal a time to consider selling. However, relying solely on this strategy isn't advisable and a broader investment strategy should be considered.

- Regular NAV monitoring: Regularly check the NAV to track the ETF's performance and compare it to its benchmark, the DJIA.

- Importance of long-term perspective: Focus on the long-term trend rather than short-term NAV fluctuations.

- Comparing NAV to benchmark indices: Compare the ETF's NAV performance to the DJIA itself to measure how effectively the ETF tracks the index.

- Considering transaction costs: Factor in brokerage fees and any other transaction costs when making buy/sell decisions based on NAV.

Conclusion: Making the Most of Your Amundi Dow Jones Industrial Average UCITS ETF Investment through NAV Understanding

Understanding the Net Asset Value (NAV) is critical for successful investing in the Amundi Dow Jones Industrial Average UCITS ETF. By monitoring the NAV, comparing it to the market price, and considering its fluctuations within a broader investment strategy, you can make more informed decisions. Regularly reviewing the NAV allows you to assess the ETF's performance against its benchmark and helps you manage your investment effectively. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF investment by regularly monitoring its Net Asset Value. Learn more and start making informed decisions today! [Link to Amundi's website]

Featured Posts

-

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025 -

17 Celebrities Who Destroyed Their Public Image Instantly

May 24, 2025

17 Celebrities Who Destroyed Their Public Image Instantly

May 24, 2025 -

Microsoft Email Controversy Palestine Keyword Blocked Following Protests

May 24, 2025

Microsoft Email Controversy Palestine Keyword Blocked Following Protests

May 24, 2025 -

Mwshr Daks Ytjawz 24 Alf Nqtt Bfdl Atfaq Altjart Byn Washntn Wbkyn

May 24, 2025

Mwshr Daks Ytjawz 24 Alf Nqtt Bfdl Atfaq Altjart Byn Washntn Wbkyn

May 24, 2025 -

Billie Jean King Cup Kazakhstans Stunning Victory Over Australia

May 24, 2025

Billie Jean King Cup Kazakhstans Stunning Victory Over Australia

May 24, 2025